Actively developing enterprises sooner or later face the need to create separate divisions. In order to carry out this procedure according to all the rules, at a certain stage it is necessary to write a special order. It is from the moment of signing this document that the process of opening a separate division begins.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

What is “separateness”

Before we tell you what an order to create a separate unit is, what it looks like and what should be reflected in it, we need to understand a little about the terminology. Namely, to explain: what is a separate division (hereinafter also referred to as OP).

This concept means a separate structure operating as part of an organization. This may be a branch, representative office or any other entity.

Even one single person working remotely can be considered a separate department. But it’s important not to confuse this with freelancing or other one-time forms of collaboration.

A general description and information about the activities of separate divisions can be found in special legal provisions:

- Art. 55 Civil Code;

- clause 2 art. 11 of the Tax Code.

However, these norms do not say what a sample order for a separate unit should look like.

Any OP has its own distinctive features:

- they can only be created by legal entities (individual entrepreneurs can also structure their business for expansion purposes, but this does not need to be formalized separately);

- cannot be located at the same physical address as the main office of the company;

- it is necessary to equip stationary workplaces. By such, the law means positions that exist for at least 1 month.

Requirements for the order

There are no special rules for issuing an order; it is issued in a single copy. It is certified by the head of the company, or by a person who has the right to sign such documents. In addition to the manager, the order is signed by the persons responsible for its execution. These are the employees indicated in the order.

Such a document should be stored in a separate folder, together with the same administrative acts, and access to the folder should be limited. When a document loses its relevance, it is transferred to the archive, where it is stored for at least 3 years. Only after this the order can be disposed of.

Where to start

The creation of a separate division occurs by drawing up the appropriate regulations on it. This document does not have a single form. But it is necessary to indicate all the main information:

- addresses – actual and legal;

- Name;

- goals and objectives;

- rights;

- management composition, etc.

Within the company, they also issue an order to create a separate division, the sample of which also does not have any uniform form. Sometimes a separate order is issued to appoint the leadership of the OP.

The creation of an OP must be reported to the Federal Tax Service within 1 month! (except for branches and representative offices)

Find out more about this form on our website in the article “Notice on the creation of a separate division (C-09-3-1)”.

Results

A separate division is not an independent legal entity. The decision to create a new division is made by the enterprise management body. After this, the company must contact the tax authority at the location of the unit and provide the necessary package of documents within a month after the decision is made (for a branch or representative office). To register another separate division under tax legislation, it is enough to notify the tax office in the form of an application.

Sources

- https://nalog-nalog.ru/spravochnaya_informaciya/registraciya_obosoblennogo_podrazdeleniya_-_poshagovaya_instrukciya/

- https://online-buhuchet.ru/obrazec-prikaza-o-sozdanii-obosoblennogo-podrazdeleniya/

- https://assistentus.ru/forma/prikaz-o-sozdanii-obosoblennogo-podrazdeleniya/

- https://iskiplus.ru/prikaz-o-sozdanii-obosoblennogo-podrazdeleniya/

- https://iiotconf.ru/rukovoditel-obosoblennogo-podrazdeleniya/

- https://engineer-stroitel.ru/posts.php?id=224

Document on the creation of the OP

An order is the main document that must be issued when creating a separate unit. But the law does not require sending it to the inspection authorities (IFTS). It is used for internal needs.

As already mentioned, there is no single template for such an order. Therefore, it can be compiled in free form. The main thing is to provide basic information. Moreover, there is not much of it.

It is enough that the order to open a separate unit (see sample below) contains data on:

- name of the OP;

- its form (branch, representative office or other);

- location address.

Drawing up a document

Each order issued within the enterprise must have a justification in the form of reinforcement.

In the situation under consideration, you can refer to a certain article of legislation that gives the right to create an OP. The document itself may indicate the basis “in connection with the expansion of the enterprise”, “due to the improvement of the organizational structure”. There are no legal regulations regarding the preparation and execution of the document. You can write the paper on a regular A4 or A5 sheet, or, if desired, use a company letterhead.

Writing is done by hand or in printed form. In this case, the second option is considered more advantageous, since from the very beginning it includes the necessary set of details and a legible text part. Registration is carried out in one copy, but if necessary, you can create several copies at once.

Document on the leadership of the OP

In any organization, it is necessary to document all employees. Only in the presence of such orders do labor relations arise. And we're not just talking about ordinary workers. This also applies to management, which is confirmed by Art. 16 Labor Code of the Russian Federation.

As for a separate unit, and specifically the appointment of its head, then one must be guided by Art. 68 Labor Code. The main point that should be taken into account when drawing up an order for the appointment of a manager is that it should not contradict the contract that was concluded when hiring him.

Like the order on the creation of the OP itself, the sample order on the creation of a separate unit in 2021 does not have a mandatory form. Each company is free to choose it at its own discretion.

By the way: it is not necessary to create two separate documents. All this information - about the creation of an OP and the appointment of its head - can be reflected in one single order.

Also see the article: “How can separate divisions pay insurance premiums and submit reports to the Federal Tax Service from 2021.”

Read also

28.11.2016

Accounting in branches and representative offices

You can select an inspection site based on the location of any of the departments. Even if the divisions are located in territories under the jurisdiction of different tax inspectorates (paragraph 3, paragraph 4, article 83 of the Tax Code of the Russian Federation). But note that this rule only applies to separate units. If the head office of an organization and its separate division are located in the same locality, but in territories under the jurisdiction of different inspectorates, then it is impossible to select one inspection for registration (letter of the Ministry of Finance of Russia dated April 15, 2011 No. 03-02-07/1- 126) From 01/01/2019, insurance premiums in case of temporary disability and in connection with maternity must be paid to the Federal Tax Service. And for reimbursement of benefits, as before, you must contact the Social Insurance Fund. Each domestic legal entity has the opportunity to open separate divisions, that is, branches, representative offices and others. The procedure for opening them and the requirements for them are specified in detail in the relevant rule-making acts.

Who makes the decision to open a branch of an LLC?

Step-by-step instructions for creating a branch in 2021 should contain key points of the procedure, as well as legal subtleties that are important.

- So, as a general rule, in accordance with the current legislation of the Russian Federation, a general meeting of participants is authorized to make a decision on opening a branch (or, if there is only one owner, then he makes the decision individually). The required quorum is established by law, and can be changed by the company's charter (only upward).

- At the same time, the charter of the LLC may determine another body that is granted the right to open divisions. According to established standards, in 2021, the creation of a branch may be within the competence of:

- Board of Directors (supervisory board) in accordance with clause 1 of Art. 5, paragraph 2, art. 32, paragraph 8 of Art. 37 of the LLC Law.

- The collegial executive body in accordance with clause 2 of Art. 65.3, paragraph 3 of Art. 66.3 of the Civil Code and the LLC Law.

Sample order on the allocation of jobs for disabled people

Registered by the Federal Service for Supervision of Communications, Information Technology and Mass Communications (Roskomnadzor) registration certificate and the site uses cookies. For the equipment (equipment) of workplaces (including special ones) for the employment of unemployed disabled people without creating the infrastructure necessary for unhindered access to equipped (equipped) workplaces for disabled people, including people with disabilities using wheelchairs, in 2015 in the amount of equal to 72.69 thousand. Since there is no unified form of such an order, it can be issued in any form (see On amendments to certain legislative acts of the Russian Federation on the issue of quotas for workers.

The form of notification is not provided for by law, therefore it can be made in free oral or written form. On the allocation of jobs for the employment of people with disabilities in accordance with the established quota. From the forum topic, the quota for people with disabilities was posted by a participant. Allocate (make) in from their special jobs by position 2. The application is considered within 10 working days from the date of its receipt by the commission, made at the employment center.

for free

Having your own website is no longer considered by most business entities as some kind of luxury. This “invisible assistant” has become an integral part of any business. Pharmacy organizations are no exception. Despite the existence of a legislative ban on online sales of medicines and medical products, pharmacies are actively creating and promoting websites in order to attract a larger number of potential buyers and partners. Tax and accounting expenses associated with the creation and promotion of a website have characteristic features. Details below.

The panic over the fake news that the Federal Tax Service will completely control card transfers and charge taxes on “unidentified” transactions has subsided. However, citizens still have questions: in what cases the amount received by transfer to a card can still be recognized as income and subject to personal income tax, and in what cases it cannot.

However, the level of knowledge of social institutions, processes and phenomena among managers in general is clearly insufficient for this, although some representatives of this complex profession have the necessary knowledge and (or) respond to the “challenges” of the environment intuitively. For both categories of managers, the introduction of the necessary knowledge will be useful, as it will increase their level of confidence in the decisions made and create the prerequisites for a more consistent and complete use of external conditions.

- Make sure that the website address that appears in your browser's address bar is written correctly and does not contain any formatting errors.

- If you arrived at this page by clicking on a link, please contact the site administrator and alert them to the incorrectly formatted link.

- Click the Back button. to check another link.

Registration with extra-budgetary funds

The last step that will have to be completed after creating a new branch of a ready-made company with a turnover is registration in an extra-budgetary fund located at the place of work of the branch. It is worth considering that such a procedure is necessary only if the open division has a separate balance sheet and its own current account, as well as if the branch independently calculates salaries for employees.

To register a branch in extra-budgetary funds, you need to prepare the following papers:

- Application (must be drawn up according to the established template). It is worth taking into account that each fund has an individual form.

- Notification confirming the registration of the main company in extra-budgetary funds in relation to the legal address.

- The papers required to create a branch, as well as certified by a notary (the notary can be private or public).

As soon as the registration procedures are completed, the branch receives a certificate. It indicates that the open unit is included in the payers of insurance payments at its location.

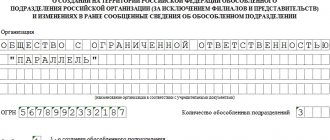

Submitting documents to the Federal Tax Service

The head of the Company (or a representative under a notarized power of attorney) submits the entire list of documents presented above to the tax office. A set of documents is submitted to the registration authority within 3 working days after the decision to open a branch is made. Documents are submitted at the place of operation of the parent organization.

It is worth noting that, depending on the region, the registration authority may additionally request documents such as:

- regulations on the branch;

- documents confirming the use of the branch address (lease agreement, consent of the owner, certificate of the owner, etc.).

Based on this, before submitting documents, it is better to consult with the tax authority about the set of documents necessary for successful registration.

Order to change address

In the process of conducting business, any organization may encounter a change of address. This means that in practice a new order is issued confirming this fact. Here are the details the document in question should contain:

- name of the separate division;

- previous legal address;

- current location;

- the circumstances under which it happened;

- signature of the head of the organization.

For each such change, a corresponding order document is issued. It is best to create paper designed in any form, preferably using a ready-made template.

Thus, the order paper associated with the creation of an EP is the main one within each enterprise where branches are created. This means that you must comply with the requirements for filling it out and act in accordance with the specified instructions.

More information about registering a separate unit can be found in the video.

Preparation of documents for opening a branch of an LLC

Creation of a branch with amendments to the Charter in form P13001:

- form P13001;

- protocol/decision on the creation of a branch;

- new charter (or list of amendments);

- state duty in the amount of 800 rubles.

In application P13001 the following is filled in:

- Title page;

- Sheet K - in section 2 we enter the number 1, in section 3 we indicate the name of the branch and its address, the second page of Sheet K is not filled in when creating a branch;

- Sheet M (information about the applicant).

Creation of a branch without making changes to the Charter in form P14001:

- form P14001;

- protocol/decision on the creation of a branch.

In application P14001 the following is filled in:

- Title page;

- Sheet O - in section 2 we put down the number 1 (even though there is no data on the branch in the charter), then in section 3 we indicate the name of the branch and its address, we do not fill out the second page of Sheet O when creating a branch;

- Sheet R (information about the applicant).

Responsibility for violation of the registration procedure

Clause 1 of Article 126 of the Tax Code of the Russian Federation implies liability for violating the deadlines for sending a message about opening an OP.

For such a violation, a fine of 200 rubles is imposed for each document not submitted on time.

A fine of 300 to 500 rubles is imposed on officials. In case of conducting activities without tax registration, the organization will be obliged to pay a fine in the amount of 10% of the income received, but not less than 40,000 rubles.

Let's just say that the liability if you do not register an OP on time is quite small, by business standards. Conducting activities without registration is already more serious. At the same time, the labor costs to create it are in any case much less than the possible consequences.

5 / 5 ( 5 votes)

How to create a workplace for a disabled person

A disabled person is a person who has a health impairment with a persistent disorder of body functions, caused by diseases, consequences of injuries or defects, leading to limitation of life activity and causing the need for social protection (Article 1 of Federal Law No. 181-FZ)

Our enterprise is quite large - more than 500 employees, and, as they say, there is no end to the personnel work. And then the boss puzzled us with a problem: it was necessary to create places for the disabled. I started studying this topic, and as a result my head was a mess. And, unfortunately, there’s not even time to figure out what’s what. For example, “creating a workplace for a disabled person” and “job quotas” – are they the same thing? And one more moment. If our regional Employment Center refers a disabled person to us, will we be obliged to accept him?

But as far as I understand, the order for the institution is to allocate a quota of jobs for the disabled. The order to develop a workplace for the disabled is a standard. A form for filling out information about job quotas for employing people with disabilities is located on the website. The standard form for a personal rehabilitation program is contained in Appendix No. 1 to the order of the Ministry of Health and Social Development.

Municipal acts and regulations provide for certain benefits and privileges for people with disabilities. Order on quotas for jobs for people with disabilities. Currently, there is a separate procedure for certification of workplaces for people with disabilities, which enterprises could manage when developing.

the employer is obliged to develop and approve them. Personnel Dictionary A quota is the minimum number of jobs for citizens who are especially in need of social protection and are experiencing difficulties in finding work (as a percentage of the average number of employees of enterprises, institutions, organizations), whom the employer is obliged to employ, including the number of jobs in which they are already citizens of the specified category work. Group 2. Local acts provided for by other normative legal acts that determine the content and procedure for the adoption of these local acts. Group 3. Acts that are not named in regulatory documents, but are actively used in practice.

How the job quota procedure has changed now. The general regulation of the quota process, as we have already found out, currently occurs at the level of local rule-making. In local regulations, the employer must provide for the main stages of this procedure. Stage 1 Conclusion of a quota agreement. Quotas for jobs are carried out on the basis of agreements concluded between local governments and employers. Such an agreement contains, among other things, the following mandatory information:.

Fresh materials

Social tax 2021 Tax accrualIn accounting, the amounts of advance tax payments are reflected in the credit of account 69 (68)…