Reasons for refusing the simplified tax system

Why they refuse:

- Termination of activities. In this case, the liquidation procedure is practically no different from the general system and includes the implementation of all the necessary stages, including the preparation of an interim liquidation balance sheet.

- Transition to another tax regime. A change in the tax regime occurs on the basis of a voluntary decision of the taxpayer or due to forced circumstances.

Reasons for voluntary refusal:

- buyers (customers) who provide the largest turnover of the company are VAT payers. Cooperation with a simplified counterparty becomes unprofitable for them due to the impossibility of refunding tax amounts;

- next year it is planned to open branches or increase staff;

- Individual entrepreneurs switch to the regime for the self-employed (used in some regions of Russia).

Forced refusal occurs due to exceeding the maximum amount of revenue or other criteria, compliance with which is mandatory under the simplified tax system. In all cases, it is necessary to notify the tax authorities of the change in regime.

INTRODUCTION.

Sometimes situations arise when you have to make a decision to terminate your business activity.

Of course, this step is very unpleasant, but life presents its moments.

Then it is necessary to go through the procedure of registering the termination of the activities of an individual as an individual entrepreneur.

It is important to terminate your business activity wisely.

On the one hand, it looks quite simple, but even here there are some nuances, failure to comply with which will lead to the registration authority refusing to satisfy your desire to cease being a businessman.

How to notify the tax office

In case of a voluntary transition, a notification to the tax service must be submitted no later than January 15 of the year in which the transition is planned. If you decide to change the regime later than this period, then the transition is possible only next year. The recommended form of notification is 26.2-3. Submission of a tax return payable in connection with the application of the simplified system and payment of the tax is carried out within the usual deadlines:

- for organizations - no later than March 31 of the year following the expired tax period;

- for individual entrepreneurs - no later than April 30 of the year following the expired tax period.

In case of termination of an activity in respect of which the simplification was applied, it is necessary to submit a notification within 15 working days after the relevant decision is made.

Initialization of the procedure for closing and liquidating an individual entrepreneur

This procedure begins with the collection of documents established by law, which must subsequently be provided to the tax authorities in order to deregister the businessman and cancel his individual entrepreneur status. For the Federal Tax Service you must have the following documents:

- application for termination of the activities of the individual entrepreneur;

- confirmation of payment of the state duty established by law.

Previously, this list was broader; a certificate from the Pension Fund, etc. was required. Now the procedure is simpler and the list is extremely shortened. Moreover, currently, notarization of the applicant’s signature on the form is not even required.

Application for termination of business activity

An individual entrepreneur ceases to operate from the moment he is deregistered as a taxpayer, for which a corresponding application must be submitted to the Federal Tax Service. As a rule, there are no problems filling out all the fields of the application for termination of business activity. The exception is cases when an individual entrepreneur, having the status of an individual entrepreneur, changed his last name and, accordingly, his passport, or changed his residential address. In this case, you must first make changes to the Unified State Register of Individual Entrepreneurs and only after that can you begin the procedure for liquidating your business.

In the event that nothing has changed at the time of closure of the individual entrepreneur, the individual entrepreneur filling out the paperwork to terminate the activity should clarify the address of the Federal Tax Service to which he will apply. According to the law, this is the Federal Tax Service where the individual entrepreneur was registered.

The application is drawn up in form P26001. This application can be submitted on paper. Today, its design in electronic form is also quite common. The application form is usually taken from any tax office or downloaded from the official website of the Federal Tax Service.

Payment of state duty for termination of business activity

Termination of business activity is subject to state duty. A blank receipt form to fill out is available at any tax office. If for some reason the visit to the Federal Tax Service is postponed, this form can be found on the Federal Tax Service website. Payment of state fees occurs at Sberbank branches. The state duty for this procedure in 2014, as in the previous one, is 160 rubles.

The cases will be officially terminated when the tax authorities make an appropriate entry in the state register. To do this, you must submit the above documents to the Federal Tax Service.

The registration authority, having received the necessary papers, on the sixth day issues the entrepreneur a document confirming the loss of his individual entrepreneur status - a registration sheet from the Unified State Register of Individual Entrepreneurs.

Procedure for termination of activities

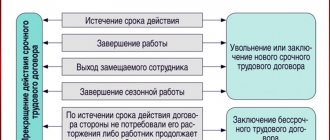

The procedure for terminating activities under the simplified tax system is divided into several stages:

- Decision-making.

- Submission of notification in the appropriate form. It must be completed manually or in a machine-readable manner. The document is provided in person, transmitted via telecommunications channels or sent by registered mail.

- Filing reports and paying taxes.

Risks of refusing the simplified tax system

It is necessary to analyze current turnover, sources of replenishment of working capital and the reliability of counterparties. It is advisable to request the following documents from existing and potential buyers (customers):

- copies of tax returns and financial statements for the last reporting period;

- a certificate of the status of settlements with the budget;

- certificate of turnover on the current account.

In addition, it should be clarified whether the main suppliers are VAT payers. If you work with companies that use special regimes, VAT refunds are impossible, which means that the point of refusing simplification is lost.

In what cases is the notification not completed?

The notice is not filled out:

- upon liquidation;

- during the planned transition to OSNO or another special regime for those types of activities that are subject to a single tax under the simplified tax system;

- if the established criteria for simplification are exceeded (forced refusal).

APPLICATION TO THE TERRITORIAL BODY OF THE PFR FOR VERIFICATION OF ALL OBLIGATIONS WITH SUBSEQUENT DE-REGISTRATION.

From January 1, 2021, the legislation regarding the administration of contributions to the Pension Fund and other extra-budgetary funds has changed.

It is from this date that individual entrepreneurs do not apply to deregister with the Pension Fund. This procedure is carried out through the Federal Tax Service, but... If you, as an individual entrepreneur, acted as an Employer, then you need to contact the territorial department of the Pension Fund of the Russian Federation where you were registered to reconcile obligations, as well as provide all the necessary reports.

Individual entrepreneurs who decide to cease their activities, starting from January 1, 2017, who are Employers, submit to the Pension Fund: – information about insured persons (monthly) – SZV-M; – information about the insurance experience of the insured person.

All other procedures for deregistration are carried out by the Federal Tax Service, where information on accrued insurance premiums is sent.

Registration of taxpayers on UTII

Business entities who have expressed a desire to work for UTII must, within 5 days, register with the Federal Tax Service at the place of activity or at the actual address, depending on the type of work (clause 3 of Article 346.28 of the Tax Code of the Russian Federation). After this, they will have to report and pay the imputed tax based on the data submitted to the relevant tax office.

For more information about registering as a UTII taxpayer, see the article “How UTII registration occurs”

Conducting activities without registration may result in a fine of 10% of income, but not less than 40,000 rubles.

Who needs to be notified

Upon termination of activity, a legal entity must notify:

- Creditors.

- Employees.

- Tax office.

- Employment Center (in some cases).

The specifics of notifying creditors during the liquidation of a company are regulated by the provisions of the Civil Code, Federal Law No. 127 “On Insolvency” and other regulations.

If the liquidation is carried out as part of bankruptcy proceedings, then the appointed administrator must send information in writing to notify creditors of the liquidation. The manager must make inquiries and notify persons to whom the company has debt obligations. This is done so that creditors can present their claims against the debtor as part of the bankruptcy procedure.

Both individuals and legal entities can act as creditors of a company. The most common methods of notification of liquidation may be:

- Written notice by mail.

- Notification through the media (information about the introduction of bankruptcy proceedings against the debtor and one or another stage is published in the EFRSB and the Kommersant newspaper).

In order to have a chance of repaying the debt, creditors need to have time to include their claims in the register (registered claims are repaid extremely rarely). Debts are not included in the register automatically, but on the basis of an application from creditors and subject to documentary confirmation and validity of the obligations. The validity of the creditors' claims must be confirmed by the arbitration court that is conducting the bankruptcy case.

A company that has no debts can also voluntarily notify its partners and counterparties of its upcoming liquidation.

When a company is liquidated, all employees are laid off en masse. But the employer must comply with legislative requirements and procedural procedures. Taking into account the provisions of the Labor Code under clause 1, part 1, art. 81 all laid-off employees must be notified in advance of the upcoming layoff .

Notification to employees must be written and personal. It is handed over to them personally against their signature or sent by mail to their residential address. When laying off workers as part of the liquidation of a company, notification must be received 2 months before the termination of the employment contract. If the established notification procedure is not followed, employees can appeal the employer's actions.

The employer should create a special journal in which employees will sign upon receipt of the notification. Another option is to give employees two copies of the notice. In one, they will sign to acknowledge receipt of the notice, and it will remain in the custody of the business. If a person refuses to sign, then a special act is drawn up about this.

The enterprise also notifies the trade union of the upcoming staff reduction if such an organization was created on the basis of a legal entity.

The employment center is notified by the employer if more than 15 employees are fired. The process of notifying the regional labor exchange is regulated by the “Regulations on the organization of work to promote employment in conditions of mass layoffs.”

After the decision to liquidate is made, the company has three days to submit a notification to the Federal Tax Service. Notification of tax authorities is mandatory.