Checking the purchase book by turnover The purchase book is a large table that is maintained in

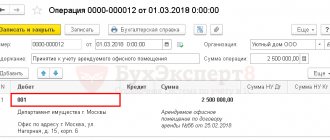

Tax agent is a person charged with the responsibility for transferring taxes by the Tax Code of the Russian Federation.

Payment order (or payment order) is a payment document confirming the order of the account owner (bank client) to

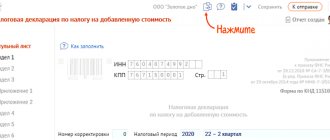

VAT payers, as well as tax agents, are those categories of organizations (IP) that are charged

In my practice, I quite often came across a situation where employees were not paid a bonus

Federal laws of November 30, 2016 No. 401-FZ and No. 405-FZ amended Article 266

Author of the article: Yulia Kaisina Last modified: January 2021 20651 The state continues the policy of transition

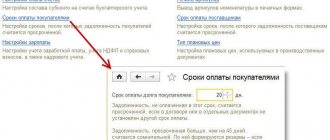

Discounts and bonuses (premiums) for customers. VAT taxation procedure and accounting nuances Discounts and bonuses

Magazine "Warehouse and Equipment", No. 3–4, 2008 // April, 2008 The process of goods receipt

In accordance with the Tax Code of the Russian Federation, warranty repair services are exempt from VAT.