Let's understand the basics

Legislators have determined a unified way of systematizing and grouping information about the economic activities of Russian enterprises and institutions.

Order of the Ministry of Finance No. 94n establishes a Unified Chart of Accounts for commercial and non-profit organizations, and Order No. 157n - for public sector institutions. Accounting accounts are special digital and alphabetic codes that are used to reflect business transactions in accounting, or more precisely, when drawing up accounting entries.

Each account has its own classification characteristic, which is determined by the “balance sheet” method. This means that, like a balance sheet, all accounts are divided into assets and liabilities. And some accounts can be reflected in both assets and liabilities. Consequently, all accounts are divided into active, passive and active-passive accounts; the table for budgetary organizations contains about 1000 such codes.

The principle of working with the chart of accounts

The organization must select the accounts that it will use in its work. You also need to think about which subaccounts need to be opened based on the specifics of the company’s activities.

IMPORTANT. The organization is not required to strictly adhere to the list of subaccounts. They can be renamed, refined, combined and excluded. The main thing is that it is convenient to work with them.

The result will be a working PSBU. It should be included in your accounting policies. If the organization’s activities have changed during the year, the changed version can be approved for the next year.

If any business transaction is specific, and there is no suitable synthetic account for it, it is permissible, with the permission of the Ministry of Finance, to enter a new account for yourself. For this purpose, numbers not used in the plan are used.

Maintain accounting and tax records for free in the web service

Active accounting accounts

To reflect property, material and monetary values in the chart of accounts, special active accounting accounts are provided. In simple words, active accounts are accounts for accounting:

- company property, both tangible and intangible (fixed assets, inventories, intangible assets);

- amounts of funds, both in cash and in current bank deposits and accounts (in rubles, foreign currencies, precious metals);

- production costs, work in progress and semi-finished products;

- financial investments of various types, both short-term and long-term.

Since active accounts are intended to account for the property and finances of the company, the balances on such accounts can only be in debit, that is, have a positive value.

For example, active accounts include:

- account 01 “Fixed Assets”, for which there cannot be a negative balance, because the initial cost of an asset cannot have a negative value;

- or active account 10 “Inventories”. Transactions involving the receipt of property and monetary assets are reflected in accounting as a debit turnover, and disposals as a credit turnover;

- active account 50 “Cashier”, which cannot reflect a negative cash balance in the cash register.

The final debit balance on active accounts should be reflected in the asset balance sheet, in the corresponding lines of the reporting form.

Accounting table

Below is a table with an approved list of accounting accounts. Each position contains a link to a page with reference information that provides answers to the most common questions and allows you to study in detail the specifics of working with a specific account.

| Accounting account | Account name |

| 01. | Fixed assets |

| 02. | Depreciation of fixed assets |

| 03. | Profitable investments in material assets |

| 04. | Intangible assets |

| 05. | Amortization of intangible assets |

| 07. | Equipment for installation |

| 08. | Investments in non-current assets |

| 09. | Deferred tax assets |

| 10. | Materials |

| 11. | Animals being raised and fattened |

| 14. | Reserves for reduction in the value of material assets |

| 15. | Procurement and acquisition of material assets |

| 16. | Deviation in the cost of material assets |

| 19. | Value added tax on purchased assets |

| 20. | Primary production |

| 21. | Semi-finished products of our own production |

| 23. | Auxiliary production |

| 25. | General production expenses |

| 26. | General running costs |

| 28. | Defects in production |

| 29. | Service industries and farms |

| 40. | Release of products (works, services) |

| 41. | Goods |

| 42. | Trade margin |

| 43. | Finished products |

| 44. | Selling expenses |

| 45. | Goods shipped |

| 46. | Completed stages of unfinished work |

| 50. | Cash register |

| 51. | Current accounts |

| 52. | Currency accounts |

| 55. | Special bank accounts |

| 57. | Transfers on the way |

| 58. | Financial investments |

| 59. | Provisions for impairment of financial investments |

| 60. | Settlements with suppliers and contractors |

| 62. | Settlements with buyers and customers |

| 63. | Provisions for doubtful debts |

| 66. | Calculations for short-term loans and borrowings |

| 67. | Calculations for long-term loans and borrowings |

| 68. | Calculations for taxes and fees |

| 69. | Calculations for social insurance and security |

| 70. | Payments to personnel regarding wages |

| 71. | Calculations with accountable persons |

| 73. | Settlements with personnel for other operations |

| 75. | Settlements with founders |

| 76. | Settlements with various debtors and creditors |

| 77. | Deferred tax liabilities |

| 79. | On-farm settlements |

| 80. | Authorized capital |

| 81. | Own shares (shares) |

| 82. | Reserve capital |

| 83. | Extra capital |

| 84. | Retained earnings (uncovered loss) |

| 86. | Special-purpose financing |

| 90. | Sales |

| 91. | Other income and expenses |

| 94. | Shortages and losses from damage to valuables |

| 96. | Reserves for future expenses |

| 97. | Future expenses |

| 98. | revenue of the future periods |

| 99. | Profit and loss |

You can download the table with the chart of accounts here.

Passive accounts

The sources of formation of the enterprise's assets constitute the passive side of the balance sheet. Passive accounts reflect:

- capital of an economic entity (statutory, reserve, additional);

- obligations accepted by the company for execution;

- loan, credit and loans received;

- some types of expenses, such as depreciation;

- reserve funds for doubtful debts.

Passive accounts can only have a credit balance at the end of the reporting period; a debit balance on passive accounts indicates the presence of errors in accounting. An increase in indicators on passive accounts is formalized by a credit turnover, and a decrease in liabilities, capital or write-off of expenses is formalized by an operation on the debit of a passive account.

In the balance sheet, passive accounts represent the corresponding section - liabilities. The generated balances at the end of the reporting year are distributed along the corresponding lines of the liability side of the balance sheet, in accordance with the current rules for preparing financial statements.

Explanations by section

| Section number | Section name | Account number | Explanations for this section |

| I | Fixed assets | 01 … 09 | Generalization of information on the availability and movement of assets:

|

| II | Productive reserves | 10 … 19 | Reflections of data about:

|

| III | Production costs | 20 … 39 | Accounting for data on costs for ordinary activities (other than selling costs) associated with:

|

| IV | Finished products and goods | 40 … 49 | Generalizations of data on availability and movement:

|

| V | Cash | 50 … 59 | Accounting for data on cash and cash equivalents:

|

| VI | Calculations | 60 … 79 | Generalizations of information about all types of company payments to other persons (individuals and legal entities):

|

| VII | Capital | 80 … 89 | Reflection of data on capital and reserves |

| VIII | Financial results | 90 … 99 | Collection of all expenses and income of the company, as well as summing up the final results of operations, identifying profit or loss |

| Off-balance sheet | 001 … 011 | Reflection of data about:

|

Example of passive accounts in an NPO

Passive account 02 “Accrued depreciation” has a credit balance on the account. Turnover in the debit of the account reflects the write-off of accrued depreciation upon disposal of fixed assets.

The following example: passive account 70 “Settlements with personnel for wages”. The credit of the passive account reflects the accrual of earnings. Debit account turnover - withholding income tax or making payments. A negative account balance is a declaration of an erroneous account.

Description of the document

Chiefs, managers and accountants of the organization need to receive timely and up-to-date information about the status of accounts, because this data directly influences management decisions. Let's say a company needs to pay suppliers a certain amount. With proper accounting, an employee only needs to look at the documents to understand whether the necessary money is available. Information is also added there about who should pay the company, how much money is on deposit, etc. This is very convenient and greatly simplifies the work, especially when it comes to large companies.

Accounts

Account

To understand what a chart of accounts is, you first need to understand the concept of “bookkeeping accounts.” This is a way of reflecting property by composition and sources of its formation. Business transactions are also subject to sorting according to monetary, natural and labor criteria. It is quite difficult for an unprepared person to understand what is hidden behind this definition. But in reality, everything is much simpler: in essence, an accounting account is a table containing the following information:

- Debit turnover is the sum of all transactions reflected in debit.

- Credit - all transactions reflected in the loan.

Note! Debit (increase) is on the left, and credit (decrease) is on the right. We can say that a debit is what a company owes, and a credit is what it owes to others.

For convenience, each operation is assigned a two-digit number from 01 to 99. This is very convenient because it eliminates the need to write the full name of the asset each time. Here's what a simplified accounting account would look like:

| Debit | Credit |

| Balance at the beginning: 50,000 rub. | |

| 7,000 rub. — received from Konstruktor LLC | 8,000 rub. — paid by Stroymaterialy LLC |

| 3,000 rub. - received from Yagel LLC | |

| Balance at the end: 52,000 rub. | |

Every day the company pays wages, purchases equipment or materials, pays taxes and other operations. For convenience, they are grouped according to homogeneous characteristics. Each group is assigned a specific number. For example, payment for materials to suppliers belongs to account No. 50 called “Cash of the organization.” All cash on hand in the company should be accounted for in this category.

Chart of accounts

The chart of accounts is a system for recording and grouping facts of economic activity. It is used in companies of any form of ownership (except for financial organizations) that use the double entry method (correspondence of accounts) for postings. The plan indicates 99 accounting accounts and another 11 off-balance sheet accounts. Which account to use depends on the transaction category. Thus, at any time you can look into the document to clarify the current account number.

Example chart of accounts

Important information! An organization can establish a working chart of accounts that uses only the most common transactions. Small firms can get by with 15-20 positions.

Mixed accounts

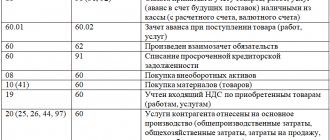

Some ledger accounts may have both credit and debit balances. Such mixed accounts are called active-passive accounting accounts. For example, accounting accounts reflecting information on settlements with customers or suppliers. Consequently, when goods are shipped to a buyer, an account receivable is formed in the accounting system, and when an advance payment is received from the same buyer against future deliveries, an account payable is formed. It cannot be hidden. Settlements with suppliers are carried out similarly to account 60.

Account 84 “Retained earnings, loss” is also considered both an active and passive account, since it can have both a credit and a debit balance at the end of the reporting period.

What is an active view?

Active accounts are those types that count the company's assets. They have a closing and opening balance in the form of a mandatory debit. According to debit (Dt), an increase in the asset is indicated, and according to credit (Kt), a decrease is indicated. The presented rule must be a prerequisite for correctness, otherwise the accounting contains an error.

Examples of division

The main programs for keeping records in electronic form have a limitation that will not allow you to write off more than what was received in total terms.

In addition to the assets of the enterprise, this type displays available property and external debts.

Company assets are divided by type:

- monetary;

- expensive;

- material (property, inventory, etc.);

- settlement;

- distribution

The income of active accounts is constantly recorded according to Dt, and the decrease or disposal - according to Kt. In the most accessible way, you can consider the accounting account called “Cashier”, number 50. The California Hotel received revenue for rental services for a golf course and car parking in the amount of 38 thousand rubles. During the specified day, the staying guest received a refund for the overpayment of room rent in the guest house. This is due to the fact that the visitor left a day earlier. The refund amount is 4 thousand rubles. At the end of the day, the remaining funds were transferred from the cash register to the current account. All that remains is the approved balance limit for the cash register.

Sample

The calculation is made as follows:

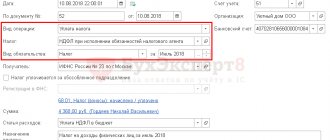

- debit 50, credit 76, transaction description - revenue received for field and parking services, amount - 38,000. Document - receipt;

- debit 76, credit 50, transaction description - partial refund, amount - 4000. Document - consumable;

- debit 51, credit 50, description of the transaction - cash transfer to an account, amount - 34000. Document - expenses.

The executed transactions are displayed in the table.