Maternity leave

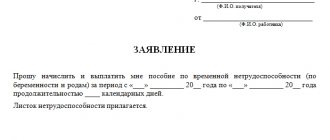

Pregnant women working in the company have the right to contact the manager with a request to provide guaranteed leave in connection with pregnancy and upcoming childbirth. The basis for such an appeal is a certificate of incapacity for work.

The vacation period, depending on certain circumstances, is:

- 70 days before birth and 70 after;

- 70 days before and 110 days after - for the birth of two or more children;

- 70 days before and 86 days after - if complications arise during childbirth;

- 70 days before and 84 days after - if the pregnancy is multiple.

During the vacation, the employee is paid state social insurance benefits.

Vacation must be calculated in total. It doesn’t matter how many days a woman used before giving birth, the leave is provided in full.

Are maternity workers included in the average number?

To answer this question, it is necessary to indicate that the calculation of the average payroll number is carried out on the basis of daily accounting of the payroll number.

And the headcount of employees must take into account not only those present on a daily basis, but also those who are absent, regardless of the reasons. It is important that the employee remains on the company's staff.

For maternity leavers - workers on vacation. related to pregnancy and childbirth, the workplace is preserved. That is, they are not excluded from the state. This category of workers is included in the payroll.

But there is a list of employees who need to be included in the payroll, but not included in the average number. These include:

- maternity workers (workers who went on maternity leave);

- persons who went on maternity leave to care for an adopted newborn child straight from the maternity hospital;

- female employees on maternity leave;

- employees who went on additional leave without pay due to training;

- employees who went on leave without pay to take an exam for admission to educational institutions.

From this provision it is clear that when asked whether those on maternity leave are included in the average payroll, the legislation gives an unequivocal answer - no.

The number of payroll and average payroll may be the same or may differ. If the indicators are different, then the average number of employees is always less than the payroll number.

After leaving maternity leave, a woman has the right to ask her employer to set her a part-time working day to breastfeed her child. In this case, workers who have been given reduced working hours must be counted in the average number as whole units.

To summarize: maternity leavers do not appear in the average number of employees.

If a woman goes on maternity leave (pregnancy and childbirth), she is said to be on maternity leave. According to labor legislation, such employees retain their jobs. But are maternity workers included in the average number? The question is fundamentally important, because the calculation of the average indicator for reference and other forms of reporting depends on the answer.

Consultant Plus

Try it for free

How is headcount calculated?

Employees can be hired by an enterprise on a temporary or permanent basis.

Indicators of the number of people in the state are the total and the list. The first option should be understood as all individuals who are in an employment relationship with the employer. The list includes all employees of the enterprise for a certain period.

In this case, the working time of each person is taken into account. This determines the need for additional hiring of people.

It is used if you need to replace a sick employee. By performing simple arithmetic operations, you can determine the payroll number.

Are maternity workers included in the average number?

If they have a certificate of incapacity for work issued by a medical institution, women expecting children have the right to go on maternity leave. The duration of such rest is determined depending on the characteristics of pregnancy. In this case, the entire period is subject to payment, and the employee retains her place of employment in the organization for the entire duration of the maternity leave.

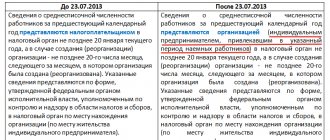

Should maternity leave be included in the average headcount? The answer must be found in Rosstat Order No. 772 dated November 22, 2017, which contains rules for filling out various statistical reporting forms. At the same time, clause 77 states that the average payroll number is determined from the payroll number indicators using a special formula. And the procedure for calculating the payroll number of the employer’s staff is given in paragraphs 77-78.

Having analyzed these provisions, it becomes clear that the meaning of the payroll should take into account not only the specialists present at the place of employment (full-time or part-time), but also persons temporarily absent. The latter include:

- Posted workers.

- Persons not working due to downtime.

- Citizens who are at home due to illness.

- Homeworkers.

- Vacations, including maternity leave.

- Truants, etc.

Thus, maternity leavers are taken into account when determining the number of payrolls. But are maternity leavers included in the average payroll? In accordance with the norms of clause 79.1, when calculating this indicator, this category of employees is not taken into account. This means that it is impossible to say that the average number includes women on maternity leave. Additionally, when determining the average indicator, the following are not taken into account:

- Company employees who are on leave due to the adoption of babies from maternity hospitals.

- Persons on “children’s” leave, with the exception of specialists who work part-time or work at home.

- Specialists undergoing training or admission to general education structures and who are on pre-vacation without pay.

Accordingly, when calculating the values of the payroll and average headcount, the accountant will receive different values. Moreover, if the employer has maternity workers on its staff, the first indicator will always be higher than the second. And if, after returning to work, a woman is registered for part-time work and receives earnings and benefits at the same time, such employees are taken into account in proportion to the actual time worked. In this case, when the average number of employees is calculated, maternity workers are included in the calculation, but according to the rules for accounting for part-time employment (clause 79.3 of Order No. 772).

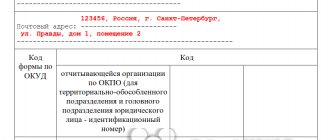

Certificate of staffing - sample

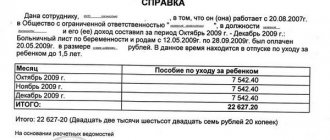

Maternity workers in the average and payroll numbers - example of calculation

Let's look at an example of how to determine the payroll and average payroll number for March 2021. Let's assume that on March 5 the company had 75 people. On March 6, 5 more employees were hired, and on March 12, 2 employees went on maternity leave. Since March 19, 8 people quit their jobs, and on March 22, one employee returned from leave under the BiR. Let's calculate the numbers:

If you need to make calculations based on annual headcount indicators, you must first determine the values for each month. Then the results obtained are summed up and divided by 12 months.

Calculation example

Let's try to calculate the average headcount for an organization using an example.

The following data is known: as of April 8, the company employed 200 people. Since April 8, 12 more people were hired, and after the 15th, 18 employees were fired. One employee went on maternity leave on April 28, and another came back from maternity leave on the 29th.

Let's try to calculate the indicator:

- the first 8 days of the NSR is 200 people;

- from April 8 to April 15, the NFR was 200 + 12 = 212 people;

- from April 15 to April 28, the NCR is 212 – 18 = 194 people;

- as of April 28, the NFR is 194 – 1 = 193 people;

- as of April 29, 193 + 1 = 194 people;

- Let's use the formula and calculate the total NFR = (204* 8+ 212*7 + 194*13 + 193*1 + 194*2) / 30 = (1632+ 1484+2522+193+388)/30 = 6219/30= 207 people.

The procedure for submitting a report (certificate) on the average headcount

In order to fulfill the tax requirements of paragraph 3 of Art. 80 all taxpayers, with the exception of individual entrepreneurs without hired employees, are required to annually submit a certificate of headcount. The current form of the document was approved by the Federal Tax Service in Order No. MM-3-25/174 dated March 29, 2007. The federal deadline for submitting the form is January 20, and for newly created companies - the 20th of the month nearest after registration. This rule also applies to reorganized companies.

Filling out the document includes calculating the headcount indicator for the year. Read more about the calculation method here. Submission format – electronic or “on paper”. Failure to comply with the deadline for submitting a report will result in a fine of 200 rubles. according to stat. 126 of the Code.

Who should not be included in the calculation?

When calculating this indicator, it is very important to know who should be taken into account and who should not. This directly affects the correctness of the calculations carried out and the provision of reporting information. So, the average headcount does not include:

- Those workers who were sent to carry out activities abroad.

- Workers provided by government organizations to increase the number of labor forces on the basis of a contract of a certain format.

- Employees performing duties based on receiving training of a professional nature.

- Lawyers who currently provide their services.

- Founders who do not receive wages.

- Those who expressed a desire to resign in the form of a formalized application.

Many sources say that you should not include external part-time workers in the calculation, but this is not entirely true. External part-time workers are included in the average headcount when calculating this indicator for the organization where they are officially employed, that is, there is an order for employment, as well as an employment contract, which is the basis for this order. Those companies where the part-time worker is not properly registered are not required to include him in the calculation of the headcount.

Regarding internal part-time workers, the person doing the accounting needs to be especially careful, since an internal part-time worker should be taken into account only once for the reliability of the data.

Average number

To calculate this indicator, we need to determine the average number of external part-time workers and persons performing work under civil contracts.

The algorithm for calculating the average number of external part-time workers is the same as when calculating the average number of part-time workers.

And the average number of persons performing work under civil contracts is determined according to the general rules for calculating the average number of employees. But there are still some peculiarities. So, if an employee on the payroll of a company has entered into a civil law agreement with it, he is counted only in the payroll and only once (as a whole unit). Also, the average number of employees under civil contracts does not include individual entrepreneurs.

Thus, by adding all three indicators, we can determine the average number of employees. Note: it must be rounded to whole units.

Nuances

If we talk about the number of employees, which is determined per month, then the attendance of workers, days off, the number of employees on business trips, etc. are taken into account. At the same time, you need to understand that this figure is influenced not only by employees who are fully employed in this organization, but also by those who work part-time, work from home, and perform a certain amount of work. Thus, the average number includes women on maternity leave, if this indicator is calculated for the year.

Regarding weekends and holidays, there is a general calculation procedure. On such days, the number of employed persons will correspond to the working day that preceded the holiday. If there are several holidays or weekends, then for each of them you must use the indicator of the last working day.

For more details, watch this video:

How is the staffing level of an organization determined?

Types of Headcount You need to know that there are different types of employees that are reported differently on your tax return and other reports.

Types of employees: 1.

Standard number. Determined by labor standards and the volume of work required to be performed.

Its meaning must be idealized.

It is a little more realistic relative to the current time than the normative one, but still close to it. This is influenced by labor productivity factors and the changing specifics of the organization itself. The composition includes only those employees who are established by the staffing table of the enterprise.

How to count part-time work?

For persons who are not fully employed in the organization, a calculation should also be made to determine the monthly number. In this case, what is taken into account is not the number of employees employed, but the number of hours that they actually performed their duties.

The number of part-time employees can be obtained by dividing the total number of hours worked by them by the total number of hours worked for that company in that month. This way we get the average.

So, the average headcount is an average for different types of headcount, which plays an important role, since it allows us to determine the average employment at the enterprise, taking into account the working hours that employees actually work.

Indeed, IN THE GENERAL CASE, according to the Instructions for filling out state statistical reporting forms on labor (Post dated May 31, 2006 No. 62), the payroll INCLUDES workers who are both on maternity leave and on leave due to with the adoption of a child under the age of three months, and on parental leave until the child reaches the age of three years.

HOWEVER, in a SPECIAL CASE - in the report, the 4-Fund FSZN is interested in the payroll with the exception of... (this category of persons) and THEREFORE in the report of the 4-Fund we are NOT ORDERED to include them in the payroll:

Scroll: Resolution of the National Statistical Committee of the Republic of Belarus 03/05/2013 No. 17

INSTRUCTIONS for filling out the state statistical reporting form 4-fund (Ministry of Labor and Social Protection) “Report on the funds of the Social Protection Fund of the Ministry of Labor and Social Protection of the Republic of Belarus”

4. Line 001 of Section I reflects the average number of insured workers, which is determined in the same way as the average number of workers in accordance with paragraph 10 of the Instructions for filling out statistical indicators on labor in the forms of state statistical observations, approved by the resolution of the Ministry of Statistics and Analysis of the Republic of Belarus dated 29 July 2008 No. 92 (National Register of Legal Acts of the Republic of Belarus, 2008, No. 222, 8/19374).

5. Line 003 of Section I is filled out only by payers - commercial organizations that have the right to pay payments to the Fund quarterly, in the report for January-December. Branches and representative offices of legal entities-payers do not fill out line 003.

Line 003 of Section I reflects the average number of employees for the legal entity as a whole, including separate divisions, and is determined as the sum of the average number of employees on the payroll for the year (except for employees on maternity leave, in connection with adoption) a child under the age of three months, caring for a child until he reaches the age of three years), the average number of people working part-time with their main place of work for other employers, the average number of people performing work under civil contracts (including those concluded with legal persons, if the subject of the contract is the provision of services for the provision, hiring of workers).

And these categories of persons are NOT INCLUDED in the average number of people in ANY case (both in general and in particular)…

dispel my doubts again: I read that maternity leavers are excluded from the average number. And in this case, she is still on sick leave, has not yet given birth and has not gone on maternity leave. Should we exclude her anyway?

“Maternity leave”, “sick leave according to the BiR” - these are all our “folk” names. It is correctly called “maternity leave”, “leave to care for a child until he reaches the age of three years”. AND SUCH female workers in the 4-fund report should be EXCLUDED from both the payroll and the average number...

And please note:

Line 003 of Section I is filled in ONLY by payers - commercial organizations that have the right to pay payments to the Fund quarterly, in the report for January-December. those. it is only in the ANNUAL report. In quarterly terms - average payroll (line 001)…

Is sick leave and vacation pay for this period used somewhere in the calculation?

— vacations at your own expense (at the initiative of the employee) and sick leave, as you can see, reduce the average number of employees.

The payroll average takes into account the incomplete output from the employee = “underperformance” due to sick leave, part-time pay, etc.

Labor holidays - no (the employee is considered to be “working”)

From July 1, 2017, a new line 8 “Identifier of the government contract, agreement (agreement)” appeared in invoices. Naturally, you only need to fill out this information if it is available. Otherwise, this line can simply be left blank.

Obtaining property tax benefits has been simplified

Starting next year, citizens entitled to benefits on property tax, transport and/or land tax will not have to submit documents confirming their right to the benefit to the Federal Tax Service.

We simplify the use of PBU 18/02

PBU 18/02 is perhaps one of the most difficult. For each transaction, the accountant calculates temporary or permanent differences. Then - SHE, IT, PNO or PNA. However, there is an alternative approach in which you can do without complex calculations.

How is an employee’s stay on maternity leave formalized at the enterprise?

Employees of an enterprise with children under three years of age can take parental leave. The right to leave is granted to the mother or father or other relative who is actually caring for the child.

Working citizens provide the employer with a package of documents:

- Application for parental leave for a child up to 3 years old and granting benefits for a child up to 1.5 years old.

- A certificate from the second parent’s place of work stating that he does not receive benefits for this child. For other relatives - certificates from both parents.

- Child's birth certificate.

- Certificates for previously born children (for calculating child benefits). For the second and subsequent children, the allowance will differ significantly.

Based on the listed documents, the enterprise issues an order to grant leave to an employee to care for a child. The duration of leave is calculated from the date the application is written until the child reaches 1.5 years of age. At the request of the employee, the leave can be extended up to 3 years.

An employee can interrupt his vacation at any time and return to work full or part-time. At the next stage, the accountant calculates the amount of benefit for a child up to one and a half years old.

The working time sheet records parental leave until the child reaches the age of three years in the T-13 form (approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 N 1).

We talked in more detail about applying for vacation in this article, and you can find out how benefits are calculated and other nuances here.

Average headcount - should we take into account women on maternity leave and those on maternity leave?

The average number of employees as of the established date is determined in accordance with the Procedure for filling out and submitting the federal state statistical observation form No. 1-T “Information on the number and wages of employees by type of activity,” approved by the resolution of the Federal State Statistics Service dated October 9, 2006. No. 56 (hereinafter referred to as the Resolution). The average number of employees for the year is determined by summing the average number of employees for all months of the reporting year and dividing the resulting amount by 12. The average number of employees for the month is calculated by summing the average number of employees for each calendar day of the month, including holidays (non-working days) and weekends, and dividing the amount received by the number of calendar days of the month. The number of employees on the payroll for a weekend or holiday is assumed to be equal to the number of employees for the previous working day (clause 8 of the Resolution). The payroll for each calendar day takes into account both those actually working and those absent from work for any reason (clause 9 of the Resolution). Please note that the following categories of employees are not included in the payroll (clause 10 of the Resolution): - external part-time workers; — performing work under civil contracts; - sent to work abroad; - sent by organizations to study at educational institutions outside of work, - receiving a scholarship at the expense of these organizations; - persons with whom an apprenticeship contract for vocational training has been concluded with a stipend paid during the apprenticeship period; - those who submitted a letter of resignation and stopped working before the expiration of the warning period or stopped working without warning the administration; - owners of this organization who do not receive wages; lawyers; - military personnel. The following employees on the payroll are not included in the average payroll (clause 11.1 of the Resolution): - women who were on maternity leave, persons who were on additional leave to care for a child; - employees studying in educational institutions and who were on additional leave without pay, as well as those entering educational institutions who were on leave without pay to take entrance exams. In addition, persons working part-time under an employment contract are taken into account in proportion to the time worked (clause 11.3 of the Resolution). If the organization has been operating for less than a full year, the average number of employees for the year is determined by summing the average number of employees for all months of the organization’s operation and dividing the resulting amount by 12 (clause 11.6 of the Resolution). Polyatkov S.S. (Information Agency "Financial Lawyer")

The list of employees of the enterprise includes...

In our case, it will be equal to 8 hours (40 hours: 5 hours). The total number of person-days will be 23 person-days. ((65 person-hours + 119 person-hours): 8 hours). 2. The next step is to calculate the average number of part-time workers per month in terms of full employment. To do this, divide the result by the number of working days in the month (there are 21 in December).

We get 1.1 people. (23 person-days: 21 days). 3. To determine the average number of employees for a month, add the previous indicator and the average number of other employees. That is, it is necessary to keep separate records of such employees.

In our case, the company has only 2 part-time employees, so the average headcount for December will be 1.1 people. In whole units - 1 person.