Payment order (or payment order) is a payment document confirming the order of the account owner (bank client) to transfer funds. Typically, payment orders are used by legal entities (organizations) that regularly send funds to the payment details of counterparties and government organizations. For example, a furniture factory purchases raw wood, puts the blanks into production and sells finished furniture to customers. To pay taxes, settlements with suppliers of raw materials, employees and clients, the factory accountant draws up payment orders in the bank-client program. Money is transferred automatically.

Individuals use a shortened version of payment orders by transferring funds on the website of the servicing bank or in a smartphone application. For example, a loan payer deposits a set amount monthly from a debit (salary) card, creating a payment order. In this case, the bank details and information about the payer are filled in automatically, the operation is processed instantly, sometimes delays of several hours are possible.

Types of payment orders

The payment order can be urgent or early. Urgent payment orders can be used in cases where:

- prepayment (advance payment) is made;

- payment is made after the goods have been shipped;

- Partial payments are made for large transactions.

Early payments are deferred payments and are used only by agreement of the parties involved in the contract, for example, during a sale and purchase, and if it does not incur monetary losses to the parties to the transaction.

How can I print a PP through my personal account?

Knowing how to issue a PP, it’s not superfluous to be able to print a receipt. So that the client can always receive a check in hand, and not just virtually, Sberbank’s online service has provided the ability to print it.

Actually, you can print a document for any transaction reflected in your personal account. To do this, click on the “Operation History” item and select the desired one. Afterwards, click on the print icon.

Print function

Settlements carried out by payment order

Using a payment order you can make the following calculations:

- payment for work performed, products supplied or services provided;

- transfer of money to budgets of all levels and to extra-budgetary funds;

- transfer of money for the purpose of returning or placing loans or deposits and paying interest on them;

- transfer of money for other purposes provided for by law or agreement;

- payment for goods, works or services in advance;

- making periodic payments.

Algorithm of actions when paying through Sberbank Online

Clients who are accustomed to conducting all operations remotely are often interested in how to pay online? To make a payment using this service, you need to complete the following steps:

- log in to your personal account;

- fill out the payment order in detail;

- thoroughly confirm the operation (all names must be correct);

- wait time before the money is transferred.

More detailed guide:

- Go to the “Transfers and Payments” tab.

“Transfers and payments” tab, “Organization transfer” item - Select “Organization transfer”.

Form to fill - Fill out the fields, indicating information about the recipient's account number

, INN and BIC of the bank, as well as the debit account. - Specify the purpose of the payment transaction. The form for this purpose contains fields for the account number for which the payment is made and the date on which it was issued. Information about the product for which payment is made is also located.

- Enter the document amount. It is taken from the receipt.

- Confirm the action.

Carrying out the transaction involves a commission fee. Its size is reflected on the screen when filling out a payment order.

Payment order

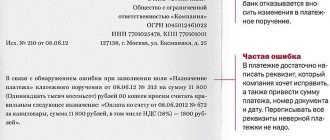

When filling out a payment order, it is important to correctly indicate the order of payment. If it is entered incorrectly, the bank will refuse to carry out the transaction.

- Payments that occur under executive acts on compensation for harm caused to health or life and payment of alimony.

- Transfers in accordance with writs of execution for the payment of severance pay upon dismissal or salary arrears and payment of royalties.

- Payment of debts on taxes, fees and contributions and payment of salaries to employees.

- Cash payments for other executive acts.

- All other payment documents in the calendar order of their receipt.

The Constitutional Court of Russia invalidated the distribution of the 3rd and 4th stages, however, changes have not yet been made to the Civil Code. All acts or their individual provisions recognized as unconstitutional shall lose force. The court classified all payments to the budget and state extra-budgetary funds as the third priority. It turns out that the fourth stage includes only payments to non-state extra-budgetary funds. Debiting funds from the account for claims that relate to one queue occurs in the order in which documents are received.

Deleting transaction history in your personal account

For many users, the pressing question is: how to delete the history of previously performed operations? You need to understand that this data represents reflected information that is recorded by the bank for its part. Such information becomes necessary in controversial circumstances: for example, when it is necessary to find out or prove that the operation was actually carried out by the user.

Option "Transaction history"

Some options can simply be disabled. This is done in the profile settings.

Procedure for filling out a payment order

The payment order is filled out in accordance with the requirements of Bank of Russia Regulation No. 383-P dated June 19, 2012 “On the rules for transferring funds” and Appendices 1, 2 and 3 to this regulation. The payment order must not contain empty fields, otherwise the bank will not carry out the transaction. In the case where this is impossible, optional or not necessary, you must enter zero (0). The payment order is filled out in four copies:

- 1 is used when written off at the payer’s financial institution and ends up in bank daily documents;

- 2 is needed to credit money to the recipient’s account and is sent to his bank;

- 3 confirms the bank transaction and is attached to the recipient's account statement (at his bank);

- 4 with the bank’s stamp is returned to the payer and serves as confirmation of acceptance of the payment for execution.

| Props number | Props name | Meaning |

| 1 | Payment order | Name of order |

| 2 | 0401060 | Form number according to the All-Russian Classifier of Management Documentation |

| 3 | № | Order number. The order number must be indicated in numbers other than 0 |

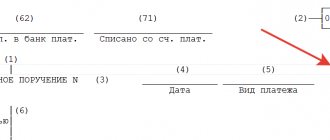

| 4 | date | The date of drawing up the payment order is indicated |

| 5 | Payment type | It is indicated as “urgent”, “telegraph”, “mail”, another value in the manner established by the bank, or the value is not indicated in cases established by the bank. In an order in electronic form, the value is indicated in the form of a code established by the bank. |

| 6 | Suma in cuirsive | It is written with a capital letter. The word “ruble” in the corresponding case is not abbreviated, kopecks are indicated by numbers, and the word “kopek” in the corresponding case is also not abbreviated. If the payment amount is expressed in words in whole rubles, then kopecks can be omitted, while the payment amount and the equal sign “=” are indicated in the “Amount” detail. |

| 7 | Sum | The amount is indicated in numbers. Rubles are separated from kopecks by a dash sign “-“. If the payment amount is expressed in numbers in whole rubles, then kopecks can be omitted; in this case, the payment amount and the equal sign “=” are indicated. |

| 8 | Payer | Legal entities indicate:

IP:

|

| 9 | Account No. | Payer's account number. The payer's bank account number is indicated. |

| 10 | Payer's bank | The name and location of the payer’s bank are indicated in the order on paper |

| 11 | BIC | The bank identification code of the payer's bank is registered. It was appropriated by the Central Bank upon its opening. |

| 12 | Account No. | Payer's bank account number. The number of the correspondent account of the credit organization, the correspondent sub-account of a branch of the credit organization opened in a division of the Bank of Russia is indicated. In the case where the recipient is a client of a Russian bank, the value of the details is not indicated. |

| 13 | payee's bank | The name and location of the recipient's bank is written. For example, JSC “Kirpich”, Moscow. |

| 14 | BIC | Bank identification code of the recipient's bank. |

| 15 | Account No. | The recipient's bank account number. In the case where the recipient is a client of a Russian bank, the value of the details is not indicated. |

| 16 | Recipient | Recipient legal entity:

IP Recipient:

Recipient: individual:

Recipient is an individual who is engaged in private practice:

If the transfer of money is carried out through a correspondent account, which is opened in another bank or branch of the organization, or through an inter-branch settlement account specified in the details “Account. No., indicates the name and location of this organization. |

| 17 | Account No. | Recipient's account number. |

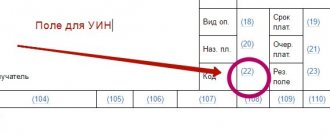

| 18 | Type op. | Type of operation. The payment order code is indicated - 01. |

| 19 | Payment deadline. | Not filled in |

| 20 | Name plat. | Not filled in |

| 21 | Essay. plat. | Sequence of payment. The order of payment is indicated in numbers in accordance with federal law. |

| 22 | Code | UIN CODE |

| 23 | Res. field | The sign of the transfer conditions is indicated, including in the form of a code |

| 24 | Purpose of payment | The name of goods, works, services, numbers and dates of contracts, commodity documents are written down, and other necessary information may also be indicated. |

| 43 | M.P. | Place for the payer's seal imprint |

| 44 | Signatures | Payer's signature |

| 45 | Bank marks | Bank stamp. |

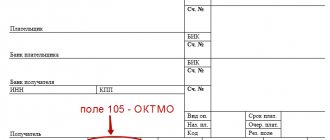

| 60 | TIN | Payer's TIN |

| 61 | TIN | Recipient's TIN |

| 62, 71 | — | Filled by the bank |

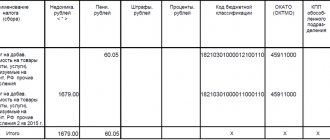

| 101-110 are filled in when paying payments to the budget or customs duties | ||

| 101 | — | Payer status is indicated |

| 102 | — | The payer's checkpoint is indicated |

| 103 | — | The recipient's checkpoint is indicated |

| 104 | — | The KBK indicator is indicated |

| 105 | — | OKTMO code is indicated |

| 106 | — | When paying tax payments, the payment basis indicator is indicated, which consists of 2 characters:

When making customs and other payments from foreign trade activities:

|

| 107 | — | The tax period indicator is indicated, which indicates the frequency of tax payment. |

| 108 | — | Indicate the number of the document on the basis of which the payment is made |

| 109 | — | The date of the document is indicated |

| 110 | Payout code | When paying taxes, advance payment, contribution, tax sanctions, fines and other payments administered by tax authorities, “0” is indicated. |

How many copies should there be?

For one financial transaction, 4 copies of the payment order are made. The first copy is kept in a banking institution, and on its basis money is debited from accounts.

The second and third copies are intended for the recipient and his bank. That is, one copy remains in the recipient’s bank, on its basis the money is credited to the current account. And the second is attached to the bank statement, which is transferred to the recipient.

The last copy, with the bank’s mark of completion, is returned to the paying institution. That is, the payment is attached to the bank statement as confirmation of the execution of the PP.

Please note that the number of copies may be different, depending on the circumstances and conditions of sending the wire transfer.