Payment

In accounting and tax accounting of an enterprise, it is customary to amortize intangible assets (intangible assets) that have a specific period

Home / Bankruptcy / Bankruptcy of legal entities Back Published: 09/02/2019 Reading time: 4

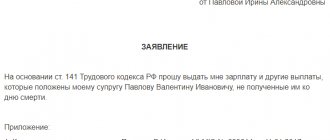

Financial assistance to the relatives of a deceased employee is paid by employers on a voluntary basis. This is the request of family members

In what cases is account 67 applied? The account “Settlements for long-term loans and borrowings” is maintained

The invoice for the internal movement of fixed assets, form OS-2, is intended to document the actual

Account 99 Profit and loss Net profit (net loss) consists of the following components: Profit

A simplified taxation system is a great opportunity to reduce the tax burden for small businesses. And low

What has changed according to UTII in 2020? There are two main changes from 2021: On

Sale of goods Sales of goods are reflected in debit 90 of account subaccount “Cost” (90.02.1) and Credit

Increases in excise taxes on fuel occur almost every year. This is a natural process that allows you to increase