The simplified tax system or simplified system is a tax regime under which more than half of small businesses work. By choosing this system, the taxpayer receives simple reporting, a low tax rate and the opportunity to reduce tax due to paid insurance premiums.

The simplified tax system Income option is especially popular among entrepreneurs without employees, because with small revenue the tax can be reduced completely, i.e. to zero. We will show you how to do this using examples below, but first learn about the main features of the simplified tax system 2021.

Single tax for “simplified people”

Payment of taxes by individual entrepreneurs using the simplified tax system is reduced to a minimum. Its distinctive feature was the replacement of three taxes with one - a single “simplified” tax. Entrepreneurs using the simplified system do not need to pay:

- income tax for individuals (excluding those specified in paragraph 2 and paragraph 5 of Article 224 of the Tax Code of the Russian Federation);

- property tax for individuals (excluding those included in the list determined in accordance with clause 7 of Article 378.2 of the Tax Code of the Russian Federation);

- value added tax (excluding VAT when importing goods at customs and execution of trust management agreements).

The declaration is submitted once a year. Actual payment of individual entrepreneurs' taxes on the simplified tax system is made in advance payments quarterly; there is no need to submit separate documents with calculations for them. Advance payment of individual entrepreneur taxes on the simplified tax system in 2021 must be made no later than April 25 (for the first quarter), July 25 (for the first half of the year), October 25 (for 9 months).

The main tax for 2021, taking into account the advances made, must be transferred by April 30, 2021.

Read also: Deadlines for payment of advance payment of the simplified tax system 2018

Types of taxation systems

The taxation system is a method of paying mandatory taxes determined by law in the form of cash payments to the state budget.

There are the following types of taxation:

- general taxation system (OSNO);

- simplified taxation system (STS);

- unified tax on imputed income (UTII);

- single agricultural tax (USAT);

- patent payment calculation system;

- fixed payments to the Pension Fund and the Compulsory Medical Insurance Fund.

What to choose, 6% or 15%?

But even within the framework of a single tax, individual entrepreneurs have the opportunity to choose a starting point, depending on which individual entrepreneurs’ taxes on the simplified tax system will be calculated in 2021. We are talking about choosing the object of taxation “income” or “income minus expenses”.

The amount is calculated as the tax rate multiplied by the tax base. Both multipliers depend on the choice of taxation object. At the same time, it does not matter whether there is a workforce on the balance sheet or whether we are talking about individual entrepreneurs on the simplified tax system without employees; the tax, or rather the principle of its calculation for a particular object, will not change from this.

Choosing the simplified tax system “income” is advisable when the amount of expenses is low. For example, when renting out real estate or transport or when providing services to the public. The standard tax rate in this case will be 6%. Regional authorities have the right to further reduce the rate to 1%.

“Income minus expenses” is justified when necessary, for example, to purchase materials for production or goods for resale, or other cases when the ratio of expenses to income is 60% or more. The calculation will be based on net profit, but the standard rate will increase to 15%. For this facility, regional authorities have the right to reduce the rate to 5%. The difficulty is that not all expenses can be counted toward tax reduction, and those that qualify, as specified in Article 346.16 of the Tax Code, must be documented.

What should an individual entrepreneur pay under simplified legislation in 2021?

An entrepreneur without employees using the simplified tax system in 2021 is required to pay two types of basic payments:

- Taxes for the simplified tax system.

- Fixed insurance premiums.

Let's take a closer look at what these payments are, how to calculate them correctly and when they must be paid. Let's start with individual entrepreneurs' insurance premiums for themselves in 2021. Read about how to pay taxes and fees online here.

Insurance premiums

Payments for medical and pension insurance are mandatory for an individual entrepreneur as long as he is registered in the Unified State Register of Individual Entrepreneurs. Their number depends on the number of employees the individual entrepreneur has. This also affects the deduction procedure, which can significantly reduce individual entrepreneurs’ taxes on the simplified tax system.

From 2021, insurance premiums are no longer tied to the minimum wage. Their size is established by law and is gradually increasing.

How much can insurance payments affect taxes? Individual entrepreneurs (USN 6%) without employees transfer insurance premiums exclusively “for themselves.” This year their amount is 32,385 rubles, of which 26,545 rubles go to the Pension Fund and 5,840 rubles to the Compulsory Medical Insurance Fund.

With an annual income of over 300 thousand, contributions to the Pension Fund increase by 1% of the excess income. The amount can grow up to a maximum of 212,360 rubles, after which the pension payment will no longer change.

Tax deductions can be made for the full amount of insurance premiums “for oneself”, which implies the possibility of zeroing out taxes for individual entrepreneurs (USN 6%) in 2021.

If there are employees, individual entrepreneur taxes (USN 6%) cannot be reduced to zero. The “simplified” tax can be reduced by no more than half due to the individual entrepreneur’s own fixed contributions, as well as due to contributions for employees.

In the case when the object of taxation “income minus expenses” is selected, the taxes of individual entrepreneurs on the simplified tax system with and without an employee are calculated in the same way. Insurance premiums in full (both for yourself and for employees) are included in expenses, reducing the tax base.

Let us remind you that the simplified tax system does not relieve an individual entrepreneur of the obligation to calculate and transfer NLFL from employees’ wages. But in this case, this is not a tax on the individual entrepreneur himself. This is a tax on the income of individuals - its employees. In this case, the employer only plays the role of a tax agent: withholds tax from income and transfers it to the budget.

It's worth paying taxes on time

The main responsibility of an entrepreneur to the state is to pay all taxes and fees to the budget on time and in full, and to make deductions for insurance premiums to extra-budgetary funds. Public services are urged not to violate legal requirements. The main regulator of the Russian Federation, the Federal Tax Service, strictly controls private business and warns that violations of the Tax Code of the Russian Federation can lead to fines and administrative liability, and if particularly large economic crimes are committed, a criminal case can be opened.

Illegal actions, when a businessman tries to hide part of his income or shows increased expenses for running his business, trying to reduce the tax base, can lead to penalties from the Federal Tax Service of the Russian Federation:

- late submission of a declaration to the Federal Tax Service will entail an additional fee - 5% of the tax amount for each overdue month (no more than 30%, but not less than 1,000 rubles);

- late payment of tax - a fine of 20 to 40% of the tax amount.

At the same time, individual entrepreneurship is the least protected structure from the collection of fines. For debts to the state. budget, as well as for all financial obligations to counterparties, the individual entrepreneur is responsible with his property. Even if the property is not related to business activities, it can be taken into account when collecting a debt.

But with all the above risks, a private entrepreneur has many more benefits and advantages than an LLC:

- simplified reporting;

- lower fines for violations;

- freedom to manage your profits;

- simplified liquidation procedure (an application to terminate activities is sufficient).

Additional taxes for individual entrepreneurs

The simplified tax system does not exempt entrepreneurs from additional taxes. We are talking about those that are tied to the specifics of the business that an individual entrepreneur runs on the simplified tax system. What taxes might these be?

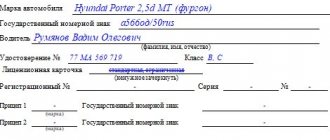

For example, transport tax, property tax, excise taxes, water or land tax, mineral extraction tax, etc. In Moscow, individual entrepreneurs on the simplified tax system conducting trading activities may also be payers of the trade tax. Certain types of activities of an individual entrepreneur on the simplified tax system can be transferred to a patent or to UTII - in this case, he becomes the payer of these additional taxes.

Deadlines for paying taxes on payroll

From 2021, there is a single date on which income taxes must be paid. Thus, the employer is obliged to withhold it at the time of payment of wages, and it must be transferred to the budget the very next day. It does not matter exactly how the funds were issued - in cash from the cash register, to a current account or salary card, or in any other way.

There is an exception to this rule. If tax is withheld from vacation or sick pay, it can be transferred on the last day of the month. Moreover, such a transfer can be made in a single amount for all deductions from this type during this month.

Social contributions that were accrued on employee salaries must be paid before the 15th day of the month that follows the month of accrual. If this date falls on a weekend or holiday, then the payment deadline can be moved forward to the next working day.

Conditions and restrictions of the simplified tax system in 2021

The simplified taxation system does not provide any benefits separately for individual entrepreneurs. The simplified tax system itself is a preferential special regime, for the application of which it is necessary to remain within the framework of several requirements:

- The type of activity must be included in the list that allows the use of the simplified tax system;

- The number of full-time employees should not exceed 100 people;

- Annual income should not exceed 150 million rubles;

- The cost of fixed assets should not exceed 150 million rubles.

There is only one possible benefit for “simplers” - preferential rates for insurance premiums if you work in one of the types of activities listed in paragraphs. 5 p. 1 art. 427 of the Tax Code of the Russian Federation and fulfill a number of other conditions, in particular, to limit revenue.

Let’s summarize what taxes and contributions an individual entrepreneur under the simplified tax system is required to pay to the budget this year:

- Single tax (at a rate of 6% or 15%);

- Fixed contributions (pension and medical);

- Personal income tax on the income of hired employees;

- Insurance premiums calculated on income paid to employees;

- Additional taxes specific to certain types of individual entrepreneur activities.

Calculation of tax payments on the simplified tax system Income

For example, let's take a typical entrepreneur who provides household services himself, for example, sewing and repairing clothes at home. His expenses are small, because the fabric and accessories are paid for by the customer, and there is no need to spend money on rent either.

Income is unstable throughout the year; there is a circle of regular customers who order things from time to time. However, for 2021, income from sewing and repairing clothes amounted to 740,000 rubles. Let's see how many taxes and contributions need to be paid on this turnover if an individual entrepreneur works on the simplified tax system Income.

We will not use the academic formula for the calculation, because it is difficult for beginners in accounting; if you wish, you can find it here. But the option that we will offer is easier to understand in practice, and all payments will be exactly the same as according to the accounting rules.

So, during the year the income received:

- in the 1st quarter – 183,000 rubles;

- in the 2nd quarter – 119,000 rubles;

- in the 3rd quarter – 152,000 rubles;

- in the 4th quarter – 286,000 rubles.

The advance payment for the 1st quarter amounted to (183,000 * 6%) 10,980 rubles, but in March the individual entrepreneur paid part of the insurance premiums for himself in the same amount. The advance payment is completely reduced by the contributions paid, so there is no need to transfer anything to the budget.

The advance for the second quarter is equal to (119,000 * 6%) 7,140 rubles, while in May 7,000 rubles were paid for oneself. We find that the advance payment will be only 140 rubles.

In the third quarter, the calculated advance payment (152,000 * 6%) was 9,120 rubles, with 9,020 rubles paid as contributions in September. You need to transfer 100 rubles to the budget as an advance.

In the last quarter, the entrepreneur paid additional mandatory contributions, taking into account those already paid:

- total fixed amount of contributions is 40,874 rubles;

- contributions paid quarterly (10,980 + 7,000 + 9,020) = 27,000 rubles;

- paid an additional 13,874 rubles in December.

The total amount of the single tax for the year is equal to (740,000 * 6%) 44,400 rubles, while 240 rubles of advance payments and 40,874 rubles of fixed contributions are deducted from this amount. We find that the amount of tax to be paid additionally at the end of the year is: 44,400 – 240 – 40,874 = 3,286 rubles.

But if the individual entrepreneur did not pay contributions quarterly, then first he would have paid all the calculated advance payments (10,980 + 7,140 + 9,120) in the amount of 27,240 rubles. Then in December the contributions would be paid in a one-time amount of 40,874 rubles. In this case, the calculated balance of tax payable would be (44,400 – 27,240) 17,160 rubles. This calculated amount is reduced by the contributions paid (17,160 – 40,874<0), i.e. There is no need to pay anything to the budget. However, in this case, there was an overpayment of tax in the amount of 23,714 rubles. The overpayment can be returned or offset after submitting the annual declaration and submitting an application to the Federal Tax Service.

Prepare a simplified taxation system declaration online

To prevent this from happening, we recommend immediately reducing the calculated advance payments using insurance premiums paid in installments throughout the year.

As for the additional insurance premium in the amount of (740,000 - 300,000) * 1%) 4,400 rubles, the individual entrepreneur has the right to pay it next year - until July 1, 2022. In this case, the additional contribution will reduce the advance payment paid for the 1st or 2nd quarter of 2022.