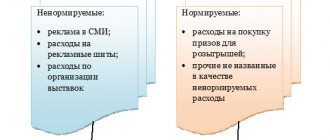

First, let’s find out what is generally considered advertising. This way we will understand what expenses can be attributed

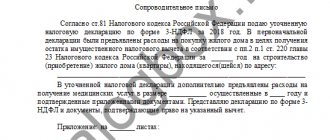

Let us assume that some time after submitting the Tax Return for personal tax

How to get a duplicate work book if lost Any employment is accompanied by presentation to the HR department

When getting a job, a person brings with him not only a baggage of knowledge, skills and hopes,

Introductory information Insurance premiums for injuries are paid by those organizations and individual entrepreneurs that have hired

Legislative regulation The declaration is submitted to the tax authorities electronically, in person or by mail up to 30

Features of the shift method The Labor Code of the Russian Federation defines the shift method as a special algorithm for organizing work

Administrative and management costs are one of the main expense items of a manufacturing enterprise.

The advance travel report in 2021 remains one of the few mandatory travel documents.

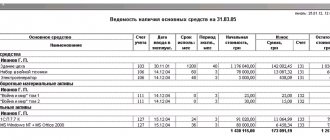

In accordance with Accounting Regulations 6/01, the cost of fixed assets is repaid by