Calculate the amount of sick leave benefits for child care based on average earnings

What is the main purpose of an invoice? An invoice is a tax accounting document for VAT.

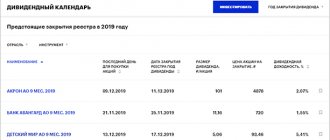

How to calculate the amount of dividends Dividend payments in a company are initiated by the board of shareholders after the closure of the register.

Loss of the current period In a situation where, at the end of the year, the enterprise’s expenses exceed income,

The obligation to pay severance pay and average monthly earnings for the period of employment is established by the Labor Code

We recommend filling out a declaration in the online personal income tax service Ivan Ivanovich Ivanov bought in 2012

In what currency can residents make payments? Let us turn to Art. 140 of the Civil Code of the Russian Federation

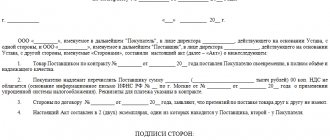

Receipt of goods and materials into the organization for quantitative and cost assessment is reflected in the acceptance certificate

In cases where the earned remuneration is not transferred to the employee’s bank card by non-cash method,

Who are the TC payers? Since the TC-1 form is submitted by trade tax payers, it is necessary