Dividends are part of the LLC’s profits, which participants can take for their own needs. Each time, to do this, you need to formalize a decision on the payment of dividends. In this article, you will learn how to prepare a solution for one or more participants, and you will also find relevant samples.

Payment of dividends at the end of the year: general principles

The decision on the distribution of net profit is made by persons who participate in the authorized capital of the organization.

Their composition depends on the organizational and legal form of the legal entity and the number of participants. The dividend payment schedule in 2021 can be set at the discretion of the owners. Part of the profit can be paid:

- quarterly,

- semiannually,

- once a year.

Distribution of profits between participants is not allowed if:

- the company has signs of insolvency (bankruptcy),

- the value of net assets is less than the value of the authorized capital, or will become so as a result of the distribution and transfer of profits.

When transferring part of the profit to a participant, a payment order is issued in accordance with the general procedure. The recipient of the funds transfer and his bank details are indicated. It is necessary to correctly specify the purpose of the payment when paying dividends to the founder so that the transfer can be clearly qualified by the bank and regulatory authorities. For example, like this:

“Transfer of part of the net profit to the participant in accordance with the Minutes of the meeting of shareholders No. 1 dated May 11, 2018.”

Please note that to confirm the legality of the money transfer, the bank has the right to request a copy of the specified Protocol.

Protocol containing a decision on the distribution of profits: sample

The owners' decision to distribute profits in the LLC is documented in a protocol.

The minutes of the meeting of founders on the distribution of profits are drawn up in writing and signed by the chairman and secretary of the meeting (clause 3 of Article 181.2 of the Civil Code of the Russian Federation).

The Law “On Amendments to Chapter 4 of Part One of the Civil Code of the Russian Federation and on Recognizing As Invalid...” dated 05/05/2014 No. 99-FZ established new rules for certifying the decisions of owners, which came into force on 09/01/2014. According to these rules, the minutes of the meeting must be certified by a notary. Thus, the legislator established a mechanism for confirming the composition of the founders present when the decision was made.

The law gives participants the right to provide for a non-notarial method of certifying decisions, and this possibility must be recorded in the company’s charter (clause 4 of article 12 of the LLC law). If the charter does not contain such provisions, the issue of the method of certifying decisions can be included on the agenda of the general meeting. By unanimous decision, the participants can establish any method of certifying the decision that does not contradict the law (clause 3 of Article 67.1 of the Civil Code of the Russian Federation).

Failure to comply with these legal requirements in itself does not entail the nullity of the decision of the general meeting. However, the opportunity to challenge such a decision in accordance with paragraph 1 of Art. 181.4 of the Civil Code of the Russian Federation is available to the participants of the company.

IMPORTANT! If the decision of the participants on the distribution of profit is declared invalid, the monetary payments transferred in accordance with it will become unreasonably received and must be returned (Article 1102 of the Civil Code of the Russian Federation).

This position is confirmed by arbitration practice (ruling of the 15th Arbitration Court of Appeal dated December 22, 2011 in case No. 15AP-13377/11).

Payments of dividends on shares in 2021

The decision to pay dividends to a joint stock company is made by the general meeting of shareholders. To do this, it is necessary to initiate a meeting. This can be done by the board of directors or another person determined by the charter.

The board of directors submits a proposal on the amount and procedure for distribution of profits for consideration by the general meeting of shareholders. Based on the results of the consideration and voting of shareholders, a Protocol on the results of the meeting is drawn up, which reflects the decision to transfer income to shareholders. This document is the basis for the transfer.

Part of the profit can only be paid to the shareholder by bank transfer. There is no need to issue a separate transfer order. The previously listed documents are sufficient. But if it is provided for by the organization’s document flow, then its preparation is not prohibited.

Order for payment of dividends, sample

How does the founder of an LLC make a profit?

There are two ways to make a profit:

- dividend payment;

- receiving wages.

The first method is the simplest and most understandable, however, if the corporate procedures established by the charter of the LLC are followed, questions from the regulatory authorities will not arise if such a procedure is carried out no more than once every three months.

The algorithm for paying dividends is as follows:

- The accountant calculates the company's net assets;

- A meeting of founders is convened (if there is only one, then he can resolve this issue independently);

- Minutes of the meeting are drawn up, which indicate the shares for the distribution of funds and the final date for their transfer;

- The agreed funds are paid (in compliance with the deadlines specified in the minutes of the meeting).

Despite the fact that the frequency of paying interest on profits is limited to quarterly, there is a legal way to receive revenue on a monthly basis: to do this, you need to divide the amount of assets in equal shares and pay it once a month.

If the founders wish to receive a certain amount of money monthly, they can also withdraw money through the payroll processing procedure. This method is associated with large monetary salaries, but in this case the founder of the company is guaranteed to receive a salary at the end of the month, provided that the company does not operate at a loss. In order to receive a salary, the founder must be registered as a member of the organization in accordance with current labor legislation.

In the case of registration as a staff member, the founder, as a rule, is appointed as a director or manager, and the organization pays all the necessary contributions: to the Pension Fund (22% of wages), pays for compulsory health insurance (5.1%) and contributes part of the salary to the Fund social insurance (2.9%). Ultimately, the company may lose from 30% to 50% of the founder’s salary, but the latter, in turn, receives all social guarantees.

Payment of dividends in LLC

In a limited liability company, to make a decision on the distribution of profits, it is necessary to hold a general meeting of participants. Part of the profit is distributed on the basis of the Minutes of such a meeting in proportion to the owners’ shares in the authorized capital (unless the Charter of the organization provides for a different procedure).

The deadline for paying dividends to an LLC after a decision is made cannot exceed 60 calendar days. But at the same time, the Protocol or Charter may provide for other deadlines not exceeding this date.

The procedure according to which the profit is divided

Distribution of profits in an LLC is possible only by decision of the company's owners (subclause 3, clause 2, article 67.1, clause 4, article 66 of the Civil Code of the Russian Federation). The procedure for carrying out this operation is regulated by Art. 28 of the LLC Law.

The division of profits by the founders is carried out in proportion to their contributions made to the authorized capital of the company upon its creation.

However, the law allows society to deviate from the traditional order of profit distribution and provide for any mechanisms and schemes. In this case, the procedure according to which the distribution of profits in the LLC is made between the participants must be recorded in the charter of the company.

IMPORTANT! The decision to introduce provisions into the charter regarding the procedure for distributing profits that differs from the traditional one must be adopted unanimously by the participants at the general meeting.

The frequency of profit distribution is regulated by clause 1 of Art. 28 of the LLC Law. According to its provisions, participants can distribute profits upon completion of:

- quarter;

- half a year;

- of the year.

The procedure for paying dividends to the sole founder of an LLC

When the owner of the company is a single person, there is no need to hold a meeting. To make a decision, the sole order of the owner is required.

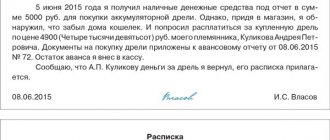

Founder's decision to pay dividends, sample

In pursuance of the decision, the General Director may issue a Transfer Order, which will become an order to the Chief Accountant to make the transfer. But this is not mandatory and is not requested by regulatory authorities. In principle, the decision of the sole owner is sufficient for transfer.

Order on payment of dividends to the sole founder, sample

What to consider when drawing up the founder’s decisions

On December 25, 2019, the judicial practice of the Supreme Court of the Russian Federation was published, which clarified the procedure for confirming the legality of the minutes of meetings of all founders. Key conclusions also apply to decisions of the sole owner:

- any decision must be certified by a notary or other means;

- the notary is present when decisions are made, or the sole participant himself visits the notary to formalize the decision (this option is very expensive);

- another method of identification is prescribed in the Charter and is used without restrictions.

We recommend taking into account current practice and making changes to the Charter. Otherwise, the decision to pay dividends may be declared invalid.

Accrual and payment of dividends, postings

The organization conducts settlements with the founders on account 75 of accounting.

Postings for payment of dividends to the founder

| Operation | Debit | Credit |

| The amount to be transferred to the participant has been accrued | 84 | 75 |

| Withholding tax on income (personal income tax or profit) | 75 | 68 |

| Transfer made to the founder | 75 | 51, 50 |

| Withheld taxes transferred to the budget | 68 | 51 |

If your organization is the founder of another company and received income from participation, then you need to reflect this operation as follows:

| Operation | Debit | Credit |

| Income received from participation | 51 | 76 |

| Funds received from participation in the authorized capital are reflected in income | 76 | 91 |

Dividend tax 2021

Taxes on dividends to the founder in 2021 are calculated depending on who is paid to: an individual or an organization.

Payment of dividends to the founder - organization is subject to income tax. Moreover, the payer acts as a tax agent, that is, he must withhold and transfer the tax to the budget. As a general rule, the rate is 13% (clause 2, clause 3, Article 284 of the Tax Code of the Russian Federation). But if the owner owns at least half of the authorized capital for at least one year, then the rate is set at 0% (clause 1, clause 3, article 284 of the Tax Code of the Russian Federation).

Income paid to the founder - an individual - is subject to personal income tax at a rate of 13% if he is a resident of the Russian Federation. If the owner is a non-resident, then the transfer of part of the net financial result to him will be taxed at a rate of 15% (paragraph 2, paragraph 3, article 224 of the Tax Code of the Russian Federation).

The tax calculation does not depend on the dividend payment calendar for 2021. For each transfer, the tax is calculated separately, and not on an accrual basis from the beginning of the year. To calculate, use the formula:

If your company itself receives income from participation in affiliated companies, then they must be taken into account when calculating the tax on amounts paid to the founders:

How to determine the amount to pay?

The procedure for distributing earned profits for the purpose of paying dividends to the sole founder of a business company is regulated by the charter of the LLC.

This constituent document (charter) must take into account all the requirements and rules provided for by 14-FZ (if we are talking about an LLC) and the Tax Code of the Russian Federation.

Of course, generally binding norms of the legislation of the Russian Federation will take precedence over the internal regulations of a separate legal entity.

When determining the amount of dividends due to a citizen - the sole participant of an LLC - it is necessary to take into account that the income paid to him in the order of distribution of the organization's profits is for him earnings subject to personal income tax.

A company owned by one owner acts as a tax agent in relation to the amounts of dividends paid to its participant.

The company withholds the appropriate tax on accrued payments (for example, personal income tax 13% on dividends to a resident citizen), and then issues the remaining amount of distributed profit (without taxes) to the legal recipient.

Taxation of dividends.

If dividends are paid to the sole founder once a year, the basis for their calculation is the net profit earned by the organization for the full calendar year.

However, the legislation (14-FZ) provides for the possibility of distributing profits not only for the year, but also for interim periods, namely, half a year, quarter.

The payment of interim dividends is usually financed from the amounts of undistributed (accumulated) profits, if the business company actually earned this profit at the time of such distribution.

The sole founder of the LLC has the right to accrue and pay dividends if the following requirements stipulated by the norms of 14-FZ (Article 29) are simultaneously met:

- The net asset indicator exceeds the sum of the authorized capital and reserve fund. This requirement must always be observed (both before payment and after settlements with the participant).

- The legal entity has no signs of financial insolvency. The bankruptcy procedure in relation to a legal entity is not implemented. Payment of dividends will not lead to problems with solvency and financial stability.

- The sole owner of the LLC fully paid the declared amount of the authorized capital.

If the above requirements are not met, the sole participant does not have the right to distribute profits. He will be able to return to the issue of paying dividends only if the existing discrepancies are completely corrected.

In order to reasonably determine and accrue the amount of dividends paid, the sole founder will need information about net profit for the relevant period (for example, for the previous year, if we are talking about the payment of annual dividends).

Then he will be able to decide which part of the earned net profit should be withdrawn in the form of a dividend payment, and which part should be used for the development of his company, that is, left in the LLC.

Read the rules for paying dividends if there are several founders here.

How to pay correctly - procedure

Of course, it is easier for the sole founder of a business company to receive well-deserved dividends than in cases where a legal entity has several co-founders.

However, a certain procedure involving the calculation, accrual and, accordingly, payment of dividends will still have to be strictly followed.

We are talking about the sequential implementation of the following actions:

- Clarification of the amount of net profit according to financial statements.

- Making a sole decision on how to dispose of the available profit remaining after payment and repayment of all necessary payments (taxes and other obligations). You need to decide how much of this profit should be allocated to dividends.

- Documentation of the rendered verdict - the decision of the sole owner of the business company.

- Issuance of an official order on dividend payment. The basis is a decision made by the sole owner of the legal entity and documented. The responsible executor is the chief accountant of the legal entity.

- The assigned amount is calculated, the corresponding tax is withheld from it (for example, personal income tax), then it is paid to the sole owner, after which the withheld tax is transferred to the budget from the current account of the legal entity. The founder can receive the due money by bank transfer or cash payment from the cash register.

- All transactions are properly recorded in the legal entity’s accounting records. The necessary reports are prepared and submitted to the tax department in a timely manner.

What documents need to be completed?

In order to pay assigned dividends to the sole participant of a legal entity (LLC), you need to correctly fill out the relevant papers:

- The first document is the decision on dividend payment made by the sole owner of the business company. If there is only one owner in the LLC, he independently makes the appropriate verdict. In this case, no meetings are required. Such paper must contain the name of the organization, details of the document itself (name, number, date), passport information of the owner, the text of the verdict (specifying the amount, term and method of payment), as well as the signature of the owner himself.

- Order of the head of the LLC to make a dividend payment to the sole founder. Such an order is usually addressed to the chief accountant. Based on this order, which contains information about the amount, method and timing of payment, all necessary actions are carried out. The order is based on the above-mentioned decision of the owner.

- A financial document through which dividend payments are issued and made. Alternatively, this could be a payment order. This document indicates the date of preparation, the date of execution, the recipient's account number, the amount to be paid, the purpose of the operation, as well as other necessary details.

How to reflect dividend payments on the balance sheet

The decision to transfer part of the profit to participants affects line 1370 “Retained earnings” of the balance sheet. When deciding on the distribution of the net financial result, the amount reflected in it is reduced.

In addition, the amount of income paid to the founders must be reflected in the Statement of Changes in Capital in the appropriate line.

The company that receives income from participation in the authorized capital reflects the amount received in the Statement of Financial Results. For this purpose, in this form of financial statements there is a separate line 2310 “Income from participation in other organizations.”

How is the net profit of previous years distributed?

The law does not directly indicate whether it is possible to distribute profits from previous years in an LLC. Considering that the period within which the founders must make a corresponding decision has not been established, it can be made either immediately following the results of the reporting period or several years after its end.

Thus, the payment of profits to the founder of the LLC for previous years can be made, and in the decision it is advisable to indicate for what period the payment is made.

Many people are interested in whether the new owner who acquired the company can distribute the profits received by the company before it was bought out. The question of how the founder of an LLC receives the profit received before the buyout is not directly regulated by law. However, in accordance with the provisions of Art. 21 of the LLC Law, all rights and obligations that arose before the acquisition of the company are transferred to the new participant, including the right to participate in the distribution of its profits. Therefore, the new owner can make such a decision and make a profit, if his predecessors did not do so.