For those involved in retail trade, one of the attractive tax regimes is imputation. It is attractive because it is simple and convenient. But only as long as all the stores are open. As soon as one of the stores closes, a lot of questions arise related to UTII.

Let's consider a situation where a company or individual entrepreneur has two stores on UTII, one of which closes at some point. The very first question that arises is: is it necessary to deregister as a payer of “imputed” tax? There is no general answer to this question, since everything depends on the specific situation.

When is an application for deregistration of UTII required?

The application of the taxation regime called UTII is voluntary, however, in order to start working on it, it is necessary to register with the tax authorities. Therefore, when a taxpayer decides to leave UTII, he must also notify the tax authorities about this and go through the procedure of deregistration with the Federal Tax Service.

Voluntary departure from UTII may be due to the following factors:

- termination of activities on the UTII - this happens, for example, if the payer has ceased to provide services transferred to UTII, or territorial authorities have removed its activities from the list of services falling under this regime;

For more details, see: “What is the procedure for deregistering a UTII payer who has ceased activity?”

- switching to another mode.

You can learn more about what else can affect leaving UTII from this material.

Pay attention to one more situation: the taxpayer does not fall under any of the above grounds, but simply moved the place of business. Does this entail the obligation to deregister with the Federal Tax Service?

Look for the answer to this question in the publication “The Ministry of Finance explained how to pay UTII when moving a store to a new location .

See also the article: “Deregistration of UTII in 2018–2019: conditions and terms.”

How to calculate UTII if one of the stores is closed

So, we are approaching another important question: how to calculate UTII for the quarter in which one of the stores was closed?

First situation:

stores for which UTII is applied are registered with different tax authorities.

When closing one store, the procedure is clearly stated in the tax legislation (clause 10 of article 346.29 of the Tax Code of the Russian Federation). It says that the amount of imputed income for the quarter during which the taxpayer was deregistered due to the termination of business activities subject to UTII is calculated before the date of deregistration with the Federal Tax Service specified in the notice of deregistration of the organization (IP) as UTII payer.

Moreover, for the month in which deregistration occurred, imputed income is calculated based on the actual number of days the store was open using a special formula specified in the same paragraph. Thus, in fact, the tax will be calculated only for the period when the store was open.

Second situation:

stores for which UTII is applied are under the jurisdiction of one tax inspectorate.

When one store is closed, tax legislation does not contain rules governing the procedure for calculating UTII in such a situation. However, officials allow the use of the same procedure that is used for the complete cessation of activities on UTII, that is, the procedure established by clause 10 of Art. 346.29 of the Tax Code of the Russian Federation (first situation). This is evidenced, in particular, by letters from the Ministry of Finance of the Russian Federation dated March 14, 2018 No. 03-11-06/2/15668, dated June 23, 2017 No. 03-11-11/39527, dated December 3, 2015 No. 03-11-09/70689 (notified to the tax inspectorates by letter of the Federal Tax Service of Russia dated February 19, 2016 No. SD-4-3/2690).

Therefore, based on the explanations of officials, UTII for a closed store should be calculated for the period from the 1st day of the quarter to the date when the outlet was closed.

Let us remember that several years ago this situation was unclear. The Federal Tax Service explained that for the month in which the store was closed, the tax should have been calculated in full, that is, without taking into account the number of days the facility was in operation (letter No. GD-4-3/26206 dated December 18, 2014). The Ministry of Finance believed that for this month the area of the closed store should not have been taken into account at all. In their opinion, in this situation there was a change in physical indicators, in which the provisions of paragraph 9 of Art. 346.29 of the Tax Code of the Russian Federation (letters dated November 28, 2014 No. 03-11-09/60758, dated October 30, 2013 No. 03-11-11/46223). There was no agreement between officials from different departments. But now it doesn't matter anymore.

What deadlines must be met to submit an application for withdrawal from UTII?

When leaving the UTII, the payer must submit an application for deregistration within 5 days from the moment he stopped working for UTII. At the same time, the procedure for calculating the period for deregistration of UTII is different:

- if the activity is terminated by the taxpayer himself, then the countdown begins from the moment of its actual completion;

- if deregistration is due to reasons beyond the payer’s control, then the 5 days are counted differently.

How - you will learn from this material .

Having received such an application, the tax authorities, in turn, are obliged to remove the payer from the register within 5 days from the date of its submission. After deregistration, the Federal Tax Service sends a corresponding notification.

You can find out more about it here .

It also happens that the “imputed” person does not meet the deadline specified for filing the application. Then the tax office will not comply with it within the 5-day period allotted by law.

When the Federal Tax Service will deregister such a payer, this material .

Having withdrawn from tax registration, it is important not to forget to submit a UTII return.

Which inspectorate should you submit your latest report to, is described in the material “Deregistered under UTII? . ”

Cancellation of UTII. What to do? Detailed instructions from the Federal Tax Service

(Letter of the Federal Tax Service of the Russian Federation dated November 20, 2020 No. SD-4-3/ [email protected] )

The Federal Tax Service of the Russian Federation, in connection with the abolition of the special tax regime in the form of a single tax on imputed income for certain types of activities from January 1, 2021, sent the following clarifications.

1. What taxation regime can UTII taxpayers switch to after its abolition?

Organizations and individual entrepreneurs, after the abolition of UTII, have the right to switch to the use of other alternative special taxation regimes, for example, a simplified taxation system, a patent taxation system.

In addition, currently, in accordance with Federal Law No. 422-FZ dated November 27, 2018, an experiment is being conducted in all constituent entities of the Russian Federation to establish a special tax regime “Professional Income Tax.”

In this regard, individual entrepreneurs who do not have employees under employment contracts, after the abolition of UTII, can switch, among other things, to the use of a special tax regime of NAP .

2. On the issue of the need to submit an application for deregistration as a UTII taxpayer in connection with the abolition of this taxation regime.

Due to the fact that the termination of business activities subject to UTII taxation occurs from January 1, 2021 , that is, after the repeal of Chapter 26.3 of the Tax Code of the Russian Federation, the basis for taxpayers to submit an application for deregistration as a UTII taxpayer, provided for in paragraph 3 of Art. 346.28 of the Tax Code of the Russian Federation there are no notifications from the tax authorities about the deregistration of the taxpayer as a UTII taxpayer .

Deregistration of organizations and individual entrepreneurs registered with the tax authorities as UTII taxpayers will be carried out automatically (letter of the Federal Tax Service of the Russian Federation dated August 21, 2020 No. SD-4-3 / [email protected] ).

3. To which tax authority is it necessary to submit a tax return on UTII for the 4th quarter and within what period after 01/01/2021?

The UTII taxpayer is obliged to submit tax returns based on the results of the tax period no later than the 20th day of the first month of the next tax period ( clause 3 of Article 346.32 of the Tax Code of the Russian Federation ).

Payment of UTII is made by the taxpayer based on the results of the tax period no later than the 25th day of the first month of the next tax period to the budgets of the budget system of the Russian Federation at the place of registration with the tax authority as a taxpayer of UTII in accordance with clause 2 of Art. 346.28 of the Tax Code of the Russian Federation ( clause 1 of Article 346.32 of the Tax Code of the Russian Federation ).

Thus, the UTII tax return for the 4th quarter of 2020 must be submitted no later than January 20, 2021, and the tax must be paid no later than January 25, 2021.

In this case, the tax return is submitted to the tax authority in which the organization or individual entrepreneur was registered as UTII taxpayers before the abolition of the specified taxation regime .

4. Starting from 2021, UTII does not apply. What is the procedure for the transition of UTII payers to the use of the simplified tax system?

UTII taxpayers who have expressed a desire to switch to the simplified tax system from January 1, 2021, must submit a notification of the transition to the simplified tax system no later than December 31, 2021 ( clause 1 of article 346.13 of the Tax Code of the Russian Federation ).

Notification of the transition to the simplified tax system is submitted in form No. 26.2-1 (KND 1150001), approved by order of the Federal Tax Service of the Russian Federation dated November 2, 2012 No. MMV-7-3 / [email protected]

The notification indicates the selected object of taxation.

Organizations also indicate the residual value of fixed assets and the amount of income as of October 1, 2021 ( paragraph 2, clause 1, article 346.13 of the Tax Code of the Russian Federation ).

At the same time, it should be borne in mind that the notification in the line “Income received for nine months of the year the notification was submitted” reflects income only from those types of activities that are taxed in accordance with the general taxation regime ( clause 4 of Article 346.12 of the Tax Code of the Russian Federation ) .

Income received under UTII is not taken into account when determining the income limit ( no more than 112.5 million rubles ) for the transition to the simplified tax system .

The notification can be submitted to the tax authority at the location of the organization or the place of residence of the individual entrepreneur in person or through a representative, sent by registered mail or transmitted electronically via telecommunication channels using a qualified electronic signature, including through the one posted on the website of the Federal Tax Service of the Russian Federation www.nalog.ru service “Personal Account of an Individual Entrepreneur Taxpayer” in the “My Taxation System” section.

An organization or individual entrepreneur, after submitting a notice of transition to the simplified tax system, has the right to change the initially selected object of taxation or refuse to apply this taxation regime by sending a new notice of transition to the simplified tax system and (or) a corresponding appeal to the tax authority no later than December 31 of the calendar year in which this notice has been submitted.

Moreover, in these cases, the previously submitted notification is canceled (letter of the Federal Tax Service of the Russian Federation dated October 20, 2020 No. SD-4-3 / [email protected] ).

5. The organization applies two taxation systems: UTII and simplified tax system. According to the criteria established by Chapter 26.2 of the Tax Code of the Russian Federation, the organization will not have the right to apply the simplified tax system in 2021. Do I need to report this?

In accordance with paragraph 4 of Art. 346.13 of the Tax Code of the Russian Federation (as amended, coming into force on January 1, 2021), if based on the results of the reporting (tax) period, income , determined in accordance with Art. 346.15 and pp. 1 and 3 paragraphs 1 art. 346.25 of the Tax Code of the Russian Federation , exceeded 200 million rubles, and (or) during the reporting (tax) period there was a non-compliance with the requirements established by paragraphs. 1 – 11, 13, 14 and 16 – 21 clause 3, clause 4 art. 346.12 and paragraph 3 of Art. 346.14 of the Tax Code of the Russian Federation , and (or) the average number of taxpayer employees exceeded the limit established by clause 15 clause 3 art. 346.12 of the Tax Code of the Russian Federation , for more than 30 people, such a taxpayer is considered to have lost the right to use the simplified tax system from the beginning of the quarter in which the indicated excesses of the taxpayer’s income and (or) the average number of his employees and (or) non-compliance with the specified requirements were allowed.

At the same time, according to clause 5 of Art. 346.13 of the Tax Code of the Russian Federation , in connection with the loss of the right to apply the simplified tax system, the taxpayer is obliged to inform the tax authority about the transition to a different taxation regime within 15 calendar days after the expiration of the reporting (tax) period in which he lost the right to use the simplified tax system.

Taking into account the above, if the taxpayer fails to comply with the conditions for applying Chapter 26.2 of the Tax Code of the Russian Federation in 2021, including for income, including income from activities for which UTII was previously applied, the taxpayer loses the right to apply the simplified tax system and is obliged to report this to the tax authority in the above ok.

6. On the need to notify the tax authority about the transition to the use of the simplified tax system by taxpayers combining UTII and simplified tax system.

Taxpayers who have previously notified the tax authority about the transition to the simplified tax system are recognized as taxpayers applying the simplified tax system even after 01/01/2021, including for income that was subject to UTII before 2021.

In this regard, it is not necessary to submit a repeated notification of the transition to the simplified tax system .

7. On the issue of accounting for income received during the period of application of the simplified tax system for goods (work, services) purchased (performed, provided) during the period of application of UTII.

Taxpayers applying the simplified tax system , when determining the tax base, take into account income from sales determined in accordance with Art. 249 of the Tax Code of the Russian Federation , non-operating income determined in accordance with Art. 250 of the Tax Code of the Russian Federation , and do not take into account the income specified in Art. 251 Tax Code of the Russian Federation .

According to paragraph 1 of Art. 249 of the Tax Code of the Russian Federation, income from sales is recognized as proceeds from the sale of goods (works, services) both of one’s own production and those previously acquired, and proceeds from the sale of property rights.

At the same time, according to paragraph 1 of Art. 39 of the Tax Code of the Russian Federation, the sale of goods, work or services by an organization or an individual entrepreneur is recognized , respectively the transfer on a paid basis (including the exchange of goods, work or services) of ownership of goods, the results of work performed by one person for another person, the provision of services for a fee by one person to another person, and in cases provided for by the Tax Code of the Russian Federation, the transfer of ownership of goods, the results of work performed by one person for another person, the provision of services by one person to another person - on a free basis .

At the same time, on the basis of paragraph 1 of Art. 346.17 of the Tax Code of the Russian Federation, for the purpose of applying Chapter 26.2 of the Tax Code of the Russian Federation, the date of receipt of income is recognized as the day of receipt of funds into bank accounts and (or) cash, receipt of other property (work, services) and (or) property rights, as well as repayment of debt (payment ) to the taxpayer in another way (cash method).

Thus, a taxpayer’s transition from paying UTII to using the simplified tax system, the tax base for the tax paid in connection with the application of the simplified tax system should include income from the sale of goods (work, services) received by the taxpayer during the period of application of the simplified tax system for goods (work, services) ), sold (that is, actually transferred on a reimbursable basis) during the period of application of the simplified tax system.

These incomes should be taken into account for tax purposes on the date of their receipt .

At the same time, if the sale of goods (work, services) was carried out during the period of application of the UTII, then income from the sale of these goods (work, services) received by the taxpayer during the period of application of the simplified tax system is not taken into account when determining the tax base under the simplified tax system .

Based on the above norms of the Tax Code of the Russian Federation, when determining the tax base for calculating tax according to the simplified tax system, advances received from buyers of goods or consumers of services are taken into account in income in the reporting ( tax ) period of their receipt .

Accordingly, if an advance for the sale of goods (rendering services) was received during the period of application of UTII , and the services were provided when applying the simplified tax system , the taxpayer should not take such an advance into account as income under the simplified .

8. On the issue of accounting, for the purposes of applying the simplified tax system, expenses for the purchase of goods for resale incurred during the period of application of UTII.

In accordance with clause 2.2 of Art. 346.25 of the Tax Code of the Russian Federation , taxpayers who applied UTII before the transition to the simplified tax system with the object of taxation in the form of income reduced by the amount of expenses, when determining the tax base for the tax paid in connection with the application of the simplified tax system, have the right to take into account expenses incurred before the transition to the simplified tax system to pay for the cost of goods, purchased for further sale, which are taken into account as the specified goods are sold in accordance with paragraphs. 2 p. 2 art. 346.17 Tax Code of the Russian Federation .

At the same time , expenses directly related to the sale of these goods , including costs of storage, maintenance and transportation, when applying the simplified tax system, are taken into account in the reporting (tax) period in which their actual payment was made after the transition to the simplified tax system.

At the same time, it should be borne in mind that the costs of purchasing goods can only be taken into account if there are primary documents confirming the expenses incurred ( clause 2 of Article 346.16, clause 1 of Article 252 of the Tax Code of the Russian Federation ).

9. On the issue of accounting for the purposes of applying the simplified tax system of the residual value of fixed assets (fixed assets) and intangible assets (intangible assets) used to conduct activities taxed under UTII.

In accordance with clause 2.1 of Art. 346.25 of the Tax Code of the Russian Federation , taxpayers who applied the taxation system in the form of UTII, on the date of transition to the simplified tax system, reflect the residual value of fixed assets and intangible assets in the form of the difference between the price of acquisition (creation) of fixed assets and intangible assets and the amount of depreciation accrued in the manner established by the legislation on accounting, for the period of application of the taxation system in the form of UTII.

The residual value of the specified fixed assets and intangible assets is included in the expenses taken into account when determining the tax base according to the simplified tax system, in equal shares for the reporting periods in the manner established by paragraphs. 3 p. 3 art. 346.16 Tax Code of the Russian Federation :

– in relation to fixed assets and intangible assets with a useful life of up to three years inclusive – during the first calendar year of application of the simplified tax system;

– in relation to fixed assets and intangible assets with a useful life from three to 15 years inclusive during the first calendar year of application of the simplified tax system - 50% of the cost, the second calendar year - 30% of the cost, the third calendar year - 20% of the cost;

– in relation to fixed assets and intangible assets with a useful life of over 15 years – during the first 10 years of application of the simplified tax system.

For example , an organization operating in retail trade from 01/01/2021 switched to the simplified tax system with UTII. When carrying out business activities, the organization used the following fixed assets, purchased and paid for before the transition to the simplified tax system:

– commercial equipment with a useful life of 3 years, the residual value of the object is 200 thousand rubles;

– a car with a useful life of 10 years, the residual value of the object is 1,500 thousand rubles;

– a building with a useful life of 20 years, the residual value of the object is 2,500 thousand rubles.

After switching to the simplified tax system, the taxpayer has the right to take into account the costs of acquiring the specified fixed assets in the following order:

– residual value of retail equipment in the amount of 200 thousand rubles. during 2021, 50 thousand rubles. for each quarter of the tax period;

– residual value of the car is 1,500 thousand rubles:

for 2021 - 750 thousand rubles: for the 1st quarter 187.5 thousand rubles, for the half year 375 thousand rubles, for 9 months - 562.5 thousand rubles,

for 2022 - 450 thousand rubles: for the 1st quarter 112.5 thousand rubles, for the half year 225 thousand rubles, for 9 months - 337.5 thousand rubles,

for 2023 – 300 thousand rubles: for the 1st quarter – 75 thousand rubles, for the first half of the year – 150 thousand rubles, for 9 months – 225 thousand rubles;

– residual value of the building in the amount of 2,500 thousand rubles. annually 250 thousand rubles. (62.5 thousand rubles for each quarter of the tax period) for 10 years.

10. The tax return for UTII was submitted at the place of activity. In case of cancellation of UTII and transition to the simplified tax system, must the declaration under the simplified tax system also be submitted at the place of activity?

A declaration under the simplified tax system based on the results of the tax period is submitted to the tax authority at the location of the organization ( place of residence of an individual entrepreneur ) once a year ( clause 1 of article 346.23 of the Tax Code of the Russian Federation ).

There is no need at the location of the separate divisions .

Tax under the simplified tax system (advance tax payments) is also paid at the place of registration of the parent organization ( place of residence of the individual entrepreneur ).

Also, the Tax Code of the Russian Federation does not provide for the submission of a tax return under the simplified tax system by an individual entrepreneur for each place of business .

11. An individual entrepreneur plans to obtain a patent in relation to the type of activity for which he paid UTII. What are the deadlines for filing a patent application?

According to paragraph 2 of Art. 346.45 of the Tax Code of the Russian Federation, an individual entrepreneur submits personally or through a representative, sends in the form of a postal item with a list of attachments, or transmits in electronic form via telecommunication channels an application for a patent to the tax authority no later than 10 days before the individual entrepreneur begins to apply the PSN .

When sending an application for a patent by mail, the day of its submission is considered the date of sending the postal item.

When transmitting an application for a patent via telecommunication channels, the day of its submission is considered the date of its dispatch ( paragraph 4, paragraph 2, article 346.45 of the Tax Code of the Russian Federation ).

Thus, for the right to use PSN from January 1, 2021 an application for a patent no later than 10 working days before January 1, 2021, that is, no later than December 17, 2020.

The tax authority is obliged, within five working days from the date of receipt of the application for a patent, to issue or send to an individual entrepreneur a patent or a notice of refusal to issue a patent ( clause 3 of Article 346.45 of the Tax Code of the Russian Federation ).

12. On the issue of taxation by an organization of income received during the period of application of the general taxation regime from the sale of goods purchased during the period of application of UTII.

For the purposes of Chapter 25 of the Tax Code of the Russian Federation, income is determined using the accrual method and the cash method .

If on average over the previous four quarters the amount of revenue from the sale of goods (works, services) of these organizations without VAT did not exceed one million rubles for each quarter, then in accordance with clause 1 of Art. 273 of the Tax Code of the Russian Federation, an organization has the right to determine income ( expenses ) using the cash method .

Other organizations in accordance with paragraph 1 of Art. 271 of the Tax Code of the Russian Federation, income is recognized on an accrual basis in the reporting (tax) period in which it occurred, regardless of the actual receipt of funds, other property (work, services) and (or) property rights (accrual method).

In accordance with paragraph 3 of Art. 271 of the Tax Code of the Russian Federation for organizations using the accrual method, the date of determination of income from sales is the date of sale of goods, determined in accordance with clause 1 of Art. 39 of the Tax Code of the Russian Federation , regardless of the actual receipt of funds (other property (work, services) and (or) property rights) in payment.

Thus, in the event of a taxpayer’s transition from paying UTII to applying the general taxation regime, the tax base for corporate income tax includes income from the sale of goods carried out during the period of application of the general taxation regime.

In this case, the date of receipt of income is determined in the manner established by Art. 271 or 273 of the Tax Code of the Russian Federation .

13. On the issue of accounting for the purpose of calculating corporate income tax for income from the sale of goods (work, services) in respect of which an advance was received (payment, partial payment for future deliveries of goods), during the period of application of UTII.

In accordance with paragraphs 1 clause 1 art. 251 of the Tax Code of the Russian Federation , when determining the tax base for corporate income tax, income in the form of property, property rights, works or services that are received from other persons in the order of advance payment for goods (works, services) by taxpayers who determine income and expenses on an accrual basis is not taken into account .

Moreover, in accordance with paragraph 3 of Art. 271 of the Tax Code of the Russian Federation for organizations using the accrual method, the date of determination of income from sales is the date of sale of goods, determined in accordance with clause 1 of Art. 39 of the Tax Code of the Russian Federation , regardless of the actual receipt of funds (other property (work, services) and (or) property rights) in payment.

Consequently, for taxpayers using the accrual method, income from the sale of goods (work, services) in respect of which an advance was received (payment, partial payment) during the period when the taxpayer applied UTII is taken into account for the purpose of calculating corporate income tax during the period when he applied the general taxation regime .

14. On the issue of accounting for the purposes of applying corporate income tax for expenses for the purchase of goods for resale incurred during the period of application of UTII.

Features of accounting for expenses when selling goods and (or) property rights are established in Art. 268 Tax Code of the Russian Federation .

So, in accordance with paragraphs. 3 p. 1 art. 268 of the Tax Code of the Russian Federation, when selling goods, the taxpayer has the right to reduce the income received by the cost of purchasing these goods, determined in accordance with the accounting policy adopted by the organization for tax purposes using one of the following methods for valuing purchased goods :

– at the cost of the first acquisition (FIFO);

– at average cost;

– at the cost of a unit of goods.

The taxpayer also has the right to reduce income by the amount of expenses directly related to such sale, in particular the costs of valuation, storage, maintenance and transportation of the property being sold.

At the same time, when selling purchased goods, the costs associated with their purchase and sale are formed taking into account the provisions of Art. 320 Tax Code of the Russian Federation .

Thus, the value of the remaining goods not sold by the organization during the period of application of UTII can be taken into account when selling such goods during the period of application of the general taxation regime .

15. On the issue of calculating VAT when a taxpayer switches from 01/01/2021 from paying UTII to the general taxation regime.

When a taxpayer switches from paying UTII to the general taxation regime from 01/01/2021, VAT is calculated on the sale of goods (work, services, property rights) shipped (performed, rendered) starting from 01/01/2021 ( clause 1 of Art. 146 of the Tax Code of the Russian Federation ).

If an advance payment for upcoming deliveries of goods (works, services, property rights) is received by the UTII taxpayer before 12/31/2020 inclusive, and the shipment will be made starting 01/01/2021, then VAT is not calculated on advances .

When shipping starting from 01/01/2021 on account of an advance received (payment, partial payment for upcoming deliveries of goods, works, services, property rights), VAT is calculated in the generally established manner.

For example:

The price of the goods under the contract is 100 rubles. The advance was received in November 2020 in the amount of 80 rubles.

Shipment will be made in February 2021.

VAT is calculated only upon shipment in the following order:

100 × 20 / 120 = 16.67 rubles.

Column 8 (amount of tax presented to the buyer) of the invoice indicates the amount of 16.67 rubles, and column 9 (Cost of goods (work, services), property rights with tax - total) - 100 rubles.

When concluding contracts until 12/31/2020 inclusive for the sale of goods (work, services, property rights) starting from 01/01/2021, it is recommended that the said contracts reflect the price of the specified goods (work, services, property rights) including VAT .

If the shipment of goods (work, services, property rights) was made up to December 31, 2020 inclusive, then VAT is not calculated by the UTII taxpayer , regardless of the date of receipt of payment from buyers of these goods (work, services, property rights).

16. On the issue of obtaining a VAT deduction when a taxpayer switches from paying UTII to the general taxation regime.

When a taxpayer switches from paying UTII to the general taxation regime, are the amounts of VAT on purchased goods (works, services, property rights) that were not used in activities subject to UTII taxation subject to deduction in the manner prescribed by Chapter 21 of the Tax Code of the Russian Federation? (F ( Clause 9, Article 346.26 of the Tax Code of the Russian Federation ).

A similar norm is provided for by Federal Law No. 373-FZ of November 23, 2020 “On Amendments to Chapters 26.2 and 26.5 of the Tax Code of the Russian Federation and Art. 2 of the Federal Law “On the use of cash register equipment when making payments in the Russian Federation.”

Thus, from January 1, 2021, VAT deductions are in the following order .

If the UTII taxpayer has balances of unsold goods on the date of transition to the general taxation regime, then the amounts of VAT on such goods not used in activities subject to UTII taxation are taken for deduction in the manner prescribed by Art. 172 of the Tax Code of the Russian Federation , in the case of using these goods for transactions subject to VAT.

In this case, the right to these deductions arises for the taxpayer in the tax period in which this taxpayer switched from UTII to the general taxation regime, that is, starting from the first quarter of 2021 .

If during the period of application of UTII the taxpayer acquired and put into operation fixed assets , the cost of which was formed on the basis of clause 2 of Art. 170 of the Tax Code of the Russian Federation , taking into account VAT amounts, then the use of deductions for VAT amounts related to the residual value of fixed assets after the transition to OSN Art. 171 and 172 of the Tax Code of the Russian Federation are not provided for .

In this regard , VAT related to the residual value of fixed assets acquired and put into operation during the period of application of UTII is not accepted for deduction when calculating VAT payable to the budget .

At the same time, if a fixed asset was acquired during the period of application of UTII, and the commissioning of the fixed asset was carried out after the transition from paying UTII to the general taxation regime , then the VAT amounts presented upon the acquisition of fixed assets (or during the construction of a real estate property) are accepted as deduction in the manner provided for in Art. 172 of the Tax Code of the Russian Federation , provided that the acquired (or constructed) fixed asset object (real estate object) is intended for carrying out operations subject to VAT taxation.

In this case, the right to these deductions arises in the tax period in which the payer switched from UTII to the general taxation regime, that is, starting from the first quarter of 2021 .

17. The organization uses the general tax regime and UTII. In connection with the abolition of UTII from 2021, we plan to completely switch to the simplified tax system with the object of taxation being income reduced by the amount of expenses. What to do with the balance of goods for which VAT has already been deducted and will be sold next year?

According to paragraph 2 of Art. 346.11 of the Tax Code of the Russian Federation , taxpayers using the simplified tax system are not recognized as VAT taxpayers.

In accordance with paragraph. 5 p.p. 2 p. 3 art. 170 of the Tax Code of the Russian Federation upon the transition of a taxpayer to special tax regimes in accordance with Chapters 26.2, 26.3 and 26.5 of the Tax Code of the Russian Federation, the amounts of VAT accepted for deduction by the taxpayer for goods (work, services), including fixed assets and intangible assets, and property rights in the order provided for by Chapter 21 of the Tax Code of the Russian Federation, are subject to restoration in the tax period preceding the transition to the specified regimes.

Thus, when a taxpayer switches to the simplified tax system, the amounts of VAT accepted for deduction by the taxpayer on goods (works, services) are subject to restoration in the tax period preceding the transition to the simplified tax system.

At the same time, in order to restore VAT amounts in the manner established by paragraph. 5 p.p. 2 p. 3 art. 170 of the Tax Code of the Russian Federation , are registered in the sales book , on the basis of which tax amounts are accepted for deduction, if in the tax period preceding the taxpayer’s transition to the simplified tax system, their storage period has not expired.

In the absence of invoice data due to the expiration of the established period for their storage in the sales book, it is possible to register an accountant's certificate , which reflects the amount of VAT subject to recovery .

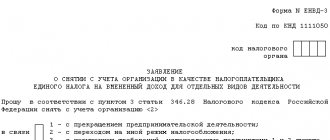

How to fill out an application for deregistration of UTII for an LLC

In the UTII-3 form, companies must indicate the following data:

- information about the reason for refusal of UTII; at the same time, it is important to reflect the correct details that characterize it, depending on the termination of one of several types of activity;

- Name;

- Kind of activity;

- place of business;

- other data.

“UTII Form 3: application for deregistration of an organization” will help you fill out UTII-3 accurately .

What is UTII

The single tax on imputed income is a special, simplified taxation system designed to reduce the tax burden on small and medium-sized businesses, used by both organizations and individual entrepreneurs. Organizations and individual entrepreneurs applying imputation are not required to pay VAT, corporate income tax, personal income tax, or corporate property tax. They are freed from the need to conduct large amounts of paperwork and reporting while observing the procedure for conducting cash and settlement transactions.

Imputation is introduced by a decision of a constituent entity of the Russian Federation, which establishes a certain imputed income for a specific type of activity, based on which the fee is paid at the rates established by local authorities. To apply this regime, there are restrictions on the type of activity (provision of services, small trade) and the number of employees (no more than 100). There are other conditions under which imputation is not allowed: classification of the taxpayer as the largest, when the share of participation in the organization of other organizations is more than 25% of the organization, and some others. In Moscow, UTII has been completely abolished. We will figure out how to terminate activities under UTII, which will need to be done not only when switching to another taxation system or closing an enterprise, but also when the above circumstances arise that prevent the application of this regime.

How an individual entrepreneur should fill out an application for deregistration of UTII

In the application, the individual entrepreneur indicates the following information:

- about yourself - last name, first name, patronymic;

- the reason for termination of activity on the imputation, indicated by codes from 1 to 4.

What else needs to be reflected in this form is discussed in the article “UTII Form 4: application for deregistration of individual entrepreneurs.”

So, deregistration must be accompanied by mandatory notification of this fact to the tax authorities. “Withdrawal from UTII” will help you understand how to do this correctly .

Standard procedure for closing an individual entrepreneur in 2021

You shouldn't have any special problems. The procedure in question is quite simple. Let us analyze in detail how the termination of the activities of individual entrepreneurs is carried out in 2021. To do this you need to follow these steps:

- Finding out the exact location for submitting documents. A fairly common mistake made by taxpayers is that they submit the documents necessary to close an individual entrepreneur to “their” tax office, where they were registered, while the official closure of the enterprise should take place at the Federal Tax Service at the place of registration.

- Filling out an application on form P26001. When filling out an application, you must carefully fill out each column of this form, since in case of any deviation it will not be accepted for consideration. Blank forms are usually taken from your tax inspector. If it is not possible to do this, the application form is publicly available on the Federal Tax Service website,

- Payment at Sberbank or transfer of state duty from your account. Termination of the activities of an individual entrepreneur has always been subject to mandatory state duty, and 2021 in this case is no exception. The cost of the duty remained the same - 160 rubles.

- Submitting a package of documents to the tax office. A correctly completed application and a stamped receipt confirming payment of the state fee are sent to the Federal Tax Service. An entrepreneur can do this personally, entrust the delivery of papers to his representative, who has a power of attorney certified by a notary, send it by registered mail, or use an electronic service. Detailed information on how to terminate activities under UTII in 2021 using this service is clearly presented on the Federal Tax Service website.

- Obtaining documents confirming the closure of an individual entrepreneur. Notification of deregistration and an extract from the state register are received on the 6th working day after all necessary papers have been submitted to the tax authorities. Documents are handed over to the former entrepreneur or his representative. If they are not collected on time, the Federal Tax Service will send them to you.

Filling out an application

Comply with the requirements for completing the application established by the Federal Tax Service. Fill out the printed application in capital letters from the first cell, placing dashes in the empty fields. To fill out the electronic form, use Courier New font size 16-18.

The detailed procedure for filling out the application is specified in Appendix No. 11 to the order of the Federal Tax Service of Russia dated December 11, 2012 No. MMV-7-6 / [email protected]

- Indicate the TIN and KPP, they are contained in the notification of registration.

- Enter the code of the tax authority where you are registered. It is contained in the registration notice.

- Carefully select the reason for deregistration. Code 4 - other, is used to terminate one of the types of activities subject to UTII or the address of its conduct.

- For Russian organizations, enter the number 1, for foreign organizations - 2.

- Indicate the full name, as in the constituent documents.

- The OGRN is indicated in the registration certificate and in the notice of registration with the statistics service.

- Indicate the date from which you stopped using UTII. From now on you have 5 days to submit your application. If you forcibly terminate your activity, having lost the right to use “imputation”, you do not need to put a date, just put dashes.

- Make an attachment to the application only if you indicate code 4 in the reason for deregistration field.

- Provide information about the person submitting the application. Enter number 3 if this is a manager, and number 4 for his representative. Next, enter your full name from your passport and indicate your tax identification number and contact information.

For individual entrepreneurs, the procedure for filling out an application is similar.

Page 2 should only be completed when certain types of activities under UTII are terminated. One page displays information about only three types of activities; if there are more, fill out several applications.

- Indicate the code of the business activity that you have decided to terminate.

- Fill in the information about the address where the activity was carried out. Including: zip code, region, district, city, street, house and office number.

In the example, we indicated one type of activity; forms for other types must be filled in with dashes.

New deadlines for the transition to the simplified tax system

The application for the transition from UTII to the simplified tax system was allowed to be submitted until 02/31/2021. The transition period has been extended for another two months. On January 27, the State Duma adopted the corresponding law in the second reading (draft No. 1043391-7). This decision came as a pleasant surprise to many - it had not been discussed before, and the amendment was carried out simultaneously with changes in tax benefits for organizations that pay for sanatorium and resort treatment for employees.

IMPORTANT!

You can write an application to switch to a simplified tax system until March 31, 2021! In this case, you can apply the simplified tax system as early as January 1.

Previously, the deadlines were extended until 02/01/2021. The letter of the Federal Tax Service dated January 14, 2021 No. SD-4-3/ stated that if by December 31, 2020 entrepreneurs have not expressed their desire to switch to a different tax regime, they must submit a notification to the inspectorate about the choice of the simplified tax system. Thus, the tax authorities equated these individual entrepreneurs and legal entities with newly created ones. After receiving the notification, the Federal Tax Service will allow the taxpayer to apply the simplification from 01/01/2021. If there is no notification, OSNO will apply from 01/01/2021.

Results

Filing an application to terminate imputation activities is a prerequisite in order to stop accruing imputed tax. It has 2 forms: UTII-3 - for legal entities and UTII-4 - for individual entrepreneurs. In the application, the taxpayer provides the date of completion of the activity on imputation. For it to be considered submitted on time, it must be sent to the tax authority no later than 5 working days from the date of completion of the activity subject to the imputed tax. Based on this document, the Federal Tax Service issues a notice of deregistration of the UTII payer and tax payment is stopped.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated December 11, 2012 N ММВ-7-6/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.