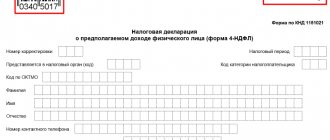

Budget classification code – KBK

KBK is a code for a specific budget item, income or expense. Since tax calculations are made specifically with the budget (Federal Treasury), and not with the Federal Tax Service, the BCC in tax documents must be indicated wherever it is required and indicated correctly. Otherwise, your tax or refund from the budget will not immediately go where it is needed, but will “hang” somewhere in the system while you prove to all authorities that you actually paid it (or should receive it).

For ordinary citizens submitting the 3-NDFL declaration for 2021, it is enough to know only two BCCs:

- “Revenue” KBK - identifies the revenue line of the budget where the paid personal income tax falls: 18210102030011000110 (indicate this code in line 020 of Section 2 of the 3-NDFL declaration if you must pay tax to the budget according to the declaration);

- “Expense” KBK - identifies from which budget item funds should be taken for a tax refund: 18210102010011000110 (indicate this code in line 020 of Section 2 if the tax back to you . Do not forget to indicate it in the application for a refund when you submit such statement.

In what cases is it required

The indicator is used in many tax reports and accounting documents, since it is uniform throughout Russia. But specifically, individuals most often encounter it in 3-NDFL, for example, when applying for a deduction or if it is necessary to pay tax, where it is necessary to indicate OKTMO.

On what sheets is it written:

- section 2 - as a payment information for the inspection for payment or return of personal income tax;

- Appendix 1 – as details of the employer.

It is assigned to each legal entity and individual entrepreneur at the time of registration and entry into the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs. As a rule, the subject learns information about the assigned OKTMO from Rosstat, since it is this agency that actively works with this classifier.

We recommend additional reading: Sample of filling out 3-NDFL when selling a car less than or more than 3 years old

OKTMO code in 3-NDFL

To make payments correctly, tax authorities and the Treasury need to know not only which budget item to use, but also where the funds for this item came from. Each municipal entity in the Russian Federation has its own unique code. The directory of such codes and territories is the All-Russian Classifier of Municipal Territories (OKTMO).

EXAMPLE

The indication in the payment to the budget of KBK 18210102030011000110 and OKTMO 46704000 shows that they paid personal income tax to the budget in the city of Balashikha, Moscow region.

As in the case of KBK, there is a difference when indicating OKTMO when paying personal income tax and when returning this tax from the budget.

| SITUATION | SOLUTION |

| Payment of tax to the budget | In the declaration (page 030 of Section 1) you need to enter the code of “your” territory in which the payer lives and reports. You can find out this code on the Federal Tax Service website by entering your address in the FIAS service. |

| Refund of personal income tax from the budget | In line 030 of Section 1 you need to put the OKTMO for which you paid the tax that you are going to return. For example, an individual from Balashikha works in Moscow on Lefortovo Embankment. During the year, the employer withheld and paid personal income tax in Moscow and indicated OKTMO 45375000. A citizen filing a 3-NDFL tax refund must indicate in line 030 of Section 1 OKTMO the employer - 45375000. |

Where can I get the OKTMO code? The easiest option is to look at the income certificate (2-NDFL). It has a separate column for indicating the OKTMO on which the tax was paid by your employer for you.

If for some reason there is no certificate, it is best to check OKTMO with the person who paid personal income tax to the budget for you.

What if there was not one source of income, but several? For example, did a person work in two places and have 2 income certificates with different OKTMO? So: it is possible that you will need to indicate both, in different blocks of Section 1 of the 3-NDFL declaration.

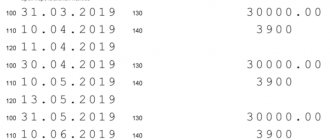

EXAMPLE 1

In 2021, Petrov worked at Pesnya LLC as his main place of work and at Bayan LLC as a part-time employee. Pesnya LLC has OKTMO 46111000, Bayan LLC has OKTMO 46222000. Petrov received 500,000 rubles for 2021. from Pesnya LLC and 300,000 rubles. from Bayan LLC.

Petrov claims a property deduction when purchasing an apartment - 2,000,000 rubles. All 800,000 rubles earned in 2021 are subject to this deduction.

Personal income tax to return everything:

800,000 × 13% = 104,000 rub.

Including:

- for Pesnya LLC (OKTMO 46111000): 65,000 rubles;

- for Bayan LLC (OKTMO 46222000): RUB 39,000.

What Section 1 of Petrov’s declaration will look like is shown below.

In conclusion, we note that there are no strict rules in what order to put different OKTMOs in the personal income tax return declaration. You can start with whichever one you like best.

If the allowable deduction amount is less than the income received for the year, and because of this, “extra” OKTMOs have been created, you can not indicate them.

EXAMPLE 2

Petrov wants to receive a deduction for treatment. The treatment is not expensive, so the tax deduction is limited to 120,000 rubles. in a year. Personal income tax refundable with the following deduction: RUB 15,600. That is, it is “enough” to return from one OKTMO.

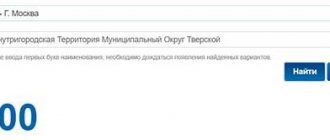

Find out OKATO, OKTMO

How to find OKTMO, OKATO or postal code by address? Our service easily solves this problem. Start entering your residence address and select one of the proposed options and find out OKTMO, OKATO and postal code.

Start entering your residential address and select the proposed option from the drop-down list

| Name | Meaning |

| OKTMO | |

| OKATO | |

| Postcode | |

| Federal Tax Service code |

Tax inspections by regions of the Russian Federation Aginsky Buryat DistrictAltai TerritoryAmur RegionArkhangelsk RegionAstrakhan RegionBelgorod RegionBryansk RegionVladimir RegionVolgograd RegionVologda RegionVoronezh Region City of Moscow City of St. PetersburgCity of SevastopolJewish Autonomous Region (Jewish OA)Trans-Baikal Territory (Chita Region)Ivanovo RegionIrkutsk regionKabardino-Balkarian Republic (Kabardino-Balkaria)Kaliningrad regionKaluga regionKamchatka regionKarachay-Cherkess Republic (Karachay-Cherkessia)Kemerovo regionKirov regionKostroma regionKrasnodar regionKrasnoyarsk regionKurgan regionKursk region

Leningrad region Lipetsk region Magadan region Moscow region Murmansk region Nenets Autonomous Okrug (Nenets Autonomous Okrug) Nizhny Novgorod region Novgorod region Novosibirsk region Omsk region Orenburg region Oryol region Penza region Perm region Primorsky region Pskov region Republic of Adygea Altai Republic Republic of Bashkortostan Republic of Buryatia Republic of Dage stanRepublic of IngushetiaRepublic of KalmykiaRepublic of KareliaRepublic of KomiRepublic of CrimeaRepublic of Mari ElRepublic of MordoviaRepublic of Sakha (Yakutia)Republic of North Ossetia-Alania

Republic of TatarstanRepublic of TyvaRepublic of KhakassiaRostov RegionRyazan RegionSamara RegionSaratov RegionSakhalin RegionSverdlovsk RegionSmolensk RegionStavropol TerritoryTambov RegionTver RegionTomsk RegionTula RegionTyumen RegionUdmurt Republic (Udmurtia)Ulyanovsk RegionUst-Ordynsky Buryat DistrictKhabarovsk TerritoryKhanty-Mans Iysky Autonomous Okrug - Yugra (Khanty-Mansi Autonomous Okrug - Yugra) Chelyabinsk Region Chechen Republic (Chechnya) Chuvash Republic (Chuvashia) Chukotka Autonomous Okrug (Chukotka Autonomous Okrug) Yamalo-Nenets Autonomous Okrug (Yamalo-Nenets Autonomous Okrug) Yaroslavl Region

Formation principle

The following divisions are used for classification:

- Urban district with intra-city division;

- Urban District;

- Municipal, intracity district;

- Rural settlement;

- In areas between settlements.

A three-stage classification structure is used:

- MO and for the subjects included in them.

- Districts, City district with intra-city division, individual municipalities, Intra-city municipal districts of federal cities.

- Urban and rural settlements, areas within urban areas, areas located between settlements.

The code is generated by numbers as follows:

- 1–2 – mean Code of the subject of the Federation;

- 3–5 – locality of federal subordination, urban district;

- 6–8 – urban, rural settlement, territory between settlements;

- 9-11 – settlements within a large municipal district.

To reduce errors when entering an identifier into the database in the AS, there is a system of check numbers in the code structure.

Formation example:

| OKTMO | |

| Ministry of Defense of the Belgorod region | 14000000 |

| Municipal districts of the same region | 14600000 |

| Municipal district, Alekseevsky district, Alekseevka | 14605101 |

| Rural settlement of the municipal district Alekseevsky district and the city of Alekseevka, village of Aleynikovo | 14605404 |

When filling out the declaration, after filling out the 8-digit code, dashes are placed in the remaining columns. (Putting 0 is wrong).

If the declaration is filled out by an individual, the employer's location code must be entered.

KBK structure

So, KBK consists of 20 characters. It is more convenient to see the structure of the indicator in the table.

| Characters in order | Explanation | Example |

| 1,2,3 | Indicate the body that manages budget funds | 182 – tax service, 392 – Pension Fund of the Russian Federation, 393 – Social Insurance Fund |

| 4,5,6 | Type of contribution paid | 101 – income tax, 102 – insurance fees for pension insurance. |

| 7,8 | Budget level for which funds are intended | 01 – federal level. 02 – local |

| 9,10,11 | Sub-item of income | Determined by the classifier; for personal income tax, for example, 010. |

| 12,13 | Income element | Also determined by the classifier. For personal income tax – 01 |

| 14,15,16,17 | Payment type | 1000 – contribution or arrears of tax, 3000 – fine, 2100 – pennies, etc. |

| 18,19,20 | Type of income | 110 – tax revenue, 160 – social insurance contributions. |

Example. The BCC for paying property tax (which is not part of the Unified Gas Supply System) looks like this: 182 1 0600 110.

The digital digits in this long number indicate the following:

- 182 – this block indicates that the manager of the funds is the Federal Tax Service.

- 106 – numbers indicate a specific tax – property tax.

- 02 – address for receiving funds – local budget.

- 010 – property tax subsection number.

- 02 – code of the income element for this tax.

- 1000 - the symbols indicate the type of payment - this is a tax, and not a fine or penalty, for example.

- 110 – the numbers indicate the type of budget income: this is tax revenue, not a social insurance contribution.

Results

The OKTMO statistical code is one of the important indicators of any tax return. In the 3-NDFL report, it indicates the registration address of the individual submitting the report. Incorrect reflection of this code in the declaration may result in the tax authority requesting clarification.

Sources:

- Order of Rosstandart dated June 14, 2013 No. 159‑st

- Order of the Federal Tax Service dated October 7, 2019 No. ММВ-7-11/ [email protected]

- Order of the Federal Tax Service dated July 8, 2019 No. ММВ-7-19/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What to do if you entered the wrong code and how to prevent this problem?

Let's start with the fact that to prevent delays with adjustments, you just need to take into account which OKTMO needs to be indicated in 3-NDFL for deduction, and which one is not necessary.

First, when filling out the column, if your municipality has only 8 OKTMO digits, you do not need to fill in the remaining three empty fields with zeros - you must add hyphens. If you specify zeros, the system will generate an error, because will not be able to correctly read the combination of numbers.

Secondly, do not confuse OKTMO with OKATO . These are not only similar abbreviations in spelling, but also similar in the very combination of numbers and their essence. OKATO is the same as OKTMO, only an outdated form of the cipher (used until 2014). At the moment, the modern version of the cipher has completely replaced the old one; OKATO is mainly required only when clarifying payments made in the past.

Third, before sending the personal income tax, you must check the code to make sure there are no errors or typos. You can check it through the services specified in this article.

What to do if the code is incorrect? The irony of the situation is that you don’t have to do anything if the declaration has already been sent. Tax authorities do not issue returns with a note to reissue 3-NDFL - instead, the Federal Tax Service independently changes the value in column 030.

However, you should not use this: tax authorities are tired of correcting other people’s mistakes without taking money for it, and therefore bill No. 445467-7 has been submitted for consideration through deputies. According to its contents, a fine is imposed for making an error in column 030. The bill has not yet been adopted, but the very fact of its appearance is already an “alarm bell.”

How to find out the organization’s BCC by OKTMO and other details

We will immediately disappoint you - the budget classification code is in no way connected with the TIN of the payment recipient and his other details. Since there is no direct relationship, it is impossible to find the BCC using these data even on the tax service website. But on it you can see a detailed KBK directory for the current year, as well as for previous years. The Federal Tax Service regularly updates data, so the likelihood of errors or outdated information on their service is minimized. As for other sites offering a list of current CBCs, it is easy to doubt the reliability of their data.

If you come across a service that offers you to find out the budget classification code by TIN or other details of the company, you should not believe it. Most likely, its creators simply want to make money through dishonest means. In any case, they will not be able to provide you with the information you are looking for.

Where is it used

A code from the classifier of municipalities is assigned to each newly registered legal entity or individual entrepreneur.

IP details - what they include, where you can find them

The need for individual entrepreneurs and legal entities to use the OKTMO code is caused by state control in this area. The OKTMO code is used by the Federal State Statistics Service (Rosstat). The authority, receiving coded information from organizations and entrepreneurs, systematizes and processes the information for its subsequent use.

Using the OKTMO code, Rosstat quickly and easily finds out which municipal division a particular organization or individual entrepreneur belongs to. It is for this reason that every person registered as an entrepreneur must know his code and enter it when filling out declarations and various reports, when paying taxes and other payments to the budget.

The new classifier is used when filling out the following documents:

- declaration of a simplified taxation system;

- value added tax declaration;

- declaration of single tax on imputed income;

- excise tax declaration;

- 2-NDFL;

- 3-NDFL;

- 4-NDFL, etc.

Note! The OKTMO code is also used when paying the following types of taxes: transport, land, mining, etc. It is included in the documents when paying fines and penalties. Used when filling out financial statements and some other documents.

Previously, when using OKATO classifier codes, zeros were placed in empty spaces, for example, if there was no need to enter the designation of a settlement in the Moscow Region when filling out the documentation. Currently, with the transition to the new code, empty spaces are filled with dashes. This change does not cause confusion when using the new code.