Legal topics are very complex, but in this article we will try to answer the question “To what budget are federal or regional insurance premiums paid?” Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

So, all fiscal payments can be divided into three types: federal, regional and local taxes and fees. The key difference between these payments is the level of government that sets the basic rules and regulations for applying taxation. That is, if the authority to determine the rate, benefit, period and principles is transferred to the authorities of the constituent entity of Russia, then the payment is considered regional.

However, it should be noted that fiscal payments are regulated in the Tax Code of the Russian Federation. That is, the Tax Code of the Russian Federation is the legal basis of the current tax system of the state. This means that municipal authorities, as well as the authorities of a constituent entity of Russia, do not have the right to introduce additional (new) obligations. Their powers include specifying the taxation procedure for existing fiscal levies.

Main characteristics and differences

For local and regional fees, the characteristic features of the application of taxation are established by the authorities of the appropriate rank. However, authorities of the second and third levels do not have the right to deviate from the general norms enshrined in the Tax Code of the Russian Federation.

The effect of local taxes is regulated by the Tax Code of the Russian Federation and regulations drawn up at the municipal level. These taxes include land tax and personal property tax. And from 2021, a trade tax has been introduced into this group (law dated November 29, 2021 No. 382-FZ).

Regional taxes, which include transport tax, taxes on gambling and property of organizations, can be regulated both by the Tax Code of the Russian Federation and by laws issued by the authorities of the country's regions, in contrast to federal taxes. The laws of the constituent entities determine the meaning of rates, as well as the availability of certain benefits, specify the terms of payments and submission of declarations.

Local taxes and fees

In accordance with Art. 12 of the Tax Code of the Russian Federation, federal taxes and fees are such obligatory payments, the transfer of which must be carried out everywhere on the territory of the Russian Federation. At the same time, the effect of federal tax standards is regulated only by the Tax Code of the Russian Federation, which introduces and repeals both the taxes themselves and individual provisions for a particular federal tax.

We considered the classification of taxes according to various criteria in our consultation and indicated that taxes and fees by budget level are federal, regional and local. We provide a closed list of federal, regional and local taxes and fees in our material.

Calculation and transfer of insurance premiums to state extra-budgetary funds

Local taxes and fees are those established by the Tax Code of the Russian Federation and regulatory legal acts of representative bodies of local self-government, put into effect in accordance with the Tax Code by regulatory legal acts of representative bodies of local self-government and mandatory for payment in the territories of the relevant municipalities.

In accordance with the Tax Code of the Russian Federation, taxes and fees established in accordance with the Tax Code and mandatory for payment throughout the Russian Federation are recognized as federal. Federal taxes and fees go mainly to the federal budget. At the same time, the highest representative body of the state may provide for a different procedure for the distribution of income received from federal taxes and fees between budgets of various levels, that is, the federal and budgets of the constituent entities of the Russian Federation.

Taxpayer questions are answered by the State Advisor of the Tax Service, Rank II I

In accordance with clause 2.13 of the Procedure for the revaluation of fixed assets as of January 1, 1997, approved by the State Statistics Committee of Russia, the Ministry of Economy of Russia and the Ministry of Finance of Russia dated February 18, 1997 No. VD-1-24/336, the procedure for conserving fixed assets listed on the balance sheet, established and approved by the head of the organization.

The definition of the term “railroad” is given in Art. 2 of the Law of the Russian Federation of August 25, 1995 No. 153-FZ “On Federal Railway Transport”, according to which “railway” is the main state unitary enterprise of railway transport, providing under centralized management and in interaction with other railways and modes of transport the needs of the economy and the population in transportation in the serviced region on the basis of regulation of production, economic and other activities of enterprises and institutions that are part of it.

To what budget are insurance premiums paid to the federal or local

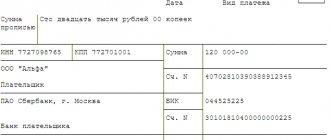

The calculation of insurance premiums is submitted to the tax office at the location of the organization and separately at the location of each separate division for which a current account is opened and which makes payments to individuals (clause 7 of Article 431 of the Tax Code). The deadline for submitting the calculation is no later than the 30th day of the month following the end of the quarter (reporting period - quarter).

When establishing a local tax, representative bodies of local self-government define the following elements of taxation in regulatory legal acts: tax rates within the limits established by the Tax Code of the Russian Federation, the procedure and deadlines for paying the tax, as well as reporting forms for this local tax.

Insurance premiums federal or regional budget

The Tax Code of the Russian Federation in the Russian Federation establishes: federal taxes and fees, taxes and fees of the constituent entities of the Russian Federation (regional taxes and fees) and local taxes and fees. In accordance with the Tax Code of the Russian Federation, taxes and fees established in accordance with the Tax Code and mandatory for payment throughout the Russian Federation are recognized as federal.

Individual entrepreneurs pay less taxes than legal entities. But among these mandatory payments there are both federal taxes (VAT, personal income tax) and taxes of a “lower” level (transport, property, trade taxes).

Where do our taxes go?

These taxes do not bring significant revenue to local budgets and fill about 12% of the municipal wallet. If the property tax on individuals is more or less clear, then why doesn’t at least the land tax give a significant increase, since we have such a large country? The fact is that in Russia, about 4/5 of all land is not subject to land tax, because this land is federal property: these are reserve lands, forest resources, military facilities, etc. Thus, the remaining lion's share of the local budget is formed from deductions from federal and regional taxes. This is money that comes from above. In this case, of course, local budgets have no incentive to expand their tax base. Instead of actively looking for additional sources of budget revenues locally, local authorities are moving into a passive mode of waiting for help from the federal government.

To what budget do taxpayer insurance contributions go?

Search for Lectures INTRODUCTION Calculation of taxes and fees determined by law for payment to budgets of various levels. In accordance with Art. 8 of the Tax Code of the Russian Federation, a tax is understood as a mandatory, individually gratuitous payment levied on organizations and individuals in the form of alienation of funds belonging to them by right of ownership, economic management or operational management, for the purpose of financial support for the activities of the state and (or) municipalities. A fee is understood as a mandatory fee levied on organizations and individuals, the payment of which is one of the conditions for state bodies, local governments, other authorized bodies and officials to carry out legally significant actions in relation to fee payers, including the granting of certain rights or the issuance of permits (licenses). ).

Federal taxes are payable throughout the Russian Federation. And these include: - value added tax - a tax that is included by the manufacturer in the cost of the product, so the tax is paid by the buyer; - excise taxes - tax on socially dangerous goods: alcohol, tobacco, cigarettes, etc.; - tax on income of individuals, as the name implies, this tax is payable if an individual receives any profit - wages, dividends, etc.; - unified social tax, includes payments to the federal budget, FFOMS (Federal Mandatory Medical Fund) education), TFOMS, FSS (Social Insurance Fund); - corporate income tax; - mineral extraction tax; - water tax; - fees for the use of wildlife and for the use of aquatic biological resources; - state duty.

Unified Agricultural Tax - Unified Agricultural Tax

The Unified Agricultural Tax - Unified Agricultural Tax - is a taxation system for organizations and individual entrepreneurs who are agricultural producers. Taxpayers applying this tax regime are exempt from paying taxes on profits, property and VAT.

The object of taxation is income reduced by the amount of expenses. The tax rate is 6 percent.

This taxation system is used for certain types of activities: household services, motor transport services, retail trade, public catering, etc.

The tax base for calculating the amount of a single tax is the amount of imputed income, calculated as the product of the basic profitability calculated for the tax period and the value of the physical indicator characterizing this type of activity.

Payment of a single tax by organizations provides for their exemption from the obligation to pay corporate income tax (in relation to profits received from business activities, subject to a single tax), corporate property tax (in relation to property used for conducting business activities, subject to a single tax, for with the exception of real estate objects, the tax base for which is determined as their cadastral value in accordance with this Code).

Organizations and individual entrepreneurs who are taxpayers of the single tax are not recognized as taxpayers of value added tax.

Insurance premiums federal or regional

An important criterion for classifying them as taxpayers is the presence of a land plot that belongs to them with one of the following rights: Individuals and legal entities using plots of land in accordance with a lease agreement or under the right of free-term use are excluded from the number of taxpayers of such tax.

It is not permissible to unjustifiably exempt some payers from paying tax and simultaneously collect it from others under the same conditions. The principle of unity of the economic space of the Russian Federation. Taxes and fees that in any way encroach on the integrity of the country's economic space are unacceptable. Mandatory payments to the budget cannot directly or indirectly affect the freedom of movement within the country, both goods, services, and financial resources.

Insurance premiums federal or regional budget

Local taxes and fees are those established by the Tax Code of the Russian Federation and regulatory legal acts of representative bodies of local self-government, put into effect in accordance with the Tax Code by regulatory legal acts of representative bodies of local self-government and mandatory for payment in the territories of the relevant municipalities. When establishing a local tax, representative bodies of local self-government define the following elements of taxation in regulatory legal acts: tax rates within the limits established by the Tax Code of the Russian Federation, the procedure and deadlines for paying the tax, as well as reporting forms for this local tax.

As you can see, not all taxes remain at the disposal of the region where they were collected. The current tax policy is such that significant amounts first go to the federal budget, and then are returned in the form of transfers to regional and municipal budgets.

Property tax: calculation, payment, budget accounting

The scheme for calculating and paying property taxes is relatively transparent. Its practical application, as a rule, does not cause problems. However, on the eve of summing up the results of the tax period (at the end of the calendar year), there is a need to clarify the correctness of the calculation of previously made advance payments.

For this purpose, an analysis of changes in tax and accounting legislation over the past period should be carried out. At the same time, assess the need to adjust the procedures for calculating and paying taxes and document flow schemes in terms of determining the tax base for property tax.

Organizational property tax is one of the most common regional taxes. It is established by Chapter 30 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation) and the laws of the constituent entities of the Russian Federation, and is put into effect in accordance with federal and regional tax legislation. At the regional level, the legislative (representative) bodies of the constituent entities of the Russian Federation determine the tax rate, procedure and deadlines for tax payment. In addition, government bodies of constituent entities of the Russian Federation can establish tax benefits (in addition to the list of benefits defined in Article 381 of the Tax Code of the Russian Federation).