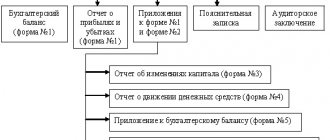

Let's look at the key features of drawing up and submitting a balance sheet in 2021 and provide a sample for filling it out.

Author: Evdokimova Natalya

Balance sheet form 1: form 2018

All Russian organizations, as well as official representative offices of foreign companies in our country, are required to report on their financial and economic situation for the reporting year. This obligation is regulated by the Law “On Accounting” No. 402-FZ.

The law also provides “indulgences” for certain categories of economic entities that have the right to keep accounting records in a simplified form. However, regardless of the method of accounting, basic or simplified, Form No. 1 is mandatory for all economic entities: organizations, individual entrepreneurs and private individuals.

This year you will have to generate reports for 2021. The current form was approved by order of the Ministry of Finance of Russia No. 66n dated 07/02/2010.

Distinctive features of the current balance sheet

The forms of financial statements used to date are established by the current edition of Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

From June 1, 2021, the edition dated April 19, 2019 is in effect. The basic approach to the preparation of accounting reports corresponds to the following principles: it must be done according to accounting data, be complete, reliable, and useful for users. However, such reporting may have abbreviated versions. Recommendations for the preparation and presentation of forms are contained in the current edition of PBU 4/99.

For information on how to apply this PBU, read the article “PBU 4/99 - financial statements of an organization (nuances)” .

The full form of the balance sheet introduced by Order No. 66n (Appendix 1) is distinguished by the fact that it:

- offered only as one of the possible report options;

- assumes that the report compiler has a preferential right to independently detail the indicators;

- proposes to provide data for 3 dates (reporting date and the end of 2 years preceding the reporting year);

- provides a column for links to possible explanations by line;

- does not contain a section with information on off-balance sheet accounts.

The same document contains a simplified balance sheet form (Appendix 5), the use of which is available to persons specified in clause 4 of Art. 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

You can check whether you filled out the balance sheet correctly using step-by-step instructions from ConsultantPlus. If you do not have access to the system, get a trial online access and go to the Typical Situation for free.

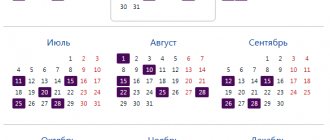

Deadlines for submitting reports for the 2nd quarter of 2021

We have prepared a taxpayer reporting calendar for the 2nd quarter of 2021.

Save it for yourself so you don’t have to look for it later. It’s convenient to share on social networks - you won’t lose it yourself, and you’ll help your friends. Under the header there are buttons for Facebook, VKontakte, Odnoklassniki and Twitter. To the right there are buttons to save the reporting schedule for the 2nd quarter of 2021 to “favorites” or to the diary on “Clerk”. You can also print the table.

And use our Google taxpayer calendar, which will remind you of the need to submit a particular report.

Table. Deadlines for submitting reports for the 2nd quarter of 2018

| Declaration form, calculation, information | Approved | Deadline |

| Social Insurance Fund | ||

| Form 4 FSS of the Russian Federation. Calculation of accrued and paid insurance premiums for compulsory social insurance against industrial accidents and occupational diseases, as well as expenses for payment of insurance coverage | FSS Order No. 381 dated 09/26/2016 (as amended by Order No. 275 dated 06/07/2017) | July 20 (hard copy) July 25 (in the form of an electronic document) |

| Personal income tax | ||

| Calculation of personal income tax amounts calculated and withheld by the tax agent (6-NDFL) | Order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/ [email protected] dated 10/30/15 (as amended on 01/17/2018) | July 31 |

| Insurance contributions for pension and health insurance | ||

| SZV-M Information about the insured persons | Resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 N 83p | May 15 June 15 July 15 |

| DSV-3 Register of insured persons for whom additional insurance contributions for funded pension are transferred and employer contributions are paid | Resolution of the Board of the Pension Fund of the Russian Federation 06/09/2016 N 482p | July 20 |

| Calculation of insurance premiums | Order of the Federal Tax Service of Russia N ММВ-7-11/ [email protected] dated 10.10.2016 | July 30 |

| VAT, excise taxes and alcohol | ||

| Presentation of the log of received and issued invoices in the established format in electronic form for the first quarter of 2021. The log is submitted by non-VAT payers, taxpayers exempt under Article 145 of the Tax Code, not recognized as tax agents, in the case of issuing and (or) receiving invoices by them - invoices when carrying out business activities under intermediary agreements. | Clause 5.2. Article 174 of the Tax Code of the Russian Federation | July 20 |

| Submission of a tax return on indirect taxes when importing goods into the territory of the Russian Federation from the territory of member states of the Eurasian Economic Union | Order of the Ministry of Finance of the Russian Federation No. 69n dated 07/07/2010 | May 21st June 20 July 20 |

| Tax return for value added tax | Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ [email protected] dated 10/29/2014 (as amended on 12/20/2016) | July 25 |

| Tax return on excise taxes on ethyl alcohol, alcohol and (or) excisable alcohol-containing products | Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ [email protected] dated January 12, 2016 | May 25 June 25 July 25 |

| Tax return on excise taxes on motor gasoline, diesel fuel, motor oils for diesel and (or) carburetor (injection) engines, straight-run gasoline, middle distillates, benzene, paraxylene, orthoxylene, aviation kerosene, natural gas, cars and motorcycles | Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ [email protected] dated January 12, 2016 | May 25 June 25 July 25 |

| Submission of declarations on alcohol (with the exception of declarations on the volume of grapes) | Decree of the Government of the Russian Federation dated 08/09/2012 N 815 (as amended on 05/13/2016) | July 20 |

| UTII | ||

| Tax return for UTII | Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ [email protected] dated 07/04/2014 (as amended on 10/19/2016) There will be a new declaration! | July 20 |

| Unified (simplified) tax return | ||

| Unified (simplified) tax return | Order of the Ministry of Finance of the Russian Federation No. 62n dated February 10, 2007 | July 20 |

| Income tax | ||

| Tax return for income tax of organizations calculating monthly advance payments based on actual profit received | Order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/ [email protected] | May 28 June 28 July 30 |

| Tax return for income tax of organizations for which the reporting period is the first quarter, half a year and nine months | Order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/ [email protected] | July 30 |

| Tax calculation (information) on the amounts of income paid to foreign organizations and taxes withheld (when calculating monthly payments) | Order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/ [email protected] | May 28 June 28 July 30 |

| Tax calculation (information) on the amounts of income paid to foreign organizations and taxes withheld | Order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/ [email protected] | July 30 |

| Tax return for income tax of a foreign organization | Order of the Ministry of Taxes and Taxes of the Russian Federation of January 5, 2004 No. BG-3-23/1 | July 30 |

| Tax return on income received by a Russian organization from sources outside the Russian Federation | Order of the Ministry of Taxes and Taxes of the Russian Federation dated December 23, 2003 No. BG-3-23/ [email protected] | May 28 June 28 July 30 |

| Property tax | ||

| Calculation of advance payment for corporate property tax | Order of the Federal Tax Service of the Russian Federation No. ММВ-7-21/ [email protected] dated 03/31/17 | July 30 |

| MET | ||

| Tax return for mineral extraction tax | Order of the Federal Tax Service No. ММВ-7-3/ [email protected] dated 05/14/2015 (as amended on 04/17/2017) | May 31 July 2 July 31 |

| Water tax | ||

| Tax return for water tax | Order of the Federal Tax Service No. ММВ-7-3/ [email protected] dated 09.11.2015 | July 20 |

| Gambling tax | ||

| Tax return for gambling business tax | Order of the Federal Tax Service of Russia dated December 28, 2011 No. ММВ-7-3/ [email protected] | May 21st June 20 July 20 |

| Other | ||

| 2021 Controlled Transactions Notice | Clause 2 of Article 105.16 of the Tax Code | May 21st |

The reporting deadlines for the 1st quarter of 2021 can be found in this table.