Why are personnel documents needed?

The existence of personnel records documents is determined by the norms of the Labor Code of the Russian Federation. For example, Art. 56 of the Labor Code of the Russian Federation establishes the concept of an employment contract, and Art. 212 obliges the employer to create internal regulations that will regulate labor protection. Thus, the need for mandatory personnel documents follows from the norms of the Labor Code of the Russian Federation. In addition, often the preparation of correct personnel documentation allows you to reduce the amount of income tax; for example, many payments in favor of employees can be confirmed by a collective agreement.

Self-employed

By hiring self-employed people for some types of work, a company can save on personal income tax and insurance premiums. Let's consider when this is legal and does not pose risks for the organization.

After the introduction of the Professional Income Tax (hereinafter referred to as the PIT), many employers may be tempted to register full-time or newly hired employees as self-employed. Both individuals without individual entrepreneur status and individual entrepreneurs can be self-employed.

Federal Law No. 422-FZ dated November 27, 2018 (hereinafter referred to as the Law on the Self-Employed) establishes the obligation for the employer to pay personal income tax and insurance contributions in the event of hiring its current or former employees as self-employed, less than two years have passed since their dismissal (clause 1 and clause 8, part 2, article 6 of the Law on the Self-Employed).

Thus, the law establishes a direct ban on hiring current or former employees as self-employed workers for two years from the date of dismissal.

Companies enter into civil contracts with self-employed contractors for the provision of services or paid services in the manner established by the Civil Code of the Russian Federation, therefore, the conclusions of the courts on the reclassification of a civil contract (hereinafter referred to as the CLA) into an employment contract can also be applied to relations with self-employed people.

According to the Supreme Court of the Russian Federation, the mere fact of concluding a civil contract between an organization and an individual does not indicate the absence of labor relations . In Determination No. 66-KG17-10 of September 25, 2017, the Supreme Court identified the key distinguishing features of the GPA from the labor law. For convenience, we present them in Table 1.

Table 1. Key distinguishing features of a GPA from an employment contract

For example, if you hire a programmer to do a one-time job - creating a website on the Internet, you can enter into an agreement with a self-employed contractor. And if you need a programmer to carry out current tasks on a daily basis, who must always be at his workplace, work according to a schedule and obey internal labor regulations, you hire him under an employment contract.

If you hire a self-employed contractor, pay attention to the following points:

- check its registration on the Federal Tax Service website: https://npd.nalog.ru/check-status/. If there is no registration with the tax authority, the company will have to charge personal income tax and insurance premiums on the remuneration paid;

- request a check from the contractor from the “My Tax” application for each payment for work/services; it is needed to confirm the expenses of your self-employed status;

- include in the contract a condition on the obligation to immediately notify in case of loss of the right to use the NAP;

- you should not be the only customer of work/services.

Consequences of retraining a self-employed employee into an employment contract:

- fine under Article 5.27 of the Code of Administrative Offenses of the Russian Federation: for officials from 10 to 20 thousand rubles; for individual entrepreneurs from 5 to 10 thousand rubles; for organizations from 50 to 100 thousand rubles;

- additional calculation of personal income tax and insurance premiums as for an employee;

- accrual of fines for non-payment of taxes and insurance premiums;

- payment of sick leave, vacations and other compensation that would be due under the employment contract.

Please note that all of the above about the requalification of the GPA into an employment contract is also true for a self-employed individual entrepreneur, and not only for an NPA payer without the status of an individual entrepreneur. This is evidenced by the Determination of the Supreme Court No. 302-KG17-382 dated February 27, 2017.

The consequences for the organization will be similar when retraining the GPA with a self-employed individual entrepreneur into an employment contract: you will have to pay personal income tax and insurance premiums, fines and penalties; liability under Article 5.27 of the Code of Administrative Offenses of the Russian Federation; fulfill the provision of social guarantees.

Therefore, be vigilant and involve self-employed performers only in cases where this is legal and corresponds to the essence of civil law relations, and not labor relations.

Check the registration of self-employed people on the Federal Tax Service website with whom you have already entered into an agreement or plan to enter into one in January 2021 , ask for a certificate confirming registration. A self-employed person can print it out from the “My Tax” mobile application or from their Personal Account on the Federal Tax Service website.

Mandatory individual personnel documents

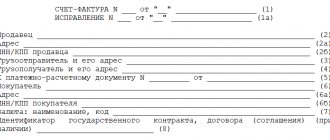

Individual personnel documents include:

- labor contract (form TD-1);

For information on drawing up a contract, see the material “Unified Form No. TD-1 - Employment Contract.”

- employment history;

- administrative document on hiring/dismissal (forms T-1 and T-8, respectively);

For information on using the T-1 form, see the material.

For more information about Order T-8, see the material “Unified Form No. T-8 - form and sample filling.”

- employee personal card (form T-2);

The template for this form can be found in the material “Unified Form No. T-2 - Form and Sample Filling Out”.

- order on the basis of which the employee is transferred (form T-5);

For more information about this form, see the material.

- order for vacation registration (form T-6).

The specified type of document is presented in the material.

Claims for standard deductions

Let us remind you that employees do not need to write applications every year for standard personal income tax deductions for themselves, children and students. You only need to receive one application, which will be the basis for providing deductions for several years.

In the new year, only employees who have:

- the previous year’s application indicates a specific tax period - a calendar year;

- The circumstances of receiving the deduction have changed, for example, an 18-year-old child became a student, another child was born.

But in order to receive a deduction for a student, an employee must provide a certificate from the place of study annually; it must indicate the period and form of study (Letter of the Ministry of Finance dated July 21, 2020 No. 03-04-05/63596).

At the beginning of the year, the HR officer needs to collect applications for standard deductions from employees:

- those who indicated the tax period in last year’s application as 2020;

- whose circumstances for receiving the deduction have changed;

- who got a job with you in the new year.

For those who come to work with you not from the beginning of the year, in addition to the application and the usual documents confirming the right to deduction, you need a certificate of income from the previous place of work.

Mandatory personnel documents in a general purpose organization

Among the general purpose personnel documents, the following stand out:

- staffing table (form T-3);

You will find its template in the material “Unified Form No. T-3 - Staffing Schedule (form).”

IMPORTANT! When hiring an employee, his position in the employment contract must correspond to the staffing table (letter of Rostrud dated January 21, 2014 No. PG/13229-6-1).

- vacation schedule (form T-7);

For information on the schedule and the procedure for filling it out, see the material “Unified Form No. T-7 - Vacation Schedule.”

- order to dismiss employees (form T-8a);

- time sheet, on the basis of which the number of hours worked and salary calculation is monitored (forms T-12 and T-13);

For information about the T-12 form, see the material “Unified Form No. T-12 - Form and Sample.”

The structure of the T-13 report card is discussed in the material “Unified Form No. T-13 - Form and Sample.”

- other regulatory documents:

- on labor protection;

- on the protection of personal data;

- collective agreement;

- according to internal regulations;

- on wages and bonuses;

- about trade secrets;

- log books:

- work records;

- contracts;

- sick leaves.

IMPORTANT! Some documents that are required in one situation may not be of equal importance in other circumstances. So, for example, if there is no trade secret clause in the contract with an employee, then there is no need to issue a corresponding provision.

For information about archiving personnel documents, see the material “What is the period for storing personnel documents in an organization?”

Electronic work books. Selection Statements and Other Important Points

Let us remind you that it was necessary to complete the collection of applications for choosing a method of administration before December 31 of last year inclusive. Employees who refused to maintain a paper work book had to return it, and the rest had to continue keeping it simultaneously with an electronic work book (hereinafter referred to as the ETC).

In the new year, persons who did not have the opportunity to submit such an application before December 31, 2021 (Clause 6, Article 2 of the Federal Law of December 16, 2019 No. 439-FZ) may contact the employer:

- employees who do not perform labor duties and whose place of work is retained:

- for the period of vacation or temporary disability (for example, maternity leave, parental leave);

- for the period of suspension from work in cases provided for by the Labor Code of the Russian Federation, other federal laws, and other regulatory legal acts of the Russian Federation;

- persons with work experience, but as of December 31, 2020 were not in an employment relationship.

Please note that this list is public.

The above-mentioned persons have the right to do this at any time by submitting an application to the employer at their main place of work, including during employment (Letter of the Ministry of Labor of Russia dated August 12, 2020 No. 14-2/OOG-12933).

From 2021, there is no need to issue paper work books for those who will be getting a job for the first time. The legislator has not provided for the right of choice for this category, so the employer can only maintain an electronic registration code for them (Clause 8 of Article 2 of the Federal Law of December 16, 2019 No. 439-FZ).

People who refused to keep a paper work record book at their previous place of work may come to you to get a job; the entry made in it will indicate this. In this case, there is no need to continue maintaining a paper work book, since information about the refusal by the former employer has already been transferred to the Pension Fund of the Russian Federation, so it will be impossible to return to maintaining a paper work book at a new place of work. Explanations on this issue are provided by the Russian Ministry of Labor in Letter No. 14-2/OOG-10180 dated 07/03/2020.

At the beginning of the year, the personnel officer needs to collect applications regarding the choice of method of maintaining a work record from employees who, in January 2021:

- returned to work after illness, vacation, maternity leave, parental leave;

- got a job with you, have work experience, and were not working as of December 31, 2021.

Responsibility for the absence and improper storage of personnel documents

The following methods of punishment related to office work in the personnel sector can be distinguished:

- Disciplinary sanctions provided for in Art. 193 of the Labor Code of the Russian Federation, the maximum measure for which is dismissal.

- In accordance with the provisions of the Code of Administrative Offenses of the Russian Federation, the rules for bringing to administrative responsibility for the lack of documents are reflected in Art. 5.27, 5.27.1 Code of Administrative Offences.

Example:

An audit was carried out at Landysh LLC for 2021, during which it turned out that the company’s personnel service did not have a staffing table for the specified period. The LLC was held liable under paragraph 1 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, according to which the following punishment is provided:

- for officials - 1,000–5,000 rubles;

- for a company - 10,000–50,000 rubles.

Besides:

- Art. 13.20 Code of Administrative Offenses punishes 300–500 rubles. officials for violating the rules for storing documents;

- Art. 5.39 imposes a fine of 1,000–3,000 rubles. against responsible persons for failure to provide the requested personnel records information to the employee, for example, for refusing to issue a copy of the work record book.

In accordance with the Criminal Code of the Russian Federation:

- Art. 137 of the Criminal Code of the Russian Federation provides for punishment in the form of a fine of up to 350,000 rubles. or corrective labor for disseminating personal information about an employee;

- Art. 183 of the Criminal Code of the Russian Federation applies measures in the event of disclosure of trade secrets.

For information on the penalties provided for by law, see the material “From 01/01/2015, fines have been established for failure to draw up an employment contract or GPA.”

Who should be entrusted with HR administration?

Personnel records management is a whole complex of procedures for documenting labor relations. Key moments of interaction with personnel - employment and dismissal, transfer and assignment on business trips, rewarding and disciplinary punishment - are accompanied by certain formalities. All employers using hired labor are required to conduct personnel records management in 2021: the new requirements somewhat simplify this process for individual entrepreneurs and micro-enterprises, but do not completely exempt them from it.

Personnel records can be maintained either by one HR specialist or by an entire personnel department. It all depends on the size of the company and the complexity of its structure. The larger the staff, the larger the flow of documents that the personnel officer has to deal with, the more difficult it is for him to cope alone. The HR department has to be expanded. And in small organizations, where a total of 10–20 people work, all issues related to personnel can be resolved solely by the manager. Ideally, this requires appropriate qualifications, but with a small amount of work, even HR administration for dummies mastered from scratch allows you to cope with it normally.

| Valentina Mitrofanova will tell you what's new in labor legislation this week. Watch the new episode of Personnel Review. |

Results

Every company wants to keep reliable records.

This applies not only to documents reflecting business transactions, but also to personnel records. In case of non-compliance with the norms of the Labor Code, the company may face penalties, and in the case of disclosure of information from personnel documents, even criminal liability may be applied. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Courses to help improve document flow

The latest HR course 2.0

16551

Building an effective HR service 2.0

15801

Documents on certification, advanced training and retraining, independent assessment of qualifications

| DOCUMENT TYPE | STORAGE LIFE | NOTE |

| Qualification requirements, professional standards: | – | |

| a) at the place of approval; | Constantly | |

| b) in other organizations | Before replacing with new ones | |

| Typical additional professional programs: | – | |

| a) at the place of approval; | Constantly | |

| b) in other organizations | Before replacing with new ones | |

| Advanced training programs and professional retraining programs: | – | |

| a) at the place of approval; | 5 years | |

| b) in other organizations | Before replacing with new ones | |

| Curriculums, assignments | 5 years | – |

| Educational and methodological manuals for advanced training and professional retraining: | – | |

| a) at the place of development; | Constantly | |

| b) in other organizations | Until the need passes | |

| Documents (projects, reviews, conclusions) on the development of curricula, plans, manuals | 5 years | – |

| Coursework and tests for students of organizations carrying out educational activities to implement additional professional programs | 1 year | – |

| Plans for advanced training of workers and professional retraining of workers: | – | |

| a) at the place of approval; | 5 years | |

| b) in other organizations | Until the need passes | |

| Reports on the implementation of plans for advanced training and professional retraining of employees | 5 years | – |

| Documents (tests, questionnaires, questionnaires) to determine (evaluate) the professional and personal qualities of employees | 5 years | – |

| Minutes of meetings, resolutions of certification and qualification commissions; documents (protocols of counting commissions; secret ballot ballots) to them | 10 years | – |

| Statements of disagreement with decisions of certification and qualification commissions; documents (certificates, conclusions) on their consideration | 5 years | – |

| Documents (lists, statements) on certification and qualifying exams | 5 years | – |

| Documents (applications, certificates of qualifications and attachments thereto, conclusions on passing a professional exam) on passing an independent assessment of the qualifications of workers or persons applying for a certain type of labor activity | 5 years | – |

| Registers of the issuance of diplomas, certificates, certificates of professional retraining, advanced training and their duplicates | 50 years | – |

| Schedules for certification and qualifying exams | 1 year | – |

| Documents (certificates, information, memos, reports) on advanced training, professional retraining of workers, on independent assessment of qualifications | 5 years | – |

| Education agreements for training in additional professional programs, student agreements, agreements on independent qualification assessment | 5 years (1) | (1) After the expiration of the contract; after termination of obligations under the contract |

| Occupation logs of organizations carrying out educational activities to implement additional professional programs | 3 years | – |

| Logs of attendance at classes by students in organizations carrying out educational activities to implement additional professional programs | 1 year | – |

| Documents (schedules, plans, graphs) on conducting classes, consultations, final certification | 1 year | – |

| Documents (submissions, lists, characteristics, certificates) on the award of scholarships to students | 5 years | – |

| Documents (applications, programs, schedules, plans, reports, reviews, lists, characteristics) on the organization and conduct of internships and internships for students | 5 years | – |

| Lists of employees who have undergone advanced training and professional retraining, independent assessment of qualifications | 3 years | – |

| Correspondence on certification, advanced training and professional retraining of workers, on independent assessment of qualifications | 3 years | – |

How to lead correctly

When creating an employee’s personal file, you need to understand what should be included in it in 2020. However, it will not be possible to form it once and forever. Information must be updated promptly.

And this can only be done upon a written application from the employee. On his own initiative, the personnel officer has no right to make any adjustments.

The HR department can only issue a case to someone on the orders of the manager. Moreover, this also applies to the person to whom it is instituted. An interested person can familiarize themselves with the materials at any time, but they cannot be taken outside the office without the appropriate permission from management.

If a third party wishes to obtain the folder for review, it must submit a formal request. The transfer can be carried out after receiving the manager’s resolution and drawing up an act in two copies.

How long to store

We found out what documents are stored in the employee’s personal file. And obviously, their shelf life may vary. Therefore, a deadline has been set for the entire folder as a whole. Initially, they remain in the HR department for three years after leaving. Then you can transfer them to the archive for a legally prescribed period.

In accordance with Article 22.1 of the Federal Law of October 22, 2004 No. 125-FZ, personnel documents are stored for 50 or 75 years (depending on the date of establishment or graduation - before or after 2003). However, it is not recommended to file documents for short-term storage (less than five years) in a general folder. In general, it is desirable that the relevant internal local act indicate which of them and why the company intends to store.

The HR department must take into account all available documents in the journal. You can keep it in any form, the main thing is that the numbering on the cover of the folder and in the corresponding column of the journal match.

Magazine

Permitting documents of organizations and individual entrepreneurs for certain types of activities

This refers to those types of activities that require additional documents from government services:

- Licenses for licensed types of activities;

- SRO approvals (for construction companies);

- Confirmation that you have submitted a notice of commencement of activity (in the cases specified in Article 8 of Law No. 294-FZ of December 26, 2008);

- Permits from the SES and the State Fire Service (for shops, catering establishments and hotels);

- Certificates issued for your products or services, etc.