Each declaration or calculation submitted to the Federal Tax Service contains on the title page a three-digit field to fill out - “At location (accounting).” This is a required detail. The codes for each form are different: some of them are common to all declarations, some are different. Taxpayers are also divided into accounting categories. The code should be filled out carefully and in strict accordance with the instructions: for example, the same taxpayer can have the same code at the place of registration in all reports. At the same time, there is an exception form that does not obey this rule, and it uses a different code meaning (as is the case with IP).

How to fill out the “according location” field on the title page?

According to general rules, taxpayers submit a report to the tax office at their place of registration. Companies based on legal address, entrepreneurs, lawyers and notaries - based on registration. OKTMO is indicated at the place of registration, and in the field “at the location of registration” the following designations are entered (depending on the category of the tax agent):

- 120 – individual entrepreneurs using OSNO and simplified tax system;

- 125 – lawyers;

- 126 – notaries;

- 212 – Russian enterprises;

- 213 – companies recognized as the largest taxpayers.

Reference! The Federal Tax Service has identified the country's largest enterprises in a separate category. In order to get into it, the financial and economic indicators of the organization must meet a number of conditions established by order of the Federal Tax Service. One of them is the volume of accrued taxes and fees to the budget; it must exceed 1 billion rubles.

Such organizations submit reports to the tax authority at the place of their registration; the inspection should specialize specifically in the largest taxpayers.

Entrepreneurs using the patent system or imputed income submit Form 6 of personal income tax not according to registration, but according to the place of activity. What code do individuals indicate in this case? OKTMO is displayed according to the place of business activity. Also, for such individual entrepreneurs a separate registration place code is established - 320.

Tax return for individual entrepreneurs: how to fill out and submit, how to whiten income of individual entrepreneurs via the Internet

Tax return for individual entrepreneurs: 4 main types + a simple solution for correctly filling out tax return forms + 4 methods of filing reports.

Every entrepreneur who has registered a business is required by the state to provide information about his income.

Such information is carried out by submitting a tax return to the relevant regulatory authorities.

A tax return for an individual entrepreneur is a documented report reflecting the profit received for a specified period of time and the tax collected according to the chosen taxation system.

Reporting documents are submitted to tax authorities in order for the state to control the activities of citizens and their income.

Business registration is usually carried out at the place of residence. Declarations are also submitted to territorial inspectorates.

Some types of business require filing at the place of business.

Tax return for individual entrepreneurs: 4 main types

So, you are a private entrepreneur.

Now you need to decide on the tax system. Each type of taxation involves certain types of activities. Sometimes the location of the activity is also important.

There are 4 main ways to pay tax for individual entrepreneurs:

1) Tax return for UTII

The document indicates the approximate income on which a tax of 15% is levied.

Even if there was no business activity, a report must be submitted.

With this form of taxation, the possibility of filing a “zero” declaration is not provided.

Reporting documents for UTII are submitted to the tax authorities quarterly.

Submission deadline: 20th day of the month following the reporting quarter. This is the only type of reporting documents for this type of taxation.

The report should be submitted at the place of business.

For some types of activities, when it is difficult to determine the place of provision of services (for example, delivery of food products to order), reporting forms are submitted at the place of residence of the entrepreneur.

UTII declarations can be found on the official website (https://www.nalog.ru/rn77/taxation/submission_statements/#title8) or taken to the Federal Tax Service by visiting the authority in person.

UTII is charged to individual entrepreneurs for the following types of business:

- public catering;

- rental of housing, land plots, retail outlets;

- transport services;

- retail;

- domestic services;

- maintenance;

- veterinary services;

- outdoor advertising.

2) Declaration for the simplified tax system

This type of report is submitted at the place of residence of the entrepreneur.

The established form is personal income tax-3.

If there is no movement of money in bank accounts, there are no objects of taxation themselves, or the individual entrepreneur is closed, zero reporting is submitted according to the simplified tax system (quarterly).

Mandatory fields that must be filled in the tax report form according to the simplified tax system:

- Full name (or registered name of the organization),

- TIN,

- tax as a percentage,

- tax period,

- OKVED code,

- insurance premiums,

- KBK (budget classification code),

- OKATO.

The declaration is submitted once a year. It is possible to submit the document until April 30 of the next calendar year.

There are 2 ways to submit a document:

- The first option indicates profit and costs for the current period.

- In the second option, income and the amount of tax reduction provided by law are indicated.

You can also find forms on the official website or get them by visiting the tax office in person.

Recently, a declaration appeared with a 0% rate under the simplified tax system for entrepreneurs in Crimea, Sevastopol and regions where tax holidays have been introduced.

3) Declaration for Unified Agricultural Tax

From the title of the document it is clear what type of activity it provides for (single agricultural tax).

Submitted at the location of the land plot owned or leased by the individual entrepreneur.

The stipulated period of time for reporting on receipt of income is 1 calendar year.

Deadline for submitting the document: until March 31 of the following year after the reporting period.

If there was no agricultural activity, then the declaration is submitted before the 25th day of the month following its cessation.

Fines will be assessed for failure to submit a report on time.

4) Declarations for OSN

The General Taxation System (GTS) obliges an individual entrepreneur to provide a declaration of receipt of profit in the form of personal income tax-4.

Deadline for submission: one month + 5 days from the date of profit taking.

For an individual entrepreneur who is just starting his work, its submission is mandatory. The document calculates advance payments.

For individual entrepreneurs who have been working for more than a year, these payments can be calculated based on previous data.

Therefore, there are no penalties for failure to submit reports.

OSN is a more complex form of reporting.

It can combine several methods of paying taxes: reporting on UTII, unified simplified reporting, reporting on transport tax, etc. can be submitted.

A VAT declaration is also provided.

The reporting period for this form of taxation is a quarter. The 25th day of the next month after the reporting period is the final date for submitting the document.

If there were no movements of funds in the accounts, then the entrepreneur has the opportunity to report on a single simplified declaration:

Value Added Tax (VAT) is charged to participants in foreign trade activities (Non-Economic Activities) who export and import goods.

There is a reporting form for indirect taxes for individual entrepreneurs who deliver goods through the Customs Union.

This is a new type of reporting. The VAT return can be submitted as adjusted.

This happens if errors are detected in the submitted document: the specified tax is less or more than the required amount.

Filling out tax return forms

As a rule, entrepreneurs themselves successfully maintain reports.

Especially if there are no employees.

Since the law does not provide for personal completion of reporting documents, the possibility of contacting an accountant is not excluded.

You can also use the services of firms specialized in tax reporting activities.

Intermediary services are not cheap.

And a specialist does not always have the proper skills to fill out complex reports.

There is a good alternative in the form of online accounting programs and online services:

- https://service-online.su/forms/nalog/deklaratsiya_usn/ (free);

- https://www.nalogia.ru/declaration/online.php (service cost - 599 rubles);

- https://verni-nalog.ru/3-ndfl (paid service - 400 rubles);

- https://ndflka.ru (for one you will have to pay 599 rubles).

Based on the information provided, the amount of taxes is automatically calculated, and tips and instructions for filling out forms are provided.

Next, all you have to do is print out the completed completed declaration.

It is important to ensure that the forms are up to date, as their samples change quite often.

4 options for providing documents for reporting

There are 4 reporting methods. You can submit on paper or electronic media:

- by mail;

- via the Internet in electronic form (link to the required section of the Federal Tax Service website - https://www.nalog.ru/rn77/service/pred_elv/);

- in person (look for the desired branch on the official website of the Federal Tax Service https://www.nalog.ru/rn77);

- your representative at the IFSN.

If the document is submitted physically, the employee will endorse it (put a stamp on it) and record the date of submission.

This is the most important thing when submitting tax reporting documents.

If you fail to meet the deadlines, you may be subject to penalties.

Therefore, the method of transmitting documents by mail is not always convenient due to the long delivery period.

If you nevertheless decide to use postal services, then the document must be sent no later than 24 hours before the final deadline for its delivery.

The letter should be issued as a registered letter, with notification and inventory.

You should still have in your hands a duplicate of the sent documents, certified by the postal seal.

Electronic reporting is very popular now.

Moreover, online services that help you correctly prepare tax documentation also include a service for transferring it.

To use this method of sending papers, you need to obtain a personal electronic signature and enter into an agreement with a special operator.

Special software is also installed.

Detailed instructions with up-to-date information are available on the official website of the Federal Tax Service: https://www.nalog.ru/rn77/service/pred_elv/.

It is better to submit tax reports in advance, as there may be interruptions in the Internet network.

The date of sending the documentation is the date of application to the tax authority.

The video explains how to report on your activities for the year to the tax office:

A tax return for individual entrepreneurs is not the only tax reporting tool you should know about.

There is also reporting on cash transactions, additional taxes (if any) and for employees.

If an entrepreneur decides to close the business, additional reporting forms are submitted even for an incomplete tax period.

Examples of the design of all forms can be found on the official website of the Federal Tax Service using the links provided in the text.

Here you will also find news about changes in taxation systems.

Enter your email and receive new articles by email

Source: https://ndpr.ru/ooo120/nalogovaya-deklaraciya-dlya-ip-kak-zapolnit-i-podat-kak-obelit-doxody-ip-cherez-internet/

Features of filling out the form for organizations with separate divisions

Enterprises with separate divisions submit several forms 6 personal income tax. According to the territorial location of the organization itself and the place of registration of all its branches. In each case, different OKTMO codes are filled in. Reports are sent to tax inspectorates in accordance with the specified OKTMO.

However, this only applies to those companies in which separate divisions independently make payments to their employees. If all income is paid by the parent company, Form 6 personal income tax is submitted only according to it.

If the employee was paid income simultaneously by the parent company and the division, it is reflected in both reports. Cash paid by the head office is reflected at the place of registration of the organization itself. Income received from the division is indicated in the report at the location of the branch.

When submitting 6 personal income taxes for a separate subdivision, 220 is entered in the form as the code for the location of the accounting. The checkpoint and OKTMO of the separate subdivision are indicated.

Let's look at the procedure for filling out the title page of Form 6 of Personal Income Tax using the following example: Pioneer LLC is located in Moscow and has a separate division in Kazan. The Kazan office independently pays wages to its employees. The enterprise must submit two reports: to the Moscow inspectorate for the head office and to the Kazan inspectorate for the division. The title page will look like this:

- for head office

- for a separate unit

What to do if the location code for a separate division is indicated incorrectly, instead of 220, 212 is filled in? In this case, you must report the error to the tax inspector and submit an adjusted report, in which you must indicate the correct code. Not all tax inspectorates require an updated report; in some cases, a letter explaining the error may be sufficient.

Important! If you incorrectly indicate code 212 at the location of a separate division, the report may be assigned to the parent company and a fine will be imposed for failure to submit a report for the division on time.

Separate divisions of foreign companies located in Russia also submit reports on employee income. In the calculation of 6 personal income tax, they indicate 335 as the location code. OKTMO is filled out in accordance with the territorial location of the foreign subsidiary.

Tax return of an individual entrepreneur

A tax return for individual entrepreneurs is a mandatory document that all entrepreneurs submit. Even those for whom the period turned out to be unprofitable.

If you do not provide the required paper on time, you can not only get bogged down in fines, but the tax inspectorate has the right to freeze the bank account and organize an administrative audit.

What is a tax return

The essence of the term “individual entrepreneur tax return” is disclosed in the Tax Code of Russia. In simple words, this is an official document through which an individual entrepreneur provides tax information about the amount of income for a certain period.

For each tax report, a special form is provided, that is, it is impossible to say that all businessmen submit the same type of document. But all types of declarations consist of approximately the same sections:

- Title page: final results of calculations from the second section, insurance premiums, tax amount.

- Section 1: INN, full name, correction number, telephone number, number and name of the tax authority, tax period codes and OKVED, signatures, date.

- Section 2: BCC, OKTMO code, actual address at which the activity is carried out, calculation of the duty and code of the type of activity.

Types of declarations

All individual entrepreneur declarations can be divided into basic, clarified, zero and final. The main one is submitted by all entrepreneurs. It contains information about all income received in the course of business activities. But other types should be issued only in special cases:

- Only individual taxpayers can submit the updated form. Those who need to make adjustments to the already submitted main document. It can be requested by the tax service if it finds inaccuracies or errors in the calculations, but the entrepreneur himself can submit it. The updated document is drawn up in the same way as the primary one, but on the front side of the form there will be a special stamp, and in the second section there will be a serial number of the correction.

- Zero is submitted by those businessmen whose activities were suspended during the reporting period. Not everyone can resort to this form of reporting and be exempt from paying tax - UTII payers calculate the amount payable not based on real income, but on the one imputed by the state, so a zero declaration is not provided for them.

- The final one is the one that is submitted before the closure of the individual entrepreneur . If you do not report to the Federal Tax Service, it will not accept the application for closure.

A more detailed classification of declarations depends on the types of taxes for which the businessman must report. And their list depends on the chosen taxation system.

IP on basis

OSNO is the most difficult mode. There are no concessions on it - only full reporting and payment of all possible tax deductions:

TaxRateTax base

| Personal income tax | 13% | All income for the tax period |

| VAT | 0—18% | Cost of goods/services on the day of sale |

| Property tax | 2,2% | Cadastral value of individual entrepreneur property |

The Russian government is striving to make accounting easier for entrepreneurs and is developing simplified regimes with less accounting red tape.

But many businessmen still work with OSNO, since large counterparties give preference to those who pay VAT.

This way they can reduce their tax payments.

Personal income tax reporting

Personal income tax payers submit 2 types of reports - on forms 3-NDFL and 4-NDFL. The latter is filled out once, as soon as the individual entrepreneur switches to OSNO and receives his first income for the year. It should indicate the amount of income received and the amount of expected annual income.

Using this information, tax authorities will calculate advance payments and send the payer a notification with the specified amounts and payment deadlines. After this, you cannot submit a 4-NDFL declaration. Even next year.

The income declaration of individual entrepreneurs on form 3-NDFL is submitted at the end of each reporting year. The deadline is April 30 . When this day falls on a weekend or holiday, the date shifts towards the nearest working day.

Report typeTimeframeFormat

| 3-NDFL | Previously April 30 | Paper |

| 4-NDFL | Within five days after receiving the first profit | Paper |

VAT reporting

To report VAT, form KND 1151001 must be submitted. Data is entered into it from the following documents:

- invoices;

- purchase/sale books;

- other accounting registers.

KND 1151001 is due by the 25th day of the month following the reporting quarter. When an individual entrepreneur does not work for the entire period and can confirm this by the absence of movements in accounts and cash registers, he has the right to submit a general simplified declaration instead of quarterly ones.

For property tax

The entrepreneur himself does not calculate property taxes. This is done by the tax office, after which it sends a notification to the taxpayer, which indicates the payment amount and payment deadline. Therefore, declaration for this type of duty is not carried out .

Reporting on UTII

UTII is calculated based on a certain ideal income that the state has assigned for a specific activity and region.

And this is a huge disadvantage of the regime, because you will still have to submit a tax return for individual entrepreneurs who did not function in the reporting period.

The duty must be paid, even if the enterprise’s profit is zero.

Not everyone can work under UTII, since the mode is not available in all regions; in Moscow, for example, it is not, and has clear restrictions:

- Less than 100 employees;

- Less than 25% share of participation of other organizations;

- Eligible activity.

In 2021, individual entrepreneurs must submit a new form for UTII - KND 1152017. The following fields have been changed in it:

- Removed line for KBK from the first section;

- OKUN codes are excluded from the second;

- In Appendix 3, paragraphs 4 and 5 have been updated;

- New barcodes;

- In the third section, a field was added for contributions for oneself under number 030; until 2021, individual entrepreneurs could reduce the tax only on fees paid in favor of employees, so only line 020 was provided in the form;

- New wording has appeared in fields 020, 030 of section number three.

The declaration of imputation is submitted quarterly. The deadline is the 20th day of the month following the reporting quarter.

QuarterDate (to)

| First quarter | 20 April |

| Second | July 20 |

| Third | The 20th of October |

| Fourth | January 20th |

If an individual entrepreneur has a small staff, up to 25 people, he has the right to submit a tax return in any of the existing ways: in person, through a representative, by mail, via the Internet. And if there are more than 25 people, only electronic submission is allowed.

https://www.youtube.com/watch?v=5Yj06Z2WQeA

When filling out a tax return, you should consider the following nuances:

- The K1 coefficient today is the same as in 2021 - 1.798;

- You can find out K2 (line 060) only from local authorities, many of them have changed;

- K2 is rounded to the nearest thousand;

- Other values are up to round amounts;

- If an individual entrepreneur reports on several types of work under different OKTMO, then additional lines 010, 020 should be filled in in the first section.

Reporting to the simplified tax system

The simplified tax system is the same general regime, only simplified to the limit. It can only be used by those entrepreneurs who have a staff of up to 100 people, income for a quarter of the year does not exceed 112 million rubles, and the type of activity is included in the list of permitted ones.

The simplified taxation system implies the payment of only one single tax, for which individual entrepreneurs submit the KND form 1152018. The rate and tax base depend on the selected object:

- Income . Only the company's income is taxed at a rate of 6%.

- Expenses . Individual entrepreneur income minus expenses is taxed at a rate of 15%.

The deadline for submitting a declaration for individual entrepreneurs using the simplified tax system is April 30 of the year following the reporting year. At the end of the quarters, advance payments are made, which the entrepreneur calculates independently.

The tax office does not check the legality of the advances made, leaving them on the conscience of the taxpayer.

But only before filing a tax return according to the simplified tax system, a reconciliation of the accrued and deposited amounts .

The simplified tax system has one undeniable advantage over UTII - in this mode, if the company has worked in the red, a zero tax return is filed. To do this, you need to fill out the same form, but a little differently:

- For individual entrepreneurs on the simplified tax system of 6%, the title page, section No. 1.1 and section No. 2.1.1 must be completed. If the payer pays a trade fee, you must also fill out section No. 1.1.2.

- For individual entrepreneurs on the simplified tax system of 15%, the data is entered on the title page, section No. 1.2 and section No. 2.2.

- When an individual entrepreneur submits a zero declaration, section 3 does not need to be filled out.

Filling procedure

The tax return must be completed in accordance with the requirements imposed by law for this type of document:

- Use capital letters and a pen with black ink.

- If you print, be sure to install the Courier New font.

- Don’t scribble, don’t resort to the help of a proofreader.

- Remember that each cell is a place for one sign or symbol.

- In empty cells you should put a dash , not a 0.

- Do not staple the report or print the text on both sides of A4.

- Start filling out the declaration from the last page, then proceed to section 1 and only then to the title page. This is more convenient, since the title page indicates the final information that was calculated in the previous ones.

- All values are rounded to whole numbers, for example, not 10 thousand 102 rubles, but 10 thousand 100 rubles. This rule is not relevant for K1 in the UTII declaration; this coefficient is rounded to the nearest thousandth.

When you start filling out the forms, keep all the necessary documents next to you. You should need:

- TIN;

- details of the Federal Tax Service;

- certificate of registration with the Federal Tax Service;

- statements confirming payment of taxes;

- code OKTMO, KBK, OKATO, OKVED.

Which authority should I submit to?

Entrepreneurs submit tax reports to their “native” tax office. That is, the one in which registration took place. Its location always coincides with the place of residence of the individual entrepreneur.

And a few more nuances:

- When sending a declaration by mail, one copy of the report is included in a registered letter. And as confirmation of acceptance of the declaration by the regulatory authority, you can use a shipping receipt, a notification with the seal of the Federal Tax Service and the signature of its employee.

- If a businessman combines several modes, the declaration must be submitted for each.

Delivery methods

The most understandable way to submit reports is to visit the tax office in person. But if you are in another country, do not rush to book a plane ticket, because individual entrepreneurs can submit a tax return remotely. Here are some options:

- Through a representative. In order for everything to go legally, you need to draw up and notarize a power of attorney for the authorized person.

- By mail. The envelope with the declaration must contain a list of the contents and a completed notification form, on which the employee of the Federal Tax Service who accepted the documents will put his signature and seal. In this case, you should prepare the declaration in advance, since the delivery of the letter will require additional time. You can receive a notification either by mail or at the authority itself.

- Through your personal account on the government services website. This method requires your own electronic signature and seal.

Dates for 2021 and 2021

Since, according to the law, the deadline for submitting reports, which coincided with a weekend, is postponed to the next weekday, the deadlines for filing a tax return for individual entrepreneurs in 2021 and 2021 may differ from the standard ones. Let's look at them in the table:

Type of declarationDeadline in 2021Deadline in 2021

| 3-NDFL | Until May 2 | Until April 30 |

| VAT declaration |

| Same dates |

| Declaration of UTII |

|

|

| Declaration of the simplified tax system | For 2021 to May 2, 2021 | For 2021 to April 30, 2021 |

IP violated deadlines: what will happen

For late submission of the declaration, the taxpayer will be fined.

Its amount depends on the type and importance of reporting, the length of the delay and the amount of tax that was payable.

However, payment of a fine does not exempt you from subsequently filing a return. Moreover, the sooner the debtor fulfills his obligations, the less he will have to pay.

A fine is not the most painful thing an entrepreneur can expect. Very often, tax authorities resort to seizing bank accounts .

They also have the right to write off the required amount to pay off the unpaid tax. And if an individual entrepreneur often fails to meet deadlines, this will become a reason to check all his activities.

The bottom line is simple: if you don’t want the tax office to have questions for you, submit the necessary papers on time.

Source: https://IP-vopros.ru/vedenie-ip/otchetnost/nalogovaya-deklaratsiya-o-dohodah

Providing reporting

The tax period is a calendar year. The reporting period is every quarter.

Data for the first section is filled in from the beginning of the year, according to the tax rate. If the employer withholds income taxes at different rates, additional sheets with section 1 are filled out. The second section reflects all income and taxes calculated on them for the current quarter. It is not divided depending on the size of the tax rate. If there were a lot of payments and they do not fit on one page, the required number is filled in.

The reporting deadline is the last day of the month following the reporting month. For example, 6 personal income taxes for six months must be submitted by July 31st.

6 Personal income tax is provided in electronic form through specialized programs. The day of submission is considered to be the date the report is sent to the Federal Tax Service.

Small organizations and individual entrepreneurs with no more than 25 employees can submit 6 personal income tax calculations on paper in person or by mail. The calculation is submitted on the prescribed form. If the report is submitted to the tax office by mail, it must be sent by a valuable letter with a list of the attachments. The day the report is provided is the date it was sent.

For failure to submit reports on time, penalties are provided - 1 thousand rubles for each full or partial month of delay.

Codes at the location of registration are necessary for quick processing of data on taxpayers by the tax authority. They are assigned to all tax agents. The list of designations is established by the Order of the Federal Tax Service and depends on who pays income to employees: a Russian enterprise, individual entrepreneur or a separate division of a foreign company. Companies that have a separate division located in another region of the country submit two calculations of 6 personal income tax at the place of registration of the head and regional offices.

Putting the correct codes in the declaration according to the simplified tax system

is of great importance, because otherwise all the accountant’s work with this form may go down the drain. Therefore, let us consider in more detail the code indicators of the declaration under the simplified tax system.

Deadline for submitting a declaration under the simplified tax system for 2020

The tax return for the single tax under the simplified tax system by legal entities annually, before March 31 of the year following the reporting year (subclause 1, clause 1, article 346.23 of the Tax Code of the Russian Federation).

The legal entity's 2021 report must be submitted by March 31, 2021 .

The tax return for the single tax under the simplified tax system by individual entrepreneurs is submitted annually, before April 30 of the year following the reporting year (subclause 2, clause 1, article 346.23 of the Tax Code of the Russian Federation).

The IP report for 2021 must be submitted by April 30, 2021 .

Why are they needed?

Keep in mind that when filling out some details of the simplified tax system declaration for 2021, you do not need to enter specific amount information, but enter certain codes.

As a general rule, any tax return code of the simplified tax system

serves for simplification. To:

- do not overload the completed form;

- special programs could analyze this report more quickly.

Starting from the 2016 report, all simplifiers must use the form adopted by order of the Russian Tax Service dated February 26, 2021 No. ММВ-7-3/99. Let's figure out exactly what codes need to be entered in it.

Values

As was said, entering the correct codes when filling out a declaration under the simplified tax system for 2021 is very important. Actually, the main part of them is present immediately on the first sheet:

As for the tax authority code (the first two digits are the code of your region, and the second two are the number of the tax authority), it is taken from the state registration certificate of the company (IP). This question can be clarified using the services of the official website of the Russian Tax Service - www.nalog.ru.

Understand what code is in the tax return of the simplified tax system

In this or that case, the following tables will help you.

Taxable period

Features of filling out the title page

Let's consider the features of filling out the title page of updated declarations, as well as the procedure for filling out the title page of other declarations (including calculation of the amounts of income paid to foreign organizations and taxes withheld).

The taxpayer fills out page 001 of the standard title page form, except for the section “To be completed by a tax authority employee.” This page contains:

- information about the type of tax return, tax period and date of submission of the return to the tax authority (code);

- basic accounting information about the taxpayer;

- signature of the taxpayer - an individual or manager, chief accountant of the taxpayer organization and (or) their authorized representative.

Results

A “simplified” person fills out a declaration under the income-expenditure simplified tax system on the basis of KUDiR, certificates of advance payments and data on the amount of losses for previous years (if any). If the “simplifier” did not conduct any activity, he must submit a zero declaration, and if he received a loss at the end of the year, then he will have to pay a minimum tax to the budget equal to 1% of income for the year.

Read more about the details for paying advances, annual payments and the minimum tax on the simplified tax system “income minus expenses” here .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

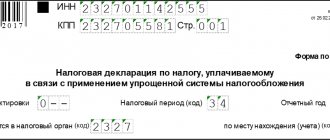

TIN and checkpoint

First, the title page indicates the TIN (taxpayer identification number) assigned to the organization or individual entrepreneur by the tax authority.

There are 12 cells in the “TIN” line. The same number of characters contains the TIN of an individual entrepreneur and an individual. An organization's TIN consists of 10 characters, so organizations fill out this line as follows. In the declaration for income tax, property tax, UTII, land tax, tax paid when applying the simplified tax system, as well as agricultural tax, the TIN indicator in a zone of 12 cells is filled in from left to right, starting from the first cell, with dashes placed in the last two cells . In other declarations and calculations of the amounts of income paid to foreign organizations and taxes withheld, organizations enter zeros in the first two cells, and the TIN is entered starting from the third cell.

After the TIN, organizations indicate the checkpoint. Legal entities and individuals submitting declarations indicate TIN and KPP on the basis of certificates and notifications of tax registration.

For Russian organizations and individuals, the forms of certificate and notification of tax registration are approved by Order of the Federal Tax Service of Russia dated 08/11/11 No. YAK-7-6/, for foreign organizations - by Order of the Federal Tax Service of Russia dated 02/13/12 No. ММВ-7-6/, for the largest taxpayers - by order of the Federal Tax Service of Russia dated April 26, 2005 No. SAE-3-09/ Features of registration of the largest taxpayers are determined by order of the Ministry of Finance of Russia dated July 11, 2005 No. 85n.

How to submit a tax return via the Internet: methods

Recently, an increasing number of services are provided via the Internet.

Particularly popular is sending documents, including tax returns, via the Internet to various government services.

What features does this procedure have? How to submit a tax return online? Can they refuse service?

The main pros and cons of remote filing of returns

The advantages of filing your taxes remotely far outweigh the disadvantages.

The main disadvantage is periodic failures and errors in accounting programs, as a result of which reports do not reach the Federal Tax Service on time.

However, such situations rarely arise when returns are filed within deadlines.

A full transition to electronic document management will not happen soon, since inspections require paper media.

The advantages of this method are:

- saving time (no need to visit the Federal Tax Service);

- ease of registration of the service (it is enough to register on the site once in order to receive the service in the future);

- a small number of errors when processing information in the Federal Tax Service (data is copied and not entered manually).

It is important to note that you can submit any type of tax return online.

What will you need?

To submit a declaration online, legal entities and individual entrepreneurs will need:

- extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs;

- certificate from Rosstat with activity code;

- certificate of registration of an individual entrepreneur or legal entity with the tax service and state accounting;

- TIN;

- passport;

- other papers confirming the registration of a legal entity or entrepreneur.

How to submit a tax return via the Internet for an individual? To do this, you will need a passport, INN and SNILS.

What do you need to send documents over the Internet?

Before filing a tax return online, you will need to first conclude an agreement with the Federal Tax Service operator, who will subsequently send the documents electronically.

The cost of this service starts from 1.5 thousand rubles per year. In addition, you must have an electronic signature, which is needed to identify the applicant.

It is issued in one of the authorized services of the Ministry of Communications at the current place of registration (directly at the tax office or at the MFC).

How to submit a declaration via the Internet: methods

Individuals and legal entities can submit reports to the tax service via the Internet as follows:

- Through the Federal Tax Service website in your personal account.

- On the government services portal.

Federal Tax Service website

According to the current legislative norms of the Russian Federation, all legal entities must be registered on the website of the Federal Tax Service, that is, they must have a personal account where information required by the regulatory authority is stored. You can log into your personal account in the following ways:

- Using a pre-issued electronic digital signature.

- By entering the taxpayer's name and code from the registration card (issued at the tax office).

And individuals can register on the Federal Tax Service website. To do this, you need to enter your full name, INN and SNILS.

How to submit a tax return online on the tax office website? To do this, you will need to go to the section on working with declarations and reports.

The declaration is filled out according to the established form template. After filling out all fields of the document, it can be sent.

After a desk check of the document, a corresponding notification will appear in your personal account.

Public services portal

Filing declarations of any type can also be done through Gosuslugi.ru.

To use the service, you must register on this site and create a login and password.

Next, you need to download and install the software called “Taxpayer”. This software has a number of significant advantages, such as:

- the ability to create various documents electronically;

- automated filling of declarations;

- saving previously created and completed documents.

How to submit a tax return online using this program? After installing the software, applicants must regularly monitor for updates. The algorithm for filing a declaration is as follows:

- We select the required declaration form and enter all the information. The completed declaration can be saved on your computer.

- Individual entrepreneurs and legal entities indicate the code of the FNM branch where the declaration will be sent.

- We draw up an application and attach a reporting document to it. The taxpayer needs to save or write down its number.

- We send the report. After this, the applicant needs to track the status of processing the application in his account on Gosuslugi.ru.

- After receiving confirmation from the Federal Tax Service that the declaration has been received, its paper form can be certified with the seal of the organization (for legal entities and individual entrepreneurs) and the signature of an authorized person.

After this, applicants must first make an appointment with the Federal Tax Service. Before your visit, you should make sure that you have all the necessary seals and signatures.

In order to avoid problems with the tax office later regarding corrections and errors in the declaration, taxpayers are recommended to submit the document at least one day before the deadline.

Can they refuse to accept a document?

Filing a tax return online is quite easy, but will there be any problems with its acceptance? Refusal to accept reporting documents may occur in the following situations:

- lack of certification with an electronic digital signature;

- lack of information about the person responsible for filling out the declaration;

- presence of errors in the document;

- filing reports through non-certified services;

- impossibility of identifying a taxpayer using an electronic signature.

How to submit an income tax return online or any other reporting document to the tax office? This service is available on the Federal Tax Service website and the Gosuslugi.ru portal. Both legal entities and individuals can submit a declaration.

Source: https://.ru/article/282666/kak-podat-deklaratsiyu-v-nalogovuyu-cherez-internet-sposobyi

Adjustment number and reporting period

Next, in declarations for VAT, income tax, property tax, land tax, UTII, tax paid when applying the simplified tax system, and agricultural tax, the “Adjustment number” cell is filled in. When submitting the primary declaration, 0 is entered in this cell. If an updated declaration is submitted, then this cell indicates which updated declaration is being submitted to the tax authority (for example, 1, 2). The numbers are entered from left to right starting from the first cell. In unfilled cells, dashes are placed.

In other declarations, fill in the line “Type of document”, which indicates code 1 (primary) or 3 (corrective).

Code 1 is entered in the primary declarations prepared for a particular tax period.

If errors (distortions) are discovered in the calculation of tax in the previous tax period, the taxpayer must recalculate it and submit an updated tax return for this period. In this case, on the title page in the “Type of document” line field, code 3 is indicated, followed by a fraction - the serial number of the updated declaration.

The next indicator in the declarations is called this. In the corporate income tax return and the calculation of the amounts of income paid to foreign organizations and taxes withheld, it is called the “Tax (reporting) period.” The cells with the named indicators are filled in as follows. Income tax payers who report their tax quarterly put the number 34 in the “Tax (reporting) period” cell in their annual declaration. The same number is indicated by payers of land tax, agricultural tax and tax paid when applying the simplified tax system. Income tax payers who report monthly taxes indicate 46 in their annual declaration. Organizations that fill out calculations on the amounts of income paid to foreign organizations and withholding taxes based on the results of the fourth quarter indicate 3. In the “Tax period” cell, VAT and water tax payers indicate number 3, and payers of excise taxes and indirect taxes - number 1. Payers of UTII in the “Tax period” cell in the declaration for the fourth quarter must put 24.

The indicators “Reporting year”, “Current tax period”, “Current billing period” are filled in with the corresponding figures.

Composition of the declaration

In addition to the title page, the declaration has 6 sections. Which ones need to be filled out?

- Entities who have chosen income as an object of taxation fill out sections 1.1 and 2.1.1 without fail. If at the same time they are payers of the trade tax, then they also fill out section 2.1.2.

- Section 3 is completed only by those who received targeted funding during the reporting period. As a rule, ordinary companies and individual entrepreneurs do not have this section in the declaration.

- Section 2.2 is filled out by simplified tax authorities who have chosen income minus expenses as the object of taxation.

Tax authority (code)

In the field of the line “Code submitted to the tax authority”

it is necessary to indicate the code of the tax authority to which the declaration is submitted and its code in the appropriate cell. The first two digits are the code of the subject of the Russian Federation, the second two are the code of the tax authority. In the declaration for VAT, income tax, property tax, land tax, UTII, agricultural tax and tax paid when applying the simplified taxation system, only the tax authority code is indicated in the corresponding cells.

The company submits a profit tax return to the Federal Tax Service of Russia No. 8 in Moscow. Tax authority code

set this - 7708. Where 77 is the region code, and 08 is the inspection code.

In the line “At the location (accounting)” in the declaration for VAT, income tax, property tax, land tax, UTII, agricultural tax and tax paid when applying the simplified tax system, the corresponding code is indicated (Tables 1, 2, 3, 4 , 5 and 6). In other declarations, depending on where they are submitted (at the location of the organization, a separate division, etc.), the sign V is placed in the corresponding cell. The largest taxpayer puts the sign V in the line “At the place of registration of the largest taxpayer.”

In the excise tax declaration in the line “At the place of location (residence)”, depending on who submits the declaration (Russian organization, separate division or entrepreneur), the sign V is placed in the corresponding cell. Foreign organizations put this sign in the line “At the place of implementation activities of a foreign organization through a permanent representative office.”

Next, the full name of the Russian or foreign organization is indicated on the title page. If the organization’s constituent documents contain Latin transcription, it also fits into the line. If the declaration is submitted by an individual entrepreneur or individual, then his last name, first name and patronymic are indicated. They are entered completely without abbreviations in accordance with the identity document. In declarations for income tax, property tax, land tax, UTII, agricultural tax and tax paid when applying the simplified tax system, text indicators are filled in block letters from left to right.

The code of the type of economic activity (if this indicator is provided on the title page) is indicated in accordance with the All-Russian Classifier of Types of Economic Activities OK 029-2001 (OKVED).

The main state registration number of an organization (OGRN) is indicated on the basis of a certificate of state registration of legal entities or a certificate of entry into the Unified State Register of Legal Entities.

Fill out section 1.1

Line 010 indicates the code OKTMO . Further in the section, a similar field appears three more times - for each period. If the code has not changed, it can only be specified once.

The remaining lines of the section are intended to reflect the amounts of advance payments and tax calculated for payment for the year. The calculation is made based on the data from sections 2.1.1 and 2.1.2. The tax payable is calculated as follows:

- if the subject does not pay the trading fee: line 130 - line 140 ;

- if the subject pays a trade fee: line 130 of section 2.1.1 - line 140 of the same section - line 160 of section 2.1.2.

The tax for all other periods is calculated in a similar way. However, the amount of tax accrued for the previous period in section 1.1 is subtracted from the amount received.

If the final tax amount comes out with a minus sign, it means the taxpayer overpaid.

Codes by location of registration

In the indicator “At the location (accounting) (code)” of the VAT return, the code value 400 is indicated. This code value means that the declaration is submitted at the place of registration of the taxpayer.

Table 1. Codes for submitting an income tax return to the tax authority

| Code | Name |

| 213 | At the place of registration as the largest taxpayer |

| 214 | |

| 215 | At the location of the legal successor who is not the largest taxpayer |

| 216 | At the place of registration of the legal successor, who is the largest taxpayer |

| 220 | At the location of a separate division of the Russian organization |

| 223 | At the location (registration) of the Russian organization when submitting a declaration for a closed separate division |

| 231 | At the location of the tax agent - organization |

Table 2. Codes for submitting a property tax return to the tax authority

Table 3. Codes for submitting a land tax return to the tax authority

Table 4. Codes for submitting a tax return on UTII to the tax authority

| Code | Name |

| 120 | At the place of residence of the individual entrepreneur |

| 214 | At the location of the Russian organization that is not the largest taxpayer |

| 245 | At the place of activity of the foreign organization through a permanent representative office |

| 310 | At the place of activity of the Russian organization |

| 320 | At the place of activity of the individual entrepreneur |

| 331 | At the place of activity of the foreign organization through a branch of the foreign organization |

| 332 | At the place of activity of the foreign organization through another organization |

| 333 | At the place of activity of the foreign organization through an individual |

Table 5. Codes for submitting a tax return to the tax authority for taxes paid when applying the simplified tax system

Table 6. Codes for submitting agricultural tax returns to the tax authority

The title page of the excise tax declaration reflects information about the presence (absence) of a certificate. The cell contains the following numbers:

- — 1 — if there is a certificate for the production of straight-run gasoline;

- — 2 — if there is a certificate for the processing of straight-run gasoline;

- — 3 — if there is a certificate for the production of denatured ethyl alcohol;

- — 4 — if there is a certificate for the production of non-alcohol-containing products;

- - 5 - if there is a certificate for the production of alcohol-containing perfumery and cosmetic products in metal aerosol packaging;

- - 6 - if there is a certificate for the production of alcohol-containing household chemical products in metal aerosol packaging;

- — 7 — in the absence of a certificate.

The taxpayer's contact telephone number is also indicated on the title pages of the declarations.

The title page must indicate the number of pages on which the declaration is presented and the number of sheets of supporting documents or their copies attached to the declaration.

The accuracy and completeness of the information contained in the declaration is confirmed by the head of the organization with his signature in the appropriate section. The signature is certified by the seal of the organization. Also in this section, the last name, first name and patronymic of the named person are fully indicated and the date of signing the declaration is indicated. The declaration can also be signed by a representative of the taxpayer. In this case, a document confirming his authority to sign the declaration is attached to the declaration. In declarations on income tax, property tax, land tax, UTII, agricultural tax and tax paid when applying the simplified tax system, the surname, name and patronymic of the head of the organization and the taxpayer’s representative are given line by line in capital letters.

When accepting a tax return, a tax official in the section “To be completed by a tax authority employee” confirms the number of pages of the declaration and the number of sheets of documents attached to the declaration. It also indicates how the return is presented, the date of presentation and the registration number. All completed information is certified by the signature of a tax authority employee.

Page 002 of the title page (if it is included in the declaration) is filled out only when the TIN of the individual who signed the declaration is missing on the first page. In the declaration for the unified social tax, data on the place of residence of an individual, if he does not have a TIN, is filled out on the first page of the declaration. On page 002 the following are indicated:

- last name, first name, patronymic - in full without abbreviations in accordance with the identity document;

- contact telephone number with city code for interaction between a tax authority employee and an individual;

- information about the identity document (name of the document, series, who issued it and date of issue);

- the address of the place of residence in the Russian Federation is indicated on the basis of an entry in a passport or a document confirming registration at the place of residence (if it is not a passport, but another identification document), with the obligatory indication of the postal code and code of the subject of the Russian Federation. For foreign persons and stateless persons in the absence of a residence address, the address of conducting activities in the Russian Federation is indicated.

In addition to the above information, individuals indicate the date and place of birth, gender and citizenship.

The information indicated on page 002 is certified by the signatures of those persons who confirm the accuracy of the information on the first page.

How to draw up and submit a UTII declaration. The procedure for filling out a UTII declaration for an individual entrepreneur at the place of residence or place of registration.

Question:

We carry out UTII activities in one municipality - Novosibirsk OKTMO is one, but in different districts of Novosibirsk. Each district has its own Federal Tax Service Inspectorate, but since OKTMO is the same, we can choose the Federal Tax Service Inspectorate that is the first at the time of registration as a UTII payer. With us, the Federal Tax Service Inspectorate where we report on UTII and the Federal Tax Service Inspectorate at the place of residence of the individual entrepreneur are the same. It turns out that the Federal Tax Service where we report can be attributed to code 320 - at the place of activity of the individual entrepreneur and to code 120 - at the place of residence of the individual entrepreneur. in the UTII declaration on the title page in the field “at the place of registration (code)”, what code should I put: 320 - at the place of activity of the individual entrepreneur or 120 - at the place of residence of the individual entrepreneur?

Answer:

Since registration at the place of activity under UTII and at the place of registration at the place of residence of the entrepreneur was carried out in one inspection, then in the declaration under UTII it is necessary to put the code at the place of registration “120 - at the place of residence of the individual entrepreneur.” This procedure is the same for both individual entrepreneurs and legal entities.

Fill out section 2.1.2

This section is completed by trade tax . It serves to calculate the amount by which they are allowed to reduce tax. Accordingly, non-payers of the trade tax do not have this section in the declaration, as do those who pay the fee, but do not reduce the tax.

Lines 110-143 indicate the same data as in section 2.1.1, but only in relation to the activities that are subject to the trade tax.

If an entity on the simplified tax system conducts activities that are and are not subject to trade taxes, it should keep separate records . This applies not only to revenue, but also to expenses that reduce tax.

Tax is reduced on contributions according to the same rules as in section 2.1.1

Lines 150-153 reflect the trading fee that was actually paid in 2021, including for 2021. Lines 160-163 indicate the amount of the fee that reduces the tax.

The trade tax is deducted from the tax due and reduces it down to zero.

The amount of the tax-reducing fee is calculated by subtracting from lines 130-133 the values indicated in lines 140-143 for the corresponding period. If the result obtained is greater than the amount of the trading fee, then the value of lines 150-153 is repeated in lines 160-163. If less, then what is calculated is indicated.

Let's say in line 130 the tax amount is 50,000 rubles. Line 140 indicates the amount of contributions and other expenses that reduces the tax - 25,000 rubles. In line 150, the amount of the trading fee is 25,000 rubles. Line 160 reflects the entire fee paid for the 1st quarter.