Business registration is a government service that is accompanied by the issuance of supporting documents. Their list depends on the organizational and legal form: an LLC receives more papers than an individual entrepreneur. Find out what documents are issued when registering an individual entrepreneur.

Starting a business

Compared to the various difficulties of entrepreneurial activity, registering an individual entrepreneur is a fairly simple and quick procedure. This presupposes strict adherence to the rules, upon fulfillment of which a person wishing to become a businessman acquires his coveted status within 3 days. At first glance, it seems that the hardest part is over, and you can calmly begin to engage in your chosen activity, but, of course, this is only the beginning. In parallel with the status of an individual entrepreneur, you assume responsibility for the correct preparation of reports within the specified time frame, which must be completed within the specifics of your business.

What documents should an individual entrepreneur have? This question interests many. The list of necessary papers that an individual entrepreneur is required to maintain can be quite problematic to determine, since it depends on a number of factors, such as the scope of your business, the place of registration of the organization, working conditions, etc.

State registers of business entities

The Federal Tax Service enters information about registered individual entrepreneurs and legal entities into various state registers. Entrepreneurs are included in the Unified State Register of Individual Entrepreneurs, and organizations in the Unified State Register of Legal Entities. These registers are open and anyone can obtain information about a specific entrepreneur or LLC from them free of charge.

Thus, the fact of registration of an individual entrepreneur or limited liability company is, first of all, confirmed by an entry from the relevant register.

List of individual entrepreneur documents

Below is a list of documents that every individual entrepreneur must have:

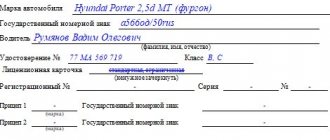

- INN IP.

- SNILS.

- Passport (copy of all pages).

- OGRNIP IP.

- Application for registration of an individual entrepreneur as a UTII taxpayer (if this is intended).

- A copy of the tax notice about opening a bank account in the bank.

- Certificate from the Compulsory Medical Insurance Fund.

- Extract from the Unified State Register of Individual Entrepreneurs.

- Certificate from the State Statistics Committee on statistics codes.

- Copies of property insurance (if available).

- Copies of title agreements for objects of entrepreneurial activity of individual entrepreneurs.

- Notification of the possibility of applying the simplified tax system (if available).

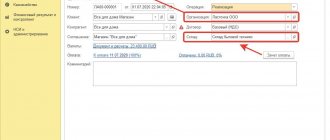

- Agreement for a bank account.

- GRN for making changes to the Unified State Register of Individual Entrepreneurs.

- Agreement on the use of the Bank-Client system (if available).

- Certificate from the FSS.

- Certificate from the Pension Fund of Russia as an employer.

- Copies of rental agreements for equipment used by the individual entrepreneur.

- Copies of lease agreements for the premises where the individual entrepreneur operates.

- Acts of inspections by certain authorities.

- IP details form.

Be that as it may, before preparing a complete list of all documents, you need to immediately clearly decide which method of taxation is most convenient for you, as well as whether your company plans to organize workplaces.

Statistics codes

Another government body that keeps records of individual entrepreneurs is called Rosstat. The department assigns special codes to business entities: OKTMO, OKPO, OKFS and others.

A document with statistics codes can be obtained by contacting the territorial body of Rosstat. You must have your passport and a copy of the Unified State Register of Individual Entrepreneurs (USRIP) entry sheet with you. Or you can request your codes online from the official website, indicating the TIN or OGRNIP of the registered entrepreneur.

Individual entrepreneur without employees and necessary documents

The most loyal way to run your business is as an individual entrepreneur without hiring employees. In such a situation, you are your own boss in managing your affairs. Against this background, you are not required to pay wages to your staff every month. Equally important, there is no need to maintain additional reporting. But still, it will not be possible to completely avoid responsibility to the state. After all, tax obligations will have to be fulfilled.

Once you get into business, you immediately face a choice: either carry out your activities in a standard manner, or choose one of the suitable tax regimes. Each of these options has its own reporting method. Let's consider what documents an individual entrepreneur must have under the standard tax regime.

Actions after registration

Founding documents are proof of the legality of the entrepreneur’s activities:

- Based on them, it is possible to confirm information about entering data into the Unified State Register of Individual Entrepreneurs about an individual;

- In addition, information is included in the database of funds, the Federal Tax Service, and Rosstat.

After registration you need:

- Choose a tax system;

- Comply with deadlines for submitting reports and paying tax and social fees;

- Obtain a license if necessary and open a cash register;

- Form the staff in accordance with legal requirements;

- Submit notice of commencement of activity.

Documentation for concluding an agreement with an individual entrepreneur

An entrepreneur has the right not to engage in business on his own, but to hire a third party for this - a director, who will become a representative of the individual entrepreneur.

You can hire yourself as a director, but this will only add extra costs for paying fees.

It is permissible to hire a director:

- Under an employment contract;

- For partial transfer of powers.

In this case, responsibility for the activities of the director falls on the individual entrepreneur who issued him the power of attorney, with the exception of criminal offenses.

The validity of the agreement with the individual entrepreneur is confirmed by the presence of his details - TIN, passport details.

The basis for drawing up the agreement is the Certificate, and now the Registration Sheet - all the details of the document are indicated, and a copy of it is also attached.

Standard tax regime

In cases where an entrepreneur chooses the standard tax regime, he must submit the following documents to the tax authorities within the specified period:

Declaration in form 3-NDFL:

- submit by April 30;

- tax transfer for the year is carried out until July 15;

- Filling out and submitting the declaration is possible in paper and electronic form.

IP INN is the main document, but what else does it need?

Declaration in form 4-NDFL:

- presented if you had income from business activities during the year;

- submitted no later than 5 days after the end of the month in which these incomes were received.

VAT declaration:

- due by the 25th day following the end of the quarter;

- accepted for delivery exclusively in the form of an electronic document;

- Tax payments are made every quarter.

VAT purchase book. We are talking about examples of reflecting entries in sales books and invoices, where codes for types of transactions are noted.

The so-called book for accounting of business transactions, expenses and income - KUDiR.

The documents required for an individual entrepreneur depend on many nuances. The tax reporting regime is considered the easiest to understand. But it does not always turn out to be profitable. To simplify the activities of small entrepreneurs, the legislation of the Russian Federation has introduced various tax regimes. Let's look at them below.

conclusions

- The individual entrepreneur cannot present the charter documents, because he is not a legal entity and does not have a charter.

- In practice, the constituent documents for an individual entrepreneur are a list of papers proving its registration with the tax office and legal status.

- Documents confirming the activities of an entrepreneur are most often requested by banks and counterparties, but these may also be other interested parties.

- The originals of the constituent documents remain with the individual entrepreneur, the execution of copies is certified by the entrepreneur’s signature and seal, if used.

ENVR

If you choose the Unified Tax on Imputed Income (UNIT), regardless of the size of your earnings, you will pay the established 15% of imputed income. Having chosen this reporting system, from the general list of documents you need to submit:

- A tax return that must be submitted every quarter before the beginning of the second ten days of the month following the reporting period.

- Taking into account indicators such as the number of employees and the area of the retail space.

Does an entrepreneur need to register with the Pension Fund of Russia?

Having started doing business, the individual entrepreneur will have to pay insurance contributions to the pension fund (PFR):

for myself as an entrepreneur,

for its employees as an employer.

However, he no longer needs to register in either capacity. There is no need to submit insurance premium reports there either.

These changes occurred in 2021 after the transfer of administration of contributions sent to the Pension Fund to the Federal Tax Service. Now the tax inspectorate sends all the information necessary for the fund’s work there through TCS channels.

PSN

Another type of taxation regime is the patent system (PSN). The patent value usually depends on the type of activity of the entrepreneur. But the required document is always the Income Accounting Book and a one-year patent for individual entrepreneurs.

Detailed information about various tax regimes for individual entrepreneurs can always be found on the official website of the Federal Tax Service. To do this, you need to go to a special section with information about tax documents that every businessman conducting business in Russia is required to submit.

Documents confirming the choice of taxation system

Another important document that every individual entrepreneur should know about receiving is confirmation of the transition to a preferential tax regime.

The fact is that after registration, all entrepreneurs and organizations are considered payers of the general taxation system - OSNO. But most beginning businessmen choose a special regime with a reduced tax rate: simplified tax system, PSN, unified agricultural tax.

The document that confirms the transition to a preferential tax system must be kept. For the simplified tax system and the unified agricultural tax, this is the second copy of the submitted notification with a mark from the tax office. If an entrepreneur chooses a patent taxation system, he will be issued a corresponding patent.

The choice of the most favorable tax regime should be made as early as possible, ideally before registering an individual entrepreneur. If you do not know how to calculate the fiscal burden on different taxation systems, we recommend that you seek a free consultation.

Free tax consultation

Documents of an individual entrepreneur as an employer

When business is impossible without the involvement of additional labor, it becomes necessary to maintain additional documents. Hiring citizens for work entails additional responsibility and the preparation of appropriate reporting.

Once you start running your own business, you come under the constant control of the Social Insurance Fund (SIF) and, of course, the Federal Tax Service of the Russian Federation (FTS).

Each of these bodies expects an individual entrepreneur, who is an employer, to submit a certain list of individual documents.

The Federal Tax Service requires information from individual entrepreneurs with employees on form 2-NDFL until April 1 of the next year. In addition, the number of employees must be reported by January 20. In cases of closure of business activities, information on the number of employees is submitted before the date of deregistration.

Reports are sent to the Social Insurance Fund in 4-FSS format. Information is provided in paper form no later than the beginning of the second ten days of the month. In addition, data transfer is possible electronically.

The Russian Pension Fund requires an information document in the form RSV-1. It must contain data for the enterprise as a whole and individual accounting information for each individual employee.

An extract from the Unified State Register of Individual Entrepreneurs is also one of the most important documents.

Legislative framework and changes therein

Explains in detail the issue regarding the constituent documentation of Art. 52 of the Civil Code of the Russian Federation.

Article 52. Constituent documents of legal entities

1. Legal entities, with the exception of business partnerships and state corporations, act on the basis of charters that are approved by their founders (participants), except for the case provided for in paragraph 2 of this article. A business partnership operates on the basis of a constituent agreement, which is concluded by its founders (participants) and to which the rules of this Code on the charter of a legal entity apply. A state corporation operates on the basis of the federal law on such a state corporation. 2. Legal entities may act on the basis of a standard charter approved by the authorized state body. Information that a legal entity operates on the basis of a standard charter approved by an authorized state body is indicated in the unified state register of legal entities. The standard charter, approved by the authorized state body, does not contain information about the name, company name, location and amount of the authorized capital of the legal entity. Such information is indicated in the unified state register of legal entities. 3. In cases provided for by law, an institution may act on the basis of a single standard charter approved by its founder or an authorized body for institutions created to carry out activities in certain areas. 4. The charter of a legal entity, approved by the founders (participants) of the legal entity, must contain information about the name of the legal entity, its organizational and legal form, its location, the procedure for managing the activities of the legal entity, as well as other information provided by law for legal entities of the corresponding organizational -legal form and type. The charters of non-profit organizations, charters of unitary enterprises and, in cases provided for by law, the charters of other commercial organizations must define the subject and goals of the activities of legal entities. The subject and certain goals of the activities of a commercial organization may also be provided for by the charter in cases where this is not mandatory by law. 5. The founders (participants) of a legal entity have the right to approve regulating corporate relations (clause 1 of Article 2) and internal regulations and other internal documents of the legal entity that are not constituent documents. The internal regulations and other internal documents of a legal entity may contain provisions that do not contradict the constituent document of the legal entity. 6. Changes made to the constituent documents of legal entities become effective for third parties from the moment of state registration of the constituent documents, and in cases established by law, from the moment the body carrying out state registration is notified of such changes. However, legal entities and their founders (participants) do not have the right to refer to the lack of registration of such changes in relations with third parties who acted in accordance with such changes.

Federal Law No. 125 specifies a list of individual entrepreneur documents and the period for their storage, while the entrepreneur must provide all conditions for the safety of documentation.

Clause 8 art. 23 of the Tax Code of the Russian Federation indicates the need to store accounting and tax records.

There have been changes in the execution of some documents that an entrepreneur must have:

- Until 2021, a Certificate of State Registration was issued in the form P21001, and after that the Unified State Register of Entrepreneurs (USRIP) Entry Sheet on the registration of an entrepreneur was issued.

- In this case, the certificate issued earlier is considered valid.

- In addition, after successful registration, the entrepreneur is given a notification in the form 2-3-Accounting.

What personnel documents should an individual entrepreneur have?

Every entrepreneur as an employer is required to have the following personnel documents:

- agreement in two copies;

- personal cards of their employees in the T-2 form;

- staffing table with paid vacation schedule;

- job description;

- rules of procedure within the enterprise.

In addition, for general compliance with the personnel system, the presence of such reporting documents as a staffing table, a time sheet for recording time spent at work, a vacation schedule, an expense book, and a labor accounting book is required.

In fact, registering a new employee to work in a private business is not such a complicated procedure. The main thing is to carry out complete document flow and properly maintain personnel records. And timely completion of all employment forms will give you a chance to avoid unpleasant problems with regulatory government agencies and the employees themselves.

Using the above list, you can always check whether all documents are available. This will also allow you to understand which of them are yet to be obtained. Experienced entrepreneurs note that you should even keep a folder of official documents of an individual entrepreneur. This will certainly become a very convenient tool in running your business and will allow you to control any situation, which will simplify interaction with government agencies. In addition, it will leave time to implement your own innovations as a businessman. These are the documents an individual entrepreneur should have.

Documentation recovery

If the entrepreneur’s documents were lost due to circumstances, steps must be followed to restore them in compliance with procedural norms.

In this case, depending on the type of loss of documents, you need to take a certificate from the police, housing office or Ministry of Emergency Situations, which will act as supporting documents.

If you lose documents, you can act in 2 ways:

- Close the enterprise - after submitting the relevant documents and settlements with all creditors, as well as funds, closure will occur within 10 days;

- To restore documents and work further, for this you need to write an application, attach a confirmation certificate to it, and pay the state fee for each restored form.

Activity codes according to OKVED

The All-Russian Classifier of Types of Economic Activities (OKVED) is a reference book in which each type of activity of an entrepreneur is assigned its own unique code. When registering, the future entrepreneur must indicate which OKVED codes he will work with. This must be done on sheet A of form P21001.

It is important to choose the right OKVED codes. Otherwise, tax authorities may have doubts about the legality of your activities. And for incorrectly selected OKVED codes they can be fined - in accordance with Part 4 of Art. 14.25 of the Code of Administrative Offenses of the Russian Federation, the fine ranges from 5,000 to 10,000 rubles.

The legislator does not limit the number of OKVED codes that you can register. The main thing is to choose one main one. This will be the code for the activity that you plan to engage in most often and receive most of the profit from its implementation. Simply record additional codes in the Unified State Register of Individual Entrepreneurs - for example, in the future you will be able to engage not only in the retail sale of non-food products, but also provide delivery services.

It is convenient to work with the classifier - it is divided into sections (from A to U), which, in turn, are divided into classes. Classes are divided into groups, and groups into subgroups. When registering, it is enough to indicate a four-digit code - all subgroups included in the selected group will be assigned to the individual entrepreneur automatically.

If at the time of registration you do not indicate in the application the code that you will need in the future, nothing bad will happen - changes to the Unified State Register of Entrepreneurs can be made later by filling out form P24001.

ConsultantPlus has many ready-made solutions, including reference information “State registration of individuals as individual entrepreneurs.” If you don't have access to the system yet, sign up for a free trial online! You can also get the current K+ price list.

Can they refuse to open an individual entrepreneur?

Sometimes a refusal is received in response to an application for registration of an individual entrepreneur. The list of grounds for refusal is given in Art. 23 Federal Law No. 129. You will not become an entrepreneur if:

- the application was drawn up incorrectly or an incomplete set of documents was attached to it;

- documents are not certified by a notary if you submit documents by mail or through a representative;

- the registration application was signed not by you, but by another person who does not have the right to do so;

- the passport data specified in the application does not correspond to the data that the Federal Tax Service received from the Ministry of Internal Affairs;

- the court has prohibited you from working as an individual entrepreneur;

- you already have the status of an individual entrepreneur;

- less than a year has passed since you were declared bankrupt or since the court made a decision to forcibly terminate your activities as an individual entrepreneur;

- the ban on business activities imposed by the court has not expired.

How to register an individual entrepreneur in this case? You will have to eliminate the reason why you were refused, for example, if the package of documents is incomplete, update it. But if there is a ban on doing business, all you have to do is wait until it expires.

Receipt for payment of the fee for registration of individual entrepreneurs

A receipt for payment of state duty is a document confirming the fact that you contributed money for the service of registering an individual entrepreneur to the budget. It must be attached to the package of documents for the tax office - if this is not done, the application will not be considered. As a receipt you can submit:

- payment order with a note about payment from a bank account (paragraph 2, paragraph 3, article 333.18 of the Tax Code of the Russian Federation);

- bank receipt - if the duty was paid in cash (paragraph 3, paragraph 3, article 333.18 of the Tax Code of the Russian Federation).