Billing period

The duration of the calculation period when calculating vacation pay in 2015 depends on how long the employee works for the employer. The billing period cannot be more than a year.

Option 1

The employee worked for more than a year before the leave.

The billing period will be 12 calendar months prior to the month in which he goes on vacation. A calendar month is taken from the 1st to the last day inclusive. That is, in May from 1 to 31, and in February - up to the 28th inclusive. Option 2

The employee worked for less than a year before the leave.

The billing period will be the entire time during which he is registered in the organization.

Mask overlay

This requires a piecewise function, but - since I found it boring - I thought about another solution, using one part of the function on one interval, the other on another. I believe that the easiest way would be to find an expression that is equal to 1 in one application area and 0 in the rest. The method in which by multiplying an argument by an expression we exclude it from the formula outside its scope, I called “mask imposition”, because this behavior is similar to a kind of bit mask. To use this method, in the last part of our function we need to find an expression equal to 1 when , and - since the argument values are always less than 16 - integer division by 8 works fine for this.

| x | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| ⌊x ⁄8⌋ | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 1 | 1 |

Now, using this mask, using an expression instead of 1 in the dividend, we can reverse the order of obtaining 0 and 1 in the formula:

| x | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| f(x) | 31 | 30 | 31 | 30 | 31 | 30 | 31 | 31 | 30 | 31 | 30 | 31 |

Eureka! Everything is correct, except for February. Surprise surprise.

Earnings for the billing period

When calculating your earnings, include all payments that are provided for by the organization’s remuneration system. This:

- salary accrued for time worked;

- allowances and additional payments (for class, length of service, combination of professions, etc.);

- compensation payments related to working hours and working conditions - regional coefficients and percentage increases in wages, additional payments for work in hazardous and difficult working conditions, at night, in multi-shift work, on weekends and holidays and overtime;

- other bonuses and rewards.

Mathematical apparatus

First, let's briefly refresh our memory on two vital operators in solving this problem: integer division and remainder of division.

Integer division

This is an operator used in many programming languages to divide two integers and remove the fractional part from the quotient.

I will portray it as . For example: Modulo

is an operator that finds the remainder of division.

Many programming languages use the %

, but I will use constructions of the form, for example: Note that the remainder of division has equal priority to division.

Average daily earnings

Once the employee’s earnings for the pay period have been determined, you need to calculate the average daily earnings. The procedure for determining average daily earnings depends on whether the employee has worked the entire pay period and whether he is given leave in calendar or working days. If the billing period is fully

and vacation is provided in calendar days, the average daily earnings are determined by formula 1:

| daily earnings | Earnings accrued for the billing period | 29, 3 days (average monthly number of calendar days) |

The indicator “29.3 is used exclusively for the purpose of determining average earnings for the payment of vacation pay and compensation for unused vacation.

Vacation pay calculation

After calculating the average daily earnings, you can calculate the amount of vacation pay that must be paid to the employee. If vacation is provided in calendar days, then vacation pay in 2015 will be calculated according to formula 2:

| Average daily earnings | Number of calendar days of vacation |

Example 1

From May 25 to June 21, 2015, Petrov was granted basic paid leave. Duration of vacation is 28 calendar days. The billing period - from May 1, 2014 to April 30, 2015 - has been fully worked out. During the billing period, the employee was accrued 360,000 rubles. (RUB 30,000 x 12 months) This amount is fully included in the calculation of vacation pay in 2015. The average daily salary of an employee is: 360,000 rubles. : 12 months : 29, 3 days = 1023.89 rub. The total amount of vacation pay was: 1023.89 rubles. x 28 days = 28,668.92 rub.

Example 2

From June 15 to June 28, 2015, Sidorov was granted basic paid leave of 14 calendar days. The billing period - from June 1, 2014 to May 31, 2015 (12 months) - has been fully worked out. During the billing period, the employee was accrued 240,000 rubles. (RUB 20,000 x 12). This amount is fully included in the calculation of vacation pay. The average daily earnings used to calculate vacation pay in 2015 will be: 240,000 rubles. : 12 months : 29, 3 days . = 682.59 rub. The total amount of vacation pay will be: 682.59 rubles. x 14 days = 9,556.26 rub.

| Dear visitors! The site offers standard solutions to problems, but each case is individual and has its own nuances. |

| If you want to find out how to solve your particular problem, call toll-free ext. 504 (consultation free) |

Calculation of vacation pay if the month is not fully worked

An employee has not worked the entire month if:

- received an average salary (was on secondment...);

- was ill or received maternity benefits;

- was on leave without pay, etc.

| Average daily earnings of the billing period not fully worked | Number of calendar days of vacation |

| Average daily earnings of the billing period not fully worked | = |

| Earnings accrued for the billing period | |

| Number of calendar days in incomplete calendar months |

If the employee has not worked the entire month

, then the number of days in this month must be recalculated using formula 3:

| Number of calendar days in an incomplete month worked | 29, 3 days | Number of calendar days in this month (28, 29, 30 or 31 days) | Number of days worked in this partial month |

Example 3

Employee Mishina’s vacation is 14 days from 04/06/2015 to 04/19/2015. The billing period is the period from 04/01/2014 to 03/31/2015. Mishina’s monthly salary is 30,000 rubles. From 03/02/2015 to 03/17/2015 (16 days) Mishina was on sick leave. In the billing period, Mishina worked 11 full months and 15 calendar days in an incomplete month (March 2015). (15 days = 31 days - 16 days of sick leave). Salary in March 2015 amounted to 10,000 rubles. In total, 340,000 rubles were accrued in the billing period. (30,000 rubles x 11 months + 10,000 rubles) Now we determine the number of calendar days in an incomplete month (March 2015): We use the above formula 3: 29, 3: 31 days. x 15 days = 14, 25 days. The total amount of vacation pay was: 340,000 rubles. : (29.3 x 11 months + 14.25 days) x 14 days vacation = 14,143.50 rub.

The procedure for calculating vacation pay was changed in 2021, in particular, the coefficient used to calculate vacation compensation for employees of enterprises changed. The change in the coefficient is due to the increase in the number of holidays in the country. The coefficient for calculating vacation pay in 2021 now has a different value, which we will discuss in this article.

We will also explain in detail how vacation pay is calculated.

When do you need to calculate the average salary?

There are well-known cases when you need to make such a calculation:

- the employee is granted paid leave;

- removal of an employee from performing basic duties with retention of salary. During this period, he may perform any special duties, act as a representative in negotiations, etc.;

- transfer of an employee due to downtime, employee participation in disaster relief;

- if the employment relationship between the employee and the employer is terminated with payment of compensation;

- when calculating payments according to sick leave;

- to calculate unused vacation upon dismissal of an employee;

- in case of downtime due to the fault of the employer;

- on business trips;

- when calculating the amounts due to be paid to an employee, the calculation of which is based on the SWP.

In addition, the employee can request a certificate of calculation of the average monthly salary from the employer.

Calculation period for vacation

The new calculation procedure does not change the formula, but changes some of its components:

- The coefficient of the average number of days worked by an employee becomes equal to 29.3.

- The average salary of a specialist is taken into account.

- The calculation period is taken into account. It is based on the amount of money earned in one day.

- The time worked in the company is also taken into account. When an employee goes on vacation after six months rather than after 12 months, vacation pay is calculated based on the shorter period.

What data is used to calculate vacation pay?

When calculating monetary remuneration for employees going on vacation, the following data is used:

- accrued allowances;

- required bonuses;

- surcharges at certain rates;

- the total number of positions held by the official and the salaries for them;

- additional payments for qualifications or class;

- increase for length of service;

- allowances for work in difficult conditions, for example, northern payments.

Paid allowances and bonuses must be approved by the director of the enterprise.

The accountant indicates the amount of all possible additional payments and the amount of vacation pay without them; the manager chooses which one to approve.

The following payments cannot affect the amount of vacation pay:

- funds allocated for business trip expenses;

- material aid;

- "sickness" payments;

- funds for transportation costs;

- compensation for food;

- payment for loss of ability to work.

Vacation pay calculation coefficient used from 2021 and formulas using it

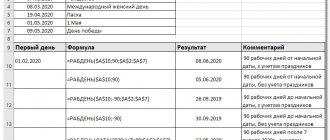

The average number of days in a month, established last year for the convenience of calculating vacation pay, is called a coefficient. Its value from 2021 is 29.3. It is used to calculate the average daily earnings, and then the funds due to the vacationer. Let's talk about several options for calculating vacation pay in 2017, taking into account the different amounts of time worked by employees:

- Full year. SDZ (average daily earnings) = payments included in the calculation of SDZ / 12 / 29.3

- Incomplete year or month. We calculate the days fully worked in each month (to do this, we multiply the number of months worked in a year by 29.3). Next, it takes into account the number of days worked in an incomplete month (29, 3 divided by the number of days in the month and multiplied with the previous indicator). We add the two obtained indicators and get the number of days used in the calculation. SDZ = total income / number of days received.

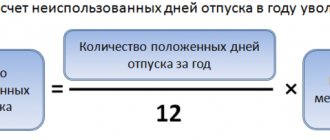

- Vacation unused by the employee. Each employee has the right to monetary compensation for vacation that he did not take. For such a calculation, the principle specified in paragraph 2 is applied, but taking into account one nuance. SDZ is multiplied by the total number of days of the employee's rest period. (see picture 1). By selecting the desired number from the table and substituting it into the formula, we obtain the required payment amount.

- Full vacation including bonus payments. Bonus + earnings for the year / 12 / 29, 3 x 28 (number of vacation days).

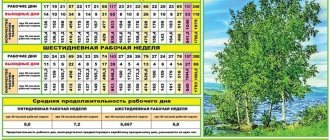

Average Number of Hours in 2021

Based on the labor legislation of the Russian Federation, working time standards are determined depending on how many hours the working week lasts.

The Ministry of Labor draws up a production calendar for each year, which indicates the number of working days, holidays, and weekends in each month. In addition, the document indicates the transfer of weekends in 2021 to other days, as well as days on which the working day can be shortened by one hour. This information is necessary to calculate payments to employees by the employer.

All the most important nuances regarding this topic will be discussed in this publication. The work activity of a citizen of the Russian Federation has certain restrictions on hours, so there is an average monthly working time standard. This is extremely useful information for many calculations of various payments by the employer.

It is also necessary to know the maximum number of working hours in a work week.

Average number of calendar days in a month

However, such a number of workdays is valid if the workweek is five days. Is a longer duration possible? Actually yes.

The legislation allows employers to extend the usual working week by one more day. It turns out that only Sunday remains a day off. In this case, one day per week should be subtracted from calendar days.

However, the number of hours should still not exceed a forty-hour work week. In Soviet times, until 1992, vacation was calculated based on a six-day working week, and to pay for it, they used the average monthly number of working days per year with a six-day week - 25.4. That is, all holidays and Sundays were subtracted from 365 days, and then divided by 12. To prevent the calculation of vacation from being distorted in leap years, the average value was taken over several years, while the number of holidays remained unchanged, as well as the number of Sundays. First, we calculate the number of calendar days in this month, for which we divide 29.3 by the number of days in the month and multiply by the number of days considered worked.

Then we calculate the average earnings per day. To do this, 29.3 must be multiplied by the number of months that do not have exclusion periods and added with the number of calendar days in the month that is not fully worked. After that, the employee’s earnings (full, for the entire calculation period) are divided by the result obtained. Employees with summarized working hours . The new Regulations take into account the decision of the Supreme Court of the Russian Federation dated July 13, 2006 No. GKPI06-637, which found it contrary to Art.

139 Labor Code of the Russian Federation, paragraph. 4 clause 13 of the Regulations on average wages, approved by Resolution No. 213, which states that for employees with cumulative working hours, the average earnings for vacation pay should be calculated not on the basis of average daily earnings, but on the basis of average hourly earnings.

Working time standards

It often happens that holidays and weekends coincide. Then the day off is postponed. Working days begin after a holiday or non-working day.

The pre-holiday working day must end an hour before its official end. This applies to all types of workweek.

The maximum working time, according to law, is no more than 40 hours per week.

Various enterprises and organizations can determine for themselves how many hours and days the working week will be. If the workweek is shorter than the legal limit, employees must still receive the full rate.

A reduction in working hours is established in the case of:

Number of working days

- If the company employs an employee of incomplete legal capacity. In this case, he is assigned 36 hours a week.

- If the employee is between fourteen and 15 years old and works during the holidays, he must work no more than 24 hours a week. If a teenager works part-time in his free time from studying, then the number of hours should not be more than half of the figure indicated above, that is, 18 hours for a teenager, 12 hours for a 14-15 year old.

- If an employee works at an enterprise that is harmful to health, the maximum number of hours should not exceed 36.

- Also, certain categories of workers have reduced working hours. Such as teachers, doctors, etc.

- Entrepreneurs can reduce working hours at the expense of an enterprise for women with disabled children or small children under 14 years of age.

Businesses have the right to decide whether to reduce hours or other benefits.

Calendar days of the billing period

Employee Mishina’s vacation is 14 days from 04/06/2015 to 04/19/2015. The billing period is the period from 04/01/2014 to 03/31/2015. Mishina’s monthly salary is 30,000 rubles. From 03/02/2015 to 03/17/2015 (16 days) Mishina was on sick leave. In the billing period, Mishina worked 11 full months and 15 calendar days in an incomplete month (March 2015). (15 days = 31 days - 16 days of sick leave). Salary in March 2015 amounted to 10,000 rubles. In total, 340,000 rubles were accrued in the billing period. (30,000 rubles x 11 months + 10,000 rubles) Now we determine the number of calendar days in an incomplete month (March 2015): We use the above formula 3: 29, 3: 31 days. x 15 days = 14, 25 days. The total amount of vacation pay was: 340,000 rubles. : (29.3 x 11 months + 14.25 days) x 14 days vacation = 14,143.50 rub. From May 25 to June 21, 2015, Petrov was granted basic paid leave. Duration of vacation is 28 calendar days. The billing period - from May 1, 2014 to April 30, 2015 - has been fully worked out. During the billing period, the employee was accrued 360,000 rubles. (RUB 30,000 x 12 months) This amount is fully included in the calculation of vacation pay in 2015. The average daily salary of an employee is: 360,000 rubles. : 12 months : 29, 3 days = 1023.89 rub. The total amount of vacation pay was: 1023.89 rubles. x 28 days = 28,668.92 rub.

- salary accrued for time worked;

- allowances and additional payments (for class, length of service, combination of professions, etc.);

- compensation payments related to working hours and working conditions - regional coefficients and percentage increases in wages, additional payments for work in hazardous and difficult working conditions, at night, in multi-shift work, on weekends and holidays and overtime;

- other bonuses and rewards.

- The coefficient of the average number of days worked by an employee becomes equal to 29.3.

- The average salary of a specialist is taken into account.

- The calculation period is taken into account. It is based on the amount of money earned in one day.

- The time worked in the company is also taken into account. When an employee goes on vacation after six months rather than after 12 months, vacation pay is calculated based on the shorter period.

Vacation pay calculation

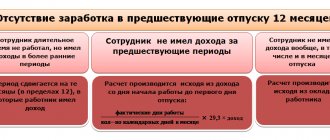

- Received payment in the form of average earnings (with the exception of breaks for feeding the child in accordance with the law). For example, the time of a business trip or other paid leave;

- Was on sick leave or maternity leave;

- Didn’t work due to downtime through no fault of his own;

- Did not participate in the strike, but due to it could not work;

- Used additional paid days off to care for disabled children and people with disabilities since childhood;

- In other cases, he was released from work with full or partial retention of wages or without pay. For example, vacation time at your own expense or parental leave.

- All payments accrued to the employee for the time excluded from the payroll period. They are listed in clause 5 of the Regulations. For example, average earnings for days of business trips and in other similar cases, social benefits, payments for downtime;

- All social benefits and other payments not related to wages. For example, financial assistance, payment of the cost of food, travel, training, utilities, recreation, gifts for children (clause 3 of the Regulations);

- Bonuses and remunerations not provided for by the remuneration system (clause “n. 2 of the Regulations”).

Important ! Non-working days to which holiday weekends are postponed are included in the calculation. If the day off coincides with a holiday, then the Government of the Russian Federation issues a resolution setting the date to which the day off and holiday is transferred.

For example, in 2021, February 23 fell on a Saturday, and the day off from that day was moved to May 10. If an employee is on vacation on May 10, this day must also be paid.

- During the billing period, immediately before or during vacation;

- The increase occurred in relation to payments not of one or several employees, but in relation to the entire organization, its branch or at least a structural unit (clause 16 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922). For example, if the salaries of all employees of the “Accounting of the enterprise” department were increased, then it is necessary to apply the coefficients when calculating vacation pay for all accountants of the enterprise. If salaries were increased only for salary accountants, the coefficient does not apply.

From May 25 to June 21, 2015, Petrov was granted basic paid leave. Duration of vacation is 28 calendar days. The billing period - from May 1, 2014 to April 30, 2015 - has been fully worked out. During the billing period, the employee was accrued 360,000 rubles. (RUB 30,000 x 12 months) This amount is fully included in the calculation of vacation pay in 2015. The average daily salary of an employee is: 360,000 rubles. : 12 months : 29, 3 days = 1023.89 rub. The total amount of vacation pay was: 1023.89 rubles. x 28 days = 28,668.92 rub. For what period are vacation pay accrued? The determining factor for this is the length of time the employee has worked for a given employer before going on leave. . The calculation period for calculating vacation pay directly depends on whether the employee has worked for the employer for a full year or not. If you have worked with the employer for more than a year before going on vacation, the period for calculating vacation pay includes 12 calendar months before the month the employee goes on vacation.

The period for calculating vacation pay is calculated according to the actual length of the month - from the 1st to the last day of the month inclusive (for example, in August on the 31st, in February on the 28th or 29th, etc.) The labor legislation of the Russian Federation determines the minimum duration of labor leave in the amount of 28 calendar days. In addition to the minimum labor leave, legislation may grant an employee the right to additional leaves, due to which the total duration of labor leave is increased. Calculation of the number of vacation days in this case will include additional days of vacation for work in harmful (dangerous) working conditions, in conditions of irregular working hours, etc. Certain categories of workers also have the right to extended vacation: military personnel, medical workers, miners, etc. The coefficient shows the average number of days in a month excluding holidays. Until April 2, the number 29.4 was written in Article 139 of the Labor Code of the Russian Federation.

Meanwhile, the number of holidays increased from 12 to 14 days back in 2012, when January 6 and 8 were added. Hence it turns out: (365 days - 14 days) / 12 months. = 29.25. Officials rounded this figure to 29.3. The previous figure 29.4 is still stated in paragraph 10 of the Regulations approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922. This norm should also be changed in the near future.

Until this is done, you still need to focus on the new coefficient. Average Number of Calendar Days in a Month

Read on the Russia-Ukraine website:

- Average Consumption of Water and Electricity in the Apartment

- Statute of Limitations for Loans from Bailiffs

- Storage periods for Time Sheets

- Standard Tax Deductions for a Disabled Child from Childhood 3 Groups

- Standard Child Tax Deduction for Alimony

Attention!

Due to recent changes in legislation, the legal information in this article may be out of date! Our lawyer can advise you free of charge - write your question in the form below.

What do you need for correct calculations?

To determine the average daily earnings you will also need to know other quantities:

- The amount of all payments received by the employee. This includes: salary and all kinds of bonus parts, bonuses, and allowances. Excluded: social payments (one-time assistance, payment for travel and food) and payments based on average earnings (sick leave, vacation, business trips);

- Settlement period is a period of time for which payments received are summed up. How many days were worked during this period?

Excluded days (for calculations of all types of compensation):

- spent on a business trip;

- absence from work due to illness;

- time off;

- additional days off provided by the employer (to care for a sick family member/disabled child);

- downtime;

- strikes;

- unscheduled unpaid leave.

Average daily earnings is the ratio of the entire amount earned by an employee during the accounting period to the twelve months (preceding) and to the average number of calendar days in a month (a coefficient of 29.3 is taken - adopted in April 2014. Article 139 of the Labor Code of the Russian Federation).

The result can be calculated manually using this formula, or you can use a special online calculator. In the form on the website you need to enter the values corresponding to each column and click on the “Calculate” button. The result will be fast and accurate.

For the convenience of calculations, you can use the online average salary calculator on our website.

When determining the amounts of each type of payment, the procedure for calculating average daily earnings is different.