All nuances relating to the calculation and payment of taxes are subject to control by the tax authorities. Federal Tax Service employees have many tools in their hands that allow them to carefully monitor compliance with legislation in the field of taxes and fees, relying on various forms of tax audits.

Due to the fact that the main document regulating the actions of tax authorities is the Tax Code of the Russian Federation, we will consider what types of tax audits are provided for by the Tax Code of the Russian Federation.

Tax audit concept

The Federal Tax Service's control over the correct and timely calculation and payment of taxes is called a tax audit.

In this case, the Federal Tax Service takes as a basis the tax returns provided by payers during a certain period (for which the audit is carried out). The audit is based on the Tax Code and legislation of the Russian Federation. Tax audit is one of the methods of tax control (Article 82 of the Tax Code of the Russian Federation) along with:

- with receipt of explanations;

- checking accounting and reporting data;

- inspection of premises and territories used for profit;

- other control procedures provided for by the Tax Code of the Russian Federation.

Whether tax monitoring helps you avoid tax audits, find out from the publications:

- “Tax control in the Russian Federation: forms, methods and types”;

- “Is tax monitoring possible not for all, but only for individual taxes?”

There are several types of tax audits.

Officially, the term “counter audit” has not been used since 2007, but in practice accountants still use it now.

If you have access to ConsultantPlus, find out how an on-site inspection differs from a desk inspection . If you don't have access, get trial of online legal access.

If I knew where to fall, I would spread straws

Of course, there is absolutely no need to wait for such a denouement. We'll give you some tips on what to do to prevent this from happening.

- Keep your documents in order: you have been provided with a service - ask the performer for a document. If you bought something, ask for an invoice. If the supplier is far away, then at least have a scan first, and the original by paper mail. Ideally, it is better to transfer all document flow into electronic form.

- Follow the numbers: if you have very low or very high profitability, the Federal Tax Service will show special interest in you. The tax burden and wages below the industry average will also attract the attention of tax authorities. You should also be wary if expenses outstrip income, and the share of VAT deductions exceeds 89% - this is the national average; in some regions it may be more or less, but not much. Make sure your accountant keeps his finger on the pulse and monitors changes.

- Be reasonable and careful: indiscriminateness in choosing counterparties will give the tax authorities additional trump cards. The desire to deal only with relatives is the same, because the tax authorities look askance at transactions of interdependent persons.

And one more very important point - if the tax office sends you a demand, then you, of course, can remain silent, but it will be interpreted against you. The logic is simple: if you don’t answer, then the tax office’s doubts will turn into suspicions - why do you need this? Make sure the tax authorities have your current contact information. Electronic document management in this case will also be the best option.

On-site inspection

When carrying out this type of inspection, the Federal Tax Service monitors how the payer fulfills the obligations reflected in the contracts, as well as the availability and compliance with protocols, orders and other internal documents. Cash discipline, accrual of personal income tax from wages, accounting of income, expenses and economic feasibility of business transactions are subject to verification, that is, almost all activities of the payer for a certain period.

The main distinctive features of an on-site tax audit (Article 89 of the Tax Code of the Russian Federation):

- place of conduct - the territory of the taxpayer or the tax authority (if the person being inspected cannot provide the inspectors with premises);

- verification period – no more than 2 months. (but can be extended up to 4 months, and in exceptional cases - up to 6 months);

- inspection period - no more than 3 years preceding the year the decision to conduct the inspection was made (unless otherwise provided by the Tax Code of the Russian Federation).

On-site inspections may include several subtypes:

| Subtypes of on-site tax audits | Purpose |

| Comprehensive | Produced in the area of economic and financial activities of an organization for a certain period of time |

| Thematic | Aimed at monitoring the correctness of calculation and payment of a specific tax - profit, VAT, etc. It is carried out if tax authorities discover violations regarding the calculation and payment of taxes. |

| Target | Analysis of specific mutual settlements between buyers and sellers, verification of import and export transactions, legality of the application of benefits. This type of verification is issued as a separate application. |

| Control | It is carried out only if the initial check was carried out poorly. It can only be carried out by a higher-level Federal Tax Service. If such an audit reveals violations, sanctions will be imposed on the taxpayer. And the Federal Tax Service, which initially inspects the organization, may be held liable |

Scheduled and unscheduled inspections

If the tax authorities warned you about the upcoming audit in advance, then this audit is planned. With unscheduled audits, everything is different: tax inspectors show up without warning. But this happens rarely, for example, when they fear that the necessary documents will be destroyed.

Tax inspectorates carry out scheduled audits on the basis of annual control work plans and quarterly plans for conducting on-site audits.

There are universal criteria by which a company (entrepreneur) can itself determine the risk of being subject to a tax audit. They are set out in the order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06 / [email protected] “On approval of the concept of a planning system for on-site tax audits.” These are the criteria.

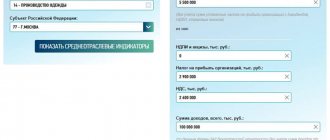

1. The tax burden is below the average level for the industry (type of economic activity).

2. Reflection in reporting of losses over several tax periods.

3. Reflection of significant amounts of tax deductions in tax reporting.

4. The growth rate of expenses exceeds the growth rate of income from the sale of goods (works, services).

5. Payment of average monthly wages per employee below the average level for the type of economic activity in the region; information about the payment of wages “in envelopes”, about the failure to formalize labor relations and other similar information.

6. Repeated approximation of indicators giving the right to apply special tax regimes to the maximum value.

7. Reflection by the entrepreneur of the amount of expenses close to the amount of his income for the calendar year.

8. Building the activities of a “chain of counterparties” without reasonable economic or other reasons (business purpose).

9. Failure to provide explanations for notifying the tax authority about the identification of discrepancies in performance indicators; failure to provide the tax inspectorate with the requested documents, availability of information about their destruction or damage; failure to ensure their safety and restoration after loss under force majeure circumstances.

10. Repeated deregistration and registration with tax inspectorates due to a change in location.

11. Significant deviation of the level of profitability according to accounting data from the level of profitability in this field of activity according to statistics.

12. Conducting activities with a high tax risk.

Desk inspection

A desk audit is carried out regarding the correctness of the calculation and payment of a particular tax and the reflection of this data in the declaration submitted by the taxpayer.

The main distinctive features of a desk tax audit:

- venue - within the walls of the Federal Tax Service with the payer providing copies of the documents requested by the inspectors;

- duration of inspection – no more than 3 months (VAT returns – 2 months);

- audit period – the reporting (tax) period for a specific tax (based on tax returns submitted by taxpayers).

It is carried out by inspectors without special approval from the head of the Federal Tax Service. This type of tax audit begins immediately after filing a tax return. Its main task is to identify inconsistencies in reporting, late reporting of business transactions and payment of taxes, and incorrect completion of declarations. If inspectors discover violations in the calculation of taxes, the taxpayer will be charged additional amounts, as well as fines and penalties.

What consequences may there be

In the case of a desk audit, everything is simple: there is a violation - you need to eliminate it, pay additional tax and pay penalties . If there was a fine, then pay that too. You will also need to submit an updated declaration.

An on-site inspection will not be limited to this: if everything is serious (and judging by the amounts of additional accruals, this is usually the case), then the directors and founders may be held vicariously liable, law enforcement agencies may initiate a criminal case, and the tax authorities may initiate bankruptcy proceedings against the debtor company itself. .

Counter check

Almost every taxpayer faces a counter audit, although it is not separately designated in the Tax Code of the Russian Federation as one of the types of tax audits. Rather, it can be called one of the tax control procedures.

A counter check can be carried out (Article 93.1 of the Tax Code of the Russian Federation):

- as an element of an on-site or tax audit during their conduct;

- an additional measure of tax control (outside the scope of the above tax audits).

Her goal:

- check the actual existence of your counterparty for transactions that interest tax authorities;

- check the reality of transactions reflected in accounting;

- compare data on transactions between you and the counterparty (according to his accounting and yours).

The counter-check is carried out on the basis of any specific documents - delivery notes, invoices. At the same time, their identity is checked between the buyer and the seller: there should be no discrepancies in the documents regarding dates, names, quantities of goods, amounts, etc. If inspectors find discrepancies, this will mean that one of the parties to the transaction is hiding income and understating the tax base.

ConsultantPlus experts spoke about the nuances of the counter-check. Get trial access to the system and move on to the Ready-made solution.

For more details, see the material “Features of conducting a counter tax audit” .

Other forms of inspection

According to the current Tax Code of the Russian Federation, there are 2 more forms of taxpayer inspection:

- Control. Conducted by a higher supervisory authority. In this case, the work of both the enterprise and the employees of the fiscal authorities who inspected the company earlier can be checked. If violations are discovered on the part of authorized persons (inspectors, experts), penalties may be applied to them, including administrative or criminal liability.

- Repeated. In this case, a duplication of the audit that was carried out earlier is carried out. All the same documents and data that were examined during the previous procedure are checked. If discrepancies are found, this will indicate either an offense on the part of the organization, or errors or violations on the part of the inspectors.

Nuances of tax audits taking into account the requirements of the new art. 54.1 Tax Code of the Russian Federation

Since July 2021, a new article has appeared in the Tax Code of the Russian Federation. 54.1 “Limits for the exercise of rights to calculate the tax base and (or) the amount of tax, fee, insurance premiums.”

More details about the contents of Art. 54.1 of the Tax Code of the Russian Federation, learn from the material “Presumption of good faith of the taxpayer - a new article in the Tax Code of the Russian Federation.”

Taking into account the norms of Art. 54.1 of the Tax Code of the Russian Federation, during tax audits, tax authorities will be even more careful:

- collect evidence indicating the taxpayer’s deliberate evasion of taxes;

- refute the actual execution of specific transactions (collect and document facts confirming the absence of a real possibility of delivery of goods, confirmation of delivery of goods, participation of counterparties in the movement of goods, etc.).

Tax officials will collect such evidence during desk and field audits.

The taxpayer can only worry in advance about collecting the necessary documents and other evidence indicating the use of legal tax optimization schemes, due diligence when choosing counterparties, etc.

Conclusion

The main tax control activities are carried out during tax audits.

A desk tax audit is an analysis of a specific declaration and, if necessary, individual supporting documents.

As part of an on-site tax audit, tax officials study all documents related to the calculation of taxes included in the plan for a certain period. Also, additional control measures may be carried out: inspection, questioning of witnesses, examination, etc.

Tax authorities control declarations in any case. An on-site tax audit is scheduled only if the inspectors have serious suspicions based on the results of the analysis of the taxpayer’s data.

Thus, it is impossible to avoid a desk tax audit. And in order to “insure” against the visit of inspectors to the company, you need to strive to ensure that the reporting indicators do not attract the attention of tax authorities.

Results

The Tax Code of the Russian Federation provides for 2 types of tax audits: field and desk. An on-site inspection is carried out on the territory of the taxpayer and cannot last more than 2 months. (with the possibility of extension up to 4 or 6 months), and the desk inspection takes place at the inspectorate, and its duration is no more than 3 months.

A counter audit is an element of an on-site or desk tax audit or an additional measure of tax control.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Types by scope of work

Depending on the scope of work, all checks are divided into 3 types:

- Comprehensive. Carried out in case of suspicion against a taxpayer. Can cover all types of documents. Can be carried out no more than once every 3 years.

- Thematic. It is carried out both as planned and in case of suspicion against the taxpayer. May cover individual areas of activity. It can be carried out either separately or included in a comprehensive tax audit plan.

- Target. Covers individual operations (for example, verification of a counterparty, export or import operations, investment of assets, and so on).

Types by organization

Based on the methods of organizing the actions of supervisory authorities, they can be divided into 2 types:

The Federal Tax Service

- Planned. They are carried out according to a schedule drawn up and approved by senior management. The schedule is determined for each period separately. The inspected taxpayer is notified of the inspection long before it takes place.

- Sudden (unscheduled). Type of on-site inspection. Conducted without notifying the audited organization. An inspection of this type requires a written order from the head of the territorial office.

What decision is made upon completion of the inspection?

After the control procedure is completed, the head of the department of the state structure makes an appropriate decision. It could be:

- An order to bring to justice the guilty person who committed a tax offense. In this case, several persons or only one may be involved. Issued if the results of the inspection revealed significant violations of current legislation.

- Refusal to be held liable.

In the latter case, the organization will not face punishment or penalties. However, this does not relieve the taxpayer from the obligation to pay the assigned penalties and accrued penalties.

The decision itself must necessarily be made by the head of the government agency by whom it was made or his deputy.

Re-request for documentation. Legislative changes

Payers should remember that the government agency has the right at any time to request documentation that has already been verified. In this case, we are talking about two main types of statements:

- Submitted in the form of originals, and after completion of the verification, returned by the Federal Tax Service to the organization;

- Already presented earlier, but lost by the civil service due to certain circumstances.

It is worth noting that until September last year, the government agency could not re-request the following documents:

- presented as part of on-site or desk control;

- provided in the form of copies under tax monitoring conditions.

However, as of September 3, 2021, a number of changes have been made to tax legislation. In particular, in paragraph 5 of Article 93 of the Tax Code. In accordance with the new rules, the Federal Tax Service no longer has any restrictions on the requested documentation.

However, for payers themselves, these changes also have some positive aspects. In particular, you don’t have to resubmit statements if you inform the tax authority:

- that the requested documentation has already been provided previously;

- details of statements that the Federal Tax Service requires again;

- the name of the government agency to which the documents were previously transferred.

The specified information must be transferred to the Federal Tax Service no later than 1 day from the date of receipt of the notification about the re-submission of documentation. Information can be provided both in writing, through the office of the Federal Tax Service, and in electronic format through the official website of the state structure.

Read also: What are CRM systems