All employers are required to calculate the average salaries of subordinates.

There are rules established by law for this. To determine the average payment to workers, it is necessary to take into account a certain time period. These values are used to calculate sick leave, vacations, and compensation in cases of dismissal. Calculation manipulations are carried out according to the established methodology. Using special formulas. The main indicator here is the number of calendar days for calculating average earnings. What is this figure in 2021? Let's try to figure it out based on the legislative norms governing this area of labor relations.

Everyone knows that in 2011, updated rules for calculating the average salary of workers appeared. This directly affected the calculation of such benefits: maternity benefits, sick leave, and maternity leave. Over the following years, labor calculations were subject to changes. Therefore, the topic of salary calculation is relevant for many this year. Has the system changed? Are there any changes expected throughout the year? This information is especially important for employees of enterprises involved in such calculations: accountants, personnel officers, etc.

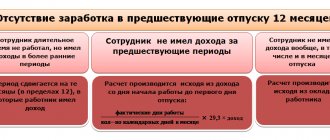

In 2021, calculations were made for the two previous periods. There have been no changes yet this year. Consequently, the average worker’s earnings are calculated according to the same scheme. Two years of work are taken into account.

The procedure for calculating average earnings in 2021

The average salary is calculated in this way: 2 previous years worked are taken, summed up, the resulting figure is divided by 730. This calculation includes amounts that are subject to deduction to the employee’s insurance account. Travel and vacation pay are also taken into account. The exceptions are daily payments, travel allowances, and maternity payments. If there were periods of child care, the amounts of their payments are also not included in the average salary.

Resolution No. 922 regulates the calculation rules and announces the list of charges included in the calculation of the average salary:

- salaries paid to employees;

- amounts for the maintenance of municipal employees;

- commission fees;

- fees for workers in the editorial offices of newspapers and other media;

- surcharges and allowances;

- compensation payments that are related to the working regime and working conditions (regulated at the district level);

- additional payments for harmful and difficult working conditions;

- rewards and bonuses.

Comparative table of charges relating to non-insurance periods

Accruals relating to non-insurance periods:

| Disability category | Withdrawals from the insurance period | Who pays |

| The worker himself | No | 3 days – enterprise, others – Social Insurance Fund |

| Caring for a family member | No | FSS |

| Pregnancy and childbirth | sick days; child care up to 1.5 years old; decree; exemption from work with pay | FSS |

| Child care up to 1.5 years old | Same | FSS |

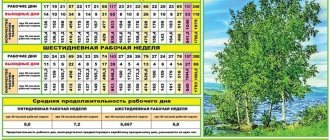

Number of calendar days taken into account

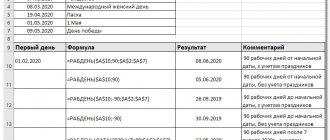

There is no specific number of days taken into account when calculating wages. When making calculations, it is customary to be guided by labor legislation and special tables.

At each enterprise, the average salary of subordinates is calculated monthly. No other way. For accurate results, accountants use online calculators or formulas. There is a convenient table that includes the days of the billing period. This table is included in Decree No. 922. It clearly states the working month and the number of working days:

- August 2021 – 31.

- September 2021 – 30.

- October 2021 – 31.

- November 2021 – 30.

- December 2021 – 31.

- January 2021 – 31.

- February 2021 – 28.

- March 2021 – 24.

- April 2021 – 30.

- May 2021 – 31.

- June 2021 – 20.

- July 2021 – 31.

How to calculate vacation pay if wages have changed

If your organization’s salary changes within the billing period, after the billing period, but before the employee’s vacation, or during the vacation, the amount of vacation pay will have to be recalculated.

This rule is established by clause 16 of the Decree of the Government of the Russian Federation of December 24, 2007 No. 922 “On the peculiarities of the procedure for calculating the average salary.”

Formula for calculating the vacation pay adjustment factor for salary increases

| Salary accrued for the month in which the increase occurred | : | Salary for each month of the billing period | = | Increase factor |

EXAMPLE 5. CALCULATION OF THE SALARY INCREASE RATIO

The employee’s salary in September and October 2021 was 20,000 rubles. From November 2021, the employee’s salary was increased to 24,000 rubles. - by 4,000 rubles. The salary increase coefficient is equal to: 24,000 rubles. : 20,000 rub. = 1.2.

If the salary was increased within the billing period, then the employee’s salary that he had before the increase must be multiplied by the increase factor.

EXAMPLE 6. CALCULATION OF HOLIDAY PAY WITH INCREASE RACTOR

From August 21, 2021, an employee goes on vacation for 28 calendar days. The employee’s salary was 20,000 rubles before February 1. From February 1 - 22,000 rubles. Let's calculate vacation pay for an employee: 1) Calculate the increase factor: 22,000 rubles. : 20,000 rub. = 1.1.2) We determine the months that will be included in the billing period:— August-December 2021;— January-July 2021.3) We calculate the amount of payments that we must take into account when paying for vacation:— we take into account the amount of wages before they are increased for 6 months (August 2021 - February 2021) with a coefficient of 1.1 and the amount of wages after an increase without a coefficient (February - July 2017) (RUB 20,000 × 6 months × 1.1) + (22,000 rubles × 6 months) = 264,000 rubles. 4) We calculate the average daily earnings: 264,000 rubles. : 29.3 calendar days days : 12 months = 750, 85 rubles. 5) We calculate the amount of vacation pay: 750, 85 rubles. × 28 days of vacation = 21,023.8 rubles.

It is also necessary to adjust the average earnings if the salary increase occurred outside the billing period, but before the moment when the employee went on vacation.

EXAMPLE 7. ADJUSTMENT OF HOLIDAY PAY IF SALARY IS INCREASED AFTER THE CALCULATION PERIOD BUT BEFORE THE START OF HOLIDAY

The employee goes on vacation from August 21, 2021 for 14 calendar days. Until August 1, his salary was 18,000 rubles. From August 1, the organization increased salaries, and the employee’s salary was: 21,600 rubles. Let’s calculate vacation pay: 1) Let’s calculate the increase factor: 21,600 rubles. : 18,000 rub. = 1.2.2) We determine the billing period. It will include: August-December 2021 and January-July 2021. The employee was not sick during the billing period, did not take vacation at his own expense - he worked the full period.3) Average earnings for calculating vacation pay will be: (RUB 18,000 × 12 months): 12 months. : 29.3 calendar days days = 614.33 rubles. 4) We calculate the amount of vacation pay for 14 calendar days: 614.33 rubles. × 14 calendars days = 8,600 rubles. 5) Let’s adjust the amount of vacation pay taking into account the coefficient. The salary was increased after the pay period, but before the start of the vacation. 8,600 rub. × 1.2 = 20,320 rub.

If wages increase during a vacation, which is very rare in practice, you only need to adjust that part of the average earnings that falls on the period from the moment the salary was increased until the end of the vacation.

EXAMPLE 8. ADJUSTMENT OF HOLIDAY PAY IF SALARY IS INCREASED DURING HOLIDAY

An employee goes on vacation from March 27, 2021 for 14 calendar days - until April 9. The employee's salary is 28,000 rubles. The billing period includes: March - December 2021 and January -February 2017. The employee was not sick in the last 12 months before the vacation. Worked throughout the entire billing period. On April 3, the company increased wages. The employee’s salary was 30,000 rubles. Let’s calculate the employee’s vacation pay: 1) We calculate the average earnings: (28,000 rubles × 12 months): 12 months. : 29.3 calendar days = 955.63 rubles. 2) We calculate vacation pay according to the general rule: 955.63 rubles. × 14 calendars days = RUB 13,378.82 3) During the vacation, wages were increased. Therefore, we will calculate the salary increase coefficient: 30,000 rubles: 28,000 rubles. = 1.07 Remember that wages are increased during vacation. This means that we need to adjust the part that falls on the period from April 3 to April 9, 2021 (7 calendar days). 4) Let’s calculate the amount of vacation pay for 7 calendar days that falls in the period before the salary increase. Average earnings before going on vacation was: 955.63 rubles. The amount of vacation pay for 7 calendar days (before the salary increase) was: 955.63 rubles. × 7 calendar days = 6,689.41 rubles. 5) Let's calculate the amount of vacation pay for the period during which the salary increase occurs - 7 calendar days. To do this, multiply the earnings by the increase factor. 955.63 rubles. × 7 calendar days × 1.07 = 7,157.67 rubles. 6) Calculate the total amount of vacation pay. To do this, you need to add two figures: the amount of vacation pay before and after the promotion. RUB 6,689.41 + RUB 7,157.67 = RUB 13,847.08 7) Let’s determine the amount that needs to be paid to the employee. Since vacation pay was paid to the employee before the vacation, we need to calculate the difference that is obtained when recalculating vacation pay for 7 calendar days after the salary increase with the coefficient. The difference must be paid to the employee. It is: 13,847.08 – 13,378.82 rubles. = 468.26 rub.

Procedure for calculating average daily earnings

To determine the average daily or average hourly salary, it is necessary to take into account the working time of the subordinate. If the company takes into account hourly time, you should find the average hourly wage. In this case, accountants are guided by the rules that are established for recording the accumulated work time. The income of employees of the billing period is taken for the actual hours worked.

Daily accounting of working time is calculated using a different formula: the employee’s income for those days worked in the calculation period. And the actual days worked in a given period.

In situations with the calculation of vacation pay, two main aspects should be taken into account: how the calculation period was worked out - fully or partially, on what days the vacation is calculated - calendar or working days. In addition, the worker’s payment is taken into account - whether it changed during the billing period. If the period is fully worked out and the vacation days are calendar days, the average daily salary is calculated as follows: the salary of the billing period is divided by 12, and the resulting figure by 29.3.

If the period has not been fully worked out, another calculation method applies: all months of the period are multiplied by 29.3. Days from the month not fully worked are added to this amount. The salary for the calculation period is taken and divided by the resulting figure.

Vacation registration

There are two types of leave - main and additional, the calculation and documentation of which are identical.

The employer must create a vacation schedule for each year. No later than 2 weeks before the start of the vacation according to the schedule, the employee must be reminded in writing about the upcoming vacation. An employee may ask to reschedule a planned vacation. In this case, the transfer is carried out in agreement with management.

If an employee goes on vacation, an order is issued for him. The calculation of vacation pay is presented in the form of a calculation certificate containing a full calculation of the average daily earnings, the amount of vacation pay, withheld tax, and the amount due to be paid to the employee.

Submit reports for employees. Kontur.Extern gives you 3 months free!

Try it

What is the procedure for paying sick leave?

In 2021, employers will partially pay for sick leave.

They only take the first three days. The rest is compensated from the Social Insurance Fund. In some cases, payment is received from the budget, which consists of insurance contributions for workers. If a worker went on sick leave before immediate dismissal or within 30 days (month) after dismissal, sick leave benefits will be paid to him in the amount of 60% of the average salary. The figure is taken for the past 2 years. The law established some restrictions on receiving payment to an employee who went on sick leave. The benefit should not exceed four deductions for the insurance portion. This year, the maximum amount of sick leave per month is calculated using the formula: 61,375 × 4 = 245,500.

Results

Calculating vacation days and payment for it is easy. The main thing is to know the basic rules (and, as we see, they have not changed in 2020-2021) and take into account some, for example, “holiday” nuances. The rest, as they say, is a matter of technique.

Our vacation pay calculator will help you calculate vacation pay or check your calculation.

Sources:

- Labor Code of the Russian Federation

- Decree of the Government of the Russian Federation dated December 24, 2007 No. 922

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How many sick days are paid per year?

Sick leave benefits are paid to all employees who find themselves in a difficult health situation: injury, poisoning, illness. In this case, the entire duration of disability is taken into account. When calculating the number of paid days, all time periods for which sick leave payments are not due are taken into account.

Benefits are accrued to a worker recognized as disabled. And they are paid for four months in a row. If a subordinate is diagnosed with tuberculosis, he is entitled to payments until he fully recovers his health. Until he can return to work obligations. There is a clause in the law according to which sick leave benefits are accrued to an employee for 75 calendar days. But for this, certain conditions must be met:

- If a person works in an organization under a temporary employment agreement, which specifies a clear term of work. It should not exceed six months.

- In case of injury to employees before the expiration of the temporary employment contract.

Thus, we can conclude that the number of calendar days for calculating average earnings is not a constant indicator. It depends on the ability to work, health, and vacation time of workers. For any calculations, formulas and a table will help.

Attention! Within our portal, you can get advice from a corporate lawyer completely free of charge. Ask your question in the form below!