How is payroll calculated for part-time work?

A part-time working schedule can be specified in an employment contract immediately after its conclusion or later by agreement of the parties.

This mode can be applied within a working day or week. The last option is more convenient for both employees and administration, and is more common in practice. Combined schedules are also used, when the working day and week are reduced at the same time. The legislator proposes to calculate wages for employees according to such individual schedules in proportion to the time of work or the volume of work.

Who sets the part-time mode of operation?

Article 93 of the Labor Code of the Russian Federation declares: part-time working hours can be established for an employee if both parties to the employment contract agree with this. If the decision is made after the employee has been registered by the personnel service, it is necessary to draw up an additional agreement.

The regime can be established by a unilateral decision of management (Labor Code of the Russian Federation, Article 74) for the period of reorganization of the company, fundamental changes in the production process and other factors that impede the fulfillment of the provisions of the employment contract. However, the legislator introduces serious restrictions on the unilateral actions of the employer, for example, it obliges employees to warn about changes 2 months before they are introduced.

In practice, it is easier for the head of a company to reach an agreement with his subordinates than to unilaterally change their work schedule.

There is also a direct obligation of the company’s management to provide the opportunity to work part-time (day), if the request is made by:

- pregnant worker;

- parent (citizen replacing him) of a minor under 14 years of age;

- parent (citizen replacing him) of a minor child on disability;

- a citizen caring for a sick relative.

What is important for an accountant to remember?

When calculating wages and similar payments to a part-time employee, an accountant must remember a number of key points:

- Wages are calculated proportionally (time, volume of work). A reduction in pay, compared to the full regime, always occurs and does not depend on the wage system.

- There is no change in the duration of annual leave (Article 93 of the Labor Code of the Russian Federation). Part-time work does not affect length of service.

- Calculation of vacation pay, sick pay, and “travel pay” is done according to a standard algorithm: based on average earnings for the previous year.

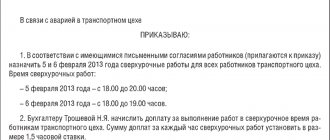

- Partial working hours, agreed upon with the employee, are considered the basic value, the norm, for him. If he is involved in work beyond this norm, it means he is working overtime. Such work is paid accordingly (Labor Code of the Russian Federation, Art. 152, 99). Likewise, when such an employee is involved in work on a weekend or holiday (Labor Code of the Russian Federation, Art. 153, 113).

- The minimum wage - the required minimum payment for labor - (Article 133 of the Labor Code of the Russian Federation) is applied in full only if the time is fully worked. Under the regime under consideration, this value decreases proportionally, as set out in Art. 93 Labor Code of the Russian Federation.

Salary and bonuses for a part-time employee

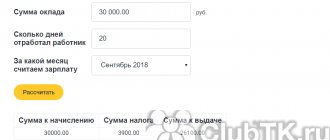

Part-time wages are cut in proportion to the time spent.

The illustrator’s price tag of 70,000 rubles and half the rate is reduced to 35,000 rubles.

Taxes for an employee are calculated based on their actual salary. Piecework pay will decrease because the employee has time to do less.

The remaining bonuses of working for hire remain the same as for full-time employment.

A person rests for 28 days every year, receives money twice a month, gets sick with compensation for earnings, goes on maternity leave for three years and can demand a heater in winter. In general, the length of service for a pension does not decrease.

A part-time employee is even entitled to a lunch break of at least 30 minutes. The Ministry of Labor recalled this in Letter No. 14-2/B-1012. Except for shifts shorter than 4 hours, you can go without lunch here.

Lead employees in Elba

The service will calculate taxes and prepare all necessary reporting for employees. And you don’t have to understand the legislation and fill out the forms yourself.

Try 30 days free Gift for new entrepreneurs The promotion is valid for individual entrepreneurs under 3 months old

What to write in an employment contract

Text of Art. 93 of the Labor Code of the Russian Federation does not make it possible to unambiguously determine how to formulate the conditions of a part-time working week in a contract or additional agreement. There is no consensus on this issue today.

Quite often, the personnel service indicates the monthly salary according to the staffing table for a full month, and then makes a note that payment is made in proportion to the time worked, and lists the conditions of the reduced work schedule (days of the week, hours). An employee who wants to determine the actual accrual amount for the month has to do this by calculation.

Note that Art. 57 of the Labor Code of the Russian Federation insists on the need to include the working conditions of a specific employee in the employment contract. Information about his remuneration should also be as specific as possible. Therefore, it is advisable to indicate in the document exactly the remuneration already calculated according to the individual work schedule, in addition, the schedule itself: “Working days - Monday, Wednesday, Friday”, “Working days - Monday, Wednesday, Friday, from 9 to 13 hours " and so on.

The latter position is defended by labor inspectorate officials both in official comments and when applying it in the practice of inspections of organizations. According to the logic of the regulatory authorities, the employee must be paid the amount specified in the employment contract. An employer may find itself in a situation where it is required to pay for a full working month, while the employee has only partially worked that month’s working time.

On a note! The concepts of “part-time” and “reduced” working hours are different. In case of part-time work, wages are calculated proportionally, and in case of reduced work, the employee generally receives the same salary as if he had worked the whole day or week (Article 92 of the Labor Code of the Russian Federation).

When is an employer required to establish a part-time rate?

Family responsibilities

For workers with children or elderly relatives, 40 hours a week is too much. It doesn't matter who it is: a man or a woman.

The employer is obliged to reduce working hours, even if this is inconvenient for the business:

- pregnant;

- parent or guardian of a child under 14 years of age;

- parent or guardian of a disabled child under 18 years of age;

- a person caring for a sick relative with an ITU certificate.

If an employee has taken out maternity leave to care for a child, he retains benefits from social insurance under Art. 256 Labor Code of the Russian Federation. The main thing is not to raise suspicions about a fake reduced rate - we’ll talk about this in the section on risks.

The employer can check whether there really is no one else in the employee’s family to care for the child. To do this, they ask for a certificate about the working hours of the second parent. This is the recommendation of the Ministry of Labor from Letter No. 14-2/B-1012. If it turns out that the other parent does not work, the reduction of the day will be denied.

The working hours are agreed upon. But the law does not provide a framework for how many hours the week is cut and how to shift the working day. Sometimes a person comes for a couple of hours a day, but sometimes they only cut it for thirty minutes in the evening.

The Labor Code advises to negotiate this way: it is convenient for the employee and the business does not suffer.

In real life, often the employee and the employer cannot agree. For example, a woman has a child in the nursery until lunchtime, but it is more convenient for the employer to make it a non-working environment and leave the rest of the days full.

❗ Important: it is the employer who will suffer if the employee is not given a convenient schedule. After all, management has the last word, and the employee is dependent on his salary.

Rostrud advises workers to complain about employers to the labor inspectorate of their city. In response to such complaints, inspectors come and fine you. But no one will draw up a schedule for you anyway.

To transfer an employee to part-time work, take an application from him, agree on the working hours and sign an additional agreement to the employment contract.

Sample employee application for transfer to part-time work

Sample additional agreement on part-time work

Minors and disabled people

There are also workers who, due to age and health, are supposed to work less. The number of hours for them is prescribed in Art. 92 Labor Code of the Russian Federation:

- workers under 16 years of age - no more than 24 hours a week,

- workers from 16 to 18 years old and disabled people - no more than 35 hours per week,

- workers in hazardous work – no more than 36 hours a week.

If a minor is studying, the week is further cut in half - to 12 and 17.5 hours. So be careful with child prodigies