The assignor and the assignee are the main actors (parties) in the agreement for the assignment of rights (assignment agreement). Typically, the rights to claim a debt are transferred from one creditor to another. The third party affected by this agreement is the debtor, who, as a rule, does not participate in the legal formalization of the “transfer” of rights. First he owed the original creditor (assignor), and then he will owe the new one (assignee). The transfer of a claim under an assignment agreement is regulated by law. We will talk in a few words about such an agreement and talk in more detail about the assignor and assignee: who are they and how does the assignment of rights take place between them?

Assignment: the essence of the concept

The term "cession" is used to refer to the process during which one organization transfers to another the right to collect an outstanding debt . One of the simplest examples of this process is a situation in which a banking organization transfers to a collection service the right to claim debt on an outstanding loan.

It should be noted that a banking organization can transfer to collectors not only the debts of individuals, but also of organizations.

In addition, the term in question is used to refer to a contract for the transfer of obligations and rights from one shareholder to another. As a rule, this concept is often used in the construction industry. It should be noted here that in this example, the shareholder transfers to his counterparty not only the rights and obligations assigned to him. This means that this type of agreement cannot be considered as a full-fledged assignment agreement.

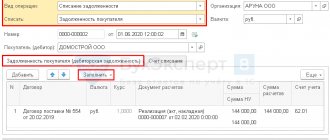

Assignment of the right of claim: postings to the assignee

For the recipient of the obligation, it will be taken into account as part of financial investments in account 58 of the chart of accounts. As a rule, debt is acquired at a cost less than its size, so its acquisition is an object that should bring profit in the future. At the time the debtor repays the debt, the purchase price will be written off as expenses, and the amount received from the debtor will be reflected as income.

Accounting with the assignee, posting:

| Operation | Debit | Credit |

| The right of claim has been taken into account | 58 | 76 |

| Payment under the assignment agreement was transferred to the assignor | 76 | 51 |

| Received payment of debt from the debtor | 51 | 76 |

| Income is reflected in the amount received | 76 | 91-1 |

| The claim has been written off from financial investments | 91-2 | 58 |

Legislative provisions on assignments

The twenty-fourth chapter of the Civil Code of the Russian Federation, entitled “Change of persons in obligations,” contains regulations governing the use of assignment contracts. This topic is also discussed in detail in the one hundred and fifty-fifth and two hundred and seventy-ninth articles of the Tax Legislation. Many controversial issues related to this concept are resolved by the Supreme Court on the basis of a letter from the Ministry of Finance.

As we said above, the term “cession” is closely related to the activities of collection services. The two hundred and thirtieth Federal Law regulates the activities of such firms. This law sets out in detail the rights and interests of individuals with outstanding debt.

It should be noted that in two thousand and seventeen, adjustments were made to this regulatory act to limit the actions of collection agencies.

The assignee is

The rights of the assignee at the conclusion of the transaction have the same scope and the same limits as those of the original lender. For example, the agreement provided for the possibility of repaying obligations by transferring property. The creditor can thus turn it to his advantage. The assignee also has the same opportunity. This will not depend on whether notice of the transaction was sent to the debtor. Payment (repayment of obligation) can be made in any form (cash/in-kind). But in all cases it is necessary to determine the powers that the new creditor has. In practice, payments are rarely made in cash. Typically, repayment of obligations is made by crediting to an account held by the assignee. This can also be done by issuing promissory notes, checks, and other negotiable documents. In accordance with the principle of autonomy of the will of the participant, the parties to the assignment agreement may differently resolve the issue concerning the rights of the assignee to sums of money and property received in pursuance of the original agreement.

Please note => Additional agreement for advance payment under Federal Law 44 sample

Basic Concepts

Putting aside complex economic terms that may not be clear to the average person, the term “cession” can be described as the transfer of rights to demand repayment of a debt . This process involves several parties, each of which has a certain list of rights and obligations.

Assignor (from the English “cedent” - transferor of the right) is a party to the transaction (individual or legal entity) who transfers (assigns) the rights of claim to another person

Who is the assignor

The assignor is the original owner of the debt of an organization or individual . As a rule, this status is given to financial structures that issue funds in the form of loans to organizations and individuals. If difficulties arise with the return of funds, financial institutions can contact the collection service. This approach can significantly reduce the amount of loss due to late repayment of issued loans. It should be noted that credit organizations operate on the basis of current legislation that allows the transfer of the right to claim debt to third parties. This means that concluding an assignment agreement is a completely legal process.

It is important to note that in the case under consideration, the object of the contract is only debt. The parties cannot transfer to each other the right to claim additional compensation and cover additional costs. To the amount of the total debt, you can add accrued penalties and fines in the form of interest. According to the established rules, the parties can transfer the debt only in its original form. This means that the parties are prohibited from making additional amendments to the contract with the debtor that change the terms of repayment of the loan.

Who is the assignee

The assignee is the second party to the agreement who receives the right to demand repayment of the debt . This status can be assigned to both a collection service and a third-party banking structure. The assignee acts as a third party who is not mentioned when concluding an agreement between the lender and the borrower.

The new owner has the same rights to demand repayment of the debt as the original owner of the debt. In the case where the contract between the lender and the borrower mentions the possibility of covering debts through the transfer of property assets, the assignee also has the opportunity to exercise this right. If the contract does not contain this clause, then the third party to the contractual relationship cannot call on the debtor to repay the loan by selling material assets.

Definition of debtor

Debtor status can be assigned to an individual who has an unclosed loan taken out from a financial institution. A legal entity can also be a debtor.

Assignee (from the English “cessionary” - legal successor) is a party to an assignment agreement that assumes the obligation to act as a new creditor or a legal successor receiving ownership rights

Rights and obligations of the ex-assignor

So, we already know that the assignor is the original lender who financed the borrower. Next, we will consider what rights and obligations the borrower has after signing the contract. They are described in the Code of Civil Procedure of the Russian Federation, in particular, in Article 388, which states that this form of transaction is legitimate if the requirements of the country’s legislation are met. In this case, the borrower, when signing the contract, is obliged to transfer his rights to collect exclusively the existing receivables, and not related expenses. That is, this does not include compensation for moral damage or harm to health - only the amount of debt (and its servicing, i.e. interest on the loan).

It turns out that the bank transfers the rights to the existing debt to the collection company. However, he cannot change the terms of the contract in force with the borrower under any conditions. That is, if it did not contain requirements for the payment of penalties or interest, then it will no longer be possible to introduce it, since these are additional conditions. The loan is transferred “as is”, without additions or changes.

The assignor is a bank or borrower, the assignee is a “collector”

What is the difference between assignment and assignment

People new to the financial sector are unlikely to be able to distinguish an assignment contract from an assignment agreement. These types of agreements have minimal differences from each other. According to the assignment contract, the party acting as the assignor transfers to the assignee only the right to demand repayment of the outstanding loan. In the case of an assignment agreement, the original owner of the debt can transfer to a third party not only his rights, but also certain obligations.

As an example, consider an agreement for the assignment of rights to lease a property. This form of agreement cannot be regarded as the object of an assignment contract. This fact is explained by the fact that the lease agreement implies the establishment of a certain tariff according to which the rented premises are paid. However, when the assignor and assignee enter into an agreement for the assignment of rights under securities, the concluded contract receives the status of an assignment agreement. In this case, the new owner of the rights acquires the opportunity to receive dividend payments. It should be noted here that obtaining such rights does not impose any obligations on this participant in legal relations.

What is the benefit of the parties

For the assignor, the main benefit is the ability to partially or fully compensate for losses. There are two options here - when the debt is completely purchased by a third party or transferred free of charge for collection, but then receives reimbursement of the debt minus interest.

There are several options for making a profit for the assignee:

- compensation for transfer of debt;

- the opportunity to receive material benefits if the loan was in kind.

In most cases, only overdue debts with losses, the prospects for recovery of which are unclear, are transferred by assignment. In this case, it is more profitable for the creditor to transfer the rights to it to another organization with compensation than to seek repayment of the loan and losses on their own.

Features of the transfer of rights to foreclose

Quite often, assignment agreements are concluded when selling a business. In this case, the original owner of the company transfers the right to use the assets to the new owner of the company. It should be noted that when drawing up such contracts, it is very important to take into account all the interests and rights of each of the parties involved in the transaction . If one or more terms of the concluded agreement contradict current legislation, then the transaction cannot be formalized.

It is also necessary to take into account a number of legal nuances. In some cases, the terms of the contract stipulate a prohibition on transferring rights to claim debt to third parties. Despite this, the assignment contract concluded between the assignor and the assignee is considered completely legal. In this case, penalties are imposed on the original owner of the debt for failure to comply with the terms of the agreement.

What debts can be transferred

According to the established rules, not all types of debts can be considered as subjects of assignment agreements. Most often, such transactions are concluded when transferring rights to the following debts:

- unpaid loans and credits;

- outstanding loans;

- securities, including bills of exchange;

- accounts receivable.

The three hundred and eighty-eighth article of the Civil Code provides regulations governing the process of transferring debt obligations. This regulation limits the transfer of rights in cases where the identity of the lender is important to the borrower. This means that concluding an assignment agreement is prohibited in cases where close relatives act as lender and debtor.

The triangle of relationships: assignor, assignee and debtor must be equilateral in the sense that no one’s rights, enshrined in law, should be violated when assigning rights

Must the assignor notify the debtor of the transfer?

In a tripartite agreement, the assignee acts as a third party who is not party to the original agreement. Each of the participants in such legal relations has its own rights and obligations. Many people who encounter this concept often ask the question of whether the original owner of the debt is required to inform the borrower about the transfer of rights to the debt. According to current laws, the assignor does not need to contact the debtor to obtain consent to transfer the debt to a third party . This means that an assignment contract can be concluded without the participation of the debtor himself. However, after the conclusion of the transaction, the original owner of the debt is obliged to notify the debtor of the fact of transfer of rights to claim the debt. As practice shows, many financial institutions often forget about this obligation.

Notifying the debtor of the fact of transfer of rights to claim the loan to a third party to the transaction allows minimizing the risk associated with incorrect execution of payments. A person who does not know that the debt has been transferred to a new person will continue to make payments in the name of the old owner. The development of such a situation contributes to the emergence of new debts. It must also be said that there is an exception to this rule. The parties who have entered into a loan agreement may indicate in the agreement the possibility and procedure for transferring the rights in question. According to lawyers, even in the case when the original owner of the debt obligations does not notify the borrower about the transfer of rights to the debt to a third party, the assignment agreement receives the status of a legitimate document.

What are the benefits of assignments for the parties?

The conclusion of an assignment agreement brings certain benefits to each of the parties. The original owner of the rights to the outstanding loan gets the opportunity to fully or partially cover the existing losses. The party acting as assignee can either buy the debt at the time of the transaction or transfer the funds after the borrower repays the debt obligations.

The party acting as assignee also has its own benefits. This can be either accrued interest for the time of delay in payments, or compensation associated with the transfer of debt. In addition, it must be taken into account that this party can receive material benefits in the case where collateral was used when applying for a loan. As practice shows, such agreements are concluded in situations where the object of the agreement is an overdue debt with “vague prospects.” In such a situation, it is more profitable for the lender to transfer the right to claim the debt to third parties than to wait for the loan to be repaid.

According to Art. 388 of the Civil Code of the Russian Federation, assignment of a claim by the assignor to the assignee is allowed if it does not contradict the law

Introduction

The first step is to review the basic terms and concepts so as not to get confused by them. There are three sides to this scheme:

- Assignor.

- Assignee.

- The specific company or person who incurred the receivables (debtor).

An example of who is the assignor, assignee and borrower

The term “cession” is the procedure for assigning rights, respectively, the assignor is the party who transfers the existing rights, the assignee is the one who receives the rights, and the debtor remains the same. The contract that confirms the transfer procedure is called “title”.

Attention:

A classic example of an assignment is the transfer by a bank of a borrower’s debts to a collection company. The bank is the assignor, the collectors are the assignee, that is, a third party who was not initially in the transaction between the borrower and the financial institution.

The title is signed after the assignor considers working with the lender to return the receivables unreasonable or does not want to spend man-hours and other resources on repaying the loan. In this case, the case is transferred to the assignee for a certain percentage or established remuneration. Moreover, any actions on the part of the assignee before the signing of the official agreement and its entry into force are considered illegal and are subject to administrative and criminal liability. After the document comes into force, the assignee becomes the owner of property rights (in fact, becomes the assignor).

Types of assignment agreements

To date, there is no unified model according to which the type of contracts under consideration is developed. Participants in a transaction to transfer rights to claim debt can draw up a contract in free form. However, in order for this document to gain legal force, the following factors will need to be taken into account:

- Indication of the date of drawing up and signing of the contract.

- Description of the parties with full details of the participants in the transaction.

- Detailed description of the subject of the agreement. The subject of the contract may be rights to financial debt, commercial products or real estate.

- Availability of a detailed list of rights and obligations of each party participating in the agreement.

- Fixed conditions for the transfer of the right to claim debt.

- Listing of all types of liability for violation of contract clauses.

The last section provides payment details for each participant. The fully completed form must be signed by each participant in the contractual relationship.

The assignee is

Entities that have certain obligations are called debtors. This term has a somewhat narrow meaning. Nevertheless, in accordance with existing practice, it can mean not only monetary obligations, but also debts of other kinds. For example, this could be an obligation to perform work/provide a service, transfer ownership, and so on. The entity acting as the creditor is called the assignor in the assignment. This person transfers to a third party the ability to demand payment of the debt. The latter is called the assignee in the transaction. He gets the opportunity to demand payment of the debt in his favor. An individual, as a result of concluding a transaction to transfer the legal ability to demand repayment of a debt, assumes the full scope of powers that the original creditor had. The latter then withdraws from the contract. The assignee is a party to the transaction who, in accordance with the agreement concluded with the original creditor, has the opportunity not only to demand repayment of the debt, but also to apply sanctions to the person who evades this.

Conflict situations among creditors

The assignee's primary responsibility to the assignor is to transfer funds in accordance with the terms of the agreement. When concluding a contract, the parties can agree to make an advance payment or cover the debt after receiving funds from the debtor. All financial obligations of each party must be specified in the contract. However, in practice, the assignee may violate the procedure for fulfilling its obligations.

In this case, the assignor who has not received the promised funds may file a claim in court. It is important to note that Russian laws prohibit the reverse transfer of rights to a debt from the assignee to the assignor. This means that in the event of a violation of contractual obligations on the part of the assignee, the assignor must demand the return of his money from the third party to the transaction. The assignment agreement implies that the assignor loses the opportunity to demand coverage of debts from the primary borrower.

By assignment, only and exclusively the rights of the assignor are transferred

How does recovery proceed?

Let's consider how the proceedings with the borrower proceed in a tripartite agreement. On the part of the bank, the payer becomes not the person with whom the agreement was originally signed, but his successor, that is, the assignee. That is, after signing the agreement, the claim is transferred to the “collector” if he violates the assignment agreements. If the claim is not satisfied, the bank has every right to sue the collector and demand that he fulfill his obligations.

Such situations are actually quite rare, since the borrower is loyal to the collectors, and often works with them for hundreds and thousands of debtors, observing general agreements. If the lending party is replaced, the new creditor sends a letter to the debtor about the changes, warning that the debt must be repaid using the new details. It is noteworthy that this can also be done through the court, prosecuting the borrower for refusing to fulfill their obligations. If he did not receive the notification and transferred part of the debt to the original borrower, then the dispute no longer arises between him and the collector, but between the collector and the bank. According to the law, the one who made the mistake is responsible for such consequences, i.e. in our case, the assignee who did not provide new details.

When an assignment agreement can be declared invalid

As practice shows, a person acting as a borrower does not participate in concluding an assignment agreement. He receives notification of a change in ownership of the rights to the debt only after the transaction is concluded. Many people faced with such a situation try to protect their interests through the courts, asking regulatory authorities to invalidate the transaction.

As judicial practice shows, such claims are rarely satisfied by control authorities. The only exception is those cases where the agreement concluded between the assignor and the assignee has gross violations. It should also be noted that the absence of a note in the original agreement on the possibility of transferring rights to the loan is not considered a violation. This means that it is almost impossible to challenge the assignment agreement.

Required documents

There is no single standard package of documents for drawing up an assignment agreement. It all depends on the type of transaction. But there are also general documents.

Thus, the most important thing is the contract itself that was originally concluded (for example, supplies, sales, credit). An act of reconciliation of mutual settlements is mandatory, which will determine the amount of the assigned debt. It is also supported by receipt and expenditure documentation (TTN, payment receipts). For bank loans, you must provide a repayment schedule, account statement, and payment receipts.

Assignor, assignee and debtor - features of an assignment agreement

- Financial. The right is confirmed exclusively by a signed agreement and accompanying documents, which indicate the exact remaining amount that should be returned.

- Property. The volume of documentation here is much larger, and each unit will require a separate document that will confirm ownership of the property.

In any case, during the conclusion of a tripartite agreement, it is very important to inform the third party, in relation to whom all rights and obligations apply. Often, persons sign all formalities in the presence of the “debtor,” because in this case he is automatically considered notified and a whole series of formalities that must be resolved in the coming days can be avoided.

: April 03, 2016

The relationship between the assignor and the assignee of the debtor can arise in a wide variety of cases, but they always come down to drawing up the appropriate agreement. There are quite a few peculiarities of office work in this case, however, only in exceptional cases is the debtor notified.

A similar agreement is used in the financial sector in quite a number of areas, because often the creditor does not have the ability to collect the required amount on his own.

Most civil legal relations between two entities become the basis for the emergence of obligations of one to the other. There are quite a few types of contracts for their execution. Each specific case may differ radically in the following features:

- The parties can be represented by individuals (PEs) or legal entities (LEs).

- The type of agreement depends solely on the need that arises - loan, purchase and sale, lease, etc.

- Obligations assumed: transfer of financial resources, property, provision of services, etc.

The contract itself is considered concluded immediately after it is signed by both parties. During the drafting process, you need to indicate absolutely all the conditions, because both parties during the validity of the agreement will have to adhere to all the nuances that are indicated here. Particular attention should be paid to the procedure for recognizing the fulfillment of conditions.

During the interaction, a situation may arise in which one of the parties is no longer interested in further cooperation.

For example, the debtor does not repay the loan on time, or even has serious arrears. Here the bank simply wants to return the money assigned to it as quickly as possible.

It is on this basis that the transfer of powers occurs from one organization (assignor) to another (assignee).

An assignment agreement is a transfer of the right to claim under a contract.

- Assignor. A company that transfers its rights and obligations to the debtor

- Debtor. The party who owes a debt or obligation to a partner.

- Assignee. A company that assumes the right to claim obligations in relation to the second party. Read here the procedure for collecting loan debt.

In the process of concluding a transaction, it is imperative to consider all the features of the interaction of the debtor with the assignor, because only in this case will it be possible to achieve optimal results and fully clarify the legal framework within which the assignee will operate.

When drawing up an agreement on the assignment of property rights, it is required to use generally accepted literature. This approach ensures uniformity of all terms and also significantly simplifies office work in the future.

Cession – from Latin means “assignment” or “transfer”. If we consider the assignment agreement, then there are several fundamental factors:

- The concession is complete. After the conclusion of the contract, all rights and obligations of the assignor are transferred to the assignee, while this should not affect the debtor for the worse.

- Benefit. The transfer of rights implies compensation, which is most often expressed in financial terms, although legal aspects are often indicated.

In the process of concluding an assignment agreement, it is necessary to take into account that it is the assignor who assumes most of the formal responsibilities, because he needs to confirm the legality of the requirements presented to the debtor. And after that, also provide the assignee with all the documents that will confirm the rights to any property transferred.

The compensation that the assignor receives from the assignee depends on many factors. Thus, one of the most important conditions is the complexity of debt collection.

If the debtor maliciously evades his obligations or occasionally disappears from sight, then the amount of compensation increases significantly, because

It is important to understand that such an approach is beneficial not only to the assignor, but also to the assignee, and together with them will help the debtor get out of an unpleasant situation.

There are many types of agreements that can be concluded under a wide variety of conditions - divorce, enterprise reorganization, failure to complete a transaction, and many others. With all the diversity, there are also the most popular among all:

- Between YL. It is most common during the reorganization of an enterprise, and in this case only the name of the debtor changes. During the transaction process, stamps will be required on both sides.

- Between FL. Such agreements do not need to be notarized, but all details must be included - passport numbers, full name, amount, terms and method of return. Most often, such relationships arise when dividing property, transferring children's debts to parents or vice versa, and providing support in obtaining a loan.

- Transfer from legal entity to individual entrepreneur. The most common case is the bankruptcy of an enterprise, in which all responsibilities of the legal entity are transferred in full to the director personally. The agreement is sealed on one side and signed on the other. Read more about the concept of bankruptcy here.

The assignor assumes most of the formal responsibilities.

When concluding contracts, all parties must adhere to a number of conditions:

- Openness. It is necessary to indicate all the required details, including signatures and seals for legal entities, as well as passport data from individuals.

- Conditions. All conditions for the transfer of rights must be clearly reflected in the contract, because only in this case can each party be completely confident in their legal security.

- Price. Indicated when the contract is for a fee. If it is free of charge, then this will also need to be indicated.

- Documentation. A complete list of documentation that was provided to confirm ownership of the property, as well as all additional formalities, is indicated.

- The agreement that started it all. It must certainly be available, and its data must be transferred to the newly compiled one.

- Date of. This specifies the precise moment at which rights and obligations are transferred from one party to the other. Most often, this moment is the signing of the contract, although the time of transfer of all necessary accompanying documents is often used.

There are a number of factors that make the conclusion of such agreements impossible. Among them are the payment of alimony and compensation for material damage incurred as a result of harm to health or life.

In addition, it should be remembered that such a transaction cannot contradict the law or other legal acts.

Declaring insolvency can be made much easier by a bankruptcy lawyer. In difficult cases, it is better to seek help from a specialist at the very beginning of the process. Credit organizations often transfer the rights to collect debt to third parties, that is, they enter into an assignment agreement. Find out more about where to get protection from creditors here. You should not delay contacting specialists.

The assignor and assignee are equally interested in ensuring that the debtor fulfills its obligations by legal means. Most often, the methods of claim and possible sanctions are prescribed in the text of the contract itself, although it is often necessary to refer to the current legislation.

In the process of concluding an agreement, only two parties often participate, and the third party is notified of the transfer of rights only after signing. This is due to the fact that this action will not bring any legal changes to the latter, and the party to whom compensation will be sent can be absolutely anyone.

If the debtor was not notified and sent the funds to the assignor at the address indicated in the original agreement, then the obligations are considered fulfilled to the assignee. All further disputes should no longer affect the rights and freedoms of the debtor, and all imposed sanctions should be declared unlawful and immediately cancelled.

Civil legal relations between two entities are often the reason on which one of the parties to such relations may have obligations towards the other.

Despite the fact that the legal nature of such relations will be quite similar, their specific conditions and circumstances may differ significantly: for example, the parties may be individuals or legal entities, the agreement concluded between them may be a loan, lease or other type of agreement, and the obligation assumed by one of the parties in accordance with it may consist of the transfer of an item or value, the provision of services, the performance of any work or other actions.

Moreover, in all of these cases, it is a written document signed by both parties between whom the agreement is concluded that confirms the fact that both parties agree with the rights and obligations that such a document imposes on them. It is assumed that all specific conditions for fulfilling obligations under the contract and the procedure for recognizing them as fulfilled are also fully reflected in the document signed by the parties.

Attention!

However, subsequently the borrower repeatedly violated the terms and conditions specified in the agreement. In this regard, the banking institution was no longer interested in having a long-term financial relationship with this borrower.