An employee's calculation upon dismissal is the employer's obligation to pay him wages for all time worked and compensate for days of unused vacation. Sometimes severance pay is also required.

When terminating an employment contract for any reason, the employer makes the final payment: the Labor Code of the Russian Federation formulates the rules of this procedure in Article 140 of the Labor Code of the Russian Federation. In accordance with its requirements, the employer is obliged to give the employee all amounts and documents due to him on the last working day. The payment terms are directly regulated by labor legislation and will change only when the citizen did not work on the day of his dismissal (in this case, the corresponding amounts are paid no later than the next day after the payment request is submitted). The calculation should include:

- wage balances for days actually worked;

- amounts of vacation pay compensation for days of unused vacation;

- other compensation payments (depending on the reason for termination of the employment contract and its terms).

Let's look at each of these amounts in more detail and understand how the calculation is made upon dismissal, using an example.

Composition of payments due upon dismissal

The amounts that should be included in an employee’s calculation upon dismissal can be divided into:

- basic – mandatory for accrual;

- additional - due to the employee depending on the grounds for dismissal and the conditions of local regulations .

Let us remind you that full payment upon dismissal must be made on the date of termination of the employment relationship (Article 140 of the Labor Code of the Russian Federation).

Mandatory include :

- wages - for time worked or work performed that was not previously paid;

- compensation and incentive payments;

- compensation for unused vacation days.

What applies to additional payments upon dismissal?

Additional payments include severance pay , which is included in the calculation upon dismissal in the following cases (Article 178 of the Labor Code of the Russian Federation):

- when an employee is released as a result of liquidation or staff reduction - in the amount of the average monthly earnings for the first month on the day of dismissal. Also, if the employee has official unemployed status, another benefit is paid for the 2nd month , and also, by decision of the employment center , for the 3rd month (provided that the citizen has not found a job);

- a one-time benefit in the amount of average earnings for 2 weeks : if the employee refused to be transferred to another job for medical reasons and was fired;

- if the employee’s departure is due to conscription for military service;

- if the employee did not want to transfer to work in another location due to the employer’s relocation;

- if the dismissal is due to a change in the essential terms of the employment contract;

- in case of reinstatement of the former employee and termination of the employment contract in connection with this.

Also, additional accruals included in the employee’s calculation upon dismissal may be provided for in an employment contract or local regulations. For example, severance pay in a larger amount than provided for by the Labor Code of the Russian Federation, additional financial assistance.

Severance pay upon dismissal or similar payments cannot be accrued in the event of termination of cooperation with a worker for his guilty actions (Article 181.1 of the Labor Code of the Russian Federation).

The procedure for challenging the calculation made

A dispute may arise between the employee and the employer regarding the calculation made. For example, an employee may believe that he should be paid more money. How should you act in such a situation?

First of all, an employee who does not agree with the calculation made must provide the employer with his justified written calculation. Having received such a calculation, the employer is obliged to review it, and if it turns out that he actually made an error in the calculations, make payments according to the new calculation.

It might be interesting!

What to do if your employer delays your salary

If the employer does not agree with the calculation, he is obliged to pay the employee on the date of dismissal the amount to which he does not object. A delay in payment by the employer even in this situation is unlawful.

If the parties fail to reach an agreement regarding the amounts to be paid to the employee, the latter has the right to resolve the issue in court.

How to calculate the required salary for work performed

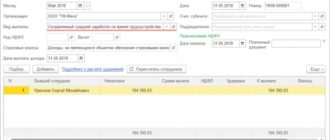

The procedure for making calculations for dismissed employees regarding amounts due but not previously paid for time worked is determined by the company’s remuneration system.

The most common at present are time-based and piece-rate forms of remuneration. They can be used in the form of simple time-based or piece-rate systems, or in the form of time-based bonus or piece-rate systems. In the second case, in addition to the basic salary, the employee is paid an incentive portion in the form of a bonus.

Example 1

The employee's salary is 25,000 rubles. He quits in August 2020, having worked 15 working days out of 21 scheduled days for the entire month. Calculate the amount due to the employee.

Solution:

25 000 × 15 / 21 = 17,857.14 rubles.

Example 2

The employee has a daily wage of 1,200 rubles. in a day. In the month of dismissal, he worked 14 days. The rest of the employee's salary was paid earlier. Make calculations at work when dismissing a worker.

Solution:

1200 × 14 = 16,800 rub.

Example 3

From the beginning of the month until the date of dismissal, the worker produced 46 units of products. The price for it is set at 650 rubles. for a unit. How much should an employee be paid upon dismissal?

Solution:

650 × 46 = 29,900 rub.

It is possible that employees will work a certain number of overtime hours at the end of the month. In this case, such hours must be paid at an increased rate - in accordance with the requirements of Art. 152 Labor Code of the Russian Federation:

- the first 2 hours – in the amount of 1.5 parts of the salary/tariff rate/piece rate;

- other excess hours - in the amount of double salary of the tariff rate, piece rate.

Design features

Requirement of Art. 122 of the Labor Code of the Russian Federation establishes that paid leave is provided to the employee annually on the basis of the vacation schedule (Article 123 of the Labor Code of the Russian Federation). During the vacation, the “vacationer” retains his place of work (position) and average earnings (Article 114 of the Labor Code of the Russian Federation), but he cannot be fired.

An employee can be dismissed only when he: has begun to perform his official duties; wrote an application for leave with subsequent dismissal, in this case the last working day will be considered the last working day, and the day of dismissal will be the last day of rest (Article 127 of the Labor Code of the Russian Federation).

The number of documents to be completed depends on whether the employer uses the following forms:

- unified (for the case under consideration - on the basis of Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1);

- own (approved independently in accordance with the law of December 6, 2011 No. 402-FZ);

- for public sector organizations (by order of the Ministry of Finance dated March 30, 2015 No. 52n, as well as departmental ones, for example, by order of the Federal Antimonopoly Service of the Russian Federation dated July 1, 2016 No. 887/16).

If unified ones are used, the personnel service prepares two orders: on providing rest to the employee (Form No. T-6); on termination of an employment contract with an employee (form No. T-8).

The same principle applies to settlement documents.

If the employer uses unified forms, the accounting service prepares two documents:

- note-calculation on the provision of rest (form No. T-60);

- settlement note upon termination of an employment contract (form No. T-61).

In public sector organizations and extra-budgetary funds, document forms of class 05 (order No. 52n) are used, in particular, the OKUD form 0504425. If unified forms are not used, then the documents are drawn up in the manner established by the budget legislation of the Russian Federation (for the public sector) or by the organization itself in accordance with Law No. 402-FZ.

How to calculate incentive payments upon dismissal

The procedure for calculating the calculation upon dismissal in terms of incentive payments depends entirely on the internal regulations of the company. As a rule, they are used in the form of bonuses or allowances . Moreover, their accrual is usually a right and not an obligation of the employer. Only if the local act clearly states obligation to pay bonuses, does it pay them under any circumstances.

However, in practice, companies link the emergence of the right to receive incentive payments with the fulfillment of certain conditions . It can be:

- making a profit by the company;

- the employee’s fulfillment of the set goals;

- exceeding plans;

- no disciplinary action.

Moreover, it is permissible to indicate in the local act the possibility of non-accrual of incentive payments in cases where the employee did not fully work for the month of dismissal . Therefore, the fact that the right to a bonus arises is closely related to the content of the employer’s internal regulations.

The procedure and amount of payments are directly linked to many parameters enshrined in the company’s internal documents. For example:

- the bonus is set in a fixed amount or as a percentage of basic earnings;

- whether the incentive payment depends on the time worked in the period for its calculation or not;

- whether its structure depends on the achievement of one or more target indicators.

Example 4

The employee is given a bonus of 5,000 rubles, which depends on the time worked. The employee worked 16 out of 21 days in the month of dismissal. Determine the amount of the premium.

Solution:

5000 × 16 / 21 = 3809.52 rubles.

Example 5

The employee is entitled to a monthly bonus of 30% of his salary. Employee salary is 25,000 rubles. In the month of dismissal, 15 days out of 20 days were worked. Calculate the premium.

Solution:

25 000 × 15 / 20 × 30% = 5625 rub.

How to calculate vacation compensation

Here is the general formula for calculating compensation for unused vacation days:

Average daily earnings × Number of days of unused vacation |

The number of days of unused vacation is determined by the following algorithm:

Important

When calculating the vacation period, the number of days less than half a month is not taken into account, and more than half is rounded up to the whole month.

To calculate the average daily earnings, the following formula is used (Resolution of the Government of the Russian Federation dated December 24, 2007 No. 922):

At the same time, payments that are not related to wages are excluded In addition, periods of release from work for good reasons with job retention are not taken into account. And if during this time the average income was maintained, it is also not taken into account.

Thus, the billing period may include fully and partially worked months. Then the calculation of average daily earnings will take the form:

Important

If an employee quits on the last day of the month, that month is included in the calculation of average daily earnings.

Indexation of average earnings with salary increases

It happens that an increase in tariff rates, that is, an employee’s salary, occurred before or during a vacation. Then the average earnings need to be indexed and vacation pay will have to be recalculated.

Three indexing options are used:

- Let's say the salary was increased during the reporting period, which means that all payments are taken into account in the calculation of vacation pay from the beginning of the period until the month of the salary increase. To do this, you need to multiply the salary or vacation pay by the increase factor (Kpv): Kpv = He / Os, where He is the new salary, and Os is the old salary;

- The increase occurred later than the billing period, but before the start of the vacation, which means the entire calculated average earnings are multiplied by the Kpv (increase coefficient);

- The increase happened during vacation - only part of vacation payments is increased, starting from the date of introduction of new salaries.

How to calculate severance pay upon dismissal

In general, the calculation of dismissal benefits is done using the formula:

Average daily (average hourly) earnings × Number of days (hours) according to the planned work schedule of the paid period |

To calculate average earnings, the provisions of the Decree of the Government of the Russian Federation of December 24, 2007 No. 922 are also used. The following algorithm is used:

They also calculate a two-week severance pay upon dismissal of an employee, as well as benefits for a month or a longer period of time.

Example 6

The employee earned 652,000 rubles 12 months before dismissal, having worked 235 days. He is entitled to two weeks' severance pay. In the two weeks following the day of dismissal – 10 working days. How to calculate benefits when dismissing a worker?

Solution:

652 000 / 235 × 10 = 27,744.68 rub.

Read also

11.06.2020