What is a penalty as an accounting object?

A penalty is a penalty determined by law or contract for failure to fulfill obligations by one party to the agreement to the other (others). From an accounting point of view, it is legitimate to consider a penalty:

- other income of the receiving party (clause 7 of PBU 9/99);

- other expenses of the obligated party (clause 11 of PBU 10/99).

Penalties as income are reflected in accounting in the reporting period in which the title documents on the basis of which the penalty was formed appeared. Such a document could be, for example, a court decision or a bilateral act of the parties to the agreement (clause 16 of PBU 9/99). The penalty as income or expense must be reflected in the balance sheet before the actual settlements of the parties (clause 76 of the regulations by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

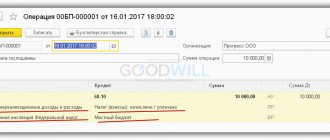

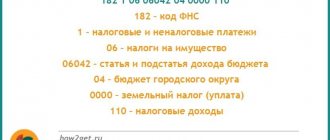

The main accounting account for generating entries for penalties is 76. Let's study how it and its subaccounts are used to reflect transactions related to the payment of a penalty by a business entity (or its receipt of corresponding income from a counterparty).

Application of PBU 18/02

When expenses are recognized in accounting in the form of the amount of an estimated liability arising in connection with a legal proceeding, a deductible temporary difference (DTD) and a corresponding deferred tax asset (DTA) arise in the organization's accounting. On the date of recognition of the expense in tax accounting in the form of an amount subject to recovery from the organization by court decision, the above-mentioned VVR and ONA are repaid. This follows from paragraphs 11, 14, 17 of the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02, approved by Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n, taking into account the explanations given in Interpretation R82 “ Temporary differences in income tax” (approved by the Accounting Methodological Center on October 15, 2008).

| Amount, rub. | Primary document | |||

| When recognizing an estimated liability in accounting | ||||

| An estimated liability to pay a penalty to the counterparty has been recognized | Accounting certificate-calculation | |||

| SHE is reflected | Accounting certificate-calculation | |||

| On the date of entry into force of the court decision | ||||

| Reflects the amount payable to the counterparty by court decision | A court decision that has entered into legal force Accounting information | |||

| ONA extinguished | Accounting information | |||

| On the date of payment of penalties to the counterparty | ||||

| The amount recovered by court decision was transferred to the counterparty | Bank account statement | |||

M.S. Radkova Consulting and Analytical Center for Accounting and Taxation

The accrual of penalties under a contract - we will consider postings for such transactions below - is a fairly common procedure in commercial relations. The procedure for accounting for such penalties depends on many factors: the organizational and legal status of the party to the agreement, the type of agreement, the taxation system - we will study them in more detail.

How are fines (penalties) paid by the obligated party to the contract reflected in accounting?

The party to the contract, which is obliged to compensate the counterparty for losses by paying a penalty, will generate the following entries:

- Dt 91.2 Kt 76 (the penalty was recognized on the basis of a title document);

- Dt 76 Kt 51 (the penalty is transferred within the time limits specified by law or contract).

If the penalty is paid to an individual in cash, this will be reflected by the posting: Dt 76 Kt 50.

In cases provided for by law, when making settlements with an individual, not only the penalties paid - fines (penalties) are reflected in the accounting records, but also the taxes and contributions accrued on them.

So, if the recipient of the penalty is an individual who is not registered as an individual entrepreneur, then the following correspondence may additionally be drawn up:

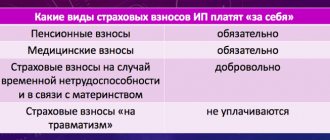

- When the penalty arose within the framework of legal relations under an agreement, payments under which are subject to insurance premiums (for example, under a civil process agreement for the performance of work by an individual):

- Dt 76 Kt 68 (personal income tax charged for a penalty);

- Dt 68 Kt 51 (NDFL paid);

- Dt 91.2 Kt 69 (contributions are calculated for the amount of the penalty - pension and medical, in accordance with subparagraph 1, paragraph 1, article 420 of the Tax Code of the Russian Federation);

- Dt 69 Kt 51 (dues paid).

- When the penalty arose within the framework of other legal relations:

- Dt 76 Kt 68 (personal income tax charged);

- Dt 68 Kt 51 (NDFL paid).

An example of such a penalty is compensation to an individual under a shared construction agreement (letter of the Ministry of Finance of Russia dated September 15, 2017 No. 03-04-06/59629). Contributions for this type of penalty are not charged.

In both of these cases, personal income tax must be paid no later than the next day after the calculations are made (clause 6 of Article 226 of the Tax Code of the Russian Federation). Contributions, if any, are made, as usual, by the 15th day of the month following the date in which the payments were made.

Online calculator

To help persons entering into contracts, a special online calculator has been developed for calculating fines and penalties. There are many of them on the Internet, let’s look at the example of the website dogovor-urist.ru.

The calculator finds the amount of the penalty based on the parameters entered in the window:

— Amount of debt; — Period of delay; — Share of the Central Bank rate; — Application of interest rates, etc.

Important point! From February 10, 2021, the key rate of the Central Bank of the Russian Federation has been lowered to 6%.

Penalty under an employment contract: how to take into account personal income tax and contributions?

If we are talking about the payment of a penalty to an individual under an employment contract (in the general case - in connection with a delay in wages), then other entries will be reflected in the accounting records:

- Dt 91 Kt 73 (the employer's penalties to the employee for wages have been accrued);

- Dt 73 Kt 51 or 50 (penalties paid).

The use of entries, which in turn are associated with the calculation of personal income tax and social contributions for penalties under employment contracts, is characterized by certain nuances.

A penalty under an employment contract is not subject to personal income tax if it is accrued within the limits established by the provisions of Art. 236 Labor Code of the Russian Federation. This is stated in paragraph 3 of Art. 217 of the Tax Code of the Russian Federation and is confirmed by the Ministry of Finance of Russia in letter dated February 28, 2017 No. 03-04-05/11096.

If a collective agreement or a specific employment contract establishes higher standards, then personal income tax is also not charged on interest. But if such standards are not established at the enterprise, then when a higher compensation is actually paid, personal income tax is charged on the difference between this compensation and the standards prescribed in the Labor Code of the Russian Federation (letter of the Ministry of Finance of Russia dated November 28, 2008 No. 03-04-05-01/450).

Contributions for penalties under an employment contract are generally always accrued (letter of the Ministry of Labor of Russia dated April 27, 2016 No. 17-4-OOG-701). Although in judicial practice there are also opposing positions (for example, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 10, 2013 No. 11031/13). But strictly speaking, according to the letter of the law, contributions must be calculated and, in order to avoid legal disputes, it is recommended.

If you need to reflect personal income tax on a contractual penalty, the following entries apply:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

- Dt 73 Kt 68 (personal income tax withheld for a penalty);

- Dt 68 Kt 51 (NDFL paid).

Insurance premiums are reflected in the same entries as in the case of a civil contract.

Normative legal acts

To find the necessary information about penalties, you should refer to the following documents proposed by law:

- In the Civil Code of the Russian Federation: Art. 530, 533, 534, 384, 720, 783.

- In 44-FZ: Article 34.

- Decree of the Government of the Russian Federation of August 30, 2017 No. 1042 “On approval of the Rules for determining the amount of a fine...” (hereinafter referred to as Decree No. 1042). It is this document that customers rely on when calculating penalties. The current liability measures related to the execution of the contract are reflected here. Courts and regulatory authorities use them in their activities.

Resolution No. 1042 states that the amount of the fine directly depends on the amount of the contract. The procedure for calculating fines for representatives of SMP and SONCO is given. And also for fines when bargaining is carried out for an increase (in this case, the law is to protect the customer). There is an emphasis on an important point: for each violation it is necessary to impose appropriate penalties.

In the Resolution you can find the term “cost obligation”. What does it mean? According to Article 424 of the Civil Code of the Russian Federation, contractual obligations that can be expressed in monetary terms are called value obligations. Thus, obligations that cannot be expressed in monetary terms will be non-valuable.

On August 14, 2021, Resolution of the Government of the Russian Federation No. 1011 dated 08/02/2019 came into effect. It amends Resolution No. 1042. What has changed in the new regulations? The adjustments affected fines.

- Now fines, by analogy with penalties, are not calculated according to the norms of RF Resolution No. 1042. The legislation of the Russian Federation establishes a different procedure for calculating fines. This is stated in paragraph 13, which was not previously in RF PP No. 1042.

- Clause 4 of this resolution has been completely changed. Now fines for non-fulfillment or improper fulfillment of procurement obligations carried out only for representatives of SMP and SONCO are set at the same amount. This is 1% of the price of the contract or its stage, but not less than 1 thousand rubles. and no more than 5 thousand rubles.

- The rules for calculating the fine for the contractor who signed the contract at the highest price (when bidding for the right to conclude) have become more complex. Now, if the contract price is less than the NMCC, then the penalty is:

10% NMCC if the contract price is less than 3 million rubles; 5% NMCC, if the price is 3-50 million rubles; 1% NMCC, if the price is 50-100 million rubles.

If the contract amount is higher than the NMCC, then the penalty is:

The difference between the first and second cases is obvious: in the first case, interest is taken from the NMCC, and in the second - from the contract price.

- The instructions regarding the total amount of the penalty have changed. Previously, it should not have exceeded the contract price. From August 14, this amount does not include penalties. That is, the total amount of accrued fines for both the customer and the contractor should not exceed the contract price.

As for the calculation of penalties, it essentially has not changed. In Resolution No. 1042, the clause regarding how penalties are calculated by the customer for late fulfillment of obligations by the supplier has become invalid. The name of the Resolution has also changed: “Rules for determining the amount of the fine accrued in the event of improper performance by the customer, non-fulfillment or improper fulfillment by the supplier (contractor, performer) of the obligations stipulated by the contract (except for delay in fulfillment of obligations by the customer, supplier (contractor, performer)."

Thus, on August 14, RF PP No. 1042 does not regulate the rules for calculating penalties, but establishes a procedure only for fines.

The calculation of the penalty has not changed - it is specified in Parts 5 and 7 of Article 34 of 44-FZ.

How to take into account the penalty for the entitled party?

In turn, the party that receives the counterparty’s penalty under the contract will reflect the following entries in the accounting records:

- Dt 76 Kt 91.1 (the penalty was recognized by the court or the parties in accordance with the supporting document);

- Dt 51 Kt 76 (the penalty is credited to the company’s current account).

Note that according to account 76, it makes sense for the authorized party (by the way, as well as the obligated party) to use a separate sub-account to account for penalties and other penalties under civil contracts - 76.2.

Separate nuances characterize the establishment of the company’s obligation to charge VAT on the received penalty (if the taxpayer works under the OSN). This issue is highly controversial. It will be useful to familiarize yourself with the arguments for and against the calculation of VAT in legal relations involving the formation of a penalty.

Question

A government institution (local government body) is located in a premises that belongs to the city administration. (The institution’s activities are carried out at the expense of the local budget, it has no income and does not provide paid services. Expenses are incurred exclusively to support the activities). In this premises three years ago, the administration city (the owner) carried out a major overhaul, as part of which air conditioners were installed. However, the cost of air conditioners was not reflected in account 101. Moreover, earlier, in the same premises, the administration installed air conditioners, and took into account their cost in account 101. This year, a decision was made on the gratuitous transfer of property located in this premises, but on the balance sheet of the city administration , our organization (local government body). It turned out that the air conditioners that were installed as part of a major overhaul are not listed on the administration’s balance sheet, and therefore cannot be transferred. How can our organization account for air conditioners? Can they be identified during inventory and taken into account? 2. This year, our organization concluded a municipal contract for the supply of cartridges. As security for the contract, the supplier transferred the amount of the security to the funds account at temporary disposal. The goods under the contract were of inadequate quality, as a result of the work carried out with the supplier, the goods were not accepted by us and the municipal contract was terminated unilaterally. A claim was made to the supplier and penalties were assessed. Part of the funds, in an amount equal to the amount of the contract security, must be transferred to the budget revenue, and the supplier must reimburse part of it independently. What transactions does a government institution need to make to withhold and transfer to budget revenue the penalty accrued to the supplier by securing the contract and funds received from the supplier?

Penalty and VAT: should tax be charged?

There are 2 opposing points of view regarding this issue:

- VAT must be charged because, in accordance with subparagraph. 2 p. 1 art. 162 of the Tax Code of the Russian Federation, the tax base for VAT is formed from any amounts that are associated with payment for goods sold (and there is no obvious reason to consider the amount of the penalty as an exception).

- There is no need to charge VAT, since the agreement on penalties in accordance with Art. 331 of the Civil Code of the Russian Federation is drawn up separately from the main agreement of the parties. Therefore, the penalty should not be associated with payment for goods (letter of the Ministry of Finance of Russia dated 06/08/2015 No. 03-07-11/33051).

If we talk about the type of penalty accrued on the basis of Art. 317.1 of the Civil Code of the Russian Federation (on interest for illegal withholding of funds), the Ministry of Finance allows VAT to be charged on the amount of such a penalty if there is a connection between it and payment for goods, without explaining the specific criteria for establishing the fact of such a connection (letter from the Ministry of Finance of Russia dated 03.08.2016 No. 03-03-06/1/45600).

Thus, the taxpayer determines whether or not to charge VAT. If there is objectively no reason to consider the penalty related to the receipt of payment for the goods, no tax is charged.

There are many types of penalties: for late payment, for downtime, for exceeding limits, etc. The Tax Guide ConsultantPlus will help you determine the calculation of VAT on the amounts of various types of penalties. You can take advantage of a free trial if you don't have K+ yet.

But if the company believes otherwise, then VAT transactions will be reflected (by the authorized party) in the accounting registers using the following entries:

- Dt 91.2 Kt 76 (sub-account “VAT”) - VAT is charged on the amount of the calculated penalty;

- Dt 76 Kt 68 - VAT is charged on the amount of the penalty received;

- Dt 68 Kt 51 - VAT on the penalty has been paid.

The penalty under the contract can be written off by the entitled party. Let's study which entries reflect this in accounting.

Deciding on the type of fine

In order to determine the accounting procedure for a fine, it is necessary to clarify its nature. So, for example, a fine assessed for violation of tax legislation in accordance with the norms of the Tax Code of the Russian Federation is reflected in profits and losses in account 99 “Profits and losses” (Order of the Ministry of Finance dated October 31, 2000 No. 94n):

Debit account 99 – Credit account 68 “Calculations for taxes and fees”

And if this is a fine payable for violating the terms of a business agreement or a fine accrued in connection with a violation of the norms of the Code of Administrative Offenses of the Russian Federation, then it will be reflected as part of other expenses (clause 11 of PBU 10/99).

Accordingly, the accrued fine receivable for violation of contractual terms will be recognized as other income (clause 7 of PBU 9/99, Order of the Ministry of Finance dated October 31, 2000 No. 94n):

Debit of account 76 “Settlements with various debtors and creditors”, subaccount “Settlements on claims” - Credit of account 91 “Other income and expenses”