In accordance with Accounting Regulations 6/01, the cost of fixed assets is repaid by calculating depreciation.

Depreciation is a process that characterizes the wear and tear of equipment or other equipment during operation. Depreciation cannot be calculated for a category of property whose properties do not change over time (for example, land plots).

In accordance with Russian legislation, depreciation should be calculated monthly, starting from the month following the commissioning of the facility. Control over depreciation is important not only for accounting, but also for tax accounting. Depreciation in reporting for accounting purposes is used in preparing the balance sheet. Line 1150 should reflect the residual value of the objects, which is calculated taking into account accumulated depreciation. In order to determine the residual value of a non-current asset, it is enough to subtract the credit balance of account 02 “Depreciation of fixed assets” from the debit balance of account 01 “Fixed Assets”.

For tax accounting, depreciation is no less important, since it allows you to reduce the calculated base for income tax. At the same time, to control the write-off of the value of an object as it wears out, organizations can use a depreciation sheet.

General rules for calculating depreciation

State (municipal) institutions, including government institutions, calculate depreciation of fixed assets according to the rules established by Instruction No. 157n . Let us recall these rules.

| Rules for calculating depreciation of fixed assets | Instruction point No. 157n |

| Linear method of calculating depreciation | 85 |

| During the financial year, depreciation is calculated monthly in the amount of 1/12 of the annual amount | |

| During the useful life of the fixed asset, depreciation is not suspended* | |

| Depreciation begins on the first day of the month following the month the fixed asset was accepted for accounting | 86 |

| Depreciation accrual stops from the first day of the month following the month of full repayment of the cost of the fixed asset or the month of its disposal from accounting | 87 |

| Depreciation cannot be calculated in excess of 100% of the cost of the depreciable object | 86 |

| For fixed assets worth over 40,000 rubles. depreciation is accrued in accordance with calculated depreciation rates | 92 |

| For fixed assets worth up to 40,000 rubles. inclusive, depreciation is accrued in the amount of 100% of the book value in relation to: – real estate when it is accepted for accounting; – the library collection when it is put into operation; – other fixed assets when put into operation, with the exception of objects whose cost does not exceed 3,000 rubles. | |

| For fixed assets worth up to RUB 3,000. inclusive, with the exception of the library collection and real estate, depreciation is not charged |

Except for cases of transfer of a fixed asset object to conservation for a period of more than three months, as well as during the period of restoration of the object, the duration of which exceeds 12 months.

Concept

This is a uniform, dispersed in parts, transfer of the cost of fixed assets and intangible assets to the products manufactured by the company or services performed by the organization. It occurs as equipment wears out or becomes obsolete.

Features of depreciation for state employees are as follows:

- One-time depreciation is allowed when registering an asset if it is real estate or library funds less than 40,000 rubles.

- Or other objects worth 3,000 - 40,000, which are accounted for as fixed assets.

Since intangible assets, in fact, are an analogue of fixed assets, but in the form of intangible, intellectual property, they are subject to the same principles of depreciation as for tangible objects.

Linear, cumulative and other methods

It is important to know and remember: for all fixed assets included in the eighth, ninth and tenth groups of the classifier, only linear depreciation is applied.

Article navigation

- Procedure for calculating depreciation

- Depreciation statement

- Methods for calculating depreciation of fixed assets

- Linear method of calculating depreciation

- Lifetime

- What fixed assets are not subject to depreciation?

If we consider depreciation in a simplified way, then it represents the transition of a fixed asset in the process of its commercial operation from physical form to monetary form. An asset used in the course of business generates a profit equal to the difference between the selling price and costs.

Depreciation charges are included in the cost price, and after the sale of the product they are credited to a special account intended to pay for the renewal of production facilities. The features of this process will be discussed in the article offered to your attention.

Depreciation calculation

The main indicators necessary to calculate depreciation of a fixed asset are its cost and the depreciation rate, calculated based on the useful life of the depreciable fixed asset.

Useful life. The useful life of a fixed asset is the period during which it is planned to use the fixed asset in the course of the institution’s activities for the purposes for which it was acquired, created and (or) received (for the planned purposes). The procedure for determining the useful life of a fixed asset is presented in paragraph 44 of Instruction No. 157n . Below we present a diagram for determining such a period.

| The useful life is determined based on: | ||||

| information contained in the legislation of the Russian Federation establishing the useful life of property for the purpose of calculating depreciation. In this case, we mean Resolution of the Government of the Russian Federation dated January 1, 2002 No. 1 “On the Classification of fixed assets included in depreciation groups” and Resolution of the USSR Council of Ministers dated October 22, 1990 No. 1072 “On approval of uniform norms of depreciation charges for the complete restoration of fixed assets of the national economy THE USSR" . If information is missing, then based on: | ||||

| recommendations contained in the manufacturer's documents included with the fixed asset. If information is missing, then based on: | ||||

| decision of the institution’s commission on the receipt and disposal of assets, taken taking into account: | ||||

| the expected life of this object in accordance with the expected productivity or capacity | expected physical wear, depending on the operating mode, natural conditions and the influence of an aggressive environment, the repair system | regulatory and other restrictions on the use of this object | warranty period for use of the object | terms of actual operation and previously accrued amount of depreciation |

Calculation of depreciation based on book value. As a general rule, depreciation is calculated based on the book value of the fixed asset ( clause 85 of Instruction No. 157n ).

A government health care institution purchased medical instruments. Its book value is 47,000 rubles. It is necessary to determine its useful life and calculate the amount of monthly depreciation.

Medical instruments (OKOF code 14 3311010) are included, according to the Classification of fixed assets included in depreciation groups, in the first depreciation group (as property with a useful life from one year to two years inclusive). In this case, based on clause 44 of Instruction No. 157n, the useful life is established according to the longest period determined for the specified depreciation group. Consequently, the useful life of a medical instrument is recognized as equal to two years (24 months).

Taking this into account, monthly depreciation for this object will be 1,958.33 rubles. (RUB 47,000 / 24 months).

Calculation of depreciation based on residual value. The residual value of a fixed asset is used to calculate depreciation in the following cases:

– when, as a result of completion, retrofitting, reconstruction, modernization or partial liquidation of a fixed asset, its initially accepted standard performance indicators have changed, which resulted in a change in the useful life. In this case, starting from the month in which the useful life was changed, depreciation is calculated based on the residual value of the fixed asset and the remaining useful life as of the date of change ( clause 85 of Instruction No. 157n >);

– if the object was registered with previously accrued depreciation. In this case, depreciation is calculated based on the residual value of the depreciable object on the date of its acceptance for accounting and the depreciation rate calculated on the basis of the remaining useful life on the date of its acceptance for accounting ( clause 85 of Instruction No. 157n ).

In this case, the residual value of a fixed asset as of the corresponding date is understood as its book value reduced by the amount of depreciation accrued on the corresponding date, and the remaining useful life as of the corresponding date is the useful life of the depreciable fixed asset, reduced by the period of its actual use on the corresponding date. .

As a result of the reconstruction of a building listed on the balance sheet of a government institution, its book value increased by 500,000 rubles. (from 1.5 million rubles to 2 million rubles). As a result of the reconstruction work, the standard performance indicators of the building were improved. In this connection, by decision of the commission, its useful life was revised. This period was increased from 20 years to 25 years. At the time of changing the useful life, the building had been in operation for 17 years, and the amount of accrued depreciation on it amounted to RUB 1,275,000. It is necessary to calculate the amount of monthly depreciation accrued from the month in which the useful life was changed.

So, on the date of change in the useful life, the residual value of the building will be equal to 725,000 rubles. (1,500,000 + 500,000 - 1,275,000), and the remaining useful life is eight years (25 - 17). Thus, the monthly depreciation amount starting from the month in which the useful life was changed will be RUB 7,552.08. (RUB 725,000 / 96 months).

As part of an intradepartmental transfer, a government agency received free of charge a car that had previously been in use by the transferring party. According to the documents, the book value of the transferred car is 500,000 rubles, and the amount of depreciation accrued on it is 300,000 rubles. The useful life of this vehicle is five years. At the time the institution accepted it for registration, it had been in operation for three years. It is necessary to calculate the monthly depreciation amount for the car.

In this case, the residual value of the car is 200,000 rubles. (500,000 - 300,000), and the remaining useful life is two years (5 - 3).

The amount of monthly depreciation accrued at the institution will be 8,333.33 rubles. (RUB 200,000 / 24 months).

The role of depreciation of fixed assets in the activities of an enterprise

As is known, depreciation of fixed assets represents the cost of fixed assets, gradually distributed among the cost of production, manufactured goods and services provided. This implies the gradual accumulation in a specialized fund of funds received as a result of the sale of goods produced or services provided. These funds can be used as investments and, as a rule, they are: depreciation charges in many companies range from 70 to 80% of all investment funds, since their use is more profitable than third-party investment.

This investment can be used for the following needs:

- Purchasing new equipment instead of worn-out and retired equipment;

- Carrying out major repairs of equipment;

- Modernization of production;

- Reconstruction of structures;

- Technical re-equipment.

What is it used for?

The depreciation sheet for fixed assets is used to reduce the tax base for the reporting period, reflect the value of fixed assets for the period (month, year), as well as changes in the cost of equipment for the period.

In general, it is possible to divide the tasks regarding the OS for which the list is used into:

- disposal of fixed assets from the production process and turnover;

- modernization of means of production and costs incurred in connection with this;

- movement of the operating system during the production process;

- accrual of depreciation of funds over a period of time.

The indicators reflected in the statement must be of a cost and quantitative nature.

These parameters allow the company to have an idea of the amount of depreciation, the movement of fixed assets and allow them to adequately respond to changes.

Why is the statement required?

In the company's accounting department, it is advisable and objective to provide a specialized form for keeping records and recording information about existing fixed assets, as well as their movement. The role of this form is usually the statement of depreciation of fixed assets.

When using it you can see:

- On the movement of the OS,

- Their modernization

- Depreciation,

- Disposal.

And all this in value terms. In addition, the statement allows you to view detailed information about the OS. For example, view information about the fixed assets group by division, depreciation by individual groups, etc.

It should be noted that for small enterprises a universal form of this statement has been created (Form No. 1MP). But it is only a recommended document. The legislation does not force you to use it. At the same time, each company has the right to take this document as a basis and develop its own format for this statement and use it as an internal template.

Some features of filling out this form will be discussed below. But given that this particular format (No. 1MP) is optional, in reality the process of filling it out may differ slightly from what will be written here.

The period for which the statement is prepared is one month. Based on the results of this month, the results for the next month are calculated. However, for small enterprises, internal movements are often not reflected in the statements.

The depreciation statement should be filled out correctly, since in the future the final values of depreciation indicators from this document must be transferred to the statement of costs and production accounting.

In addition, it is important not to forget that depreciation rates have a direct impact on the final cost of fixed assets, which should be reflected on the balance sheet at their residual value (which means deducting depreciation from their cost).

Also, for companies related to medium or small businesses, it is strongly recommended to use the specified form No. 1MP not only to keep track of information on fixed assets, but also to keep track of the company’s intangible assets, and therefore to charge depreciation on them.

Accountant's Directory

- Add your publication

registration is required for this

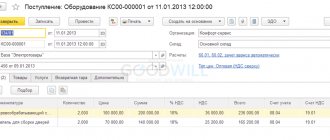

Work with reports on the operating system will be in the context of documents: fixed assets depreciation sheet, fixed assets inventory card, fixed assets inventory book (management accounting), fixed assets inventory book (accounting), Calculation of costs for improving the fixed assets (Fig. 1)

Fig.1

In this article we will look at the OS depreciation statement.

We select the statement of depreciation of fixed assets from the menu:

Reports - Fixed assets - Fixed assets depreciation statement

We can create the statement itself for both management and accounting. The report gives us information about the depreciation of fixed assets, in terms of the parameters specified in the settings that we set before generating the statement.

Operating Instructions

In order not to set parameters every time when generating the Statement of Depreciation of Assets, we can save the settings and generate the report automatically in the future.

In the depreciation statement we can see:

— list of fixed assets by MOL and Divisions;

— cost and depreciation of fixed assets (initial, changes and at the end of the period).

Using the “Advanced setup” option (check the box when going to the Settings menu), we can select, group fixed assets, or add additional fields to the depreciation statement (depreciation calculation method, commissioning date).

Note to the accountant: Here we can check whether depreciation is calculated correctly.

For example, we accepted fixed assets for accounting last month - May, in the document of acceptance for accounting we forgot to check the “Calculate depreciation” checkbox on the management accounting tab, in this case depreciation will not be accrued.

When we generate the depreciation sheet for June, we will see in the documents that there is no value in the Depreciation for the period column, since the “Accrue depreciation” checkbox was not checked in the document for accepting fixed assets for accounting.

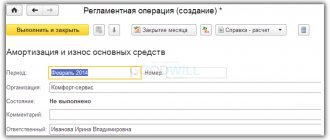

To check and correct errors in depreciation calculation, we can also use the depreciation calculation register (Fig. 2-3)

Fig.2

Fig.3

Operations - Information Register

From the list, select Accrual of depreciation (management or tax accounting) and check the list of fixed assets for the checkbox in the “Accrue depreciation” field; if there is no checkbox, and depreciation should be calculated in this period, make the change through the register. By double-clicking on the empty field where the depreciation value calculated for the period should have been entered, we go to the document of acceptance for accounting and check the box to calculate depreciation in management or accounting.

previous()all

≡ to the list of articles

Balance Sheet

Page 1

The balance sheet reflects the financial position at the end of the calculated period of time. Balance sheet indicators throughout the entire period of time indicate the stable financial position of the company.

In this regard, Stern adds, NNFK's balance sheets make for interesting reading.

Book value refers to the value of property included in the balance sheet of an enterprise or organization. It includes the value of real estate, indexed as of the date of revaluation of fixed assets, less accounting depreciation approved by government decree, and the value of newly constructed and acquired objects for the reporting period.

The use of a double posting system eliminates the possibility of any inconsistencies in the balance of payments statement due to discrepancies in the interpretation of the general concept of residence or the status of individual economic units.

This most general presentation of users of accounting form No. 1 and balance sheet makes it possible to take into account all interested parties who can analyze the financial and economic condition of the enterprise according to open press data.

In such transactions, the leased property is typically placed on the lessee's balance sheet and recorded on the company's balance sheet as an asset and a corresponding liability in the fixed assets category. The party leasing the asset receives substantially all the economic benefits and assumes all the risks of the leased property.

To analyze the financial and economic condition of an enterprise, the initial data can be, on the one hand, Form No. 1 of the enterprise’s financial statements or the project’s balance sheet, or data from a checkerboard balance sheet, on the other hand.

Risk arising from changes in foreign exchange rates: can be divided into transaction risk, in which currency fluctuations affect the course of day-to-day transactions, and translation risk, which affects the value of assets and liabilities on the balance sheet.

This reporting is completed according to analytical accounting data in the Profit and Loss account. It is a balance sheet on the basis of which the final balance of profit or loss of the enterprise is determined, taking into account non-sale income and losses.

It is calculated as the initial cost of acquisition, creation of an object, at which it was entered into the balance sheet, less accumulated depreciation.

It is calculated as the initial cost of acquisition, creation of an object, at which it was entered into the balance sheet, less accumulated depreciation. The book value of a company or firm is defined as its net assets, equity capital, that is, total assets minus total liabilities and debts.

Such modeling is a series of computational procedures that simulate the preparation of an industrial financial statement (profit - loss) and a statement of financial position (balance sheet) based on the rules set out in the previous section.

The economic content of individual parts, sections and the entire balance of payments of the state is determined by a unified nomenclature of standard articles. Each standard article reflects in summary form the results of a certain group of foreign economic transactions similar in their economic purpose.

It is a unique component of the reporting balance sheet. Components combined into classes according to one or another economic characteristic represent an account that is built on the principle of double entry.

At the highest level of aggregation of standard components, the balance of payments can be presented in the form of two interconnected accounts: the current account and the capital account.

The current account of the balance of payments summarizes statistical information on foreign economic activity: intercountry movement of goods, provision of services, distribution of factor income, remittances, transfer flows.

Each standard article reflects in summary form the results of a certain group of foreign economic transactions similar in their economic purpose. It is a unique component of the reporting balance sheet.

Statement of depreciation of fixed assets by month

Components combined into classes according to one or another economic characteristic represent an account that is built on the principle of double entry. At the highest level of aggregation of standard components, the balance of payments can be presented in the form of two interconnected accounts: the current account and the capital account.

His main occupation was participation in the joint-stock company General Tax Commission, which, before the Great French Revolution, collected taxes from the population for the government on a concession basis.

One of Lavoisier’s biographers called the law of conservation of mass he formulated the law of the balance sheet and believed that its discovery was connected with Lavoisier’s position as a tax farmer.

Pages: 1 2

At the time of Accounting 8.1 (configuration edition 1.6) there was a wonderful 1C report on fixed assets -

“Asset Depreciation Sheet” (OS Menu - OS Depreciation Sheet).

The unique feature of this report was its customization.

The settings for the fixed assets depreciation report provided the ability to display a large number of accounting and reference indicators for fixed assets accepted for accounting in the program.

For example, it was possible to generate a depreciation sheet for fixed assets, which includes for the period the initial cost of the fixed asset, changes in its value (increases and decreases in separate columns of the report), depreciation for the period, residual value and a large number of details for the fixed asset: date of issue , serial number, manufacturer, period of use, procedure for paying off the cost, procedure for reflecting depreciation expenses.

Page not found

Additional details in the report settings could be displayed in separate columns, which is certainly very convenient for the visual perception of large reports.

And plus a large selection of parameters for grouping the report by rows and columns - by departments, by financially responsible persons and others.

Such a customizable fixed asset report could be used not only for accounting, but also for many other management and operational accounting tasks. An example of one of the report settings can be seen in the picture below.

In Accounting 8.2 (configuration edition 2.0), the same statement in 1C remained in the same place in the program menu. But now there are fewer options for customizing this report. The number of additional output parameters has been reduced, there are no groupings by columns, and there is no ability to display additional fields in separate columns of the report.

For those who liked the 1C statement on the OS accounting edition 1.6 more, there is a simple way out. You can download the Asset Depreciation Sheet from the Revision 1 configuration.

6 into an external 1C report , convert the report to platform 8.2 and use it as an external report on depreciation of fixed assets in accounting department 8.2. On current versions of the 1C Accounting 8 program.

2 external report “Depreciation Statement OS-82.erf” works great.

The finished external report 1C 'Statement of depreciation of fixed assets' for 1C 8.2 can be downloaded from the link below:

Depreciation sheet for fixed assets in 1C Accounting

External report 'Depreciation statement OS-82.erf'

Accrual and distribution between various industries of depreciation charges for fixed assets. Statement of depreciation of fixed assets. Distribution of production costs between oil and gas. Reporting calculation of oil and gas

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

- Calculation and accounting of the cost of oil and gas

Nomenclature of cost estimates in drilling and oil and gas production. Planned costing for oil and gas production management. Planning and division of costs by item. List of distribution of main expenses between oil and gas.

presentation, added 11/29/2013

- Accounting for depreciation of fixed assets

The procedure for calculating and accounting for depreciation charges on fixed assets. Concept, regulatory regulation, documentation of accrual and economic essence of depreciation of fixed assets. Methods of calculation for tax purposes.

Purpose of depreciation sheet B-1

Individual entrepreneurs are not required to keep accounting records, which means that depreciation expenses are not taken into account, so the service life is not established.

Here you will learn how to calculate depreciation of fixed assets. From 2002 to the present day, the following methods of calculating depreciation have been used in accounting: the straight-line method of calculating depreciation, the reducing balance method, the method proportional to the volume of output, as well as the method based on the sum of the numbers of years of useful life.

The calculation of depreciation charges for fixed assets involves the use of the original or residual value and the depreciation rate of fixed assets. The initial cost is the cost at which the object was accepted for accounting upon receipt by the enterprise.

Specialists should not forget that the calculation of depreciation also affects the final cost of fixed assets reflected in the balance sheet, since fixed assets are reflected in the balance sheet at their residual value, i.e., minus depreciation.

The statement of form No. 48-APK is designed to include all names of fixed assets, therefore it is provided with loose-leaf sheets, stitched in the required quantity (based on the nomenclature of fixed assets) into one notebook. If necessary, this statement can be used by department.

The calculation is made as follows: to the amount of depreciation accrued in the previous month (column 5), add the depreciation amounts determined in the reporting month for received fixed assets (column 90).

In the 1st subsection of the statement, the compilers reflect the following information:

- Object name;

- its original cost;

- the fact of movement of the object (and a document confirming this fact), for example, commissioning, sale or the fact of depreciation on the object.

Depreciation deductions for a rental (leasing) object are made monthly during the term of the rental (leasing) agreement, regardless of whether the object is on the balance sheet of the tenant (lessee) or the lessor (lessor).

The accrual sheet is not a difficult accounting document to execute, but it requires care and adherence to the sequence of completion

Rules for filling out the depreciation sheet for fixed assets - form + sample

The statement is a document of strict reporting. The accounting department is responsible for drawing up the document. The statement serves to document the accrued depreciation charges on fixed assets and shows the movement of funds across fixed assets through the use of depreciation.

The accrual sheet is not a difficult accounting document to execute, but it requires care and adherence to the sequence of completion.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

Accounting

Depending on the nature of the use of a fixed asset, depreciation accrued on it is included either in expenses for ordinary activities, or in other expenses, or in capital investments. In this case the wiring is carried out:

Debit 20 (23, 25, 44...) Credit 02 – depreciation has been accrued on fixed assets used in the production of goods (performance of work, provision of services) or in trading activities;

Debit 08 Credit 02 – depreciation was accrued on a fixed asset used in the creation (modernization, reconstruction) of another non-current asset;

Debit 91-2 Credit 02 - depreciation has been accrued on a fixed asset used in other types of activities (for example, on a leased fixed asset, if leasing property is not the main activity of the lessor, or on a non-production object).

Such postings must be made monthly (clause 21 of PBU 6/01).

OS received free of charge

The organization has the right to depreciate fixed assets received free of charge (clause 17 of PBU 6/01). When such objects are received, their market value is taken into account in account 98 “Deferred income”.

As the value of a gratuitously received fixed asset is transferred to expenses, other income is reflected in accounting in an amount equal to the accrued depreciation (clause 29 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n). In this case, two transactions are performed simultaneously:

Debit 20 (08, 23, 25, 44, 91...) Credit 02 – depreciation has been accrued on a fixed asset received free of charge;

Debit 98 Credit 91-1 - other income is recognized in the amount of depreciation accrued on a fixed asset received free of charge.

How to fill in when calculating depreciation charges for fixed assets?

Filling out the statement on a monthly basis allows the management of the enterprise and its financial departments to receive up-to-date information about the state of fixed assets, the degree of wear and tear of equipment and the cost taking into account depreciation.

For correct registration you need to remember:

- The depreciation sheet is divided into two main sections - account 01, in which fixed assets are recorded, and account 02, in which depreciation charges are reflected.

- Groups of fixed assets are reflected separately in each line without general mixing. Otherwise, it may provide misleading information about accrued depreciation.

In account 01 the following is reflected:

- Name, inventory number of the object. Each OS in the enterprise is given an individual number when such funds arrive at the enterprise.

- Price. The cost of an object is based on the method of its receipt - acquisition or production on site and must be reflected in the invoice.

- Status of the object and its location. The OS can be moved, which is fixed by regulatory documents - this information is also subject to mandatory reflection. A movement or change can also include the calculation of depreciation on an object.

At the same time, assets that the enterprise intends to give for use to other industries must be calculated in a separate statement and separate depreciation records are kept in relation to them.

Account 02 indicates the facts about the calculation and calculation of depreciation of the object and the grounds for this procedure:

- The amount of depreciation per unit of time. Since the form is filled out monthly as deductions are calculated, the unit of time is usually considered to be 1 month.

- The category to which the fixed asset belongs. The value of this category determines the rate at which depreciation (wear and tear) of equipment is calculated.

- The amount in total monetary terms of depreciation accrued on a separate fixed asset item.

- Volume and amount of depreciation per unit of time (month). It should be understood that subsequent accruals will directly affect the residual value of the asset.

- The value of a fixed asset after depreciation has been calculated at the end of the month (including the deduction of deductions).

After calculating all the values under each item, a separate total is summed up for each group of fixed assets, which ultimately provides objective information about the state of fixed assets.

Upon completion of filling out the form, data on fixed assets, their cost and condition are transferred to the organization’s cost accounting sheet.

The inclusion of such a list of data can be applied to both small and medium-sized businesses. New equipment is entered into the list in the month following its acquisition (manufacturing).

Procedure for conducting an inventory of fixed assets ↑

For buildings and structures, depreciation is calculated using the methods provided for in PBU 6/01 and Ch. 25 Tax Code of the Russian Federation.

The fixed assets accounting sheet is one of the most important documents in the financial accounting of an organization. It is required so that the company has an objective idea of the amount of depreciation on its own fixed assets, as well as on their movement. Why exactly the statement of fixed assets is so important will be discussed in this article.

A certain organization purchased a machine at a purchase price of 20,000. Its service life is four years. The organization takes the acceleration factor equal to 2.

Blanker.ru

To record the movement of fixed assets and calculate the required amounts of depreciation, a statement in form B-1 is used - a statement of accounting for fixed assets and accrued depreciation. The purpose of this document is analytical as well as synthetic accounting of both the presence and movement of fixed assets.

For individual objects, a specific place is provided in the statement form (this is the so-called positional accounting method). The period for compiling the statement is 1 month, based on the results of which the amount of turnover of fixed assets is calculated and derived from the balance for the next month (on the first day). It is worth noting that for small enterprises this statement does not reflect the internal movement of fixed assets.

Another purpose of this financial document is to control accrued depreciation amounts. For this purpose, the statement contains columns for accounting for depreciation (this value is reflected with an increasing effect). The accrual is displayed from the beginning of the operation of fixed assets.

In the future, data from Statement B-1 is used in Statements B-3 and B-4 to reflect the movement of accrued amounts of depreciation charges. If a small enterprise has a significant amount of fixed assets, their accounting can be kept on cards of the OS-6 form.

Consolidated accounting in statement B-1 for account 01 “Fixed assets” is carried out on the basis of the resulting data from the OS-8 accounting cards (movement of fixed assets). In this case, depreciation is calculated using table No. 6 or No. 7 (development tables of the journal-order form of accounting).

Fixed Asset Accounting Form

Most often, to account for depreciation of fixed assets, various types of enterprises use documents such as statements of depreciation of fixed assets in form No. B-1.

Important ! According to Article 314 of the Tax Code of the Russian Federation, employees of the accounting service of an enterprise can also develop their own form of accounting depreciation sheet . However, in this case, you should follow the recommendations of the Ministry of Finance on the approximate composition of the details of each section.

In this article, we will consider the most commonly used form of statement - form No. B-1 , developed for small enterprises. Despite the fact that the form is intended for small organizations, it can also be adapted for use in manufacturing companies with a large production volume.

conclusions

If you follow all the rules for filling out Form B-1 or sample statements developed by yourself, the enterprise will be able to see and evaluate the existing fixed assets, their total capitalization and analyze the process of depreciation (depreciation) of fixed assets, adjusting the company’s behavior towards increasing fixed assets or getting rid of surpluses, and also a correct reflection of the tax base.

Accounting statement indicators have a direct impact on the final cost of fixed assets, which, if calculated incorrectly, leads to a large number of difficulties, both in the field of tax and accounting, and can lead to direct losses for the organization.

What points should compilers remember when creating a statement?

Filling out the statement in question is not a difficult task for professionals. However, a number of rules must be followed.

First of all, compilers should remember that for each individual fixed asset (or for a group of similar fixed assets), information on accrued depreciation must be reflected line by line. That is, each new line must contain a new object or OS group.

The statement itself consists of 2 subsections: account 01 “OS” and account 02 “Depreciation on assets”.

In the 1st subsection of the statement, the compilers reflect the following information:

- Object name;

- its original cost;

- the fact of movement of the object (and a document confirming this fact), for example, commissioning, sale or the fact of depreciation on the object.

In the 2nd subsection, devoted to the reflection of information on depreciation, you should indicate:

- depreciation rate for a specific object;

- monthly depreciation amount;

- the amount of accrued depreciation for a given object for a certain month;

- the residual value of the object minus the depreciation specified above.

After entering all the necessary information into the statement in question, the turnover for the period is calculated, after which the final values are displayed as the last line.

IMPORTANT! In addition, compilers should remember that the company statement must separately reflect information on fixed assets that the company requires for subsequent rental or for the purpose of making investments.

What you should know when filling out the form

For professionals, filling out a depreciation sheet for fixed assets is not a problem. But at the same time, there are some serious rules that many people for some reason forget about during the filling process.

First of all, you should remember that each individual fixed asset (or, in extreme cases, a group of fixed assets) must be indicated in its own line and all information on it also in this line. Accordingly, in each separate line there is a new OS or group of objects.

The document itself consists of two parts:

- Account 01, according to which we keep records of “OS”;

- Account 02, according to which we maintain its depreciation.

In the first part we must provide the following information:

- Name of the property;

- Its original cost;

- The fact of movement of this object, as well as the document that confirms this. For example, this could be its commissioning, or the calculation of depreciation for this object.

In the second part, reflecting information about depreciation, you must indicate:

- Wear rate for a specific OS;

- Monthly depreciation amount;

- The accrual amount for this operating system for a certain month;

- The residual value of the calculated object minus the calculated depreciation.

After all the listed values have been entered into the accounting sheet, you need to calculate the turnover for a certain period, and after the last line you should add up the total for all values.

In addition, when filling out the statement, you should remember that the company must take into account the fixed assets that it plans to rent out or invest in some way in a separate statement.

Tip: If a company keeps records in a specialized program, then when filling out the document it is important to check all the settings. The process of filling out the document in this case is much simpler. The main thing is just not to get confused.

A statement of fixed assets is required by the organization in order to accurately track the movement of the fixed assets themselves, as well as the final amounts of depreciation. To create, compile and fill out this document, you do not need to use complex and complex accounting methods. It is much more important for the performer to remember the basic rules for filling out the two component parts of the document.

Deadlines

The amount of depreciation charged on fixed assets directly depends on their depreciation period (useful use).

To determine this period for a specific object, there is a classification approved by the Government of the Russian Federation, in which all fixed assets and intangible assets are divided into depreciation groups.

The basis for assigning equipment to a certain group is its expected period of use as an operating operating system.

There are ten such groups:

- Duration from one to two years – various types of tools and pneumatic units.

- From two to three years – electronic and computer equipment, as well as lifting machines and sports facilities.

- From three to five – minibuses, various wells, copying equipment.

- From five to seven - buildings made of metal structures and plastic, cattle, trucks.

- From seven to ten – passenger cars, gas turbines, industrial sites.

- From ten to fifteen - large watercraft, main gas pipelines.

- From fifteen to twenty - permanent buildings, long-term plantings, fuel and energy transportation systems.

- From twenty to twenty-five - river fleet, railways, fireproof safes.

- From twenty-five to thirty - carriages, berths, vegetable storage facilities.

- More than thirty years - reinforced concrete buildings, ocean ships.

Lifetime

The key parameter for any of the listed methods is the useful life of the asset. It must be justified and can be determined by the Classifier group, technical standards of the product, manufacturer’s recommendations or the conclusion of an independent examination.

It is important to know and remember: for all fixed assets included in the eighth, ninth and tenth groups of the classifier, only linear depreciation is applied.

Other non-current assets are also often characterized by uniform depreciation over time, and if there are no circumstances that determine the need for acceleration, accounting prefers to use the straight-line depreciation method. It is simple, clear and, what is also important, does not raise questions from inspection organizations.

In what form?

According to Art.

314 of the Tax Code of the Russian Federation, an enterprise can develop its own accounting form; this is not an imperative form. However, in accordance with the order of the Ministry of Finance of Russia dated December 21, 1998 No. 64n, recommendations are given for reflecting relevant information for each section.

The most popular form of statement is the OKUD form No. B-1, which is designed for small businesses, but can be used in larger-volume industries.

This form is advisory in nature; the enterprise has the right to develop its own regulatory document.

The form is filled out monthly. The total for the previous month is carried over to the next month until the reporting form for the year is completed.

Maintaining a special form allows you to streamline the accounting of fixed assets and reflect objective data about fixed assets.

OS is not used in activity

Situation: is it necessary to charge depreciation in accounting for a fixed asset that is registered but is not actually used?

As a general rule, if property is accounted for on account 01 (it is a fixed asset), then regardless of whether it is used in the organization’s activities or not, charge depreciation on it. An exception, in particular, is the conservation of a fixed asset for a period of more than three months and other cases.

The organization may not start using the main tool immediately. In this case, it is accepted for accounting in a separate subaccount to account 01, which may be called, for example, “Fixed assets in stock.” This procedure applies to all fixed assets: movable (acquired, created, requiring installation) and real estate (from the moment of filing documents for state registration of ownership). This follows from subparagraph “a” of paragraph 4 of PBU 6/01, paragraph 20 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n and the Instructions for the Chart of Accounts.

Depreciation in accounting must be calculated starting from the month following the month in which the property was accepted for accounting as a fixed asset (clause 21 of PBU 6/01). Thus, after reflecting the received property on account 01, the organization must begin to depreciate it. This must be done regardless of whether the organization has started using this object or not.

Reflect the amounts of accrued depreciation on account 02 “Depreciation of fixed assets” in correspondence with expense accounts. Select an account for accounting expenses depending on the reason why the fixed asset is not used (production necessity, technological features, planned delay in operation).

Accrue depreciation as part of expenses for ordinary activities (accounts 20, 08, 23, 25, 44...).

For the convenience of generating and tracking information on the amounts of accrued depreciation for fixed assets that are not used in activities, open a separate sub-account for account 02 “Depreciation of fixed assets”. It may be called, for example, “Depreciation of fixed assets in inventory.” In accounting, reflect depreciation on these objects by posting:

Debit 20 (23, 25, 44, ...) Credit 02 subaccount “Depreciation of fixed assets in inventory” - depreciation has been accrued on fixed assets that are not yet used in activities.

At the beginning of actual operation, write off the amount of accrued depreciation:

Debit 02 subaccount “Depreciation of fixed assets in inventory” Credit 02 subaccount “Depreciation of fixed assets in operation” - the amount of previously accrued depreciation was transferred to the subaccount for depreciation of fixed assets in operation.

This procedure is based on the provisions of paragraph 21 of PBU 6/01, paragraphs 9 and 18 of PBU 10/99.

An example of reflecting in accounting depreciation of fixed assets that are not actually used

One of the activities of Alpha LLC is the hotel business. In March, the organization purchased furniture for a room on the fourth floor at one of the hotels. The cost of the headset is 118,000 rubles. (including VAT – 18,000 rubles). The first reservation for the room was received in May.

For accounting and tax purposes, the useful life of the furniture was set at six years (72 months). According to the accounting policy, depreciation on fixed assets is calculated using the straight-line method.

The accountant calculated the annual depreciation rate for furniture as follows: (1: 6 years) × 100% = 17%.

The monthly depreciation amount was: (RUB 118,000 – RUB 18,000) × 17%: 12 months. = 1417 rub.

In the Alpha working chart of accounts, the following subaccounts are approved for account 01 – “Fixed assets in stock”, “Fixed assets in operation”. To account 02 – “Depreciation of fixed assets in operation”, “Depreciation of fixed assets in inventory”.

The accountant made entries in the accounting.

In March:

Debit 08 Credit 60 – 100,000 rub. (RUB 118,000 – RUB 18,000) – the cost of the purchased furniture set is taken into account;

Debit 19 Credit 60 – 18,000 rub. – input VAT is taken into account on the cost of the purchased furniture set;

Debit 01 subaccount “Fixed assets in stock” Credit 08 – 100,000 rub. – the cost of the purchased furniture set is reflected as part of fixed assets;

Debit 68-2 Credit 19-3 – 18,000 rubles. – accepted for deduction of input VAT on purchased furniture.

In April:

Debit 26 Credit 02 subaccount “Depreciation of fixed assets in inventory” – 1417 rubles. – depreciation was accrued on furniture for April.

In May:

Debit 01 subaccount “Fixed assets in operation” Credit 01 subaccount “Fixed assets in stock” – 100,000 rubles. – the furniture set is transferred to the composition of fixed assets actually used;

Debit 02 subaccount “Depreciation of fixed assets in inventory” Credit 02 subaccount “Depreciation of fixed assets in operation” - 1417 rubles. – the amount of previously accrued depreciation was transferred to the subaccount for accounting for depreciation on fixed assets in operation;

Debit 26 Credit 02 subaccount “Depreciation of fixed assets in operation” – 1417 rubles. – depreciation was accrued on furniture for May.

In tax accounting, the accountant also began calculating depreciation in April.

The procedure for filling out the OS accounting sheet

The document in Form B-1 must be completed monthly . In this case, every month a new clean sheet is used, and the total for the previous month is entered into it.

In order to correctly draw up a depreciation statement in Form No. B-1, the following points should be taken into account:

- This document is divided into two parts: information on account 01, where fixed assets are recorded, and information on account 02, where depreciation is reflected.

- OS is reflected in groups, information for which is indicated separately.

The following information is reflected in the fixed assets account:

- OS name;

- Its inventory number;

- Cost of the OS object;

- Object status;

- Its location.

Important! It should be taken into account that fixed assets subject to transfer for use to other production companies, as well as depreciation on them, must be taken into account in a separate statement.

Account section 02 requires indicating the facts of calculation and calculation of depreciation of fixed assets. In this case, the following indicators are important:

- The amount of deductions per unit of time (for 1 month, since this is the frequency of updating this document);

- Category of operation of the fixed asset. This value should determine the period for calculating depreciation of the equipment, that is, over what period the wear and tear of this OS will occur.

- The total amount of depreciation. Indicated in monetary terms.

- The volume and amount of accrued depreciation for the specified period. This value directly affects the residual value of the depreciation item.

- The cost of the fixed asset. The remaining value of the object is indicated after deduction of depreciation charges from the original cost.

Based on the calculation results, under each column of the table, the total value is displayed for each group of fixed assets. The information obtained allows us to objectively assess the state of the fixed assets fund.

The completed form is the basis for reflecting data on fixed assets in the organization’s cost accounting sheets.

Important! The use of this form of statement allows you to enter information about the purchased equipment in the month following its acquisition or manufacture.

Grouping of fixed assets in the report “Statement of depreciation of fixed assets for the period”

Question: Is it possible to group fixed assets into groups (folders) in the Fixed Assets Depreciation Statement report for a period, just as they are in the Fixed Assets directory?

Answer: In the report Fixed assets depreciation sheet for the period, fixed assets are initially shown by divisions and materially responsible persons.

If necessary, in the report, fixed assets can be grouped according to the principle of location of fixed assets in the Fixed Assets directory.

To do this you need to do the following:

- In the report Statement of depreciation of fixed assets for the period (section fixed assets and intangible assets - Reports) and click the Show settings button to go to the form settings window.

- In the report settings window that opens, on the Grouping tab, you need to add a new field Fixed asset.Group.

- When the field is added, this parameter in the Grouping Type column is set to With Groups.

In the generated report, all fixed assets will be formed into groups (folders) in which they are located in the Fixed Assets directory.

Important

If in the accounting parameters settings the signs of accounting in the context of MOL and divisions are set, then it is recommended that in the report settings you disable the setting for generating a report in the context of divisions and materially responsible persons. To do this, on the Groupings tab for the values Division (BU) and MOL (BU), you need to clear the characteristics.

Results

A statement of depreciation and fixed assets accounting is necessary for a company to correctly reflect the results of the movement of such objects, as well as the final values of accrued depreciation. The formation of the statement in question does not require the use of complex and complex accounting mechanisms. The main thing for responsible specialists is to know the basic rules for filling out the main 2 subsections of the statement: on accounting for fixed assets and on the amount of accrued depreciation.

Sources

- https://www.klerk.ru/buh/articles/367215/

- https://buhuchetok.ru/vedomost-amortizacii-osnovnyh-sredstv.html

- https://NalogObzor.info/publ/uchet_i_otchetnost/uchet_osnovnykh_sredstv/kak_v_bukhgalterskom_uchete_nachislit_amortizaciju_osnovnykh_sredstv/41-1-0-2962

- https://online-buhuchet.ru/vedomost-amortizacii-osnovnyx-sredstv/

- https://arnasai.ru/vedomost-nachisleniya-amortizacii/

- https://buh-spravka.ru/buhgalterskij-uchet/registry-buhgalterskogo-ucheta/vedomost-ucheta-osnovnyh-sredstv.html

- https://onalogonline.ru/sostavljaem-vedomost-amortizacii-osnovnyh-sredstv.html

- https://nalog-nalog.ru/buhgalterskij_uchet/vedenie_buhgalterskogo_ucheta/sostavlyaem_vedomost_amortizacii_osnovnyh_sredstv/

- https://praktibuh.ru/bez-rubriki/vedomost-nachisleniya-amort.html