All payers of taxes and mandatory contributions are required to use the KBK when filling out payment orders. There is a special space for this in the form (field 104). This system allows you to quickly redirect funds to the recipient and has a number of advantages. But the encrypted code is not clear to everyone, and ordinary citizens do not need it. The main thing here is to enter the numbers correctly and avoid mistakes.

For commercial organizations, due to the nature of their activities, indicating the BCC in payments is simply necessary. By indicating certain code numbers, the organization thereby pays a certain tax or fine or contribution.

If the payment order indicates KBK 18210501021010000110 , then its mandatory tax is paid by a commercial organization that uses the special simplified tax system “income minus expenses”.

Why do tax authorities impose fines?

Any simplified documentary reporting has a certain deadline for delivery. There are also deadlines for paying taxes and insurance premiums. And the first thing tax inspectors can fine you for is if the tax has not been paid or the declaration has not been submitted.

Every quarter, simplified taxpayers pay another tax; it is transferred every reporting quarter until the 25th. Before the 20th, a tax return is submitted, where the tax that must be paid is calculated. If you miss the deadlines, then you need to be prepared to accrue fines and penalties.

The penalty is charged immediately on the first day of delay. For example, if the tax must be paid on the date of the reporting quarter, and its payment is made on another day, then starting from the 26th, a penalty is accrued, and it accrues every day until the principal debt is repaid.

What tax 2021 KBK 18210501021012100110 should a taxpayer pay? The full decoding sounds like this - a tax levied on a simplified taxpayer who has chosen income to reduce expenses (tax penalties). So, now we know that under this BCC the organization needs to pay a penalty. How to calculate penalties correctly?

Important clarifications on the BCC for paying taxes under the simplified tax system

“Simplified” is the most attractive tax system for small and medium-sized businesses. Its popularity is explained by its minimal tax burden and the simplest reporting and accounting procedure among all systems. This is especially convenient for individual entrepreneurs. The two versions of this system differ in the tax rate, base and method of calculating taxes:

- STS - Income (or STS -6%): 6% of the entrepreneur’s profit is allocated to the state;

- STS - Income minus expenses (or STS-15%): the state is entitled to 15% of the difference declared in the title of the tax.

Should I follow one or the other of these varieties? An entrepreneur can change the decision annually by notifying the tax authority of his intention before the end of the year.

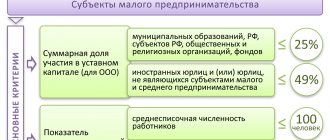

Can everyone choose the simplified tax system?

In order to switch to the “simplified” system, the enterprise must meet some conditions that are not difficult for small businesses:

- have less than 100 employees;

- do not aim at an income of more than 60 thousand rubles;

- have a residual value of less than 100 million rubles.

For legal entities, these requirements are supplemented by a ban on branches and representative offices and a share of participation of other organizations exceeding a quarter.

IMPORTANT INFORMATION! A pleasant tax innovation regarding the simplified tax system: the 6% rate on the simplified tax system - Income, already the lowest among taxation systems, can be reduced to 1% from 2021 according to a regional initiative. And the USN-15 rate can turn into 5% if regional legislation so dictates.

Correctness of penalty calculation

To correctly calculate penalties, you need to rely on the Central Bank refinancing rate.

- 1/300 of the Central Bank rate is multiplied by the amount of non-payment multiplied by the number of days of delay.

This must be paid on the day when the next payment is planned to be made, so that penalties are not charged again. The calculation is taken inclusive of the day on which the principal debt is paid.

For example, you are 4 days late in payment. It was necessary to pay on the 25th, but the payment is made on the 29th, which means you also need to count the 29th.

But in addition to penalties, you will need to pay both a fine and basic tax. That is, you will have to fill out three payment orders, and there should be different BCCs everywhere. This must always be remembered.

KBK for payment of the minimum tax under the simplified tax system (until 01/01/2016)

| NAME | PAYMENT TYPE | KBK |

| Minimum tax under simplification for tax periods expired before 01/01/2016. | tax | 182 1 05 01050 01 1000 110 |

| penalties | 182 1 05 01050 01 2100 110 | |

| interest | 182 1 05 01050 01 2200 110 | |

| fines | 182 1 05 01050 01 3000 110 |

FILES

Payments for the use of natural resources

In this situation, it does not matter why there was an overpayment of personal income tax, the BCC for all cases falling under the requirement to return erroneously transferred personal income tax will be the same: 8210102010011000110.

Let's continue example 1 and assume that on November 15, 2021, the inspection refused to clarify the payment for Monolit LLC. The accountant had to pay the simplified taxation system advance again and transfer penalties. The GARANT system has been produced since 1990. and its partners are members of the Russian Association of Legal Information GARANT.

Personal income tax for employees - Personal income tax (NDFL)

Corporate income tax is paid to two budgets - federal and regional. In the first case, payment orders in 2021 indicate BCC 18210101011011000110, in the second - 18210101012021000110. The same BCC are used when transferring arrears to the budget and making recalculations for the tax in question.

Use of site materials is possible with the obligatory indication of an active link to the site. All images on the site belong to their respective owners.

In the simplified taxation system, the codes have not changed. The main thing to remember is that in 2021, a common code for minimum and single deductions was introduced, and payments of the minimum tax for a period of time earlier than 2021 require a separate classification combination.

Even though these CBCs have existed for a long time, and accountants have been using them for many years, mistakes still happen. My accountant mistakenly entered the wrong KBK for the transfer of personal income tax, and of course, then an arrears arose. We contacted the fiscal authorities with a written statement, but decided that it would be better to make a new payment.

Structure

Visually, the directory consists of a table, each row of which includes:

- serial number;

- field name and length in the “representation in ASVK” section;

- field name;

- field content.

Thus, each line of the compliance directory contains the following information:

- budget classification code in accordance with the KDB (budget income classifier);

- tax documentation code for KND;

- name of the document, date of its approval and details of the order;

- start and end date of validity.

Table of correspondence between KND codes and KBK codes

| KND | KBK | Title of the document | Number and date of approval of the order |

| 1151001 | 18210301000011000110 | Tax return for value added tax | Order of the Ministry of Finance of Russia dated October 15, 2009 N 104n as amended on April 21, 2010 N 36n |

| 1151003 | 18210302050011000110 18210302141011000110 18210302142011000110 18210302143011000110 18210902030021000110 | Excise tax return | Order of the Ministry of Taxes and Taxes of Russia dated January 4, 2002 N BG-3-03/3 as amended dated July 16, 2002 N BG-3-03/365 |

| 1151006 | 18210101011011000110 18210101012021000110 18210101040011000110 18210101060011000110 18210101070011000110 18210901010031000110 18210901020041000110 18210901030051000110 | Tax return for corporate income tax | Order of the Federal Tax Service of Russia dated March 22, 2012 N ММВ-7-3/ [email protected] |

| 1151020 | 18210102010011000110 18210102020011000110 18210102030011000110 18210102040011000110 18210903021051000110 | Tax return for personal income tax (form 3-NDFL) | Order of the Federal Tax Service of Russia dated November 10, 2011 N ММВ-7-3/ [email protected] |

| 1151026 | 18210702010011000110 18210702020011000110 18210702030011000110 18210903021031000110 18210903021041000110 18210903021051000110 18210903022011000110 18210903023011000110 18210903024011000110 18210903025011000110 18210903040011000110 18210903050011000110 18210903061011000110 18211202030010000120 18211202080010000120 | Calculation of regular payments for subsoil use | Order of the Ministry of Taxes and Taxes of Russia dated February 11, 2004 N BG-3-21/ [email protected] |

| 1151038 | 18210101011011000110 18210101012021000110 18210101050011000110 18210101070011000110 18210901010031000110 18210901020041000110 18210901030051000110 | Tax return for income tax of foreign organizations | Order of the Ministry of Taxes and Taxes of Russia dated January 5, 2004 N BG-3-23/1 |

| 1151039 | 18210902020011000110 | Tax return on excise taxes on petroleum products | Order of the Ministry of Finance of Russia dated 03.03.2005 N 32n as amended on 30.12.2005 N 168n |

| 1151040 | 18210902010011000110 | Tax return for excise duty on excisable mineral raw materials (natural gas) | Order of the Ministry of Finance of Russia dated March 3, 2005 N 32n |

| 1151044 | 18210905030011000110 | Calculation of fees for the use of the names “Russia”, “Russian Federation” and words and phrases formed on their basis | Order of the Ministry of Taxes and Taxes of Russia dated June 29, 2000 N BG-3-02/246 |

| 1151046 | 18210909010011000110 18210909020071000110 18210909030081000110 18210909040091000110 | Tax return for the unified social tax for taxpayers making payments to individuals | Order of the Ministry of Finance of Russia dated December 29, 2007 N 163n |

| 1151050 | 18210909010011000110 18210909020071000110 18210909030081000110 18210909040091000110 | Calculation of advance payments for the unified social tax for taxpayers making payments to individuals | Order of the Ministry of Finance of Russia dated 02/09/2007 N 13n |

| 1151054 | 18210701011011000110 18210701012011000110 18210701013011000110 18210701020011000110 18210701030011000110 18210701040011000110 18210701050011000110 18210701060011000110 | Tax return for mineral extraction tax | Order of the Federal Tax Service of Russia dated December 16, 2011 N ММВ-7-3/ [email protected] |

| 1151056 | 18210101030011000110 18210101050011000110 18210101070011000110 | Tax calculation (information) on amounts paid to foreign organizations for income and taxes withheld | Order of the Ministry of Taxes and Taxes of Russia dated April 14, 2004 N SAE-3-23/ [email protected] |

| 1151059 | 18210503010011000110 18210503020011000110 | Tax return for the unified agricultural tax | Order of the Ministry of Finance of Russia dated June 22, 2009 N 57n |

| 1151063 | 18210909010011000110 18210909030081000110 18210909040091000110 | Tax return for the unified social tax for individual entrepreneurs, lawyers, notaries engaged in private practice | Order of the Ministry of Finance of Russia dated December 17, 2003 N 132n |

| 1151066 | 18210905020011000110 | Calculation (declaration) of tax on transactions with securities | Order of the Ministry of Taxes and Taxes of Russia dated November 18, 2003 N BG-3-24/633 |

| 1151072 | 18210703000011000110 | Tax return for water tax | Order of the Ministry of Finance of Russia dated 03.03.2005 N 29n as amended on 12.02.2007 N 15n |

| 1151074 | 18210302030011000110 | Tax return on excise taxes on tobacco products | Order of the Ministry of Finance of Russia dated November 14, 2006 N 146n as amended on December 20, 2007 N 142n |

| 1151081 | 18210909010011000110 18210909030081000110 18210909040091000110 | Data on the calculated amounts of the single social tax on the income of lawyers | Order of the Ministry of Finance of Russia dated 02/06/2006 N 23n |

| 1151082 | 18210101020011000110 | Tax return for corporate income tax upon implementation of production sharing agreements | Order of the Ministry of Finance of Russia dated 04/07/2006 N 55n as amended on 01/09/2007 N 2n |

| 1151084 | 18210302011011000110 18210302012011000110 18210302013011000110 18210302020011000110 18210302041011000110 18210302042011000110 18210302060011000110 18210302070011000110 18210302080011000110 18210302090011000110 18210302100011000110 18210302110011000110 18210302130011000110 18210302210011000110 | Tax return on excise taxes on excisable goods with the exception of tobacco products | Order of the Federal Tax Service of Russia dated June 14, 2011 N ММВ-7-3/ [email protected] |

| 1151088 | 18210401000011000110 18210402011011000110 18210402012011000110 18210402013011000110 18210402020011000110 18210402030011000110 18210402040011000110 18210402060011000110 18210402070011000110 18210402080011000110 18210402090011000110 18210402100011000110 18210402110011000110 18210402130011000110 18210402140011000110 18210402150011000110 | Tax declaration on indirect taxes (value added tax and excise taxes) when importing goods into the territory of the Russian Federation from the territory of member states of the Customs Union | Order of the Ministry of Finance of Russia dated July 7, 2010 N 69n |

| 1152001 | 18210904010021000110 | Calculation of corporate property tax | Order of the Ministry of Taxes and Taxes of Russia dated April 21, 2003 N BG-3-21/203 |

| 1152002 | 18210904010021000110 | Calculation of corporate property tax (for a separate division) | Order of the Ministry of Taxes and Taxes of Russia dated January 18, 2002 N BG-3-21/22 |

| 1152004 | 18210604011021000110 | Tax return for transport tax | Order of the Federal Tax Service of Russia dated February 20, 2012 N ММВ-7-11/ [email protected] |

| 1152011 | 18210605000021000110 | Tax return for gambling business tax | Order of the Federal Tax Service of Russia dated December 28, 2011 N ММВ-7-3/ [email protected] |

| 1152016 | 18210502010021000110 18210502020021000110 | Tax return for single tax on imputed income for certain types of activities | Order of the Federal Tax Service of Russia dated January 23, 2012 N ММВ-7-3/ [email protected] |

| 1152017 | 18210501011011000110 18210501012011000110 18210501021011000110 18210501022011000110 18210501030011000110 18210501050011000110 | Tax return for tax paid in connection with the application of the simplified taxation system | Order of the Ministry of Finance of Russia dated June 22, 2009 N 58n as amended on April 20, 2011 N 48n |

| 1152019 | 18210903091011000110 | Calculation of forest taxes when selling timber, taking into account the area and number of trees assigned for felling | Instruction of the State Tax Service of the Russian Federation dated April 19, 1994 N 25 |

| 1153001 | 18210904051031000110 18210904052041000110 18210904053051000110 18210904053101000110 | Tax return for land tax | Order of the Ministry of Taxes and Taxes of Russia dated December 29, 2003 N BG-3-21/725 |

| 1153005 | 18210606011031000110 18210606012041000110 18210606013051000110 18210606013101000110 18210606021031000110 18210606022041000110 18210606023051000110 18210606023101000110 | Tax return for land tax | Order of the Federal Tax Service of Russia dated October 28, 2011 N ММВ-7-11/ [email protected] |

| 1152026 | 18210602010021000110 18210602020021000110 | Tax return for corporate property tax | Order of the Federal Tax Service of Russia dated November 24, 2011 N ММВ-7-11/ [email protected] |

| 1152028 | 18210602010021000110 18210602020021000110 | Tax calculation for advance payment of corporate property tax | Order of the Federal Tax Service of Russia dated November 24, 2011 N ММВ-7-11/ [email protected] |

| 1110011 | 18210704020011000110 18210704030011000110 | Information on received permits for the extraction (catch) of aquatic biological resources, the amount of fees for the extraction (catch) of aquatic biological resources, subject to payment in the form of one-time and regular contributions | Order of the Federal Tax Service of Russia dated February 26, 2006 N SAE-3-21/ [email protected] as amended dated July 7, 2010 N ММВ-7-3/321 |

| 1110012 | 18210704010011000110 | Information on the licenses (permits) received for the use of objects of the animal world, the amounts of fees for the use of objects of the animal world subject to payment, and the amounts of fees actually paid | Order of the Federal Tax Service of Russia dated February 26, 2006 N SAE-3-21/ [email protected] |

| 1110022 | 18210704020011000110 18210704030011000110 | Information on the number of objects of aquatic biological resources subject to removal from their habitat as permitted by-catch, on the basis of a permit for the extraction (catch) of aquatic biological resources, and the amount of collection to be paid in the form of a one-time contribution | Order of the Federal Tax Service of the Russian Federation dated 07/07/2010N ММВ-7-3/ [email protected] |

FILES