How are previous holidays affected?

The rules for calculating vacation pay are set out in Resolution No. 922 of December 24, 2007. Read more about them here.

To calculate the payment, the employer must take the last year, sum up the income for this time and divide by the calendar days worked.

The resulting average daily earnings are multiplied by the number of days of paid leave.

The calculation process becomes more complicated if the calculation period includes events such as business trips, sick leave, downtime, absenteeism, and previous vacations.

How does past vacation affect:

- excluded from the calculation period for vacation pay;

- payment for the previous vacation is not included in the employee’s income;

- gives the right to days of annual rest, that is, they are included in the length of service.

Similar rules apply for other periods when the employee retained his job and was paid average earnings.

Are they included in the experience?

The answer to this question is contained in Article 121 of the Labor Code of the Russian Federation, which lists those time periods that are included in the length of service and give the right to days of paid rest.

Among the listed events, it is indicated that the right to leave is also given by the time when the employee was absent from work, but his job was retained.

Being on vacation (of any kind) fits the above description.

The employee does not come to work due to a vacation, and no one will take his place; upon completion, he will return to his duties.

Thus, the time spent on regular annual paid leave is included in the length of service and guarantees the provision of rest days in the amount of 2.33 days for each full month (if the annual duration is 28 days).

The length of service also includes study leave, as well as maternity leave. In addition, 14 days of personal leave during the year are taken into account.

Are they taken during the billing period?

An accountant must know exactly what needs to be included in the billing period and what not. This information is necessary for the correct calculation of vacation pay.

According to paragraph 5 of Resolution No. 922, the time when the employee was not at work, but was paid the average income, is not included in the billing period, that is, such rest days must be excluded.

What does it mean?

When calculating vacation pay, the accountant must count the number of calendar days worked during the estimated time. If a month is completely exhausted, it is considered to have 29.3 days.

If the month is incomplete, then the calculations for it are different: the days worked are divided by the total calendar days and multiplied by 29.3.

For example, if in May 2021 an employee took 14 days off, then the days worked for calculating the next vacation pay in May = 17 * 29.3 / 31.

If there was a vacation of any kind in the month, this means that the month is incomplete and the calculation for it is carried out according to the rules specified above.

In addition, those in which there were business trips, sick leave, downtime, and maternity leave are considered an incomplete month.

Do they count towards average earnings?

To calculate vacation pay, the accountant must know the amount of income for 12 months and the number of days worked during this time.

The income that can be taken into account, according to paragraph 1 of Resolution No. 922, includes wages, bonuses, allowances, additional payments to wages and, according to paragraph 5 of Resolution No. 922, does not include payments for periods when the employee maintained average earnings.

This includes the annual rest period.

Paid vacation pay is not counted as income.

How are one-time and annual bonuses and financial assistance taken into account?

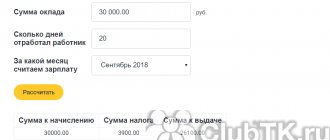

Example

Initial data:

Employee Potapova will go on vacation from September 1, 2021. For every full month of work she receives 34,000.

In April 2021, she took 14 days of annual leave, paid vacation pay amounted to 16,000, and salary for this period = 18,000.

Calculation:

How to calculate payment for current vacation:

- The calculation is carried out for the period from 09/01/2018 to 08/31/2019.

- During this segment, 34,000 * 11 + 18,000 = 392,000 were earned.

- April is an incomplete month; 16 * 29.3 / 30 = 15.63 were worked in it.

- Average daily earnings = 392,000 / (29.3 * 11 + 15.63) = 1,160.

- Vacation pay = 1160 * 14 = 16,240.

Non-working paid days in 2021

The concept of “non-working days” is absent in labor legislation. Such days have a special status because they are not weekends or non-working holidays.

Paid non-working days in connection with the coronavirus pandemic were introduced by Decrees of the President of the Russian Federation in the period from March 30 to April 3, from April 4 to April 30, and from May 6 to 8, 2021 (Decrees No. 206 of 03.25.2020, No. 239 of 02.04 .2020, No. 294 dated 04/28/2020). One non-working day also occurred in June and July: June 24 was declared a paid non-working day in connection with the Victory Parade, and July 1 was the all-Russian voting day on amendments to the Constitution of the Russian Federation (Decrees No. 345 of May 29, 2020; No. 354 of June 1. 2020, Part 5, Article 2 of Law No. 1-FKZ of March 14, 2020).

According to Decree of the President of the Russian Federation No. 316 of May 11, 2020, from May 12, 2020, a non-working days regime can also be introduced for individual enterprises in the relevant territories by decision of the authorities of the constituent entities of the Russian Federation.

basic information

Each employee can ask his employer for a short break from work. In order to take leave without saving income, the employee must explain to the boss the reason for his decision and write a statement. It is best to notify your manager about your absence, although there are emergency situations.

The employer can either agree or refuse the employee’s request. However, there is a category of persons whom the boss has no right to refuse. These are pensioners, WWII participants and disabled people. The duration of rest from work is determined by law. By agreement with management, the period is assigned individually.

Rights of working citizens

The legislation specifies a category of citizens who have the right to receive additional exemption from work for a good reason. These include:

- Members of a family that has recently welcomed a child.

- Participants of the Second World War.

- Disabled people.

- Working pensioners.

- Employees who have children or spouses of military personnel who become ill, injured, or die while on duty.

- Employees in whose families a relative has died or a wedding ceremony is taking place.

- University students have the right to administrative leave during the session.

- Mothers who have a child under 14 years of age and are raising him alone.

According to the law, the list can be expanded, and the necessary additions must be specified in collective agreements. Other categories of employees can count on additional exemption with the consent of the employer. The boss himself decides whether the reason for absence is sufficiently valid. Such circumstances may include: family difficulties, urgent departure, visiting a doctor.

It is worth noting that management does not have the right to force employees to take unpaid leave due to a decrease in work volume or production needs. However, this option is, of course, possible if there is mutual agreement between the parties.

In addition, an employer cannot refuse an unpaid vacation period to citizens who work part-time. If an employee has another place of work and in one company his paid leave is shorter than the duration of rest in the main organization, by law the employee has the right to receive compulsory time off without pay. In this case, the employee must write a statement. The holiday period must be such as to equalize both annual holidays.

Agreement of the parties

Providing unpaid time off is a right, not an obligation of the boss (unless we are talking about a certain category of citizens).

In other cases, the employee must prove that he has a valid reason for absence. These may include any urgent social needs (departure, treatment, etc.) or any emergency negative events. In a statement to the employer, the employee indicates for what reason he needs to be released from work. The manager reserves the right to make decisions. In this case, the information provided by the employee should not be disclosed to third parties. After the boss makes a decision, an order is issued to provide rest to the employee. According to the law, the following categories of citizens must be released upon first request:

- Heroes of labor.

- Persons who are currently participating in the election process at any level.

- Citizens who are proxies of the candidate taking part in the referendum.

- Spouses of military personnel whose vacation period does not coincide in duration with the rest of the wife or husband.

- Heroes of the USSR, Russian Federation.

The listed categories of citizens must also write an application for paid time off from work. However, they must indicate their status in their application, which will be considered as a valid reason.

How to calculate the average salary when leaving at the end of the month

An employee who wants to join the labor exchange as an unemployed person is provided with a certificate of average earnings for 3 months . The form for issuing such information is not fixed . But in practice, they use the form approved by letter of the Ministry of Labor of Russia dated January 10, 2019 No. 16-5/B-5.

To determine average earnings, use the formula:

Payment for work performed for 3 months / Actual number of working days × (Number of working days according to schedule for 3 months / 3) |

If an employee quits on the 31st day of the month (30th day of the month), earnings and working days of this month can be included in the calculation (determination of the RF Armed Forces dated 06/08/2006 No. KAS06-151).

Example

The employee was fired on August 31, 2020, and 3 months before that he had worked in full. In June – 20 working days, in July and August – 21 working days. The monthly salary was 26,000 rubles. Calculate the average salary for the employment service.

Solution:

(26,000 × 3) / 62 days × 62 / 3 = 1258.06 × 20.67 = 26,004.10 rubles.

Read also

11.06.2020

Recalculation of vacation pay and taxes

Personal income tax on vacation pay is withheld at the time of payment and transferred to the budget until the end of the month in which this payment occurred (subclause 1, clause 1, article 223, clause 6, article 226 of the Tax Code of the Russian Federation). The same procedure applies to additional payments arising during the recalculation of vacation. You will withhold tax from it when paying additional money and transfer it to the budget until the end of the month when it occurred. There is no need to adjust previously made calculations or reporting.

If, during recalculation, the amount of vacation pay is reduced, an excessively withheld personal income tax will arise. You will credit it when paying taxes for subsequent periods.

For more details see:

- “6-personal income tax for the 2nd quarter and vacation pay: how not to make mistakes”;

- “Updated 6-NDFL: when not needed when recalculating vacation.”

For insurance premiums, the principle is the same: if the amount of vacation pay has increased, accrue contributions for the difference in the month of the additional payment; if it has decreased, adjust the period of payment of vacation pay and offset the paid contributions for the next month.

For more details see:

- “What taxes are vacation pay subject to?”;

- “Insurance premiums for vacation pay (nuances).”

IMPORTANT! We recommend calculating and paying compensation for late payment of vacation pay for the amount of the additional payment (Article 236 of the Labor Code of the Russian Federation). Otherwise there may be liability.

Length of service and non-insurance period on sick leave

According to Part 1 of Article 7 255-FZ, the amount of sick pay depends on the employee’s length of insurance and is:

- 100% of average earnings with more than 8 years of experience;

- 80% - from 5 to 8 years;

- 60% - less than 5 years;

- If the service is less than 6 months, sick leave is paid based on the minimum wage.

When calculating the length of service, it is necessary to include all time periods when the employee worked. Such time intervals are determined according to the work book data.

You should also include in the calculation the duration of service in the army, police, Ministry of Emergency Situations and other formations where there are military or special ranks. It is these periods that are called non-insurance and are indicated separately in a special field on the certificate of incapacity for work. Military service may not be indicated in the work book. In this case, use your military ID to verify your length of service.

Example

Polikarpov M.A. handed in a sick leave certificate confirming the time of incapacity for work since April 23. to 04/25/2018. The work book indicates the following periods:

- 01.09.2009 – 15.06.2014 - studying at a university;

- 07/01/2014 – 06/30/2015 - military service (12 months);

- 07/01/2015 – 03/31/2017 - work at Delta Plus LLC (1 year 9 months);

- 04/03/2017 – present – work at LLC “Company” (11 months 50 days).

Training is not included in the insurance period; for other periods we receive:

- 1 year;

- 12 + 9 + 11 = 31 months = 2 years 7 months;

- 50 days = 1 month 20 days.

The employee's total insurance period is 3 years 8 months and 20 days. Therefore, the benefit will be paid in the amount of 60% of average earnings.