The procedure for tax authorities to request documents from taxpayers has remained virtually unchanged since 2011. The only innovation is that tax authorities now do not have the right to repeatedly request documents from the taxpayer about his counterparties if he has already submitted these documents as part of a desk or field tax audit conducted in relation to the taxpayer himself. Let's look at the current procedure.

Tax authorities have the right to request documents from the taxpayer as part of a tax audit of this person (desk or field), as well as during other tax control activities. The procedure for requesting documents in these cases is established by Articles 93 and 93.1 of the Tax Code of the Russian Federation. At the same time, the right of tax authorities to request necessary documents is limited:

- the circle of persons in respect of whom such a right is granted;

- specific cases directly provided for by the legislation on taxes and fees;

- type (nature) of the requested documents.

What documents (information) and from which persons are tax authorities entitled to request?

Persons obliged to submit documents at the request of tax authorities are taxpayers, payers of fees and tax agents

(clause 1 of article 31 of the Tax Code of the Russian Federation).

In addition, documents (information) about the activities of the taxpayer being inspected (fee payer, tax agent) may be requested from its counterparties

or other persons who have these documents or information (Article 93.1 of the Tax Code of the Russian Federation). Such persons may be bodies of state power and local self-government (for example, bodies registering individuals at the place of residence, bar associations of constituent entities of the Russian Federation, bodies responsible for maintaining cadastral records), institutions, organizations and officials specified in Article 85 of the Tax Code of the Russian Federation .

The legislation on taxes and fees provides for four cases

, in which tax authorities have the right to request documents (information):

- when conducting a desk tax audit;

- during an on-site tax audit;

- as part of additional tax control measures provided for in paragraph 6 of Article 101 of the Tax Code of the Russian Federation (during the consideration of a case of a tax offense identified as a result of a tax audit);

- if necessary, outside the scope of tax audits.

Documentation

, which the tax authorities have the right to request, can be divided into two types (subclause 1, clause 1, article 31 of the Tax Code of the Russian Federation):

- documents serving as the basis for the calculation and payment (withholding and transfer) of taxes and fees. They must be compiled according to approved (unified) forms and (or) executed electronically in established formats;

- documents confirming the correctness of calculation and timely payment (withholding and transfer) of taxes and fees.

Please note: the law does not establish restrictions on requesting documents as part of field trips

tax audits.

At the same time, when requesting documents, in all cases there is a restriction on their repeated

request, enshrined in paragraph 5 of Article 93 of the Tax Code of the Russian Federation. This limitation is described in more detail below.

Features of requesting documents during desk tax audits

If a tax authority requests documents as part of a desk tax audit, it is obliged to take into account the restrictions provided for in Article 88 of the Tax Code of the Russian Federation. Thus, as part of a desk audit, the tax authority does not

have the right to request

additional information and documents from the taxpayer, with the exception of documents that:

- confirm the taxpayer’s right to use tax benefits (clause 6 of Article 88 of the Tax Code of the Russian Federation);

- must, in accordance with the provisions of the Tax Code, be attached to the tax return (calculation) provided that they were not submitted together with this declaration or calculation (clause 7 of Article 88 of the Tax Code of the Russian Federation);

- confirm the legality of applying VAT tax deductions, provided that the submitted VAT return declares the right to a tax refund (clause 8 of Article 88 of the Tax Code of the Russian Federation).

Let us recall that the Constitutional Court of the Russian Federation in its Determination No. 266-O dated July 12, 2006 indicated: the provisions of Article 88 and other norms of the Tax Code of the Russian Federation do not oblige the taxpayer, at the same time as filing a VAT return, to submit documents confirming the correct application of tax deductions for this tax. This obligation will arise for the taxpayer from the moment the tax authority receives a request to submit the specified documents.

Features of requesting documents on taxes related to the use of natural resources

When conducting desk tax audits on taxes related to the use of natural resources, tax authorities have the right to additionally request other documents

, which are the basis for the calculation and payment of such taxes (clause 9 of Article 88 of the Tax Code of the Russian Federation). What taxes are we talking about?

The Tax Code does not contain an answer to this question. Let us turn to Article 1 of the Federal Law of January 10, 2002 No. 7-FZ “On Environmental Protection”. It states that natural resources are components of the natural environment, natural objects and natural-anthropogenic objects that are used or can be used in economic and other activities as sources of energy, production products and consumer goods and have consumer value. Based on the above concept of natural resources, we can conclude that the use of natural resources is associated with water tax, mineral extraction tax, land tax, fee for the use of fauna, fee for the use of aquatic biological resources, Unified Agricultural Tax, UTII (in terms of certain types of entrepreneurial activity) and taxes paid upon implementation of an agreement providing for the conditions for the division of produced products in accordance with paragraph 1 of Article 8 of the Federal Law of December 30, 1995 No. 225-FZ “On Production Sharing Agreements”.

Changes in inspections this year

As for the changes that will take place this year, one thing is worth noting: inspections will become more thorough and dangerous for entrepreneurs.

This becomes possible thanks to the new software of tax inspectorates, which analyzes in detail the submitted declarations, reports, the ratio of benchmark indicators and thus generates a list of candidates for inspection. The analysis takes place practically without the participation of a tax inspector, and the results are presented in a short certificate.

So, for example, the introduction of the electronic ASK VAT system, currently in its 2nd version, has made it possible to reduce illegal VAT refunds from the budget by almost 8 times.

The mandatory use of online cash registers that transmit information to the tax office in real time also makes it possible to stop non-payment of VAT and minimize “gray” tax evasion schemes.

Another innovation is that a desk audit can be carried out by a different Federal Tax Service than the one to which you usually submit reports. This is done in order to exclude any personal contacts, as well as to increase the efficiency of the events.

Currently, according to statistics, the highest tax collection occurs as a result of desk audits, rather than on-site audits. This means that the likelihood that you will be required to provide explanations and make larger additional charges than before increases.

The most thorough and dangerous checks are those that the Federal Tax Service conducts together with law enforcement officers. The number of such checks has already exceeded 4.5 thousand.

Requirement to submit documents (information)

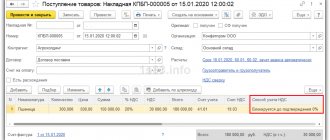

The form of the request for the submission of documents (information) was approved by order of the Federal Tax Service of Russia dated May 31, 2007 No. MM-3-06/ [email protected] It is used when requesting documents as part of a tax audit (desk or field) in relation to the taxpayer himself (payer of fees) , tax agent), and when requesting documents (information) about his counterparties in the manner prescribed by Article 93.1 of the Tax Code of the Russian Federation.

The request must include detailed information

, allowing you to identify the requested documents and determine their quantity. Such data, in particular, are:

- simultaneous indication of the name of the document and its details (date of preparation, number, name of the organization or surname, name, patronymic of the person on whose behalf the document was drawn up);

- simultaneous indication of the name of the document and its other individualizing features. If the law provides for maintaining (filling out) a specific document for a certain period of time (such as a purchase book or a sales book), as another individualizing feature of the document, the request may indicate the period to which the document relates.

If documents or information relating to relations with a counterparty are requested, the request must additionally indicate:

- name of the person (counterparty) about whom information is requested, his tax identification number and checkpoint;

- tax control event, during which there was a need to request documents (information);

- details of the order of the relevant tax authority (the tax authority conducting the inspection of the counterparty itself) to request documents (information). A copy of this order to request documents (information) must be attached to the request for the submission of documents (information) sent to the taxpayer (clause 4 of Article 93.1 of the Tax Code of the Russian Federation).

Methods of serving a request for documents (information)

The requirement to submit documents can be served on the head (legal or authorized representative) of an organization or an individual (his legal or authorized representative) in person against signature or transmitted electronically via telecommunication channels (clause 1 of Article 93 of the Tax Code of the Russian Federation).

The procedure for sending a request for the submission of documents (information) and the procedure for submitting documents (information) at the request of the tax authority in electronic form via telecommunication channels were approved by Order of the Federal Tax Service of Russia dated February 17, 2011 No. ММВ-7-2/ [email protected]

If the request for the submission of documents cannot be delivered to the taxpayer in person or transmitted electronically, it is sent to him by registered mail and is considered received after six days from the date of sending the registered letter (clause 1 of Article 93 of the Tax Code of the Russian Federation). Let us recall that until September 2, 2010, when requesting documents as part of a tax audit of the taxpayer (fee payer, tax agent), the only acceptable way to send this request was exclusively by delivering it. At the same time, when requesting documents from counterparties, it was necessary to send such a request, that is, hand it over in person or send it by mail.

Submission of requested documents

Documents that were requested during an on-site or desk tax audit (that is, in accordance with Article 93 of the Tax Code of the Russian Federation) must be submitted to the tax authority within 10 days

from the date of receipt of the corresponding request (clause 3 of article 93 of the Tax Code of the Russian Federation).

A person who has received a request to provide documents (information) about a counterparty is obliged to fulfill it within five days

from the date of receipt (clause 5 of article 93.1 of the Tax Code of the Russian Federation). If the specified person does not have the requested documents (information), he must inform the tax authority about this within five days from the date of receipt of the request.

How to obtain a deferment in the submission of requested documents

Often the volume of requested documents is so large that the taxpayer does not have time to submit them within the established 10-day or 5-day period. In such a situation, he has the right to apply for a deferment. To do this, during the day following the day of receipt of the request to submit documents (information), it is necessary to notify officials of the tax authority in writing about the impossibility of submitting documents within the established time frame. In addition, you should indicate the reasons why the requested documents cannot be submitted within the agreed time frame, and indicate the time frame when the taxpayer will be able to submit them (clause 3 of Article 93 and clause 5 of Article 93.1 of the Tax Code of the Russian Federation).

Within two days from the date of receipt of such notification, the head (deputy head) of the tax authority has the right to extend the deadline for submitting documents or refuse to extend the deadline. The decision made is documented in the appropriate document and brought to the attention of the taxpayer.

When considering the issue of extending the deadline for submitting documents, the head (deputy head) of the tax authority takes into account the following factors:

- the reasons indicated by the taxpayer for which he cannot submit the requested documents within the established time frame;

- volume (number) of requested documents (taking into account the practice of submitting documents by this taxpayer during previous tax audits);

- the deadlines proposed by the taxpayer within which he will be able to submit the specified documents;

- facts of improper fulfillment of duties by the taxpayer during this tax audit and previous audits.

Please note: even if the head (deputy head) of the tax authority decides to extend the deadline for submitting documents, he is not obliged to provide a deferment for exactly the period requested by the taxpayer.

If the on-site tax audit is suspended

The head (deputy head) of the tax authority has the right to suspend the conduct of an on-site visit

tax audit to obtain information from foreign government bodies, translate documents drawn up in foreign languages into Russian, request documents from counterparties of the inspected person, conduct examinations and other necessary activities.

During the period for which an on-site tax audit is suspended, the tax authority does not have the right to request any documents from the taxpayer being audited (clause 9 of Article 89 of the Tax Code of the Russian Federation). Moreover, the tax authority is obliged to return to this taxpayer all original documents requested during the audit (with the exception of documents received during the seizure) and to suspend all its actions on the territory and premises of the taxpayer related to the tax audit.

Thus, during the period of suspension of the on-site tax audit, the deadline for fulfilling the requirement to submit documents (information), which had not expired at the beginning of the suspension, is also suspended until a decision is made to resume the on-site tax audit.

If the deadline for a tax audit has expired

Let’s say that the taxpayer under audit (fee payer, tax agent) received a request to submit documents (information) shortly before the end of the office or field visit.

tax audit. If by the time the tax audit is completed, the deadline for submitting documents specified in the request has not yet expired, after completion of the audit such requirement is not subject to execution.

Similarly, a taxpayer (fee payer, tax agent) in respect of whom a tax audit is being conducted has the right not to comply with the requirement to submit documents (information) in the following cases:

- if the tax authority requests documents to conduct a desk tax audit, but the deadline for conducting this audit has already expired;

- if the deadline for conducting an on-site tax audit established in paragraph 6 of Article 89 of the Tax Code of the Russian Federation has expired. An on-site tax audit cannot last more than two months. This period may be extended to four months, and in exceptional cases - to six months.

In what form and how to submit documents

The requested documents can be submitted to the tax authority in person or through a representative, sent by registered mail or transmitted electronically via telecommunication channels (TCS). This is stated in paragraph 2 of Article 93 of the Tax Code of the Russian Federation. In any of the listed ways, documents (information) are also provided by those persons from whom information about their counterparties is requested (paragraph 3, paragraph 5, article 93.1 of the Tax Code of the Russian Federation).

Submission of documents on paper.

In response to a request for the submission of documents (information), the taxpayer (payer of fees, tax agent) transfers to the tax authority not the originals, but

certified copies of

the requested documents. Copies of documents are certified by the person being verified (the person from whom information about the relationship with the counterparty is requested). If necessary, the tax authority has the right to familiarize itself with the original documents (paragraph 5, paragraph 2, article 93 of the Tax Code of the Russian Federation).

Let us note that before September 2, 2010, directly in paragraph 2 of Article 93 of the Tax Code of the Russian Federation it was indicated how organizations

copies of documents submitted to the tax authority should have been certified. Copies of documents were certified by the signature of the head (deputy head) or other authorized person and the seal of the organization. Despite the exclusion of this norm from the Tax Code of the Russian Federation, nothing has changed in the procedure for certifying copies of documents submitted at the request of the tax authority. Moreover, a similar rule on how organizations can certify copies of documents has been preserved in the form of a requirement to submit documents (information).

As before, tax authorities cannot require that copies of submitted documents be certified by a notary if such certification is not provided for by the legislation of the Russian Federation (paragraph 2, paragraph 2, article 93 of the Tax Code of the Russian Federation).

Submission of documents in electronic form.

If the documents requested from the taxpayer (payer of fees, tax agent) are compiled in electronic form in established formats, he can send them to the tax authority in electronic form using the TKS (paragraph 3, paragraph 2, article 93 of the Tax Code of the Russian Federation). This opportunity became available on September 2, 2010. At the same time, established formats should be understood as formats of documents in electronic form, which are approved by the federal executive body authorized for control and supervision in the field of taxes and fees, that is, the Federal Tax Service of Russia.

As soon as the Procedure for sending a request for the submission of documents (information) and the Procedure for submitting documents (information) at the request of the tax authority in electronic form via telecommunication channels, approved by order of the Federal Tax Service of Russia dated February 17, 2011 No. ММВ-7-2/ [email protected] , will come into force and formats of documents in electronic form will be established, taxpayers will be able to choose the method of submitting the requested documents - on paper (in the form of certified copies) or in electronic form. Moreover, it is the taxpayer (fee payer, tax agent) who will have the choice. Tax authorities do not have the right to require a taxpayer (fee payer, tax agent) to submit documents exclusively in electronic form.

note

How to certify a copy of a multi-page document?

The Tax Code does not provide a direct answer to this question. Based on the practice of tax authorities, there are two acceptable options for certifying copies of multi-page documents:

- certify each page of a copy of such document;

- stitch the entire document, number all its sheets sequentially and certify the document as a whole (indicating the total number of sheets in the stitched bundle).

However, when choosing the second option, you should take into account the thickness of the pack, the quality of the paper and the strength of the material used for stitching (twine, twine, etc.). After all, tax officials will work with a copy of such a document, including familiarizing themselves with its contents, copying or scanning it. Thus, when flashing a copy of a multi-page document, you must:

- ensure the ability to freely read all the details of the document (including resolutions, visas and other notes in the margins);

- exclude the possibility of mechanical destruction (unstitching) of the stitched pack when working with it;

- provide the ability to freely copy (scan) each sheet of a document in a stitched bundle

However, taxpayers will be able to submit the required documents in electronic form (for example, invoices) only after the procedure for issuing and receiving invoices electronically via TKS using an electronic digital signature (EDS) has been approved and comes into effect. This procedure should be established by the Ministry of Finance of Russia (clause 9 of Article 169 of the Tax Code of the Russian Federation).

What should a taxpayer do?

Your actions should be as follows:

- Ask the inspector to show you his official ID and the decision to carry out inspection activities;

- Provide the inspector with the necessary documentation, if necessary, make photocopies;

- Do not interfere with the audit of reporting;

- If you cannot provide documentation, notify the inspector in advance, explaining the reasons.

Next, we will consider which actions of tax officials are legal.

Responsibility for failure to provide requested documents

Responsibility of the person being inspected.

Refusal of the audited person (taxpayer, payer of fees, tax agent) to submit

documents

requested during a tax audit, or failure to submit these documents within the established time frame is recognized as a tax offense (clause 4 of Article 93 of the Tax Code of the Russian Federation). For committing such an offense, liability is provided in the form of a fine in the amount of 200 rubles. for each document not submitted (clause 1 of Article 126 of the Tax Code of the Russian Federation).

Since a fine is levied for each document not submitted, the taxpayer (fee payer, tax agent) is held accountable only if the exact number of documents requested can be clearly established from the requirement to submit documents (information). Otherwise (for example, if the wording in the request does not allow one to accurately determine which documents are being requested), the taxpayer cannot be held liable under paragraph 1 of Article 126 of the Tax Code of the Russian Federation.

Refusal of the audited taxpayer (fee payer, tax agent) to provide additional information and explanations

, drawn up in any form in the form of various calculations, lists, lists, summary tables, etc., as well as their untimely submission cannot be the basis for bringing the taxpayer to tax liability on the basis of paragraph 1 of Article 126 of the Tax Code of the Russian Federation.

Responsibility of the counterparty.

Failure to provide the tax authority with information about the taxpayer, expressed in the refusal

of the organization

documents

in its possession containing information about another taxpayer, entails a fine of 10,000 rubles. (clause 2 of article 126 of the Tax Code of the Russian Federation). A fine of 10,000 rubles. Penalties are also imposed for evading the submission of specified documents or submission of documents with knowingly false information. These liability measures apply to counterparties - legal entities from whom the tax authority requests documents on the activities of another audited taxpayer (payer of fees, tax agent) in accordance with Article 93.1 of the Tax Code of the Russian Federation.

of information by a counterparty or other person

about the activities of the inspected taxpayer (payer of fees, tax agent), which in accordance with the Tax Code of the Russian Federation he must report to the tax authority, entails liability in the form of a fine in the amount of 5,000 rubles. (clause 1 of article 129.1 of the Tax Code of the Russian Federation). For repeated commission of the same offense within a calendar year, an increased fine is provided - 20,000 rubles. (clause 2 of article 129.1 of the Tax Code of the Russian Federation).

Administrative responsibility.

In addition to the liability provided for in the Tax Code of the Russian Federation, officials (usually the head) of the offending organization are also subject to administrative liability.

They can be fined from 300 to 500 rubles. (Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation). The specified fine is collected for failure to submit to the tax authorities within the prescribed period (refusal to provide, provision in incomplete or distorted form) documents and (or) other information

necessary for tax control. Consequently, this measure of administrative liability is applied both in a situation where the requested documents were not provided by the taxpayer being inspected (fee payer, tax agent), and in a situation where the requested documents or information were not provided by the counterparty or other person in possession of such documents (information).

Restrictions on re-requesting documents

Starting from 2010, during a tax audit and other tax control activities, tax authorities do not have the right to re-request from the person being inspected documents that he has already submitted to the tax authorities during the investigation against him.

desk or field tax audits (clause 5 of article 93 of the Tax Code of the Russian Federation). The restriction does not apply to two situations:

- if the inspected person submitted original documents to the tax authority, which the tax authority subsequently returned to the inspected person;

- if the documents submitted to the tax authority were lost due to force majeure circumstances.

From January 1, 2011, the restriction on re-requesting documents also applies to documents that, at the request of the tax authority, are submitted by counterparties and other persons who have documents about the taxpayer being inspected (paragraph 3, clause 5, article 93.1 of the Tax Code of the Russian Federation). This restriction applies to documents submitted to the tax authorities after January 1, 2011.

Consequently, in 2011, a counterparty or other person who has documents on the activities of the taxpayer being inspected has the right not to submit documents at the request of the tax authority, if the counterparty has already submitted these documents as part of a desk or field tax audit conducted in relation to the counterparty itself as a taxpayer

(payer of fees, tax agent). It turns out that the restriction on re-requesting documents does not apply to cases where documents were previously submitted to the tax authority upon a request issued in accordance with Article 93.1 of the Tax Code of the Russian Federation.

At the same time, the category of counterparties and other persons who have documents (information) about the activities of the taxpayer being audited (payer of fees, tax agent) is quite artificial. Apart from Article 93.1 of the Tax Code of the Russian Federation, it is not mentioned in other articles of the Tax Code, that is, it is rather of a technical nature and was used for the convenience of presenting this norm. Therefore, this category can be reduced to the following groups of persons:

- taxpayers (payers of fees, tax agents);

- bodies of state power and local self-government (for example, bodies that register individuals at the place of residence, bar associations of constituent entities of the Russian Federation, bodies responsible for maintaining cadastral records), institutions, organizations and officials specified in Article 85 of the Tax Code of the Russian Federation.

Thus, in the author’s opinion, in order to apply the restriction on re-requesting documents, the quality in which the person who has already submitted the requested document was not important - whether he presented the documents as an inspected person or as a counterparty about another inspected taxpayer.

What actions of inspectors violate the law?

Inspectors do not have the right:

- Require you to provide photocopies of documentation certified by a notary;

- Inspect the territory or warehouses alone;

- Seize documentation at night or on weekends;

- Conduct more than 2 inspections of your company in 12 months;

- Involve experts and witnesses from among tax officials.

In the next part of our article, we will look at how the procedure for desk and on-site inspections of individual entrepreneurs and LLCs takes place.