Read on the topic: How to refinance a mortgage in Domklik (service from Sberbank)?

Since January 2021, changes have been made to the legislation of the Russian Federation, according to which the refinancing rate was equated to the key one. The latter is a variable indicator. It is set by the Bank of Russia, depending on economic indicators, inflation levels and other factors. It is one of the main instruments for implementing the state’s monetary policy and directly affects the cost of loans issued by commercial banks to businesses and individuals, as well as interest on deposits.

A rate reduction has a positive effect on economic development. Cheap loans stimulate business development and consumer demand. But, as you know, development occurs in certain cycles. This means that the Central Bank has to change the rate from time to time, thereby implementing regulation. Thus, during a crisis, an increase in this indicator reduces the demand for loans. Reducing lending volumes, although it slows down the growth of economic development, allows us to avoid the processes of rising inflation and worsening the crisis.

Knowing the exact value of the refinancing rate, the organization’s accountant can:

- check whether the regulatory authorities or contract partners have correctly assessed penalties;

- independently calculate the penalty for the contract, payment of wages, taxes or other payments.

To find out how much interest you need to pay in penalties, you must use the current value of the indicator at the time of delay. If the rate changed during this period, the calculation for the period of validity of each rate is carried out separately.

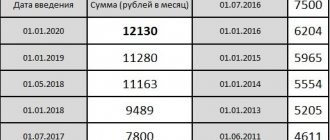

The table, which is located on the Central Bank website, contains the current value of the refinancing rate by year. It indicates the size of the indicator, the validity period and the document on the basis of which the changes came into force. It is recommended to use exclusively this table (which you also see on this page of our website), as it contains accurate and up-to-date data.

What is the refinancing rate

The refinancing rate determines under what conditions and at what interest rate banks will accept funds from the Central Bank of the Russian Federation. The key significance of the rate is that it will determine the interest rate at which clients will be able to apply for loans and deposits in Russian banks. No financial organization will provide borrowed funds below the indicator established by the Central Bank of the Russian Federation. Its size is strictly fixed and depends on the current economic situation in the country.

The indicator can be adjusted as follows:

- when inflation rises, the Central Bank decides to increase the indicator;

- When the inflation rate decreases, the interest rate decreases.

The refinancing rate is set by the Central Bank of the Russian Federation. Its size is determined by a number of factors:

- the state of the global financial market and domestic economy;

- the level of demand for loans, deposits, mortgages, loans among citizens;

- sanctions policy;

- inflation rate;

- volume of government procurement.

After analyzing all the factors and determining the indicator at the Board of Directors, information about the change in the rate is published in official sources and confirmed by the Resolution. The size of the bet can only be predicted, but it cannot be calculated using a predetermined formula.

Rate for today

Now the key rate is minimal. It was lower last time in March 2014 (then its size dropped to 7 points). At the moment, the Central Bank's forecasts are optimistic. The regulator's management does not rule out another reduction in the near future, but does not rule out a pause. As long as favorable conditions remain, the current rate will most likely not be increased. The head of the Central Bank of the Russian Federation stated that this is not planned yet, even if economic sanctions against Russia increase.

You can also leave your feedback in the comments below or ask a question.

Calculate the benefits of refinancing a mortgage or loan Loan

refinancing calculator refinansirovanie.org

Refinancing rate - table 2012-2021

| Period | Meaning, % |

| From 07/24/2020 to present | 4,25 |

| From 06/19/2020 to 07/23/2020 | 4,5 |

| From 04/24/2020 to 06/18/2020 | 5,5 |

| From 02/07/2020 to 04/23/2020 | 6 |

| From 12/13/2019 to 02/06/2020 | 6,25 |

| From 10/25/2019 to 12/12/2019 | 6,5 |

| From 09.09.2019 to 24.10.2019 | 7 |

| From 07/29/2019 to 09/09/2019 | 7,25 |

| From 06/17/2019 to 07/29/2019 | 7,50 |

| From 04/26/2019 to 06/17/2019 | 7,75 |

| From 12/16/2018 to 04/26/2019 | 7,75 |

| From 09/14/2018 to 12/16/2018 | 7,50 |

| From 03/26/2018 to 09/14/2018 | 7,25 |

| From 02/12/2018 to 03/26/2018 | 7,50 |

| From 12/18/2017 to 02/12/2018 | 7,75 |

| From 10/30/2017 to 12/18/2017 | 8,25 |

| From 09/18/2017 to 10/29/2017 | 8,50 |

| From 06/19/2017 to 09/18/2017 | 9 |

| From 05/02/2017 to 06/19/2017 | 9,25 |

| From 03/26/2017 to 05/02/2017 | 9,75 |

| From 09/19/2016 to 03/26/2017 | 10 |

| From 06/14/2016 to 09/18/2016 | 10,5 |

| From 01/01/2016 to 06/14/2016 | 11 |

| From 09/14/2012 to 12/31/2015 | 8,25 |

Is it possible for a commercial bank to take a lot of money from the Central Bank cheaper, but issue loans at a higher price?

Theoretically, this is possible. But existing competition prevents banks from establishing too large a difference. If the interest rates on loans are too high, the loss of customers is inevitable. As a result, the bank remains a double loser - there is no profit and there is nothing with which to subsequently pay the Central Bank.

In this regard, loan rates in most banking institutions vary slightly.

There are exceptions. Here we are talking about companies specializing primarily in consumer loans in large retail outlets, as well as distributing plastic cards by mail. Such organizations include:

- Home Credit Bank;

- Alfa Bank;

- Russian standard;

- OTP;

- Renaissance.

Their interest rate can vary from 30 to 70%.

Areas of influence of the Central Bank of the Russian Federation on bank credit products

Before deciding on the size of the refinancing rate, the Central Bank analyzes all the parameters that will be affected by the indicator:

- calculating the amount of payments for tax obligations;

- accrual of penalties for outstanding loans;

- payment of interest under the loan agreement;

- calculation of monetary payments for violation of obligations between lenders and borrowers.

For each indicator there is an established calculation formula. For example, to calculate the penalty for each day of delay, a value of 1/300 of the refinancing rate is used:

Penalty = debt × (refinancing rate ÷ 300) × number of days of delay

If the refinancing rate changed during the billing period, then the penalty rate is calculated for each period separately.

Ref rate or key rate?

The annual percentage that ordinary banks must pay to the Central Bank when borrowing from it is called the refinancing rate. At the same time, there is a key rate introduced in Russia since September 2013, which is the minimum percentage at which banks receive weekly loans from the Central Bank of the Russian Federation, and it is also the maximum rate on deposits accepted by the Central Bank from commercial banks.

Since 2021, the concept of “refinancing rate of the Central Bank of the Russian Federation” has actually come to mean the key rate. The Central Bank of the Russian Federation equalized these indicators with each other in 2021, but previously their values were established independently of each other (Instruction of the Central Bank of the Russian Federation dated December 11, 2015 No. 3894-U). Thus, the Central Bank’s refinancing rate for 2021 is not accepted separately, but in everyday life this term continues to be used, implying the key rate, so we will use it too.

Summary

Through the key rate, the Central Bank of the Russian Federation has a significant impact on the state’s economy and the lives of individual Russians. Therefore, it can be used as a basis for studying the current situation in the country and constructing vectors for the development of the Russian economy in the near future. However, even the most expert forecast can be destroyed overnight. There have been situations in the Russian Federation when the rate rose by several points within one day. Neither banks, nor business, nor industry, nor even ordinary citizens had time to react to the changes that had occurred.

But this does not mean that no plans can be made. On the contrary, if you evaluate not only the key rate, but also study the state of the world economy, and also take into account political prerequisites, you can predict which development options are most likely. And based on them, make certain decisions. It is especially important for Russian citizens to study such indicators before applying for a long-term loan, mortgage or when investing.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

How a specific bet value is set

The value of the key rate directly depends on the current economic situation and the inflation rate. The rate is raised if the inflation indicator jumps and vice versa.

This is how it really happens. If the Central Bank lowers the discount rate, it becomes profitable for the population to take out loans because they become cheaper. After all, you won’t have to overpay for borrowed money and you can solve your financial problems. Against this background, consumer demand increases - people begin to purchase a lot of different goods. This also applies to enterprises that will only benefit from investing extra money in their turnover. This arrangement allows you to increase production and make more profits.

Observing such popular activity, sellers begin to inflate prices for goods. And this leads to increased inflation - depreciation of money. Accordingly, the well-being of Russians is falling sharply, which causes discontent among them. This is a clear threat for the state, as it is fraught with popular riots.

Therefore, the Central Bank percentage acts as a kind of control device that stabilizes the inflation rate

. To reduce inflation, the central rate is raised. Then loans become more expensive and demand for them falls, as people stop spending money thoughtlessly. This leads to a reduction in the cost of goods.

What is included in the concept

For a deeper understanding of the refinancing rate, let’s look at how the refinancing process generally works. If we define refinancing in simple terms, then it is the refinancing of existing credit debt by issuing a new loan.

Money circulation and financial flows in each state are regulated by the Central Bank. It influences the work of all state and commercial banks, issues them licenses or revokes them. To stimulate the country's banking sector and the monetary market, the Central Bank issues loans to commercial banks, which they repay after a certain time. By issuing funds to commercial banks, the Central Bank of the Russian Federation is injecting money into the country's economy.

Banks receive money from the Central Bank for a reason, but at a certain percentage. The refinancing rate, to describe the concept in simple words, is a fixed percentage paid by a commercial bank to the Central Bank for the use of its borrowed money.

The refinancing rate (RR) is related to:

- interest rates on loans and deposits for citizens and businesses;

- the level of inflation in the country;

- economic activity of the population and business;

- establishing control over financial flows within the state.

Commercial banks never issue loans at rates lower than they receive money from the Bank of Russia. It will become unprofitable for financial companies to engage in lending under such conditions. It is important for banks not only to pay back all the debt and interest to the Central Bank, but also to “earn money” for their own needs - salaries, maintenance of offices, operating expenses. Therefore, loan rates for citizens and businesses are always higher than the refinancing rate of the Bank of Russia.

Sometimes you may come across the wording one-day refinancing rate. It is used to calculate fines and penalties. To calculate the one-day CP, the established rate is divided by the number of days in a year or any other indicator established by law, for example, by 300 or 360.

Where else does the discount rate apply?

In addition to the impact of the refinancing rate on bank loans and inflation, there are a number of other areas where this indicator is used:

- When calculating penalties for late payment for utilities. The penalty is 1/300 of the established value. For example, with a discount rate of 8%, the fine per day of delay will be 0.02% of the debt amount.

- When establishing fines against an employer due to its failure to comply with labor legislation in relation to its employees (non-payment of wages, vacation pay, settlements after dismissal, etc.). The calculation is the same as in the previous example.

- When calculating penalties when developers violated all agreed deadlines for the delivery of a construction project. For legal entities there is one standard - 1/300, for private individuals another - 1/150 of the amount indicated in the share participation agreement.

- If one of the parties fails to comply with contractual financial obligations, if the amount of dividends was not agreed upon in advance. Here, compensation is calculated differently - the current rate is divided by 360.

Relationship between the refinancing rate and taxation

We cannot ignore taxation, on which the country’s economy practically rests. Therefore, the refinancing rate plays an important role here too. In particular, this applies to the following points:

- Income received from valuable deposits is taxed if it exceeds the rate by more than 5%. For example, a citizen put money on a deposit at 15% per year, and the current Central Bank rate is 10%. You need to add 5% to this figure and you get the same 15%. This means you won't have to pay tax. If the deposit interest was 16% (exceeding the rate by 1%), then the owner of such a deposit would have to pay personal income tax on this 1%.

- When calculating penalties for failure to meet deadlines for paying various fees and taxes, they are based on the discount rate. The percentage for each day of delay is calculated according to the same principle - 1/300.

The use of the refinancing rate in all considered cases makes it possible to regulate financial stability on a global scale: to restrain inflation and price increases in the consumer sector, to standardize the amounts of fines and penalties (eliminates a biased and biased approach when calculating them).