When an intangible asset reaches the end of its regulated useful life, the asset is subject to write-off. Are common

Home — Articles As is known, the tax base for income tax is the profit that

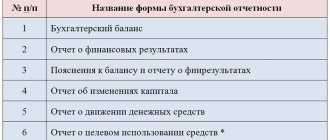

Who is responsible for preparing accounting reports? Preparation of financial statements and their presentation to

Payment of an employee upon dismissal is the employer’s obligation to pay him wages for all

Employer reporting Svetlana Melnik Expert - personnel and accounting Current as of June 1

According to the legislation of the Russian Federation, registered companies and individual entrepreneurs must submit information about employees to

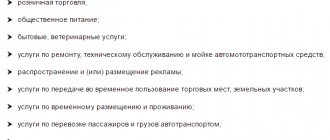

The essence of the “imputation” of UTII is one of the special tax regimes. Individual entrepreneurs who use it are classified as

How do they submit declarations under the simplified tax system now? All simplified tax collectors are required to submit annual declarations under the simplified tax system.

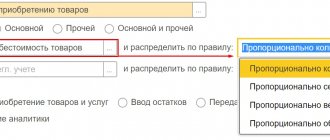

For each expense item, in the 1C:ERP program it is possible to specify a distribution option, depending

Most often, organizations think about the need for certain documents at the beginning of the year: what