The special tax regime of the simplified tax system (simplified taxation system, “simplified”) is primarily aimed at individual entrepreneurs and small business organizations. The Tax Code of the Russian Federation introduces various restrictions on the application of this tax regime. Such restrictions are, for example, the maximum amount of income and the maximum cost of fixed assets, beyond which the use of the simplified tax system is impossible.

If you want to focus your energy only on business, without wasting time on accounting, pay attention to this remote accounting service. Responsibility, literacy, competitive prices - all this has made this service the most popular in Russia!

If you have chosen a simplified tax system for income of 6%, it means that the income of your business does not exceed 150 million rubles per year, and the costs are insignificant in order to work on a simplified tax system of 15% (income minus expenses). For 2021, the income limit was set at 150.00 million rubles.

For 2021, the income limit is:

- for legal transition persons from 01/01/2021 on the simplified tax system, the income limit for 9 months of 2021 should not exceed 112.5 million rubles. For the transition of individual entrepreneurs from 01.01.2021 to the simplified tax system, there is no income limit;

- the limit for applying the simplified tax system in 2021 for individual entrepreneurs and legal entities should not exceed 154.8 million rubles;

- for the transition of legal entities to the simplified tax system from January 1, 2022, the income limit for 9 months of 2021 should not exceed 116.1 million rubles. For the transition of individual entrepreneurs to the simplified tax system from 01.01.2022, there is no income limit.

Starting from 2021, simplified tax rates have been established for the transition period. Federal Law No. 266-FZ of July 31, 2020 determines the following rates when the above income limits are exceeded and the number of employees exceeds 100 people, from the quarter in which the income exceeded from 154.8 million rubles to 206.4 million rubles and the number from 101 to 130 employees:

- for the simplified tax system, income is 8%;

- for the simplified tax system, income minus expenses is 20%.

Those. The individual entrepreneur has the right to choose if the above conditions are exceeded:

- stay on the simplified tax system and pay higher rates;

- go to OSN.

What the law says

Taxation issues for simplifiers are regulated by Chapter 26.2 of the Tax Code of the Russian Federation.

Tax payers under this special regime can be both legal entities and individual entrepreneurs.

When calculating tax, there are 2 rate options:

- 6% – only from “Income”;

- or 15% – from “Income minus Expenses”.

Let us immediately note that in 2021 there were practically no legislative changes related to the calculation of tax under the simplified taxation system.

From January 1, 2021, pension and medical contributions do not depend on the minimum wage. Their amount for a simplified individual entrepreneur without staff is fixed (Article 430 of the Tax Code of the Russian Federation):

- RUB 29,354 – pension contributions (for income over 300,000 rubles – plus 1% of the excess of this amount of income for the year);

- 6884 rub. – medical.

Only an individual entrepreneur at the “Income” object can reduce the tax on all contributions at once (i.e., the 50% limit does not apply).

Also see “Fixed insurance premiums for individual entrepreneurs “for themselves” in 2021: amounts and payment.”

The calculation procedure and payment deadlines for the simplified tax remain the same:

- I quarter – until April 25, 2019;

- first half of the year – until July 25, 2019;

- 9 months until October 25, 2021.

At the end of the calendar year, the remaining tax is calculated and paid. The deadline is the same as for filing a tax return:

- for individual entrepreneurs - no later than April 30, 2021 (taking into account the postponement - immediately after the first May holidays);

- for legal entities until April 1, 2021 inclusive.

Also see “Deadline for payment of the simplified tax system in 2019: table for organizations and individual entrepreneurs.”

Who can switch to the simplified tax system

It is up to the organization or individual entrepreneur (IP) to decide which taxation system to work in. To switch to the simplified tax system, you need to meet a number of requirements (Tax Code of the Russian Federation, paragraph 2, article 346.12):

- the company's income is no more than 112.5 million rubles (for 9 months of the previous year);

- staff of no more than 100 people;

- the company has no branches.

The simplified taxation system is perfect for individual entrepreneurs and small business organizations, because, first of all, it is the replacement of three taxes with one, as well as simplified accounting and tax accounting and the right to choose the object of taxation. There is no income tax (personal income tax), property tax or value added tax. Using the simplified tax system, an organization is required to calculate and transfer only taxes from employee salaries and insurance contributions.

How to make a calculation

The procedure for calculating the tax of the simplified tax system “Income” is regulated by Art. 346.21 Tax Code of the Russian Federation. To do this, you will need a tax rate (in this case - 6%; for some regions it can be reduced) and a tax base.

What do we have to do:

| 1 | Sum up the income received in fact for each quarter (with a cumulative total) |

| 2 | Determine size:

|

| 3 | Determine the tax base (TB): TB = Income – Contributions |

| 4 | Calculate the advance payment paid at the end of the reporting period (quarter/half-year/9 months). The formula is: AP = NB – Contributions – AVpr АВр – advance payments of tax for previous reporting periods of the year. |

| 5 | Final calculation of the simplified tax system 6%: TAX = NB × 6% – АВр |

Remember that the calculated tax is reduced by the amount of insurance premiums made in the reporting period (+ paid sick leave). For individual entrepreneurs without employees it is 100%, and for legal entities and businessmen hiring staff up to 50%.

Consider both tax and contributions as cumulative total.

It does not matter for what period the contributions are accrued. The main thing is that they are paid in the period for which you are calculating the tax. For example, for contributions for March paid in April, it will be possible to reduce the advance payment for the half-year, and not for the first quarter (letter of the Ministry of Finance dated February 25, 2019 No. 03-11-11/12121).

Payment of taxes and contributions

An individual entrepreneur pays all payments for himself according to the details of the tax office . To generate a payment invoice, you can use the official service of the Federal Tax Service. The first thing you need to know from the details is the budget classification code. Using it, the service can independently determine the type and name of payment. The individual entrepreneur must have all other details in the documents from the tax office and the Pension Fund.

Entrepreneurs on the simplified tax system of 6% should use the following codes (2018):

- for tax payment - KBK 182 10500 110;

- to pay contributions to the Pension Fund - 182 10210 160;

- to pay contributions to the Compulsory Medical Insurance Fund - 182 10213 160.

The generated payment order can be taken to the bank or used as a template for filling out a payment order in Internet banking.

Calculation example

LLC "Guru" is in a simplified tax regime with the object "Income" and has employees. It is necessary to determine the amount of advance tax payments deducted in the reporting periods of 2021.

Actual income, insurance contributions and benefits made, as well as all final calculations are presented below in the table (the amounts of income and contributions/benefits are taken arbitrarily as an example).

The Guru Society reached the end of 2021 with the following indicators:

| Period 2021 | Income on an accrual basis, rub. | Calculated advance tax payment, rub. | Amounts of incremental contributions and benefits that can be deducted, rub. | How much can the advance tax payment be reduced, rub. | Advance payment for tax payable, rub. |

| I quarter | 300 000 | 18 000 (300 000 × 6%) | 10 500 | 9000 (10 500 ˃ 18 000/2) | 9000 (18 000 – 9000) |

| Six months | 800 000 | 48 000 (800 000 × 6%) | 18 500 | 18 500 (18 500 < 48 000/2) | 20 500 (48 000 – 18 500 – 9000) |

| 9 months | 2 000 000 | 120 000 (2 000 000 × 6%) | 50 000 | 50 000 (50 000 < 120 000/2) | 40 500 (120 000 – 50 000 – 9000 – 20 500) |

| Summary of 2021 | 3 000 000 | 180 000 (3 000 000 × 6%) | 102 000 | 90 000 (102 000˃180 000/2) | 20 000 (180 000 – 90 000 – 9000 – 20 500 – 40 500) |

Let us recall that there is an important feature of the calculation of the simplified tax system: when the listed amounts of hospital benefits and insurance premiums are paid by organizations or individual entrepreneurs with employees, a reduction in the advance/tax on the amount of such contributions and/or benefits in general is possible by no more than 1/2 of the advance (see 5th column in the table).

Drawing up a declaration under the simplified tax system using a special service

Special services are becoming increasingly popular when filling out simplified reporting. With their help, even a novice entrepreneur will be able to draw up a declaration under the simplified tax system without errors. The simplicity and convenience of the service lies in the fact that the individual entrepreneur does not need to carefully study the instructions and understand all the intricacies of filling out reports. You just need to follow the system prompts. Let's take a closer look at how a tax return under the simplified tax system for 2021 is prepared for individual entrepreneurs without employees in our service and how to fill it out online in 5 minutes.

What do individual entrepreneurs without employees pay?

Individual entrepreneurs who work without hiring labor pay pension and health insurance contributions only for themselves.

EXAMPLE

For the purposes of calculating the simplified tax system “Income”, let’s assume that the income of individual entrepreneur Shirokov in 2021 amounted to 160,000 rubles for each month. Also at the end of December 2021, by virtue of the direct instructions of the law, he transferred to the budget:

- additional contribution to compulsory pension insurance – 1% on income more than 300,000 rubles. for the whole year;

- fixed payment in the amount of 36,238 rubles (for compulsory medical insurance 29,354 rubles + for compulsory medical insurance 6884 rubles).

The table below shows an example of calculating the simplified tax system “Income” in 2019:

Period 2021 Calculation of advance tax payment, rub. Amount to be paid (reduced by previous advances), rub. I quarter (RUB 160,000 × 3 months) × 6% = 28,800 The entire amount of 28,800 rubles. transfer to the budget Six months (RUB 160,000 × 6 months) × 6% = 57,600 RUB 57,600 – 28,800 rub. = 28,800 rub. 9 months (RUB 160,000 ×9) × 6% = 86,400 RUB 86,400 – 28,800 rub. – 28,800 rub. = 28,800 rub. All 2021 (RUB 160,000 × 12 months) × 6% = 115,200 RUB 115,200 – 28,800 rub. – 28,800 rub. – 28,800 rub. = 28,800 rub. That is, for the entire 2021, individual entrepreneur Shirokov had to pay tax to the budget according to the simplified tax system in the amount of 115,200 rubles. But this is not the final calculation.

When calculating the simplified tax system of 6% for individual entrepreneurs, the final tax payable for the entire 2019 year is reduced by a fixed payment (contributions for compulsory medical insurance and compulsory medical insurance) in the amount of 36,238 rubles. We get:

RUB 115,200 – 36,238 rub. = 78,962 rub.

But in addition to 78,962 rubles. You need to contribute 1% of income over 300,000 rubles to the budget. in a year. It turns out:

((160,000 rub. × 12 months) – 300,000 rub.) × 1% = 16,200 rub.

Also see “Rules for calculating advance payments under the simplified tax system.”

Read also

14.03.2018

Simplified reporting methods

A tax return under the simplified tax system can be filled out:

- By hand.

To do this, you need to report or obtain it from any Federal Tax Service. The document must be in current form, as mentioned above. The declaration must be drawn up in strict accordance with the procedure for filling it out. Errors in reporting can lead to problems during its submission and verification. - On the computer.

You can also fill out the declaration on a computer, without using special online services. This method will require care, a responsible approach and strict adherence to the drawing up instructions. - Using a special service (online calculator).

The easiest and fastest way to generate simplified reporting. It completely eliminates the risk of errors. The calculator generates reports based on data on income received and insurance premiums paid. All information is entered into the declaration in accordance with official instructions.

Let's take a closer look at the procedure for filling out simplified reporting using a clear example.

Losses

A loss is the excess of expenses over income.

Choosing an individual entrepreneur as an object of taxation under the simplified tax system “income reduced by the amount of expenses” allows you to reduce the tax base of the current year by the amount of losses from previous years. Moreover, losses can be carried forward to the next year for 10 years following the year in which losses were incurred.

Also, the individual entrepreneur has the right to add to the loss or include in the expenses of the following years the difference between the calculated tax and the minimum tax paid.

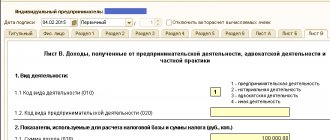

Instructions for filling out simplified reporting using the online service

1. Go to the service page and select the main parameters of the declaration:

- “Taxpayer”

– “Individual entrepreneur without employees.” - “Title page”

– “Fill out”. - “Type of simplified tax system used”

- “Income”.

2. In the “Title Page” tab we indicate the basic data about the individual entrepreneur, the main OKVED code, the tax period and the Federal Tax Service to which the reporting is submitted.

3. In the “Type of simplified tax system used” block, enter data on the income received (quarterly) and the amount of insurance contributions transferred to the budget. If a trade tax was also paid during the tax period, check the appropriate box.

4. Enter OKTMO at the place of registration and click generate in PDF or EXCEL.

Note

: for individual entrepreneurs paying a trade fee, it will be necessary to indicate quarterly the amount of income received and the fee transferred to the budget.

This completes the reporting. All that remains is to save it to disk and print it.

Keeping accounting records for individual entrepreneurs in 2021

Law No. 402-FZ dated December 6, 2011 established that individual entrepreneurs may not keep accounting records.

However, this provision should not be understood to mean that the individual entrepreneur does not report to the state at all. In addition to accounting itself, there is another one – tax accounting. Tax accounting is the collection and synthesis of information necessary to calculate the tax base and tax payments. It is carried out by all taxpayers, including individual entrepreneurs. To understand tax reporting and tax accounting procedures, you must have professional knowledge or study these issues yourself. And in addition, there are special reports on employees, cash and bank documents, primary documentation, etc.

Often entrepreneurs do not see much difference between the types of accounting, so all their accounting is called accounting. Although in the normative sense this is not true, in practice it is a familiar expression, so we will also use it.

So, how to do accounting correctly? There is only one answer - professionally. An accountant for an individual entrepreneur can be a full-time employee or a specialist from an outsourcing company. If the number of business transactions is not too large, then the salary of a permanent accountant may be an unjustified expense. If you are ready to take care of your accounting yourself, we will tell you how to do it.

How can an individual entrepreneur conduct accounting on his own? Is it possible? You will find the answer below in the step-by-step instructions.

Free tax consultation