Legislative regulation

The declaration is submitted to the tax authorities electronically, in person or by mail before April 30 of the following year (except for cases of filing a tax deduction).

Legislative regulation of issues related to form 3-NDFL is carried out:

- Chapter 23 of the Tax Code of the Russian Federation.

- By Order of the Federal Tax Service of Russia No. ED-7-11/ dated August 28, 2020 (comes into force on January 1, 2021).

IMPORTANT!

The form consists of many sheets, but the taxpayer is required to fill out a title page indicating the document type code in the 3-NDFL declaration and pages reflecting the individual situation.

ConsultantPlus experts discussed how to fill out the 3-NDFL declaration to receive a property deduction for the costs of purchasing an apartment and for interest on a mortgage loan. Use these instructions for free.

Fields for codes of types of income in 3-NDFL

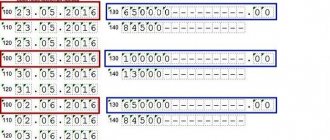

The fields for codes consist of a certain number of cells and are located in Appendices No. 1 and No. 2, which are similar in structure to the second section of the report.

The first application reflects:

- information about the source of income: its name, TIN, KPP and OKTMO;

- information about payments and taxable amounts;

- the amount of calculated and withheld income tax.

The information contained in the second appendix includes:

- information about the foreign source of payment;

- dates of transactions and exchange rates for them;

- information required to determine the amount of tax paid on revenue from foreign sources.

How to use

We would like to draw your attention to the fact that when selling a car, many people enter the wrong income code in 3-NDFL – 01. That is, they consider it real estate. However, de jure, any motor vehicle is a movable object. They have nothing to do with real estate. Therefore, the code for the car will be 02.

And for wages, the income code in 3-NDFL can take 2 values - 06 and 07. The only difference is whether the employer withheld income tax or not. To understand this, you need to look at the 2-NDFL certificate issued upon dismissal. In most salary cases, the code for the type of income in 3-NDFL is 06.

We also note that salary income is declared in 3-NDFL in order to correctly calculate the total amount of personal income tax, which will have to be transferred to the treasury or there will be an opportunity to return it.

As can be seen from the table, each code has its own composition of income. However, the Federal Tax Service does not provide any decoding of them. For example, what will be the code for income from the sale of land in 3-NDFL? We know: 01 or 09.

It is more difficult with the income code in 3-NDFL when selling shares. In our opinion, this will be code 03, since a share is a security. And according to the Tax Code, income from transactions with securities is proceeds from their sale (Article 329).

Codes for income received in the Russian Federation

The list of payments from sources in the Russian Federation includes 17 items, divided into types to facilitate user selection.

The list contains indicators of funds received:

- “01” is used to indicate proceeds from the sale of real estate or part thereof, which includes: apartments and rooms, cottages and houses, garages and other objects.

- “02” is entered upon receipt of proceeds from the sale of real estate, established on the basis of the cadastral value adjusted using a coefficient of 0.7.

- “03” is indicated for proceeds from the sale of property that is not considered real estate.

- "04" is used for gains on taxable securities.

- “05” - put by recipients of rent for any property.

- The digital code of type of income 06 in the declaration is used to designate gifts and property under a gift agreement.

- Payments for which code “07” is used in the declaration show earnings under the contract from which tax was withheld.

- Earnings from contracts from which tax is not withheld are coded “08”.

- “09” is used to reflect dividend remuneration.

- Recipients of other earnings put “10”.

- Proceeds from the sale of other real estate, determined in accordance with the price of the object under the contract, are designated “11”.

- “12” is affixed when selling other real estate at cadastral value, adjusted using a coefficient of 0.7.

- Transport sellers designate revenue as number “13”.

- The legal successors and heirs of inventors and authors of works of science, art and literature designate awards “14”.

- “15” is used by recipients of winnings from lotteries held in bookmaker companies and sweepstakes.

- Fans of games that are not classified as gambling by bookmakers use “16”.

- The cash equivalent of real estate and securities used to fund the capital of a non-profit.

IMPORTANT!

For the purposes of filling out income type code 07 in the declaration, it does not matter on the basis of which agreement the taxpayer earned the funds - labor or civil law.

Appendix No. 4 to the Procedure for filling out the tax return form for personal income tax (form 3-NDFL), approved by Order of the Federal Tax Service of December 24, 2014 No. ММВ-7-11/ [email protected] (as amended by the Order of the Federal Tax Service Russia dated November 25, 2015 N ММВ-7-11/ [email protected] )

Directory “Codes of types of income” (as amended by Order of the Federal Tax Service of Russia dated November 25, 2015 N ММВ-7-11/ [email protected] )

| Code | Name |

| 01 | Income from the sale of real estate and shares in it |

| 02 | Income from the sale of other property |

| 03 | Income from transactions with securities |

| 04 | Income from property rental (hire) |

| 05 | Income in cash and in kind received as a gift |

| 06 | Income received on the basis of an employment (civil) contract, the tax from which is withheld by the tax agent |

| 07 | Income received on the basis of an employment (civil) contract, the tax from which is not withheld by the tax agent, including partially |

| 08 | Income from equity participation in the activities of organizations in the form of dividends |

| 09 | Other income |

The procedure for filling out the tax return form for personal income tax (form 3-NDFL)

I. General requirements for filling out the tax return form for personal income tax

II. Contents of the Declaration

III. The procedure for filling out the title page of the Declaration form

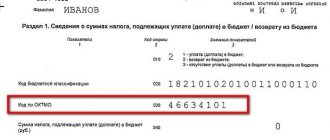

IV. The procedure for filling out Section 1 “Information on the amounts of tax subject to payment (addition) to the budget/refund from the budget” of the Declaration form

V. The procedure for filling out Section 2 “Calculation of the tax base and the amount of tax on income taxed at the rate of (001)%” of the Declaration form

VI. The procedure for filling out Sheet A “Income from sources in the Russian Federation” of the Declaration form

VII. The procedure for filling out Sheet B “Income from sources outside the Russian Federation, taxed at the rate of (001)%” of the Declaration form

VIII. The procedure for filling out Sheet B “Income received from business, advocacy and private practice” of the Declaration form

IX. The procedure for filling out Sheet D “Calculation of the amount of income not subject to taxation” of the Declaration form

X. The procedure for filling out Sheet D1 “Calculation of property tax deductions for expenses on new construction or acquisition of real estate” of the Declaration form

XI. The procedure for filling out Sheet D2 “Calculation of property tax deductions for income from the sale of property” of the Declaration form

XII. The procedure for filling out Sheet E1 “Calculation of standard and social tax deductions” of the Declaration form

XIII. The procedure for filling out Sheet E2 “Calculation of social tax deductions established by subparagraph 4 and subparagraph 5 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation” of the Declaration form

XIV. The procedure for filling out Sheet G “Calculation of professional tax deductions established by paragraphs 2, 3 of Article 221 of the Tax Code of the Russian Federation, as well as tax deductions for the sale of shares in the authorized capital and for the assignment of the right of claim under an agreement for participation in shared construction”

XV. The procedure for filling out Sheet 3 “Calculation of taxable income from transactions with securities and transactions with financial instruments of futures transactions” of the Declaration form

XVI. The procedure for filling out Sheet I “Calculation of taxable income from participation in investment partnerships” of the Declaration form

Appendix No. 1 Directory “Taxpayer Category Codes”

Appendix No. 2 Directory “Codes of types of documents”

Appendix No. 3 Directory “Region Codes”

Appendix No. 4 Directory “Codes of types of income”

Appendix No. 5 Directory “Object name codes”

Appendix No. 6 Directory “Codes of persons claiming property tax deductions”

Assistance in filling out tax returns 3-NDFL

Detailed information can be obtained by calling 210-82-31

Codes for income received outside the Russian Federation

List of payments from foreign sources:

- "21" denotes the profit of a controlled foreign company.

- “22” is used to indicate dividends.

- “23” is used to pay interest.

- “24” is indicated for royalties.

- “25” means proceeds from the alienation of property.

- “26” denotes payments from the alienation of shares and rights, more than half of the value of which is real estate located outside the Russian Federation.

- “27” is used for income from personal income: salary in the 3-NDFL declaration and similar remunerations.

- Payments to company management and directors' fees are designated by the number "29".

- “30” – revenue from artistic, musical or sports activities.

- "31" denotes income earned in government service.

- For other payments, “32” is used.

Region code of the Russian Federation

| 01 | Republic of Adygea |

| 02 | Republic of Bashkortostan |

| 03 | The Republic of Buryatia |

| 04 | Altai Republic |

| 05 | The Republic of Dagestan |

| 06 | The Republic of Ingushetia |

| 07 | Kabardino-Balkarian Republic |

| 08 | Republic of Kalmykia |

| 09 | Karachay-Cherkess Republic |

| 10 | Republic of Karelia |

| 11 | Komi Republic |

| 12 | Mari El Republic |

| 13 | The Republic of Mordovia |

| 14 | The Republic of Sakha (Yakutia) |

| 15 | Republic of North Ossetia-Alania |

| 16 | Republic of Tatarstan (Tatarstan) |

| 17 | Tyva Republic |

| 18 | Udmurt republic |

| 19 | The Republic of Khakassia |

| 20 | Chechen Republic |

| 21 | Chuvash Republic - Chuvashia |

| 22 | Altai region |

| 23 | Krasnodar region |

| 24 | Krasnoyarsk region |

| 25 | Primorsky Krai |

| 26 | Stavropol region |

| 27 | Khabarovsk region |

| 28 | Amur region |

| 29 | Arhangelsk region |

| 30 | Astrakhan region |

| 31 | Belgorod region |

| 32 | Bryansk region |

| 33 | Vladimir region |

| 34 | Volgograd region |

| 35 | Vologda Region |

| 36 | Voronezh region |

| 37 | Ivanovo region |

| 38 | Irkutsk region |

| 39 | Kaliningrad region |

| 40 | Kaluga region |

| 41 | Kamchatka Krai |

| 42 | Kemerovo region |

| 43 | Kirov region |

| 44 | Kostroma region |

| 45 | Kurgan region |

| 46 | Kursk region |

| 47 | Leningrad region |

| 48 | Lipetsk region |

| 49 | Magadan Region |

| 50 | Moscow region |

| 51 | Murmansk region |

| 52 | Nizhny Novgorod Region |

| 53 | Novgorod region |

| 54 | Novosibirsk region |

| 55 | Omsk region |

| 56 | Orenburg region |

| 57 | Oryol Region |

| 58 | Penza region |

| 59 | Perm region |

| 60 | Pskov region |

| 61 | Rostov region |

| 62 | Ryazan Oblast |

| 63 | Samara Region |

| 64 | Saratov region |

| 65 | Sakhalin region |

| 66 | Sverdlovsk region |

| 67 | Smolensk region |

| 68 | Tambov Region |

| 69 | Tver region |

| 70 | Tomsk region |

| 71 | Tula region |

| 72 | Tyumen region |

| 73 | Ulyanovsk region |

| 74 | Chelyabinsk region |

| 75 | Transbaikal region |

| 76 | Yaroslavl region |

| 77 | Moscow |

| 78 | Saint Petersburg |

| 79 | Jewish Autonomous Region |

| 83 | Nenets Autonomous Okrug |

| 86 | Khanty-Mansiysk Autonomous Okrug - Ugra |

| 87 | Chukotka Autonomous Okrug |

| 89 | Yamalo-Nenets Autonomous Okrug |

| 91 | Republic of Crimea |

| 92 | Sevastopol |

| 99 | Other areas, including the city and Baikonur Cosmodrome |