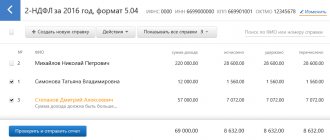

Payment

The Tester program checks tax and accounting files and is distributed free of charge. Usually files

From January 1, 2021, the amount of paid “children’s” benefits will increase, namely: benefits for

Special assessment of working conditions (hereinafter referred to as SOUT) or in the old terminology “certification of workers

Increasing the level of efficient use of assets is an important component for any organization. Inefficient use of property

Cancellation of tax: amendments to the Tax Code of the Russian Federation from 2021 In 2021, objects of taxation

Taxes and contributions Denis Pokshan Expert in taxes, accounting and personnel records Current on

The simplified tax system or simplified system is a tax regime in which more than half of the representatives of small businesses work.

When transitioning or initially choosing a simplified taxation system, the relevant business entities must immediately determine

How is payroll calculated for a part-time working week? Part-time working hours can

The legislation on charitable activities consists of the relevant provisions of the Constitution of the Russian Federation, the Civil Code, the Federal