Reasons for refusing the simplified tax system Why they refuse: Termination of activity. In this case, the liquidation procedure is practically

A bill of exchange is a security (Article 815 of the Civil Code of the Russian Federation), which certifies the obligation of the drawer or another

An interest-free loan agreement from the founder is one of the ways to quickly fill the cash gap,

The procedure for investors to apply tax deductions for VAT Clause 6, Art. 171 of the Tax Code of the Russian Federation established

Each declaration or calculation submitted to the Federal Tax Service contains on the title page a three-digit field for

Depreciation groups for fixed assets from the beginning of 2021 are determined based on new rules regulated

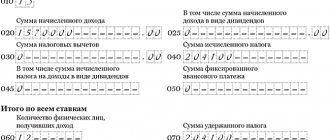

Hello! Having paid dividends to an employee, and part-time to a member of the company, I would not be surprised if the accountant wonders

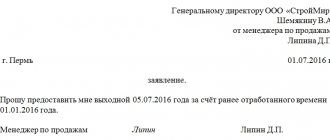

In the legislation of the Russian Federation there is neither the very concept of “time off” nor a documented form of the document

In what cases may it be necessary to recalculate vacation pay? Calculation of employee's rest pay is based on the amount

What is the procedure for calculating salaries step by step? For beginners, this information is of great importance. Usually accounting