The procedure for investors to apply tax deductions for VAT

Clause 6 Art. 171 of the Tax Code of the Russian Federation establishes that VAT amounts presented to the taxpayer by contracting organizations (developers or technical customers) when they carry out capital construction (liquidation of fixed assets), assembly (disassembly), installation (dismantling) of fixed assets, tax amounts presented to the taxpayer for goods (works, services) purchased by him to perform construction and installation work (hereinafter referred to as construction and installation works), and the amount of tax presented to the taxpayer upon his acquisition of unfinished capital construction projects.

According to paragraphs 1 and 5 of Art. 172 of the Tax Code of the Russian Federation, the specified tax deductions are made on the basis of invoices issued by sellers when the taxpayer purchases goods (work, services, property rights), after registration of these goods (work, services, property rights), in the presence of relevant primary documents.

It should be noted that the amounts of VAT accepted by the investor for deduction are subject to restoration if, in the future, real estate objects (fixed assets) are used to carry out operations that are not subject to taxation (clause 2 of Article 170 of the Tax Code of the Russian Federation), with the exception of fixed assets, which are fully depreciated or at least 15 years have passed since their commissioning.

Thus, the use of a facility under construction to carry out operations subject to VAT is a mandatory condition for a tax deduction.

Share participation agreement accounting entries

The construction process usually involves several participants. The key figures are the investor and the developer.

Everyone understands who an investor is. The investor finances the construction and upon completion receives ownership of the capital construction project. 2 tbsp. 4 of the Law of February 25, 1999 No. 39-FZ.

https://www..com/watch?v=ytadvertise

But the situation with the terms “developer” and “customer” (“technical customer”) is confusing, because different definitions are given in the regulations of different years. But now these terms are used in the meaning established by the Town Planning Code (hereinafter - GrK) Art. 3rd Civil Code of the Russian Federation.

As a rule, a developer is an organization (although it can also be an individual) that owns or leases a plot of land and organizes the construction of a property on it for investors. 16th century 1 Civil Code of the Russian Federation.

But if we are talking about shared construction, then only an organization can be the developer. 1 tbsp. 2 of Law No. 214-FZ of December 30, 2004 (hereinafter referred to as Law No. 214-FZ). The developer obtains permits for the construction of the facility and for its commissioning. 1 tbsp. 51, paragraph 2 of Art. 55 Civil Code of the Russian Federation.

A technical customer is a specialized construction organization that, on behalf of the developer (under an agency agreement), performs various organizational actions - enters into contracts for the preparation of design documentation, controls the quality of construction work, etc. 22 art. 1 GRK RF

Note that one company can combine various functions, for example, be an investor and a developer at the same time.

As we can see, “developer” and “technical customer” are categories that define the relationship between the parties solely for the purposes of state control in the field of urban planning (issuing various permits, regulating activities to raise funds for shared housing construction, etc.).

As you understand, for accounting purposes, it does not matter who issues the construction permit or the commissioning of the facility. After all, the accounting procedure, first of all, should reflect the economic content of business transactions between the parties.

By the way, we can say that the urban planning term “developer” has an economic equivalent - this is a developer. Development is a foreign word (from the English development), but recently it has taken root among us.

Companies that build real estate with their own funds and with the money of investors and make a profit from their sale or rental are called developers. But for simplicity, we will continue to use the term “developer” in this article.

Tax accounting of the developer during shared construction

Today, the position of regulatory authorities and courts on taxation of developers’ activities is that, regardless of the terms of construction financing contracts, they are essentially agents and provide a service to the investor.

As we have already said, this approach in most cases does not correspond to the essence of the relationship between the investor (shareholder) and the developer. However, this position is sustainable for both income tax and VAT purposes.

It has not changed even after the clarification of the Plenum of the Supreme Arbitration Court that, from a legal point of view, investment agreements are most often contracts for the sale and purchase of future real estate. 4 Resolution of the Plenum of the Supreme Arbitration Court of July 11, 2011 No. 54.

Let's see how a developer needs to calculate income tax and VAT on investment agreements and DDU.

VAT from the developer

If the construction of objects is carried out by contractors without performing construction and installation work by the developer, the transfer in the prescribed manner to the investor’s balance sheet of part of the object completed by capital construction is not an operation for the sale of goods or construction and installation work from the developer. Accordingly, the developer does not recognize this operation as an object of VAT taxation.

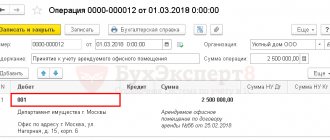

At the same time, services for organizing the construction of a facility provided by the developer to investors, provided for by the investment agreement, are subject to taxation and are subject to VAT in the generally established manner. For the above services, the developer issues invoices to investors, which he records in his sales book.

VAT upon receipt of contributions from participants in shared construction

5 of Law N 214-FZ, can be defined in the contract as the amount of money to reimburse the costs of construction (creation) of a shared construction project and money to pay for the services of the developer. If the functions of the customer-developer are highlighted in the contract with remuneration, then it is this remuneration that forms the basis for calculating VAT for the provision of services to the customer-developer . In this case, the remuneration can be: - as a percentage of the amounts received; - in a fixed amount or in the form of savings between the amounts received from investors and actually spent by the customer-developer. The Resolution of the Federal Antimonopoly Service of the West Siberian District dated May 25, 2009 N F04-2769/2009(6042-A45-49) sets out the legal position of the court on a tax dispute regarding the formation of taxable objects from a developer . When considering the issue of calculating income tax, the court found that: - according to the developer’s accounting policy, the financial result is investment savings after complete completion of the work (the financial result for the project is defined as the difference between investments and the actual costs of constructing the project); — investment contributions received from investors and construction costs from these funds, including the maintenance of the developer’s service, cannot be considered as ordinary income and expenses of the developer; - since the economic benefit of the developer for profit tax purposes can be determined only after the completion of the construction of a specific object (apartment building) in the form of a positive difference (savings) between the investments received and the actual costs, then the additional charge of income tax to the developer is unlawful. When considering the issue of calculating VAT, the court came to the following conclusions: - the basis for additional VAT assessment to the developer was the fact that the tax authority considered the amount of costs for maintaining the service of the customer-developer in the relevant tax periods as the amount of revenue from the sale of the customer’s services; — funds received by the developer from individuals and legal entities under equity participation agreements in the construction of residential buildings are of an investment nature (the developer’s responsibility included the construction and commissioning of facilities, the accumulation of investor funds to finance construction, and the transfer of apartments to shareholders); — the maintenance of the customer-developer’s service is an integral part of the total amount of capital investments (investments) in the construction of the facility, therefore the expenses in this part are of the same investment nature as all other expenses (funds) provided for by the consolidated estimate; — receipt of investment contributions and their use for their intended purpose until the completion of construction does not lead to the emergence of a taxable object and is not taken into account when determining the base for calculating VAT for the developer. Thus, the amounts received by the developer from investors should not be fully included in the base for calculating VAT . However, the following questions arise: - when is the basis for calculating VAT for the developer formed? — in what amount is the base for calculating VAT formed? According to the Ministry of Finance of Russia (Letter dated June 25, 2008 N 07-05-06/142), the moment of determining the VAT base for the provision of services over a long period of time should be considered the earliest of the dates: the day of payment (partial payment) on account of the upcoming provision of services or the last day of the tax period in which these services are provided. How to determine the cost of services provided by the developer under a continuing contract? It all depends on the terms of the contract. If the remuneration is set as a percentage of the amounts received or as a fixed fixed amount for the quarter, then this amount forms the basis for calculating VAT. The situation is more complicated if the developer's remuneration is set in the form of savings for the developer , which is actually determined only after the completion of the investment project and the transfer of the property to the investor. Tax authorities sometimes insist that the developer determine the base for calculating VAT based on expenses for its own maintenance, reflected in the debit of accounts 20 “Main production” or 26 “General expenses”. In the Resolution of the Federal Antimonopoly Service of the Far Eastern District dated October 24, 2008 N F03-4588/2008, it is noted that the basis for additional VAT assessment was the conclusions of the tax authority that the taxpayer understated the VAT base by the amount of revenue from the sale of services for the implementation of the functions of the customer-developer, and the costs reflected in account 26 “General business expenses”, he qualified as revenue from the sale of services, which is included in the VAT base. It should be noted that in such situations, tax authorities, as a rule, lose in arbitration courts. The courts recognize that if the contract determines the remuneration in the amount of savings, then the tax base arises only upon completion of the entire investment project and is equal to the amount of actual savings (Resolution of the Federal Antimonopoly Service of the West Siberian District dated October 14, 2010 in case No. A27-25524/2009, dated October 15 .2010 in case No. A46-23193/2009). Consequently, the amount of savings forms the developer’s basis for calculating VAT (Letter of the Ministry of Finance of Russia dated March 25, 2008 N 03-07-10/02; Resolutions of the Federal Antimonopoly Service of the East Siberian District dated August 31, 2010 in case N A78-9180/2009; Ural District dated 01/29/2010 No. F09-11382/09-C2 in case No. A60-20097/2009-C10, etc.).

VAT, Organization of tax accounting

* * *

Unfortunately, we were unable to find other judicial acts on the issue of the legality of an investor’s deduction of VAT charged by the developer on the amount of savings received. The disadvantage is obvious - the said Resolution is an isolated one. But there are also advantages. Firstly, (we repeat) the investor was supported by all three courts that considered the tax dispute. Secondly, there are also no court decisions negative for taxpayers-investors.

The general conclusion is the following. The risk for an investor who accepts this amount of VAT as a deduction is great. However, in the situation that became the subject of analysis by the FAS UO, the taxpayer went for it and saved almost 5 million rubles. Let us recall that in the event of an unfavorable outcome of the trial, the investor would have to pay an additional fine of 20% of the amount of the tax wrongfully claimed for deduction (Article 122 of the Tax Code of the Russian Federation) and a penalty for each day based on one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at that time (Article 75 of the Tax Code of the Russian Federation).

T.Yu.Koshkina

Magazine editor

"Construction:

Accounting

and taxation"

Common mistakes

Error:

The developer reflected in the accounting the funds of the shareholders transferred to him under the shared construction agreement as revenue.

A comment:

Investor money is not revenue; funds are recognized as targeted financing.

Error:

The developer imposes VAT on the funds of shareholders under a shared construction agreement.

A comment:

Money transferred by shareholders is not subject to VAT, since shared construction projects are not taxed.