Home / Bankruptcy / Bankruptcy of legal entities

Back

Published: 02.09.2019

Reading time: 4 min

0

796

If the law or contractual obligations between the parties do not indicate the obligation to fulfill one’s debt obligations personally, the debtor has the right to transfer this obligation to another person. This follows from the provisions of Art. 313 Civil Code. But at the same time, the debtor must comply with certain procedural requirements and send a letter to the third party asking him to pay the debt for him.

- How does a third party pay a debt?

- Procedure for writing a letter What information must be provided

- Who signs the letter

- Creditor Notice

How does legislation affect the nuances of accounting for payments to a third party?

The order of accounting entries made when paying for third parties may be influenced by legal regulations.

The law does not prohibit a company or individual entrepreneur from paying off the obligations of third parties. The subtleties of this procedure are described in Art. 313 Civil Code of the Russian Federation. But there is a limitation for such an operation - the presence in the law or agreement between the parties of a clause on the mandatory fulfillment of obligations personally by the participants in the transaction. If such a condition exists, additional entries in the accounting of counterparties will not be needed - all transfers under the agreement will occur without the participation of third parties.

Although no one prohibits a third party from financially supporting the debtor. This person can transfer money to pay off the debt, for example, as part of a loan agreement. In this case, settlements between the debtor and the third party will be made within the framework of the loan agreement using the accounting entries inherent in this type of agreement.

What are the tax consequences?

Based on the letter of the Federal Tax Service No. BS-4-21/18529, citizens and enterprises that repay the debts of third parties can enter into an agreement that protects their rights and interests. This document, along with letters, officially confirms the completion of transactions.

If companies draw up a loan agreement on the basis of which interest is charged, the company pays income tax on the interest received. If the receivables are settled, there are no tax consequences. In some situations, a company can receive a VAT credit if the amount paid acts as an advance for future supplies of goods.

Transfer of money to a creditor at the request of a supplier: example of postings from the payer and debtor

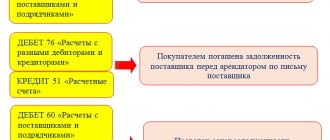

How should transactions reflect payment for a third party? Repayment of a debt for a third party affects the accounting of the payer, debtor and creditor in most cases:

- settlement accounts (60,62, 76, etc.)

- expense accounts (44, 26, 91, etc.);

- payment accounts (50, 51, 55).

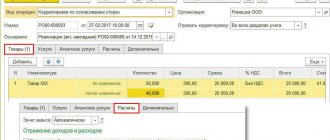

Let's look at the transactions when paying to a third party at the request of the supplier using an example.

Panther LLC sold a batch of goods worth 350,000 rubles. (cost of goods - 286,000 rubles) to PJSC Jaguar. At the same time, Panther LLC owed IP Zavgorodniy P.N. the same amount for renting production premises. Panther LLC appealed to the management of Jaguar PJSC with a request to transfer the debt for the supplied goods directly to the bank account of its lessor to pay off the rent arrears.

How Panther LLC will reflect this operation in its accounting is shown in the figure below (to simplify the example, we assume that VAT is not involved in the calculations):

Such postings are used when paying for a supplier to a third party in the accounting of the supplier himself. What transactions are required to be made by the payer when paying for a third party, see below:

In creditor accounting, the entries will be even simpler. Based on the debtor's notification and a bank statement about the amount received from a third party, he will cover the debtor's debt. No additional wiring is required.

Letter about transfer of funds

Companies often turn to debtors to pay their debts. This allows for a reset. The debtor gets rid of his debt by paying off the debt of the creditor. Under such conditions, a special letter of offset is drawn up by the creditor. It includes data:

- names of organizations;

- request to repay the existing debt against receivables;

- payment amount;

- date of preparation of documentation;

- payment details;

- signature of the director of the enterprise;

- company seal.

Such a document is used only if the company has a debt, which can get rid of it by paying off the debt of the counterparty.

What documents will justify postings for payment of a third party's debt?

Payment of a debt for a third party, like any business transaction, must be reflected in the records of all parties involved in the debt repayment procedure. In order for the entries made in accounting to be justified, supporting documents are needed.

The possibility of paying a debt by a third party may be initially provided for in the contract. However, this alone is not enough to reasonably reflect the transaction in accounting.

In general, we can name several supporting documents in such a situation:

1. A letter from the debtor to the payer with a request to repay the debt to the creditor using the specified details.

2. Agreement - order for payment.

It is advisable to issue this document to confirm the debt repayment transaction. It is usually required by tax inspectors during audits. Although the law does not require the mandatory execution of such an agreement when paying a third party’s debt.

3. A copy of the payment order confirming the payment made.

A copy of the payment slip with the bank’s mark on the execution of the payment will serve as proof of repayment of the debt and confirm not only the date and amount of the payment, but also the actual payer and recipient of the money. The payment order must correctly formulate the purpose of the payment - it must be stated that the money is being transferred to pay off a debt for another person. You will need to list the details of the debtor that will allow you to easily identify him (name, tax identification number, etc.). Otherwise, the amount received by the creditor may be considered unjust enrichment and will have to be returned.

4. Notification to the creditor about the payment made and an act of reconciliation of mutual settlements with him.

With these documents, the company whose debt was paid by a third party will confirm the validity of recording the fact of repayment of accounts payable.

We will explain in the next section what entries need to be made in accounting when paying tax debts for third parties.