Bill of exchange

- a security (Article 815 of the Civil Code of the Russian Federation), which certifies the obligation of the drawer or another specified payer to pay, after a certain period of time, the amount of money indicated in it to the owner. It can be used as a means of payment (to pay for goods to the seller), as collateral for a loan, as a source of income (purchase from a bank with subsequent receipt of interest).

Thus, there are two or three parties involved in the transaction. The drawer is the party who issues the bill. Recipient - the party to whom the payment is sent (in a simple case - the creditor). The drawee is the party who pays the amount for the drawer.

The promissory note does not indicate who the recipient of the money is. This is a bearer security. The transfer order is issued by the drawer (for example, the buyer of the goods) in the name of the remittor (the seller of the goods and the recipient of the funds). Such a document contains a written order to the bank (drawee) to pay the remitter the amount. When transferring, a transfer inscription is placed on the back - an endorsement.

Acceptance

is a written consent to fulfill obligations.

The drawee confirms his consent with an inscription on the front side. Accounting

is the release of money to the lender.

Peculiarities

- the unconditionality

of a monetary obligation implies that no conditions can cancel the obligation to pay a certain amount to the creditor; - independence

means that the bill is not legally tied to a specific agreement, it arises as a result of a certain transaction, but is separated from it and exists as a separate document; - a strictly defined form of completion

must contain all the necessary details; the absence of at least one of them makes it void.

Required details

- name

, label. may be simple or translated; - obligation to pay the amount.

Under a promissory note, the debtor “obliges” to pay; under a transferable bill, he “demands” from a third party; - amount of the amount

(in numbers and words). The bill can be issued with interest (this is a kind of deferred payment for which they may be required to pay). They can either be included in the amount or indicated separately; - payment term.

There are several options: upon presentation, within some time from presentation, within a certain time after drawing up, on a certain day. If the payment period is not specified, this means that it is payable upon sight within a year from the date of issuance of the bill; - place of payment

(by default - payer's location); - name and address of the payee (and payer).

In a simple case, information about the payer is not indicated, since he is the drawer. In the case of a transfer, these can be different persons, so the name and address of the payer must be indicated; - place and date of compilation;

- signature of the drawer

(in the lower right corner, handwritten). If the debtor is a legal entity, then the signatures are affixed by the director and the chief accountant, and next to it is the seal of the organization.

There may also be an aval

- surety, guarantee of payment on a bill of exchange of a third party. May be required when solvency is in doubt. On the reverse side there may be an endorsement - an endorsement that records the fact that the rights of claim under the paper have transferred to another person.

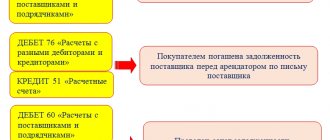

Accounting entries

To correctly reflect the receipt of a bill on the balance sheet (plus) or its debit, it is necessary to use postings. The company's accountants must correctly use the system of accounts and subaccounts, using them to form debt receipts, possible movements of income on bills, as well as write-offs in case of repayment. A sample of each posting is presented in the table.

| Operation | Giver (Dt/Kt) | Holder (Dt/Kt) |

| Debt formation | 60calc/60veks | 62veks/62calculation |

| Appearance on the balance sheet | 9 | 8 |

| Interest-bearing bill on balance sheet | 91/60veks | 62veks/91 |

| Payment of bills | 60veks/51 | 51/62veks |

| Write-offs from off-balance sheet accounts | Kt 009 | Kt 008 |

If we mean someone else’s bill of exchange as an received asset that is capable of generating income (discount type of paper), then postings are used (Dt 58-2/Kt **):

- purchase - 76;

- payment by third party paper - 62;

- acceptance as a contribution to the management company - 75;

- exchange of property occurred - 91;

- admission on a free basis - 91.

When removed from the balance sheet, the certificate should also be reflected in postings, taking into account exactly how the minus occurred. The sale or payment of a paper requires the use of Dt 76 Kt 91, but if the delivery was paid for at its expense, then it is necessary to use the posting Dt 60 Kt 91. The contribution of the bill to the capital company, at which it is removed from the balance sheet, is indicated by the combination Dt 58-1 Kt 91 If a loan was issued, then posting Dt 58-3 Kt 91 is required. A property exchange transaction in which the bill of exchange has changed the owner is reflected by the previous owner with posting Dt 10 Kt 91. Income tax (VAT) is not paid when selling a debt paper, there is no need to indicate this.

The document must be correctly formatted

Kinds

Depending on the functions performed and the conditions under which debt arises, they are classified according to different characteristics and types.

Table 1. “Classification by characteristics and types”

Data: “Accounting for securities and financial investments”, Nateprova T.Ya.

| Classification sign | Kinds | a brief description of |

| 1. Issuer | Treasury | Issued on behalf of the state by the Central Bank of the Russian Federation or the Ministry of Finance |

| Municipal | Issued by local authorities | |

| Private | Produced by private companies | |

| Banking | Issued by banks to attract temporarily free funds of companies or individuals for a certain fee | |

| 2. Economic essence | Commercial | It is based on a specific commodity transaction, the purpose is deferment of payment, provision of a commercial loan |

| Financial | The basis is the loan issued, the essence is the guarantee of its repayment | |

| Fictitious | Not related to the actual movement of goods or money | |

| 3. Payer | Simple (solo) | The payer and the drawer are one person. Two parties involved |

| Transferable (draft) | The payer and the drawer are different persons. There are three parties involved: the holder, the drawer (the debtor of the first holder), the payer (the debtor of the drawer) | |

| 4. Payment term | Definitely urgent | Specific payment date |

| Uncertainly urgent | Payment date depends on the holder | |

| 5. Availability of collateral | Secured | guaranteed by collateral, which remains at the disposal of the creditor until the debt is paid in full |

| Unsecured | not guaranteed by collateral | |

| 6. Transferability to another person | Endorsed | By endorsement they can be transferred to another person and are freely negotiable |

| Non-endorsed | Personalized, transfer to another person is impossible, the clause “not to order” is made | |

| 7. Place of payment | Domiciled | The place of payment does not coincide with the location of the payer, the first holder or the place of issue. Specified additionally |

| Undomiciled | The place of payment is the location of the drawee (transferable), the drawer (promissory note), the remitee (the first recipient) or the place of issue |

Promissory note

Bill of exchange

is a debt monetary obligation issued by the debtor to the creditor. This document, designed to document the borrower's debt to the lender, is completed in writing in accordance with legal requirements. A bill of exchange is a security and its absence of mandatory details (name, obligation to pay, amount, payment term, details of the payer and recipient of the money, signature of the drawer, etc.) makes it invalid.

Depending on how many parties are involved in the transaction, a distinction is made between simple and transferable. Solo bill (simple)

implies that there are two parties to the transaction: the debtor and the holder (creditor). That is, the payer and the debtor are one person. Essentially, it's an IOU. A promissory note contains a personal obligation of the debtor to pay the debt, while a transferable one contains an instruction to a third party to pay.

Promissory note circulation scheme

Circulation scheme

- The buyer of goods (recipient of services) issues a bill of exchange to the seller as confirmation of his obligations to pay for the goods shipped (services provided);

- The seller (creditor) ships the goods or provides services to the customer;

- The seller presents the bill for payment on time;

- The buyer pays for the goods delivered (services performed) - cancels the bill.

A bill of exchange (transferable)

involves the participation of three parties: creditor, debtor. The transfer order is issued by the drawer (for example, the buyer of the goods) in the name of the remittor (the seller of the goods and the recipient of the funds). Such a bill contains a written order to the bank (drawee) to pay the remitter the amount.

Example. Comparison of promissory note and bill of exchange.

A fruit wholesaler purchases a batch of apples worth 10 thousand rubles from an agricultural producer. But he cannot pay immediately, since the funds will be received only after the sale of a batch of goods to retail stores. The wholesaler can provide the agricultural producer with a promissory note ,

in which he undertakes to pay for the goods (with interest for deferment) by the specified date.

Also, a wholesale seller can use a bill of exchange ,

in which he obliges his debtor to pay. The retail store owes the wholesaler 20 thousand rubles for the previous batch of fruit and now the latter can “redirect” his debt (10 thousand rubles + interest) to him.

Required details

- name

(simple). Located at the top; - place and date of compilation;

- amount of the amount

(in numbers and/or in words). The bill may be drawn with interest, which may either be included in the amount or specified separately; - personal obligation of the debtor to pay the amount

by the specified date; - name and address of the payee;

- payment term.

There are several options: upon presentation, within some time from presentation, within a certain time after drawing up, on a certain day. If the payment term is not specified, this means that it is payable upon presentation within 1 year from the date of issue; - place of payment

(by default - payer's location); - signature of the drawer

(in the lower corner, handwritten). If the debtor is a legal entity, then the signatures are affixed by the director and the chief accountant, and next to it is the seal of the organization.

There may also be an aval

— guarantee, guarantee of payment of a third party. May be required when solvency is in doubt.

Sample

Sample

Bill at sight

A promissory note is a security issued by a debtor and confirming that he undertakes an obligation to pay an amount (repay) within a certain period.

Depending on the period

through which this payment must be made are distinguished:

- on a certain day.

The front side must indicate: day-month-year when payment will be made; - after a certain period

(days, months) after compilation. The day of issue is not taken into account; - upon presentation.

The bill must be presented for payment within 1 year from the date following the day of its preparation. And it will need to be repaid any day the creditor demands.

Clarifications may be made, such as: “not earlier than a certain date”, “not earlier than a certain date and not later than a certain date”.

Example 1. (Types)

On May 31, 2014, the organization paid for the supply of goods with a bill of exchange at sight in the amount of 100 thousand rubles. The interest rate is 10% per annum. The deadline for presentation for payment is June 1, 2015. The bill was presented for payment and repaid on September 1, 2014 (92 days later). Consequently, the amount was 100 thousand rubles. + (100 thousand rubles*0.10/365*92) = 100 thousand rubles. + 2520.55 = 102,520.55 rub.

Was issued on May 31, 2014 with the condition of payment on a certain day.

It is due on August 1, 2014 (in 61 days). Consequently, the amount was 100 thousand rubles. + (100 thousand rubles*0.10/365*61) = 100 thousand rubles. + 1671.23 = 101,671.23 rub.

It was issued on May 31, 2014 with the condition of payment after a certain period.

It is due in 6 months (183 days), on December 1, 2014. Consequently, the amount was 100 thousand rubles. + (100 thousand rubles * 0.10/365 * 183) = 100 thousand rubles. + 5013.7 = 105,013.7 rub.

Presentation for payment

The maturity date upon sight is presented to the debtor for payment at any time when the creditor decides, but within 1 year from the date of drawing up (or the next one). A more precise time period for repayment may be specified. To do this, make a note “not earlier than a certain date”, “not earlier than a certain date and not later than a certain date”.

There are specialized institutions - a bank, a depositary, a notary - which can be entrusted with receiving payment. The paper will be there from the moment it is presented for payment until the creditor receives the money or refuses to repay. After this, the bill will be issued either to the debtor (repayment of the amount) or to the holder (refusal to repay the amount).

Presentation for payment occurs at the place specified in the document. This may be a locality or a specific address. If the place of presentation of payment is different from that indicated, the bill will be considered improperly presented. And collecting the amount (if the debtor has difficulties with payment) in this case will be problematic.

Problems may also arise if all the necessary details are not specified. Depending on the type of bill of exchange (simple or transferable), the requirements may vary, but in general, the document must contain the following details:

- name

(simple, when the debtor himself pays, or transferable, when a third party pays); - obligation to pay the amount

(the debtor “obliges” to pay; according to a transfer, he “demands” from a third party); - amount of the amount

(in numbers and/or in words). Interest may either be included in the amount or stated separately; - payment term

(in our case - “on sight”, but within 1 year from the date of issue); - place of payment

(by default - payer's location); - name and address of the payee (and payer).

In a simple case, information about the payer is not indicated, since he is the drawer. In the case of a transfer, these can be different persons, so the name and address of the payer must be indicated; - place and date of compilation;

- signature of the debtor

(in the lower right corner, handwritten). If the debtor is a legal entity, then the signatures are affixed by the director and the chief accountant, and next to it is the seal of the organization.

Refusal to repay upon presentation

If on the day the bill is presented for payment, the creditor does not receive evidence of payment, he needs to protest with a notary in the next two business days. Refusal of acceptance or payment must be certified by an act drawn up in public order - as a protest of non-acceptance or non-payment. After this, the bearer is issued a protest act, and a special mark is made on the document.

If payment is refused when payment becomes due, the creditor has the right to bring an action against the debtor or the indorsers. During its validity period it can change several bill holders. Often it acts as a means of payment for goods, work, and services. This is done with the help of an endorsement - an endorsement. The person carrying out the transfer (endorser) on the reverse side of the document in the line “Pay to the order” indicates the new owner of the paper, below - his name and signature. And if the “No recourse to me” clause is not specified, the endorser will be jointly and severally liable with all previous owners to the creditor.

Difference from other debt documents

The main distinguishing feature of a promissory note compared to other debt securities is that it does not state the reason why one party is obligated to transfer money to the other party. If the paper is filled out correctly, then the terms of the transaction are not discussed or contested in court. They just have to be done. In essence, a bill of exchange is a confirmation of the existence of the debt itself, no matter what.

Distinctive characteristics:

- It is issued only on paper. Mainly on a special form with security elements containing the necessary details.

- There is joint liability for all persons who signed the document.

- Regulated by international law (Geneva Convention).

- The holder of the bill may change.

- Used in various fields of activity.

- Simplified collection procedure in case of refusal of the drawer to pay the debt. A protest is filed with the notary. The court then issues a foreclosure order without a hearing. Enforcement proceedings begin.

- Does not require state registration.

Discount bill

A bill of exchange can be used not only as a means of payment, but also as a way to generate income. For this purpose, you can place funds on a deposit, but it does not provide such opportunities as a bill. A bank bill is a convenient tool for placing available funds, combining profitability and the ability to use it in settlements with counterparties or as collateral.

A bank bill implies that the debtor is a bank, and the holder is legal entities, individual entrepreneurs and individuals. As a rule, banks offer interest and discount rates. Interest-bearing is a security containing the unconditional obligation of the bank to pay the bearer the amount and income on it on the terms specified in the document.

Discount

is a security that is purchased at a price below par and is redeemed at the end of the term at par. That is, the issue is carried out at a discount (discount) from the face value, and the difference between the sale price and its face value constitutes the holder’s income.

Figure 1. “Discount bill circulation scheme”

Data: “Handbook of Enterprise Financier”, N.P. Barannikova.

- A purchase agreement is concluded between the bank and the client, which specifies its denomination, sale price, repayment period and other important conditions.

- The buyer transfers a fee to the bank (sale price different from its face value).

- After receiving the funds, the bank transfers it to the client, which he can either keep for himself or use in settlements with counterparties.

- The holder uses the bill as a means of payment (at face value, not at purchased value).

- A bill of exchange can be replaced by several holders, the last of whom presents it to the bank for redemption.

- The bank redeems the bill at its face value.

Calculation of par value, purchase price and discount

nominal cost

= Sales price * (1 + (term * rate / 365*100))

Sales price

= Face value * (1 – (term * rate / 365*100))

Discount

= (Price * interest rate * term) / 365 *100

Example 1. (Definition of discount)

The organization purchased a bill of exchange with a nominal value of 20 thousand rubles from the bank. The period for presentation is 30 days. The discount rate is 10% per annum. Therefore, the discount size is determined by the formula:

Discount

= (Price * interest rate * term) / 365 *100

20 thousand rubles * 10 *30 / 365* 100 = 164.38 rubles

Example 2. (Determining the selling price)

The organization purchased a bill of exchange from the bank with a face value of 20 thousand rubles. The period for presentation is 30 days. The discount rate is 10% per annum. Therefore, the sale price of the bill is determined by the formula:

Selling price

= Nominal value * (1 – (term * rate / 365*100))

20 thousand rubles * (1 - (30*10/365*100) = 19,835.62 (Check: we add a discount to the selling price to get the face value of the bill. 19,835.62 + 164.38 = 20,000)

Example 3. (Definition of denomination)

The organization purchased a bill of exchange from the bank at a price of 19,835.62 thousand rubles. The period for presentation is 30 days. The discount rate is 10% per annum. Therefore, the denomination is determined by the formula:

nominal cost

= Sale price * (1 + (term * rate / 365*100));

9,835.62 * (1 + (30*10 / 365*100)) = 20 thousand rubles

Similar entries

- Leasing: advantages, conditions, scheme, benefits

- Bank guarantee

- Overdue loan: consequences and solutions

- What happens if you don't pay the loan?

- Loans with fixed interest rates

- What to do if you can’t pay the loan

Accounting

Usually, with the help of bills of exchange, mutual settlements are made between LLCs or PJSCs, the subject of which can be both their own securities and those issued (issued) by banking organizations. Regardless of the nature of the origin, it is necessary to maintain internal accounting of bills of exchange and create entries that reflect the entire document flow in the accounting department of the enterprise. Thanks to them, it is possible to take into account debt securities on the balance sheet of enterprises and calculate them as resources available for operations, as well as carry out re-discounting much faster.

Transactions with bills of exchange must be reflected in accounting

In many ways, accounting of bill documents is necessary for the reason that they have a nominal value included in the turnover of capital, but the method of receipt determines which category the price will be classified into. If a bill of exchange was purchased at a price that is lower than its face value, or its essence involves receiving interest at a previously determined rate, then such a document is included in financial investments, since it provides the maximum level of benefit. When a security was received at the price indicated on it, it does not need to be classified in this category, and other accounts are used to account for such a liability.