In 2021, the current legislation has undergone a fairly large number of changes, and in particular, this concerns the established list of BCCs, which has also undergone adjustments.

The main change was that now all kinds of insurance premiums should be transferred not to various funds, but directly to the budget of the Tax Service, which is what most of the adjustments to classification codes are associated with.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

That is why many entrepreneurs should re-study the KBK directory for 2021, so that later they do not make mistakes in the process of processing payment documentation.

Decoding KBK 18210502010021000110

In Russia, for calculating taxes and maintaining accounting, there is a basic taxation scheme and special regimes (SNO). Depending on the SNO used, the payer indicates the corresponding BCC on the receipt. Most often, legal entities and businessmen work under a special regime - a single tax on imputed income (UTII). This scheme replaces most fees and the tax rate is 15%. The peculiarity of imputation (UTII) is that the fee is calculated not from earned profit, but from approximate income, which is established by the Tax Code of the Russian Federation for a certain type of work. This special regime is used by companies that do not operate in all areas.

Working on UTII, the payer deposits tax funds using a standard payment, indicating KBK 18210502010021000110. The code consists of 20 digits, divided into seven blocks. For each, the corresponding meaning applies:

- 182 - department to which the funds were sent: Federal Tax Service Inspectorate.

- 1 - category of budget revenues: tax.

- 05 - specific type of collection: tax on complex income.

- 02010 - budget category, source from which the fee is calculated: imputed profit transferred to the regional budget.

- 02 - specific type of treasury: budget of a constituent entity of Russia.

- 1000 — purpose of payment: standard. Under this special regime, other types of KBK UTII 2021 income for individual entrepreneurs are also used.

- 110 - generalized group of income: income.

Terms of payment of UTII

Calculation of UTII is submitted and tax is paid quarterly. Conditions for using UTII:

- The average number of employees in the company does not exceed one hundred;

- the share of other companies in the company is not higher than 25%, excluding companies where 50% of employees have disabilities, consumer cooperation companies;

- companies and businessmen are not recognized as payers of the Unified Agricultural Tax;

- the company is not one of the largest taxpayers;

- the activity is not carried out under a simple partnership agreement;

- The area of the premises for trade or customer service hall for catering is no more than 150 square meters. m.

UTII is prohibited from using:

- when leasing gas stations;

- gas filling stations;

- educational, health and social welfare institutions providing public catering services.

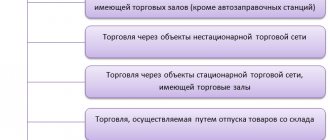

UTII has the right to use companies providing services:

- household;

- public catering;

- road transport;

- ONE HUNDRED;

- retail;

- rental of places for trade.

ENVD can be combined with various taxation regimes: OSNO, patent, Unified Agricultural Tax, simplified taxation. The simultaneous use of taxation regimes for one type of activity is not permissible.

UTII payment dates in 2021

Tax is paid according to quarterly calculations. UTII payment dates:

- 04/25/18 - for the first quarter;

- 07/25/18 - for the 2nd quarter;

- 10.25.18 - for the third quarter;

- 01/25/19 - for the fourth quarter.

Tax is paid regardless of whether income was received and the company was operating or not. As long as the company is registered as an “imputed” taxpayer, payment is required and the filing of a zero declaration is not approved. The BCC UTII 2021 for legal entities is described further in the BCC section for transfers of UTII, penalties and sanctions for individual entrepreneurs for 2018–2019.

UTII payment dates in 2021

The deadlines for payment of imputation in 2021 will not change compared to 2018.

- I quarter — April 25, 2019;

- II quarter — July 25, 2019;

- III quarter — October 25, 2019;

- IV quarter — January 27, 2021.

If the day for payment coincides with a weekend, then the tax amount is paid to the budget on the next working day.

KBK for payment of penalties

In case of untimely payment of the UTII fee, or failure to pay at all, penalties are accrued in accordance with Art. 75 of the Tax Code of the Russian Federation. The lower rate is calculated until 31 days of delay, then the sanction rate increases. Thus, up to 31 days of non-payment, the refinancing rate according to the Central Bank of the Russian Federation is calculated as 1/300, and then – 1/150. But the amount of the penalty cannot exceed the amount of the delay.

Read more: Where can you restore an apartment purchase and sale agreement?

Thus, in order to pay penalties, you will have to pay an amount multiplied by the number of overdue days and the refinancing rate. When paying a fine, the offender indicates KBK 18210502010022100110 on the payment slip.

KBC for payment of fines

Fines are a more serious punishment that is assessed not only for failure to pay taxes and penalties. The amounts of fines are fixed as a percentage or a specific amount at the legislative level in accordance with Art. 122 of the Tax Code of the Russian Federation. Most often, fines are assessed for non-payment or failure to file a declaration, as well as late payment. You must submit reports and pay the fee in the month following the reporting quarter:

- submission of the declaration - before the 20th;

- payment of UTII tax - until the 25th.

If a tax resident had to pay a fine, then the receipt must indicate KBK 18210502010023000110. For which the fine is charged:

- work without tax registration or late filing of an application for registration;

- filing an application for tax registration is overdue;

- violation of deadlines for submitting reports or paying fees;

- failure of a witness to appear or refusal to testify.

Articles on the topic

How is KBK 18210502010022100110 deciphered in 2021? What tax payment is hidden behind this decoding. The procedure for applying this budget classification code.

Legal entities and individuals regularly encounter budget classification codes, abbreviated KBK, when it is necessary to make a particular payment to the budget. These may be taxes, contributions, duties, interest on them, as well as fines, penalties, surcharges and other payments.

Legal entities with a preferential tax system also have their own budget classification codes. One of these codes is KBK 18210502010022100110. In 2021, it stands for payment of penalties by an organization or private entrepreneur for a single tax on imputed income.

This is encrypted in the structure of the code itself. In particular, the 4-6 digits forming the number 105 indicate that we are talking about a tax on total income. And numbers from 14 to 17 specify what the payment is. In this case, combination 2100 stands for penalty.

KBK 18210502010022100110 is intended only for the specified category of companies, individual entrepreneurs and specific payment. If the tax calculation is not related to UTII, or it is required to pay this UTII, the penalty for it, the BCC changes.

KBK is a 20-digit digital code that determines the type of payment and the direction of its transfer. This code is entered into the payment documentation when paying taxes, arrears and recalculation amounts, accrued penalties, interest and penalties for various violations. In order for the payment to go in the right direction, it is necessary to correctly enter the current BCC into the payment documentation.

ATTENTION! Starting with reporting for the fourth quarter of 2018, a new form of tax return for the single tax on imputed income will be used, approved by Order of the Federal Tax Service of Russia dated June 26, 2018 N ММВ-7-3/ [email protected] You can generate a UTII declaration without errors through this service , which has a free trial period.

Changes, explanations and penalties

The Ministry of Finance approved 98 new codes, while 15 were slightly adjusted, and 20 were completely abolished. In all payment documents that are issued for transfers of pension, social and medical insurance contributions, the administrator code has been changed, that is, the first three digits that must be entered in the appropriate field. Previously, it indicated codes belonging to the Pension Fund, as well as health and social insurance funds, but now they are replaced by the Tax Service code - 182.

For payments made for the periods of 2021, the code of the income subtype group has also undergone changes, that is, those values that are indicated in points 14-17. Previously, for all insurance premiums it was necessary to write codes 1000 or 1011, while now they have been replaced by 1010 and 1013.

In addition to insurance premiums, starting from January 2021, the codes that must be indicated when paying income tax and taxes paid under the simplified system have also undergone changes. Some codes have simply undergone adjustments, while others have been abandoned altogether.

What is KBC?

This abbreviation stands for budget classification code. This classification divides all payments by codes for more convenient and efficient tracking of the direction of their movement. BCCs allow you to control the movement of taxpayers' funds, separate them by type of tax obligations, and separate tax payments from the payment of fines and penalties.

Read more: Can you get your insurance back after a cooling off period?

Each entity making tax payments is required to enter the BCC into payment forms. A company on UTII is no exception. When paying a tax, fine, penalty, or interest, the person responsible must indicate the codes corresponding to the applicable tax regime, as well as the type of payment.

If the code is entered incorrectly, the payment may go in the wrong direction and get lost, and the payer will encounter problems returning it and waste time. Every time you transfer any amount of money to the budget, it is necessary to track the actual BCC values at the current moment for specific payments.

The BCC for each year is established by the Russian Ministry of Finance, which approves a special order for this. Not the entire 20-digit digital code can change, but its last four digits – from 14 to 17.

The specified 4 digits are accepted as the following values when making various payments in the imputed mode:

- 1000 – for tax payments;

- 2100 – for payment of penalties;

- 2200 – by percentage;

- 3000 – for fines.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

KBK for UTII

For the imputed tax regime in relation to the payment of a special tax, the BCC is provided for the transfer of the single tax itself, penalties for late payment, as well as various types of fines for violation of the law.

KBK for payment of a special tax of the imputed regime: 182 1 05 02010 02 1000 110 (current for 2021).

According to the specified BCC, not only the calculated special tax payable for the quarter is transferred, but also arrears, tax debt, and recalculation amounts.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

BCC for penalties for UTII

Penalties in the imputed regime are accrued if the single tax is not transferred on time. The deadline for transfer is the 25th day of the month following each quarter. If this deadline is violated, penalties should be charged for each day of delay in payment.

Read more: Voluntary payment of alimony, registration in the accounting department

The calculated penalties must be paid by filling out a payment document, for example, an order. The payment slip indicates the BCC corresponding to the payment of penalties for UTII. Since 2015 There are different classification codes for interest and penalties.

BCC for payment of penalties for UTII: 182 1 0500 110 (this value is relevant for 2021)

The interest on the special tax is paid separately; the KBK is entered into the payment documentation: 182 1 0500 110.

Sample of filling out a payment order for payment of UTII

BCC is reflected in the payment order in field No. 104. The following fields of the payment invoice are entered as follows:

- No. 105 - OKTMO of the municipality in which the company or individual entrepreneur is registered as a payer of “imputation”;

- No. 106 – “TP”;

- No. 107 - numbering of the quarter for which UTII is paid (“KV.01.2019”;

- № 108 – «0»;

- No. 109 - the date when the declaration of imputation was signed;

- No. 22 - “zero”. “UIN” – enter if the company (IP) pays tax at the request of the inspectorate.

- No. 110 - “Payment type” - do not enter.

Become an author

Become an expert

KBC on fines for UTII

A monetary fine may be imposed on the person imputed if he did not submit a UTII declaration in a timely manner, if the tax was calculated incorrectly, as a result of which the base for calculating the tax was underestimated.

The amount of monetary penalty for a declaration not submitted on time is from five to thirty percent of the outstanding tax burden for each month of delay. At the same time, the lower limit of the fine is 1000 rubles.

BCC for payment of a fine for UTII: 182 1 0500 110 (for 2021).

BCC table for UTII in 2021

| Payment type | KBK |

| Single tax UTII | 18210502010021000110 |

| Penalty | 18210502010022100110 |

| Interest | 18210502010022200110 |

| Fines | 18210502010023000110 |

Where to pay UTII

UTII is paid to the Federal Tax Service, whose department is the place where they work under “imputation”. The company is registered with the Federal Tax Service as the payer of the imputation.

Types of business for which exceptions are made from the general norms (registration at the place of provision of services is not required):

- sale of goods by carry-out and distribution methods;

- pasting of transport advertising materials;

- transportation of goods, passenger transportation.

The tax is sent to the inspectorate at the address of the company's head office. The BCC for paying UTII in 2021 has not changed compared to 2021.

Entering BCC into payment documentation

The current value of the BCC must be entered in field 104 of the order, where you must enter 20 digits corresponding to the current value of the code for the current year.

In addition to the KBK, the payment order must also include the purpose of the payment, briefly explaining the purpose for which the funds are transferred.

An example of filling out an order when transferring UTII for the second quarter of 2016.

An example of filling out an order when transferring UTII for the second quarter. 2016