All articles

67544

2020-03-12

One of the mandatory fees for Russian citizens is the tax when purchasing real estate, the amount of which is calculated based on the algorithms specified in the current legislative documents. We will tell you in more detail about how to calculate property taxes in 2021 in this article.

Owners of apartments, dachas, private houses, apartments, parking lots, garages, industrial and commercial premises, unfinished buildings and other construction projects, data on which are entered into the unified database of the Federal Tax Service of the Russian Federation, are required to pay such a fee.

The legislative framework

Real estate taxation is a mandatory fee established by government law. It obliges individuals and legal entities who have Russian citizenship and have reached the age of eighteen to pay taxes on property assets.

According to Federal Law No. 2003-1, which was in force until January 1, 2015, in order to calculate real estate tax, it was necessary to conduct an inventory assessment. Based on the value received, the tax rate was calculated.

Since 2015, new amendments have been added to the Tax Code of the Russian Federation, based on which the procedures for calculating the tax have radically changed, which has significantly increased the burden on citizens. Now the tax on the purchase of real estate should be determined based on the price indicated in the extract from the Unified State Register or a certificate of cadastral value.

Important!

You can find out the cadastral value (inventory valuation) by ordering an extract from the Unified State Register on our website.

According to statistical data, the price of an object according to such an extract is approximately equal to its price on the real estate market. However, if the owner does not agree with the price assigned by the cadastre, then he has every right to challenge the valuation of the property in court.

How to determine the tax base

From January 1, 2020, the tax base is the cadastral value of the property. It is calculated in all regions of the Russian Federation.

Let's look at ways to find out the cadastral value of your property.

- Rosreestr website

Simply fill out the online application and receive all the necessary information.

- Taxpayer’s personal account on the Federal Tax Service website

The “My Property” section contains all the objects that you own. You can immediately see the cadastral number on the card. For example, if you want to make a request on the Rosreestr website, you will need it. And if you click on the property with the mouse, you will be taken to the description, where the cadastral value is located.

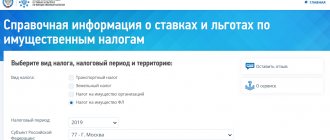

- Calculator on the Federal Tax Service website

The information is filled in sequentially. After entering the cadastral number, the value of the object is displayed. In my case, it’s still the same 1,816,986.38 rubles.

- Public cadastral map

There are no apartments on the map, only land plots and residential buildings.

- Tax receipt

If you do not have a personal account on the Federal Tax Service website or you have written a statement about your desire to receive notifications in paper form by mail, then the receipt sent in previous years contains the cadastral value.

The final value of the tax base is influenced by benefits: federal and local. There will be a separate section about them in the article.

What formula is used?

Algorithms for calculating tax collection are established by federal legislative documents. You can calculate the amount of property tax using the following formula:

Tax fee = (Cost according to extract from the Unified State Register - Tax deduction) x Share size x Tax rate

In order to fully use the calculation formula, you need to find out in advance the price according to the cadastre, which is indicated in a special extract from the Unified State Register of Real Estate. In addition to this information, the extract contains information about the owner of the object, drawings and diagrams of the object, as well as other important information about the property.

Below we will consider the remaining components of the form that will be required to carry out the calculations.

Tax deduction

This indicator is represented by the amount deducted by the owner from the total tax amount. Within the Russian Federation, this is profit subject to a tax rate of 13%.

The amount of compensation is determined based on the type of object subject to tax:

- for private houses - the cost is compensated 50;

- for apartments – 20;

- for rooms – 10.

It is important to take into account that the regional government can set the amounts of deductions that differ from the state ones. Before applying for compensation, it is recommended to study the legislation of the region in which you are located.

About tax notices for payment

The tax amount is determined independently by Federal Tax Service inspectors. Notifications are then sent to taxpayers. One month before tax payment is the deadline by which the document must be received.

Payment orders are transmitted in several ways:

- In the Personal Account of Taxpayers.

- Via email.

- By registered mail, by regular postage.

- Personally into the hands of the citizen, the legal representative of his interests.

Sometimes it happens that a citizen owns property, but notification is not received within the specified period. There are several reasons for this:

- Lack of information in the database due to the fact that the property was purchased recently.

- The document was lost.

- The total amount submitted for payment is less than one hundred rubles.

The last option is the least possible. In the other two cases, it is recommended to take the initiative and contact the control service yourself. Especially when other real estate properties, one or more, appeared in the reporting year.

Tax rate

This indicator is one of the most significant components of the formula. Municipal authorities of each region set their own rates. You can find out its size by contacting the local branch of the Federal Tax Service or by visiting the official website of the Federal Tax Service, selecting the region in which you are located.

It is important to consider that the calculated rate cannot be more than:

- 0.1% – for parking spaces, garages, unfinished buildings and residential buildings;

- 0.1-0.3% – real estate priced from 300 to 500 million rubles;

- 0.3-2.0% – for property exceeding the price of 500 million rubles.

Determination of value from the cadastre

It is acceptable to use Internet technologies to obtain detailed reports from cadastral registers. It is important to have on hand the address of the location of the object, or the number according to the current list. In the case of a number, it is enough to go through several stages:

- Go to the Federal Tax Service website.

- Selecting a property tax option.

- Definition of region.

- Entering a number.

- Obtaining information regarding prices.

It is permissible to clarify the amount accumulated for the current period. You can find out which method is used in the calculations. If you have a cadastral number, the information is easily provided by the official Rosreestr page. Just enter the address where you registered.

Who should pay property tax?

The obligation to pay the tax fee annually is assigned to individuals in whose name the following objects are registered:

- private houses;

- parking spaces or garages;

- rooms;

- apartments;

- real estate complexes;

- unfinished;

- other types of real estate.

Note! Public facilities (elevators, basements and attics, roofs and staircases) are not subject to fees, since they are not assigned to any specific owner, but are public property. The right to use these facilities is granted to all residents.

Taxation applies to buildings erected on land plots allocated for gardens and vegetable gardens, as well as non-commercial subsidiary farming and individual housing construction. This means that such owners are obliged to pay a fee, the amount of which is equal to the standard taxation of residential properties.

Objects of taxation

An exhaustive list of real estate objects on which the owner must pay property tax is given in Article 401 of the Tax Code of the Russian Federation:

- residential building, including buildings that are located on the land of personal subsidiary plots, individual housing construction, vegetable gardening and horticulture (dachas, garden houses);

- apartment, room;

- garage, parking place;

- single real estate complex;

- unfinished construction project;

- other objects.

There is no need to pay anything for objects that are not subject to state registration, as well as for the property of an apartment building that is classified as a common building (elevators, staircases, etc.).

After reading, you will understand how to stop working for pennies at a job you don’t like and start LIVING truly freely and with pleasure!

If the object belongs to several owners, then each pays in proportion to their share. And parents, guardians and other legal representatives pay for children, property owners.

Calculation of property tax based on cadastral value

The obligation to calculate property taxes for individuals and convey information to taxpayers is the direct responsibility of the Federal Tax Service. Notifications are sent to the addresses of property owners.

According to the latest amendments to the current legislation, the fee is calculated based on the cadastral value determined by the regional authorities. The final transition to the updated tax system is planned from 01/01/2021. This period is set aside for a comfortable transition to a new property valuation technology for all property owners.

Examples of calculations

When calculating the amount of the mandatory payment, it is necessary to take into account all the nuances provided for by the legislation of the Russian Federation.

Action of the reduction factor

As a result of the principle of the reduction coefficient, the tax burden for citizens increases every year by 20%, and ultimately at the end of the period it will be 100%.

How will the situation change if, for example, the transition began in the region in 2021:

| Year | Calculation | Amount (RUB) |

| 2016 | H = (2000 – 800) × 0.2 + 800 | 1040 |

| 2017 | H = (2000 – 800) × 0.4 + 800 | 1280 |

| 2018 | H = (2000 – 800) × 0.6 + 800 | 1520 |

In the fourth tax period, property owners will have to pay a contribution without taking into account Kd.

Calculation for a region where less than 3 years have passed since the transition to the cadastral valuation method

Initial data:

- living space - apartment with an area of 64 m²;

- KS – RUB 2,800,000;

- IS – 250,000 rubles;

- tax is calculated for 2021;

- calculation based on cadastral value - from 2021;

- tax benefits are not provided;

- Territory of residence - Orenburg.

In accordance with the decision of the City Council of Deputies, the tax rate is equal to 0.1%, in accordance with the Tax Code of the Russian Federation, for residential premises.

Since the value of the property is below 500 thousand rubles, a rate of 0.1% is used for IP, in accordance with the Tax Code of the Russian Federation. Art. 406.

For 2015, Kd = 1.147 (Reg. No. 685 of October 29, 2014) - in accordance with the law, the calculation applies the Kd of the last year of application of the IP. That is, when calculating property tax in 2021, the calculation of the inventory value for 2015 is used.

We consider the tax-free area for apartments to be 20 m², in accordance with the Tax Code of the Russian Federation, Art. 403, since regional authorities do not provide for another parameter.

The value of the reduction factor K = 0.6, since 2021 is the third reporting period.

We apply the formula: H = (H1 – H2) × K + H2

- We find H1 (we calculate the taxable base taking into account the required deduction):

- we determine the cost of 1 m²: 2800000/64=43750 rubles;

- we find the price of 20 m², non-taxable: 43,750 × 20 = 875,000 rubles;

- we determine the tax base: 2800000 – 875000 = 1925000 rubles;

- We calculate H1, taking into account the interest rate:

1925000 × 0.1% = 1925 rub.

- Find the value of H2 (H2 = IS × %rate × Kd):

250,000 × 0.1% × 1.147 = 286.75 rubles.

- We calculate the amount of tax H (using the formula: H = (H1 – H2) × K + H2):

(1925 – 286.75) × 0.6 + 286.75 = 1269.70 rub.

Answer:

RUB 1,269.70 must be paid to the Federal Tax Service for an apartment with an area of 64 m² owned.

An example of calculating tax based on cadastral value

To understand how to correctly calculate property taxes for 2020, let’s look at the taxation procedure using a specific example.

For example, citizen N. is a shared owner in an apartment. His share is 50%. Real estate with an area of 100 is valued according to the cadastral passport at 6,000,000 rubles. According to current federal laws, the tax deduction for such housing will be 2,400,000. The municipal authorities have set a rate of 0.1%.

You can determine the amount of the tax fee by substituting the available data into the formula:

Tax = (6,000,000 - 2,400,000) x 0.001x 0.5

After doing the calculations, you can determine that the amount of the fee to the Federal Tax Service will be 1,800 rubles.

To carry out calculations with maximum accuracy, perform the calculation several times. When working with a formula, it is important to use only the data that is relevant today.

Note! The estimated cadastral value must be taken into account before calculating the tax on the sale of real estate.

Tax payment table for the 2nd quarter of 2021

| date | Tax | Payment | BASIC | simplified tax system |

| 14.04.2021 | Ecological fee | Environmental fee | + | + |

| 15.04.2021 | Insurance premiums | Payments for March 2021 | + | + |

| Excise taxes | Advance for April 2021 | + | + | |

| 20.04.2021 | Indirect taxes | VAT and excise taxes (excise taxes on labeled excisable goods) for imports from EAEU countries for March 2021 | + | + |

| Water | Tax for the 1st quarter of 2021 | + | + | |

| Negative Impact | Payment for the 1st quarter of 2021 | + | + | |

| 26.04.2021 | VAT | Tax (1/3) for the 1st quarter of 2021 | + | — |

| simplified tax system | Advance for the 1st quarter of 2021 | — | + | |

| Excise taxes | Tax for March 2021 | + | + | |

| Tax (alcohol) for January 2021 | + | + | ||

| Tax (gasoline) for October 2021 | + | + | ||

| MET | Tax for March 2021 | + | + | |

| Trade fee | Payment for the 1st quarter of 2021 | + | + | |

| 28.04.2021 | Profit | Tax for the 1st quarter of 2021 | + | — |

| Advance (1/3) for the 2nd quarter of 2021 | + | — | ||

| Advance (actual) for March 2021 | + | — | ||

| Subsoil use | Payment for the 1st quarter of 2021 | + | + | |

| 30.04.2021 | Personal income tax | Tax on vacation and sick pay for April 2021 | + | + |

| 17.05.2021 | Insurance premiums | Payments for April 2021 | + | + |

| Excise taxes | Advance for May 2021 | + | + | |

| 20.05.2021 | Indirect taxes | VAT and excise taxes (excise taxes on labeled excisable goods) when importing from the EAEU countries for April 2021 | + | + |

| 25.05.2021 | VAT | Tax (1/3) for the 1st quarter of 2021 | + | — |

| Excise taxes | Tax for April 2021 | + | + | |

| Tax (alcohol) for February 2021 | + | + | ||

| Tax (petrol) for November 2021 | + | + | ||

| MET | Tax for April 2021 | + | + | |

| 28.05.2021 | Profit | Advance (1/3) for the 2nd quarter of 2021 | + | — |

| Advance (actual) for April 2021 | + | — | ||

| 31.05.2021 | Personal income tax | Vacation and sick leave tax for May 2021 | + | + |

| 15.06.2021 | Insurance premiums | Payments for May 2021 | + | + |

| Excise taxes | Advance for June 2021 | + | + | |

| 21.06.2021 | Indirect taxes | VAT and excise taxes (excise taxes on labeled excisable goods) when importing from the EAEU countries for May 2021 | + | + |

| 25.06.2021 | VAT | Tax (1/3) for the 1st quarter of 2021 | + | — |

| Excise taxes | Tax for May 2021 | + | + | |

| Tax (alcohol) for March 2021 | + | + | ||

| Tax (gasoline) for December 2021 | + | + | ||

| MET | Tax for May 2021 | + | + | |

| 28.06.2021 | Profit | Advance (1/3) for the 2nd quarter of 2021 | + | — |

| Advance (actual) for May 2021 | + | — | ||

| 30.06.2021 | Personal income tax | Vacation and sick leave tax for June 2021 | + | + |

Features of calculating property tax during the transition period

Not all regions of the Russian Federation have yet switched to this form of tax collection calculation. According to the Federal Tax Service's plans to calculate property taxes in 2020

under the new system there will be 7 more new regions.

Since the state system is currently undergoing a transition process, the law officially allows the use of a deterrent coefficient. For the current year, the size of the mentioned coefficient is 0.8, which is equal to last year’s figure. Such rules apply exclusively for this year and cannot be applied to calculate real estate tax based on cadastral value in 2021 and subsequent years. From the beginning of 2021, owners will be required to pay the full rate.

Information about the property and its owner

Every year, before February 15, the tax office at the location of the property receives the following information:

- about the taxable object and its owner as of January 1. The data is transmitted by the territorial branch of Rosreestr in the municipality (for example, city, district, region) where the property is located;

- on the cadastral value of the taxable object.

This data is transmitted by the territorial branch of Rosreestr in the municipality (for example, city, district, region) where the property is located as of January 1 of the current year.

If during the year there is a change of owner or the ownership of a newly built object is registered, the territorial branch of Rosreestr (which has jurisdiction over the territory on which the object is located) must transmit this information to the inspectorate within 10 days from the date of registration. At the same time, the department will determine the cadastral value for new objects on the date of registration of such an object for state cadastral registration.

This follows from the provisions of paragraph 4 of Article 85, paragraphs 1 and 3 of Article 402, paragraph 1 and paragraph 1 of paragraph 2 of Article 403, paragraph 2 of Article 408 of the Tax Code of the Russian Federation and paragraph 5.1 of the Regulations approved by Decree of the Government of the Russian Federation of June 1, 2009 No. 457 .

Information about real estate in the Republic of Crimea and the federal city of Sevastopol and their copyright holders will be received by the tax inspectorates at the location of such property before March 1, 2015. This information will be provided by the territorial branches of Rosreestr as of January 1, 2015. This procedure is provided for in paragraph 9.3 of Article 85 of the Tax Code of the Russian Federation.

Information on the inventory value of property is no longer received annually by the tax office. Therefore, the inspectorate will calculate property tax for individuals based on the latest data received. And these are the data that the BTI provided to the inspection before March 1, 2013.

This follows from the provisions of paragraph 2 of Article 402, Article 404 of the Tax Code of the Russian Federation, paragraph 2 of Article 1 of the Law of October 4, 2014 No. 284-FZ, Law of July 24, 2007 No. 221-FZ.

Situation: is it necessary to submit documents confirming the acquisition and sale of real estate to the tax office to calculate property tax for individuals?

Answer: no, it is not necessary.

All necessary information is transmitted to the tax inspectorate by the territorial branches of Rosreestr (clause 4 of article 85, clause 2 of article 408 of the Tax Code of the Russian Federation). However, in the event of a dispute (for example, due to a delay in the transfer of information), provide documents for the purchase or sale of property. For example, a purchase and sale agreement, a certificate of registration of property rights (clause 1 of Article 14 of the Law of July 21, 1997 No. 122-FZ). In particular, to confirm the date from which a person no longer has to pay tax (for example, if the property has been sold).

Calculation according to the new rules for the first 4 years

For situations where the amount on the cadastral passport (CP) is greater than the inventory value (IV), the government has developed a special calculation form that helps reduce the rapid increase in the tax burden. Miscalculations are made by substituting data into the formula:

Tax burden = (Amount for CP - Amount for IP) x coefficient + Amount for CP

These rules will be relevant until 2021. From the beginning of next year, all calculations will be performed exclusively based on cadastre data.

Start and stop of accruals

The date from which a person becomes a payer for the property of individuals depends on the method of receiving the property.

If property is inherited, then from the date of death of the testator (clause 7 of Article 408 of the Tax Code of the Russian Federation). In other cases - from the date of registration of ownership (clause 5 of Article 408 of the Tax Code of the Russian Federation).

But in any case, the inspectorate will determine the date from which the tax must be calculated according to the following rules.

If the property is registered as a property (inheritance is opened) before the 15th day of the month inclusive, the inspectorate will calculate the tax from the beginning of that month.

When a person registered property (opened an inheritance) after the 15th day of the month, the tax will be calculated from the beginning of the next month.

The date from which the inspectorate will stop charging property tax is determined according to similar rules. Namely.

If a person lost ownership of an object before the 15th day of the month inclusive, then he is not required to pay tax for that month. But if after the 15th, then this month will be fully taken into account when calculating the tax.

This follows from the provisions of paragraph 5 of Article 408 of the Tax Code of the Russian Federation.

An example of determining the moment from which it is necessary to pay property tax for citizens. The house was built this year

A.V. Lvov is building a house on a plot of land. Construction was completed in February 2015. Ownership of the house was registered on March 20, 2015. And in the same month, Rosreestr assessed the property.

By April 1, 2015, Rosreestr will send information about the owner of this house and the cadastral value of the property to the tax office. And since ownership of the house was received on March 20, 2015, the inspectorate will calculate the property tax for 2015 for the period from April to December 2015.

Tax calculation when donating real estate

This is one of the most complex procedures encountered in the legal field. It is important to realize that not all citizens will need it, since persons on whom the deed of gift is registered are exempt from taxes:

- minors;

- brothers and sisters;

- parents;

- grandparents;

- grandchildren;

- guardians.

If, when donating real estate, you do not fall into any of the categories listed above, then you will need to pay the tax fee for the gifted real estate in full.

According to current legislation, calculations when registering a donation can be made both according to the cadastral value and according to the amount specified in the deed of gift. When carrying out such a procedure, it is important to know the following points:

- the deed of gift may indicate the estimated amount of the property or its share. In such a situation, experts will compare the price according to the cadastre and the price proposed in the donation agreement;

- if the deed of gift price is less than 70% of that indicated in the cadastral department, calculations are made based on 70% of the cadastral price;

- a citizen receiving property under a deed of gift must provide the Federal Tax Service with a 3-NDFL declaration no later than April 30 of the following year. In some cases, filing a return is not associated with paying tax. Such features are established by municipal authorities, and you can find them out directly at the Federal Tax Service at your place of residence.

Regarding the assignment of benefits

Typically, citizens who require social support are entitled to a discount. We are talking about disabled people and pensioners, participants in military operations, accident liquidators, orphans, large families, and so on.

Benefits are set by local authorities. They try to post as complete information as possible regarding the issue on the local administration website.

Discounts apply equally to apartments and houses, special premises where creativity is practiced. The rule also applies to plots of land occupied by buildings with a total area of up to 50 square meters. A garage or a place for a car in the property is also included in the subjects that are subject to subsidies.

The standard type of benefit is a complete exemption from paying fees. But the scheme is applied only to an object of one specific type. If there is more property, the citizen himself chooses which part of it to apply a discount on.

To receive a benefit, you must confirm your right to it. For this purpose, the Federal Tax Service employees are provided with documents, including:

- Papers confirming social status.

- Documents on the object.

- Copy of the passport.

Calculation of property tax for individuals

Algorithms and formulas by which the tax on non-residential real estate and residential property of individuals can be calculated are prescribed in federal legislation. Detailed information about calculation methods and detailed formulas have been presented above.

However, some categories of citizens are exempt from paying real estate taxes. This right is enshrined in state laws and applies to all persons with Russian citizenship who belong to certain categories of citizens.

Is there a difference in payment: is the housing privatized or not?

Property tax is paid only by owners who have officially registered with Rosreestr and have a certificate confirming their rights . If the apartment is not privatized, then the citizens living in it are not considered its owners. Therefore, they do not have to make annual payments for the property. Instead of this amount, residents of municipal apartments pay the cost of rent for accommodation.

Property tax is paid only by owners of privatized real estate

Benefits for individuals

The amendments made to federal laws practically did not affect preferential categories of citizens who are exempt from paying property taxes. The right to the benefit can be used only for one object in each of the real estate groups.

From 03/01/2015 the following were exempted from property tax:

- citizens who have lost their breadwinner while serving;

- family members of military personnel who died in the line of duty;

- creative workers working in equipped premises (studios, galleries, libraries, exhibitions, etc.);

- owners of living space up to 50, built on plots allocated for the organization of gardens, vegetable gardens and other subsidiary farming (only if the results of such farming are used for personal purposes);

- pensioners (60 years old for men and 55 years old for women) receiving benefits from the state;

- persons affected by the Semipalatinsk radiation disaster;

- combat veterans;

- citizens who took part in the Second World War and Civil Wars, as well as persons who survived other military actions to defend the Soviet Union (headquarters employees, intelligence officers, etc.);

- Heroes of the Soviet Union and the Russian Federation, having the Order of Glory of three degrees;

- military personnel who went through Afghan combat operations;

- military personnel who have served at least 20 years and were transferred to the reserve due to age;

- persons who defended populated areas during the Second World War (the list is specified in the legislation).

Preferential benefits are provided only after submitting an application and consideration of the candidacy. You can submit an application for benefits to the Federal Tax Service at your place of residence. To confirm your right to claim tax exemption, you will need to provide a certain list of documentation.

Terms and methods of payment

The deadline for paying property tax is December 1 of the year following the reporting year. For example, until December 1, 2021, property owners pay for 2021. And for 2021 – until December 1, 2021.

Every year, the tax authority sends out a notice to each taxpayer with all the necessary information on the object, amount and timing of payment. If you have a personal account on the Federal Tax Service website, the document will go there. If not, then by Russian post.

Payment methods:

- Online on the website of the Federal Tax Service of Russia through the “Payment of taxes and duties” service.

- Online through your personal account immediately after receiving the notification.

- At the bank with a receipt. The notification already contains a receipt; you just need to take it to the bank and pay the required amount in cash or by card.

- Through the State Services portal (Payment tab).

Commercial real estate tax calculation

Real estate used by the owner for business purposes that generate income for the owner is also subject to taxes. The category of commercial property includes:

- residential premises for rent;

- shopping and entertainment centers;

- office and administrative premises;

- restaurants, bars and cafes;

- catering canteens;

- warehouses;

- workshops, etc.

The tax on commercial real estate must be calculated by taking into account its average annual value, or at the price indicated in the cadastral passport. For cadastre calculations, the tax rate is taken, the amount of which, as well as the payment deadlines, is determined by the municipal authorities. The same scheme is used to answer the question of how to calculate sales tax on commercial real estate. When selling, the cost according to the cadastral passport is taken into account.