In order to pay contributions, taxes, fees, all commercial and government entities need to fill out a payment order. It doesn’t matter why the company transfers sums of money, for goods sold (VAT), income tax for employees, mandatory insurance contributions, in any case a payment document is filled out. There, in a specially designated field, the BCC is indicated.

This is the appropriate classification code for the redirection of funds. Thanks to these codes, treasury employees can send money to the recipient without problems or delays. It is on the basis of the specified BCC that you can track the movements of a specific amount.

For example, if your company filled out a payment invoice indicating KBK 18210301000011000110, then upon closer examination you can see that this amount is paid under value added tax.

Budget Classification Codes (BCC)

KBK is an abbreviation for “budget classification code.”

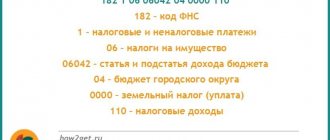

Budget classification codes are approved by the Russian Ministry of Finance. This is a long chain of numbers, representing a special code of 20 digits, which are combined into 7 groups. Each number in this sequence of numbers encodes a specific target group of budget revenues into the financial system of the Russian Federation. Decoding of groups of numbers in KBK 2018-2019

- 1-3 Code indicating the addressee for whom the cash receipts are intended

- 4 Show a group of cash receipts

- 5-6 Reflects tax code

- 7-11 Elements revealing the item and subitem of income

- 12-13 Reflect the level of the budget into which funds are planned to be received

- 14-17 Indicate the reason for the financial transaction

- 18-20 Reflects the category of income received by a government department

KBK is most often used by accountants and bank employees when filling out field 104 in payment orders. By comparing the order of numbers in the KBK groups, you can determine where the payment came from, what its purpose is, who exactly is the addressee and for what purposes the funds are being transferred, so redirecting them further will not be difficult.

The KBK code is a 20-digit digital encoding of budget expenses and revenues, including tax payments, which are considered budget revenues. KBK is entered in field 104 of the payment slip and is a mandatory detail of the payment document.

Banks control that this field is not left blank, since they need to know to which budget the payment of the company or entrepreneur should be directed. However, banks do not check the correctness of the encoding.

Why do you need to pay VAT?

Each state has certain laws that are designed to replenish the state budget. Tax on goods, services and works is applied throughout the world. This is a legal requirement. When we buy a product, we pay a tax for it, which is already included in the price of the product. If we sell, we also have to pay VAT to the state.

The only thing that may differ in this case is the tax rate. It can be as low as zero percent for special goods (space, oil, gas), ten percent for socially significant goods, and a standard rate of eighteen percent for all other goods.

Once there is a product or some service is provided to the population, the merchant must pay VAT. When filling out a payment order in the field to indicate the classification code, it is important to enter the correct data. Errors in the numbers are fraught with consequences for the payer; the money will simply go to the wrong place, and in addition to all this, a fine and penalties will be imposed.

To figure out what tax is in 2021 for KBK 18210301000011000110, you need to consider in detail what this set of numbers may mean.

Fixed payments for individual entrepreneurs “for themselves”

BCC for VAT depends on the type of transaction. Separate codes are provided for paying taxes, penalties and fines for:

- sales of goods in Russia (see previous section);

- import of property from EAEU member countries (administrator is the tax service);

- imports from other countries (the administrator is the customs service).

| Operation | KBK for tax | KBK on penalties | KBC on fines |

| Sales in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Import from EAEU member countries through the Federal Tax Service | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Import through FCS | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

The error can be easily corrected by clarifying the payment. But this should be done as quickly as possible to avoid penalties and fines for late payment of VAT.

Submit an application to change the BCC to your territorial tax office.

Fill out the payment form

Who pays and when

According to Art. 143 of the Tax Code of the Russian Federation, taxpayers for this type of fee are legal entities and individual entrepreneurs, but it is believed that ultimately it is paid by the buyer. The fact is that value added tax is indirect. With its help, the state seeks to receive part of the premium that the manufacturer or seller sets on the price of the product at each stage of production or sales. The tax is calculated by the manufacturer and the seller, but it is included in the cost of the product; in addition, the entrepreneur deducts the input VAT already paid when purchasing goods for production. Thus, the buyer is the source of the collection, but in the legislative act - in the Tax Code - individuals are not mentioned as VAT payers; they do not calculate or transfer it.

This financial commitment is of great importance for the budget and not only in terms of revenue. The state, by introducing a value added tax, ensures the contribution of funds to the budget earlier than the final sale of products, which increases the efficiency of the obligation and its collection.

IMPORTANT!

From 01/01/2019, VAT has been increased from 18% to 20%.

KBK 18210301000010000110 and other VAT codes

The encodings in VAT payments vary depending on the transaction for which the tax is transferred. All BCCs for tax are shown in Table 2.

Table 2. KBK 18210301000010000110 and other VAT codes

| Operation | Payment administrator | KBK for VAT | ||

| Tax | Penalty | Fines | ||

Sales in Russia:

| Federal Tax Service | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Import of property to Russia from the territory of the EAEU | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 | |

| Importing property into Russia from outside the EAEU | FCS | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

Features and nuances of BCC for VAT payment

This tax is the main “filler” of the Russian treasury, so entrepreneurs should be especially careful when paying it. It is paid from the sale of goods and/or services, as well as from imported goods sold in Russia. It must also be paid when transferring goods for one’s own needs, if this is not reflected in the tax return. It is also relevant when importing goods.

There were very serious changes to the payment of value added tax a couple of years ago, so for 2021, legislators touched on this tax only in passing to give entrepreneurs the opportunity to adapt.

Calculation and payment procedure

VAT is a tax that requires quarterly declaration and payment. It is calculated based on the results of each quarter: the difference in the tax base and deductions is multiplied by the tax rate. Thus, the budget receives these tax payments four times a year.

IMPORTANT INFORMATION! If legal deductions exceed the revenue portion of the VAT, then the budget will compensate for the missing share: the amount will be counted toward future payments or to pay off any arrears. In the absence of arrears, the law allows the amount of compensation to be transferred to the bank account of the entrepreneur.

The tax base is considered to be the main characteristic of the goods or services being sold - their value on the day of shipment of the goods or transfer of the service or the day of their payment (the date of the event that occurred earlier).

There are some nuances regarding VAT tax rates:

- same rate – same base;

- if transactions are subject to VAT at different rates, then their base is also calculated separately;

- the cost is always calculated in national currency, revenue from imports is converted into rubles at the current exchange rate.

Main changes in VAT payment for 2021

- From January 1, preferential rates for the sale of goods and services provided for by the Tax Code come into effect. For some products it is recognized as zero.

- The conditions for confirming the right to a preferential VAT tariff have been simplified.

- Double taxation exceptions for those using the simplified taxation system and unified agricultural tax when issuing invoices.

- Elimination of paper media: starting from this year, VAT returns can only be submitted electronically.

- New budget classification codes for VAT transactions.

NOTE! Tax rates and the method of calculating VAT have not changed.

KBK for simplified tax system in 2021

In simplified terms, BCCs depend on the applied object of taxation. Simplified people with a “income-expenditure” object should carefully consider the choice of KBK when paying the minimum tax: from 2021, a single code is used for both paying the single tax and the minimum one. If the minimum tax is paid for periods earlier than 2021, a separate BCC is used for it.

| KBK | Decoding |

| KBK simplified tax system 6% 2021 (“income”) | |

| 182 1 0500 110 | Single tax under the simplified tax system “income” |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| KBK simplified tax system “income minus expenses” 2021 | |

| 182 1 0500 110 | Single tax under the simplified tax system “income minus expenses” (incl., simplifiers transfer the minimum tax to this KBK simplified tax system in 2019) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Minimum tax under the simplified tax system (only for tax periods expired before January 1, 2021) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

How to fill out a payment form

Budget classification codes are indicated in field 104; they are the same for the entire country. When filling out the payment form, it is necessary to take into account that the details are indicated by the tax office to which the payer is assigned in accordance with his location. The registration rules are specified in the Regulation of the Central Bank of the Russian Federation No. 383-P dated June 19, 2012 and Order of the Ministry of Finance of the Russian Federation No. 107n dated November 12, 2013, as amended.

When filling out, you must also correctly indicate:

- payer status (check in the article “What is the payer status in a payment order and how to fill it out”);

- payment amount (integer);

- quarter for which payment is made (in the form “KV.01.2019”).

KBK: patent tax system 2021

The patent is paid by entrepreneurs, choosing the BCC that corresponds to the type of budget.

| KBK | Decoding |

| 182 1 0500 110 | Patent tax credited to the budgets of city districts |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Patent tax credited to the budgets of municipal districts |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Patent tax credited to the budgets of federal cities of Moscow and St. Petersburg |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

How can you find out the amount of accrued penalties?

Situations are different, sometimes the taxpayer does not know that the tax was transferred to the budget at the wrong time and a penalty must be paid. In this case, the method of independently calculating penalties certainly cannot be used.

According to an unwritten rule, all accountants who take their responsibilities seriously, at the end of each quarter (and sometimes more often) request a certificate from the tax office about the status of payments for taxes, contributions, penalties and fines. Such a certificate clearly indicates all amounts of debt and overpayments to the company. All that remains is to check them and, if necessary, pay off the debt to the budget.

The most reliable way to find out about the debt is, of course, to receive a demand from the tax office. If there is no error and the debt really exists, we will pay off the debt without delay. By the way, such a request will also indicate the current BCC, to which the amount of debt must be transferred.

KBK: land tax 2021 for legal entities

When paying land tax, companies choose BCC in accordance with the territorial location of the site. The choice of land tax penalties by the KBK, as well as “penalty” codes, also depends on the location of the site.

| KBK | Decoding |

| 182 1 0600 110 | Land tax from organizations if the site is located within the boundaries of intra-city municipalities of federal cities |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax for organizations if the site is located within the boundaries of urban districts |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax for organizations if the site is located within the boundaries of urban districts with intra-city division |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax for organizations whose land plots are located within the boundaries of intracity districts |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax for organizations whose land plots are located within the boundaries of inter-settlement territories |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax for organizations whose land plots are located within the boundaries of rural settlements |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax for organizations whose land plots are located within the boundaries of urban settlements |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

Results

Correct use of KBK is important when working with tax payments. You can always clarify any required code in the current regulatory document. Before you issue a payment order for the transfer of penalties, check the corresponding KBK code (there are 3 types), and also check that the amount of penalties is calculated correctly - they are now calculated using a special algorithm.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated November 29, 2019 No. 207n

- Order of the Ministry of Finance of Russia dated 06/08/2018 No. 132n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

KBK: State duties 2021

| KBK | Decoding |

| 153 1 0800 110 | State duty for the issuance of excise stamps with a two-dimensional bar code containing the identifier of the unified state automated information system for recording the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products (USAIS) for labeling alcoholic products |

| 160 1 0800 110 | State duty for the issuance of federal special stamps with a two-dimensional bar code containing the identifier of the unified state automated information system for recording the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products (USAIS) for labeling alcoholic products |

| 182 1 0800 110 | State duty for re-issuing a certificate of registration with the tax authority (when applying through multifunctional centers - MFC) |