- Business trip while on vacation

- Vacation during a business trip

- After a business trip on vacation

- After vacation on a business trip

The employer is obliged to reimburse the employee for travel expenses to the place of business trip and back to work. But the employee’s path does not always look like “Ekaterinburg - Moscow - Yekaterinburg”. It happens that an intermediate link appears - a vacation in Prague. In this article we will discuss 4 situations in which a vacation coincides with a business trip. We'll tell you how to correctly fill out documents and reimburse travel costs so as not to fall under sanctions.

Review from another vacation for a business trip

According to Article No. 166 of the Labor Code of the Russian Federation, a business trip is a work trip outside the municipality in which the organization is located.

If there is a need for an employee to travel on business, and he is on vacation, the employer must interrupt the vacation. To do this, you need to properly register your review and business trip.

Nuances of paperwork depending on the type of vacation

Before conducting and processing an employee's recall, his consent must be obtained in writing. Without official confirmation, orders and other documents of the enterprise have no legal basis (do not have legal force). However, there are certain nuances that depend on the type of vacation. If an employee, in addition to direct work, studies at an institute, he is given the necessary time for each session. The management can call him only if he passed the exams ahead of schedule.

A woman who is on maternity leave can also be called for an urgent business trip (unlike a pregnant girl). In addition to classic consent, it is necessary to familiarize her with all rights. For example, that there is an opportunity to refuse without consequences.

In order to interrupt an annual vacation, it is necessary to obtain the traditional written consent of the employee. You also need to determine for what period the rest of the vacation after the business trip will be transferred - the dates are chosen by the employee.

Weekends at your own expense or without pay are provided at the request of the employee. Sometimes an employee needs to stay where the business trip was for additional time. The manager decides whether there is such an opportunity or whether it is necessary to return to his workplace.

It is important to know! Some categories of citizens must be granted leave at their own expense upon request. These include disabled people, combatants and pensioners.

There are some nuances to consider when working part-time. In this case, the main employer is not obliged to pay or change anything. It turns out that going on vacation is unprofitable from a financial point of view, although purely theoretically everything is possible.

In what cases cannot an employee be recalled from vacation?

In some cases, it is impossible to send a citizen from vacation on a business trip. The restriction applies if the employee:

- has not reached the age of majority;

- is on sick leave due to pregnancy and childbirth;

- is on study leave;

- is on vacation without pay.

A business trip during vacation is also impossible for citizens whose work activities take place in harmful or dangerous working conditions.

When to submit reports?

According to the Government Decree, the deadline for submitting an advance report is determined in working days. It is not necessary to send documents by mail, transfer them through other persons, etc.

You can start filling it out immediately after returning from vacation.

Delivery time: within three days from the date of:

- returning from a business trip;

- coming out of vacation.

The employee must submit an application requesting compensation for travel expenses.

When preparing an expense report, there are usually no difficulties. It clearly states the fields that need to be filled out. Documents confirming the target costs must be attached.

We invite you to download a blank advance report form:

Advance report-ao-1

Procedure for registering a business trip during vacation

Algorithm for the procedure for sending a citizen on a business trip during the next vacation:

- The manager draws up a notice of the need for a business trip and sends it to the employee.

- The employee familiarizes himself with the proposal received and gives his consent or refuses the trip.

- The director issues a recall order and creates a job assignment for the period of work on a business trip.

- Accounting employees recalculate and pay daily allowances and vacation pay.

The notification sent is drawn up by the director of the organization in free form. The contents of the document indicate:

- company name indicating the registration form;

- Full name and position of the citizen to whom the message is addressed;

- description of the situation and proposal to interrupt vacation for a business trip;

- clarification of the employee’s right to the opportunity to receive rest after a business trip or along with the next paid rest;

- link to Part 2 of Art. 125 of the Labor Code of the Russian Federation that a citizen has the right to refuse a recall;

- Date of preparation;

- Full name, position title and signature of the compiler.

A sample of a written notification is available here.

Written consent of the employee

The consent is drawn up by the employee in free form. The contents of the document indicate the following information:

- name of the organization indicating the registration form;

- Full name and position of director;

- the date when the citizen interrupts his vacation and goes on a business trip;

- indicating the dates when the employee plans to receive the remaining vacation days;

- Date of preparation;

- signature.

ATTENTION! According to Art. 125 of the Labor Code of the Russian Federation, it is impossible to recall a citizen from vacation without approval. If a notice of interruption is refused, the employer may not take disciplinary action. Otherwise, the manager is held accountable in accordance with Art. 5.27 Code of Administrative Offenses of the Russian Federation.

The manager does not have the right to deprive bonuses, discriminate in career growth, reduce wages, etc. When using illegal methods of influence in accordance with Art. 356 of the Labor Code of the Russian Federation, a citizen can appeal to the labor inspectorate with a complaint.

Manager's decision

After receiving consent, the manager formalizes his decision. To do this, he needs to issue a recall order. It can be drawn up in free form or on a form regulated by local acts of the organization.

The contents of the order indicate the following information:

- Company name;

- Date of preparation;

- registration number of the order;

- link to article 125 Labor Code of the Russian Federation;

- date the employee returns to work;

- basis for drawing up (details of the notification sent to the citizen);

- an order for the accounting department to recalculate vacation pay;

- signature of the recalled employee;

- compiler's signature.

A sample order is available here.

Service assignment

The fact of going on a business trip must be recorded by an appropriate order. It is drawn up in the T-9a form or on the enterprise’s own form.

Details of the trip are reflected in the job description. Its contents indicate:

- document number and date of its preparation;

- Company name;

- information about the employee (full name, position);

- place of business trip;

- length of stay on a business trip;

- list of goals;

- regulations on working hours and days off during travel;

- payment provisions;

- regulations on additional charges (payment for accommodation, travel, food, etc.);

- signatures of the parties;

- Date of preparation.

To fill out a job assignment, you can use the organization’s form or the unified form T-10a. The sample is available here.

ADVICE! A job assignment is not required. The manager has the right to decide on the need to draw it up.

What does the law say?

The Labor Code does not prohibit taking leave at your own expense during or after a business trip.

Based on the Labor Code of the Russian Federation, rest is mandatory for:

| Category of citizens | Maximum duration, days |

| participants of the Great Patriotic War | 35 |

| working pensioners | 14 |

| disabled people engaged in working activities | 60 |

| spouses or parents of military personnel, employees of the fire service, the penitentiary system, etc. | 14 |

| persons who have experienced an event stipulated by the Labor Code of the Russian Federation or a collective agreement: the birth of a child, the death of a relative, registration of marriage. | 5 |

If the employee does not fall into the listed categories, the organization may refuse the request.

Read our article about how to cancel a business trip. How to pay for accommodation on a business trip without supporting documents? See here.

Calculation of business trip payments and recalculation of vacation pay

Since the citizen left his vacation early, he returns part of the funds received. Their sum is calculated using the following formula:

SO / KD × KND , where:

- SO – the amount of vacation pay received;

- KD – number of days of rest provided;

- KND – number of unused days.

Travel allowances are paid based on the citizen’s average earnings over the last 12 months. Additionally, the employer compensates for the cost of accommodation, food, travel or fuel consumed.

Payment

When an employee goes on vacation, the employer must pay him compensation. The amount of vacation pay also depends on the number of days that the employee will be on vacation.

But when a recall is issued, the employee must return part of the vacation pay for business trips back to the employer. Since the employee goes to work, he has the right to count on wages.

Since he is going on a business trip, he should receive an average salary and daily allowance.

The amount of daily allowance is regulated independently by the employer. This is stated in Art. 168 Labor Code of the Russian Federation.

The amount of daily allowance may be specified in the collective agreement or in the order of the manager.

But daily allowances in the following amounts are not taxed:

- 700 rubles per day for business trips in Russia;

- 2,500 rubles per day for trips abroad.

Per diem must be paid for each day of a business trip, including weekends and holidays, as well as travel time to the destination.

Refund of vacation pay

Vacation pay must be paid to an employee 3 days before the start of his vacation. But, if there is a recall from vacation, then the money for this must be returned to the employer.

But the employer has no right to deduct this money from the employee’s salary.

He can agree in writing with the employee:

- so that he returns the money to the enterprise’s cash desk;

- to arrange this amount as an advance against future wages;

- deduct vacation pay from the employee's salary.

The employee must agree to any deduction from his salary.

Example:

Electrician P.N. Fedortsov, who works at DOM LLC, went on vacation from July 15, 2021 for 14 calendar days. In a neighboring city there was an accident at a power plant, and they did not have enough “working hands”. The boss called Fedortsov and asked him to interrupt his vacation on July 20, and immediately go on a business trip to eliminate the consequences of the accident at the power plant. The engineer agreed to issue a review and a subsequent business trip. It turns out that he only had 5 days off, since on July 20 he already left on a business trip.

To calculate his vacation pay, the average earnings were 1,842.6 rubles.

Thus, he received 25,796.4 rubles in his hands. (1,842.6 * 14). This employee still has 9 days left of his vacation, he decided to use them from 01.09.2021.

Since the employee only took 5 days of vacation, he should have received 9,213 rubles (1,842.6 * 5) in hand. Therefore, he must return 16,583.4 rubles (25,796.4 – 9,213) to the cashier or otherwise negotiate with the employer.

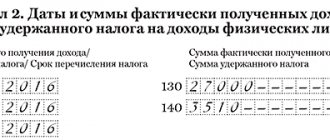

How to reflect expenses incurred in accounting

Guarantees and compensation for workers sent by the employer on a business trip are enshrined in Art. 168 Labor Code of the Russian Federation. In accordance with the standards set out in this article, the employee is reimbursed:

- expenses for renting residential premises;

- travel expenses to and from the business trip;

- daily allowance;

- other expenses (for example, payment for communication or postal services made with the permission of the employer).

According to the Instructions on the procedure for applying the budget classification of the Russian Federation, the above-mentioned expenses are reflected accordingly under subarticles 226 “Other work”, 212 “Other payments” of KOSGU.

Approved by Order of the Ministry of Finance of Russia dated December 25, 2008 N 145n

In addition, when an employer sends an employee on a business trip, he retains his place of work (position) and the average salary at his main place of work. It is calculated in accordance with the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922. To calculate the average wage, all types of payments provided for by the remuneration system used by the employer are taken into account, regardless of the sources of these payments. Expenses for the payment of average earnings are reflected in subsection 211 “Wages” of the KOSGU. For days for which the employee extended the business trip at his personal request and which are registered as vacation, average earnings are calculated in accordance with the above-mentioned Resolution.

Let's look at this situation with an example.

Example. The children's sports school of the regional center of a constituent entity of the Russian Federation sent the chief accountant to advanced training courses with a break from production in another city for 12 days. He stayed at the seminar site for another week with the permission of the head of the organization without paying per diem and accommodation for these days. The institution paid the organizers of the courses from funds received from income-generating activities, the cost of the courses on an advance payment basis in the amount of 9,000 rubles. (NDS is not appearing). Before leaving, the employee was given travel allowances in the amount of 5,000 rubles against the cash register, including:

- daily allowance - 1200 rub. (for 12 days at the rate of 100 rubles per day);

- for travel to the place of study - 960 rubles;

- for hotel accommodation - 2840 rubles.

Upon return, the chief accountant presented an advance report with the following attached:

- railway tickets, the cost of which was 960 rubles;

- invoice from the hotel in the amount of 2360 rubles. (without VAT).

The following entries must be made in the accounting of a sports school:

————————————-T————T————T———-¬¦ Contents of the transaction ¦ Debit ¦ Credit ¦ Amount, ¦¦ ¦ ¦ ¦ rub. ¦+————————————+————+————+———-+¦Money transferred ¦2 206 09 560¦2 201 01 610¦ 9000 ¦¦to the course organizer increase ¦ ¦ ¦ ¦¦qualifications ¦ ¦ ¦ ¦+————————————+————+————+———-+¦Money issued to the employee on account ¦ ¦ ¦ ¦ ¦funds for travel expenses:¦ ¦ ¦ ¦¦- daily allowance ¦2 208 02 560¦2 201 04 610¦ 1200 ¦¦- for travel ¦2 208 05 560¦2 201 04 610¦ 960 ¦¦- for hotel accommodation ¦ 2 208 09 560¦2 201 04 610¦ 2840¦+————————————+————+————+———-+¦Course cost written off as expenses ¦2 106 04 340¦2 302 09 730¦ 9000 ¦¦advancement ¦ ¦ ¦ ¦+————————————+————+————+———-+¦The above has been credited ¦2 302 09 830¦2 206 09 660¦ 9000 ¦¦advance ¦ ¦ ¦ ¦+————————————+————+————+———-+¦Written off travel expenses: ¦ ¦ ¦ ¦¦- for travel ¦2 106 04 340¦2 208 05 660¦ 960 ¦¦ ¦ (222 KOSGU)¦ ¦ ¦¦- daily allowance (100 rub. x 12 days) ¦2 106 04 340 ¦2 208 02 660¦ 1200 ¦¦ ¦ (212 KOSGU)¦ ¦ ¦¦- for hotel accommodation ¦2 106 04 340¦2 208 09 660¦ 2360 ¦¦ ¦ (226 KOSGU)¦ ¦ ¦+———— ————————+————+————+———-+¦The employee deposited into the cashier ¦2 201 04 510¦2 208 09 660¦ 480 ¦¦the unspent advance issued for the¦¦ ¦ ¦¦accommodation ¦ ¦ ¦ ¦L————————————+————+————+————

When paying for a contract for advanced training, a budgetary institution can transfer an advance in the amount of 100% of the contract amount (clause 6 of the Decree of the Government of the Russian Federation of December 24, 2008 N 987).

S.Valova

Magazine editor

"Budget institutions:

audits and inspections

financial and economic

activities"

When can money be withheld from an employee’s salary at the employer’s initiative?

At the initiative of the organization’s management (administration), the following can be withheld from an employee’s earnings:

1) unearned advance payment issued on account of wages;

2) unspent and not returned in a timely manner amounts issued on account in connection with a transfer to work in another area, etc.;

3) overpaid wages and other amounts overpaid to an employee due to a counting error or upon proof of his guilt in idle time or failure to comply with labor standards;

4) the amount of compensation for unworked vacation days upon dismissal of an employee before the end of the year;

5) the amount of benefits (sick leave and maternity benefits) overpaid in the event of a calculation error (for example, an arithmetic error was made when calculating earnings for the billing period) or unlawful actions of an employee (for example, an employee hid information affecting the amount of benefits).

Alexander Sorokin answers,

Deputy Head of the Operational Control Department of the Federal Tax Service of Russia

Answer

The advisability of leaving the business trip at a later date is decided by the manager. That is, he may allow the employee to pay for a return ticket in case of a later return from a business trip, or not allow it.

The same applies to the provision of unpaid leave - providing leave for good reason is a right, not an obligation of the organization. The duration of the vacation is determined by agreement of the parties. Moreover, in this case, vacation is granted not during the business trip, but after it.

In this case, the costs of return travel can be taken into account for tax purposes, since they would have been incurred in any case, regardless of the time spent by the employee at the destination.

At the same time, personal income tax will have to be withheld from the cost of the return ticket, since in this case payment of the fare cannot be considered as compensation for expenses associated with a business trip.

Rationale

1.From the situation of Andrey Kizimov

, Deputy Director of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia

How to take into account expenses for a business trip when calculating income tax and personal income tax if the dates indicated on the ticket do not coincide with the dates in the business trip order

When calculating your income tax, include travel costs as expenses.

But only if the employee’s earlier departure on a business trip (delay in departure from a business trip) occurred with the permission of the manager, which confirms the advisability of leaving on a business trip (from a business trip) on an earlier or later date.*

This means that the costs of a return ticket can be taken into account when taxing profits, even if the employee was delayed at the place of business trip due to vacation or a day off (provided that they were made with the permission of the manager, confirming the feasibility of these expenses).

Regarding the withholding of personal income tax on travel expenses, please note the following.

However, if an employee returns from a business trip later than the date established in the order to be sent on a business trip, payment for his travel in some cases cannot be considered as compensation for expenses associated with a business trip.

If an employee remains at the place of business trip for a short time (for example, on weekends or non-working holidays), then paying for travel from the place of business trip (vacation) to the place of work does not lead to economic benefits. In this case, there is no need to withhold personal income tax from the ticket price.

The same rules apply when an employee leaves on a business trip earlier than the date specified in the order. For example, in order to prepare for a task at a business trip.

2.From the recommendation

Nina Kovyazina

, Deputy Director of the Department of Medical Education and Personnel Policy in Healthcare of the Russian Ministry of Health

How to give an employee leave without pay

When does an organization have the right to grant leave?

The administration of the organization has the right to provide an employee with leave at its own expense for any valid reason. This could be, for example, family circumstances: the wedding of a family member, the illness of parents living in another city, etc. The organization decides whether to recognize this or that reason as valid or not. The duration of the vacation is determined by agreement of the parties.*

When is an organization required to provide leave?

The organization is obliged to provide leave without pay:

Menu

Attention

When an employee is recalled from such leave, the part not taken off can be replaced with monetary compensation. Otherwise, it is allowed either to provide the unused portion in the current year or to transfer it to the next

In the case of irregular working hours, it is allowed to replace part of the vacation with compensation payments, provided that this part exceeds three days. In the case of hazardous industries, the mandatory portion is seven days.

Info

After this period, the employer may insist on compensation and recall the employee from vacation to go on a business trip. Do not apply, because The vacation period is established by a letter of invitation from the educational institution.

Important

Moreover, an employee cannot be recalled from study leave. Is consent required? Mandatory consent is required for a call from vacation on behalf of an employee of the organization.