Over time, fixed assets physically wear out and become obsolete. If such an object cannot be restored or its further use is not economically feasible, then it is liquidated and written off from the register. This procedure is established by paragraph 29 of PBU 6/01 and follows from paragraphs 75 and 76 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

When a fixed asset consists of several items, it can be partially liquidated. That is, dismantle only that part of the object that cannot be restored. For example, instead of demolishing the entire building, you can dismantle only its separate emergency building. For more information about this, see How to reflect partial liquidation of fixed assets in accounting.

How to register liquidation

A fixed asset is liquidated when it is no longer suitable for further use.

This usually occurs due to physical wear and tear of the object. Before liquidating a fixed asset, it is necessary to create a commission. It should include the chief accountant and persons who are responsible for the safety of fixed assets. Representatives of inspections, which, in accordance with the law, are entrusted with the functions of registration and supervision of certain types of property, may be invited to participate in the work of the commission. This is stated in paragraph 77 of the Guidelines for accounting of fixed assets (approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

The commission inspects the object, evaluates it in terms of suitability, possibility and efficiency of its use, and establishes the reasons for write-off. And in the case when we are talking about the unsuitability of an object due to damage caused to it, it identifies persons through whose fault the premature disposal of property occurs and makes proposals to bring these persons to responsibility established by law.

In addition, the commission must determine the possibility of using individual components, parts, and materials of the disposed facility and evaluate them based on the current market value. Subsequent control over the removal of non-ferrous and precious metals from the object written off, determination of weight and delivery to the appropriate warehouse is also within the competence of the commission.

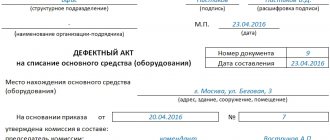

The decision taken by the commission to write off a fixed asset item is documented in the Act on the write-off of a fixed asset item in form No. OS-4 (approved by Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7). It contains data characterizing the object of fixed assets (date of acceptance of the object for accounting, year of manufacture or construction, time of commissioning, useful life, initial cost and amount of accrued depreciation, revaluations, repairs, reasons for disposal with their justification, condition of fixed assets). parts, details, assemblies, structural elements).

The act is drawn up in two copies. They are signed by members of the commission appointed by the head of the organization and approved by the head or his authorized person. The first copy is transferred to the accounting department, the second remains with the person responsible for the safety of fixed assets. The act is the basis for the delivery to the warehouse and sale of material assets and scrap metal remaining as a result of write-off.

Please note that the specified Act can be fully drawn up only after the completion of the liquidation of the fixed asset.

conclusions

Over time, any fixed assets require liquidation. The reason for this is the loss of the previous state of objects.

Liquidation occurs when the property becomes unfit for use. It is losing its economic properties.

The liquidation procedure requires documentation. The main document required to be drawn up in this case is the liquidation act.

It provides detailed information about the OS, as well as the persons responsible for the entire liquidation process.

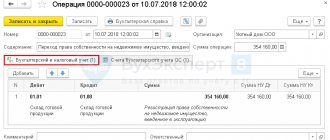

Accounting

Liquidated property is subject to write-off from accounting accounts (clause 29 of PBU 6/01 “Accounting for fixed assets”). Income and expenses from write-offs are reflected in the accounting period to which they relate and are subject to credit to the profit and loss account as other income and expenses (clause 31 of PBU 6/01). This means that the residual value of the liquidated fixed asset and other expenses associated with its liquidation are reflected in the debit of account 91, subaccount “Other expenses”. The credit of account 91, subaccount “Other income” shows income from the receipt of materials received as a result of liquidation.

To account for the disposal of fixed assets, a subaccount “Retirement of fixed assets” can be opened to account 01 “Fixed Assets”. The cost of the liquidated object is transferred to the debit of this subaccount, and the amount of accumulated depreciation is transferred to the credit. In accounting entries it looks like this:

Debit 01 subaccount “Retirement of fixed assets” Credit 01 subaccount “Fixed assets in operation” – the initial cost of the object subject to liquidation is written off; Debit 02 Credit 01 subaccount “Disposal of fixed assets” - depreciation accumulated at the time of liquidation is written off; Debit 91 subaccount “Other expenses” Credit 01 subaccount “Disposal of fixed assets” – the residual value of the liquidated object is written off; Debit 10 Credit 91, subaccount “Other income” - materials received during the liquidation of the object were capitalized (at current market value).

When fixed assets are liquidated

Typically, fixed assets are liquidated and written off under the following circumstances:

- the property is obsolete and physically worn out;

- an accident, natural disaster or other emergency has occurred;

- in case of theft or shortage of components and assemblies, without which the use of property is impossible, and their replacement is impractical;

- property damage was detected;

- the object is in the stage of reconstruction, when part of the object is being liquidated.

This is established by paragraph 29 of PBU 6/01, paragraph 76 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, and confirmed by letter of the Ministry of Finance of Russia dated January 29, 2014 No. 07-04-18/01.

All this is often revealed during regular or unscheduled inventory.

Tax accounting

Tax legislation allows the residual value of the liquidated object to be attributed to non-operating expenses (subclause 8, clause 1, article 265 of the Tax Code of the Russian Federation). The basis and documentary evidence of expenses in the form of the residual value of a liquidated fixed asset, the useful life of which has not expired, will be the above-mentioned Act on the write-off of a fixed asset item (Form No. OS-4). After all, it is this document that testifies to the liquidation of the object. This position is confirmed by the Ministry of Finance (letter dated November 16, 2010 No. 03-03-06/1/726).

But this applies only to those assets for which depreciation is calculated using the straight-line method. In relation to objects depreciated in a non-linear way, decommissioning is carried out according to the rules prescribed in paragraph 13 of Article 259.2 of the Tax Code of the Russian Federation. According to the rules, the residual value of the fixed asset will not reduce the total balance of the depreciation group, that is, the object is liquidated, removed from the depreciable property, and depreciation continues to accrue. The Ministry of Finance in letter dated December 20, 2010 No. 03-03-06/2/217 also explains that the amount of underaccrued depreciation will continue to be written off as part of the total balance of the corresponding depreciation group (subgroup).

A situation is possible when liquidation is started (and the fixed asset is taken out of service) in one tax period and completed in another. The under-depreciated cost in this case is taken into account as part of non-operating expenses on the date of completion of liquidation (letter of the Ministry of Finance dated October 21, 2008 No. 03-03-06/1/592).

Despite the fact that the Tax Code of the Russian Federation contains a rule on the possibility of attributing to expenses the residual value of liquidated property, tax authorities may doubt the need for liquidation. Thus, according to the Ministry of Finance (letter dated 04/08/05 No. 03-03-01-04/2/61), expenses for the liquidation of fixed assets, including in the form of amounts of underaccrued depreciation, are justified if these fixed assets are unsuitable for further use. use, and their restoration is impossible or ineffective. Of course, if we are talking about physical wear and tear, breakdown as a result of an accident, excessive use, etc., then problems should not arise, because the property has been damaged and is therefore unsuitable for further use.

If the reason for the liquidation of a fixed asset was, say, obsolescence of the fixed asset, then there may be problems. It is possible that, during an audit, tax authorities will require evidence that further use of the property was ineffective and inappropriate, and selling it externally is impossible.

For our part, we note that the provisions of the Tax Code of the Russian Federation do not contain such conditions, and other legislative acts mention the possibility of writing off an object due to obsolescence, however, for accounting purposes (clause 29 of PBU 6/01). In addition, the Ministry of Finance in letter dated 07/09/09 No. 03-03-06/1/454 notes that obsolescence may be the reason for the liquidation of a fixed asset.

What it is?

The concept of liquidation of an asset is the write-off of objects owned by an organization from its balance sheet. This is a process that cannot be avoided.

It can be of several types - complete or partial. The procedure must be carried out taking into account special established rules. Particular importance is given to documenting the process.

Previously, in order to carry out liquidation, it was necessary to create a special commission, whose members were to deal with this issue.

Nowadays everything has changed.

According to the information set out in Federal Law No. 402, the need to create a commission is now in the nature of a recommendation.

Consequently, the decision on its appointment can be made by the management of the enterprise independently. The absence of a commission will not be a violation.

Despite this, many continue to create commissions of this type. This is mainly due to the many benefits of this technique.

Causes

To liquidate an OS, a mandatory condition must be met—the existence of a justification for the need for this procedure.

In other words, it is necessary to confirm that the company's property does not provide economic benefits, does not represent any benefit to the labor process and does not correspond to the characteristics of fixed assets.

Liquidation is possible only if there are compelling reasons. These may be the following circumstances:

- wear and tear of fixed assets (can be moral and physical) - the procedure for writing off fully depreciated fixed assets;

- emergencies and emergencies, natural disasters;

- damage or shortage (identified during the inventory).

Partial liquidation can be carried out during reconstruction. There are 2 types of wear and tear - physical and moral.

In the first case, it is implied that the condition of the fixed asset has deteriorated and its economic and social characteristics have lost their validity.

All these actions occur under the influence of the work process - as a result of the intensity of work, special technology of use, etc.

Obsolescence has a second name - depreciation. It speaks for itself - the main product ceases to meet the necessary indicators of efficiency and the requirements put forward in relation to a specific product.

Is it necessary to restore VAT?

The next question that arises during the liquidation of a fixed asset is related to VAT. As is known, when accepting an object for accounting, organizations deduct the “input” VAT included in the cost of the object. If at the time of liquidation the useful life of the property has not expired, that is, the original cost has not been completely transferred to expenses, then the tax authorities require the restoration of VAT from the residual value of the property. They refer to the fact that the liquidated entity ceases to participate in transactions recognized as subject to VAT taxation (and one of the conditions for the deduction is the entity’s participation in transactions subject to VAT). Similar conclusions were made by the Ministry of Finance (letters dated 07/08/09 No. 03-03-06/1/447, dated 01/29/09 No. 03-07-11/22).

But we consider this position to be incorrect. Article 170 of the Tax Code of the Russian Federation contains an exhaustive list of cases in which the corresponding tax amounts are subject to restoration. The liquidation of under-depreciated fixed assets is not indicated there. Therefore, there is no need to restore VAT. It is this argumentation that allows taxpayers to win disputes in the courts (resolutions of the FAS Volga District dated January 27, 2011 in case No. A55-7952/2010, FAS North Caucasus District dated November 3, 2010 in case No. A22-60/10/9-5, FAS Moscow District dated May 14, 2009 No. KA-A40/3703-09-2).

Results

When registering materials remaining from a dismantled OS, it is necessary to act in strict accordance with the law. Namely: create a commission to liquidate an asset, capitalize the material received from liquidation and include it in income, and then take it into account depending on the end use.

We also recommend our article “How to capitalize scrap metal from write-off of fixed assets?”

Sources:

- Tax Code of the Russian Federation

- by order of the Ministry of Finance dated October 13, 2003 No. 91n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting entries upon liquidation

To liquidate funds in the accounting department correctly, it is necessary to correctly register all transactions, indicating the exact amounts and finding out the exact amount of tax. As an example, let’s take a company that operates on a general taxation system and has a machine on its balance sheet with full depreciation charged to it.

The management decides to liquidate the machine, which initially cost 120,000 rubles, and an agreement was signed with the contractors for dismantling work in the amount of 11,800 rubles, which includes VAT in the amount of 1,800 rubles. In addition, after disassembling the device, serviceable parts were found that can be used further, in the amount of 36,000 rubles.

| Debit | Credit | Bottom line | Wiring nuances |

| 01 s/h “Depreciation of fixed assets” | 01 s/h “Registered fixed assets” | 120,000 rubles | Write-off of the starting cost of equipment |

| 02 | 01 s/h “Depreciation of fixed assets” | 120,000 rubles | Writing off accrued depreciation |

| 19 | 76 | 1800 rubles | Amount of VAT charged on contractor services |

| 68 | 19 | 1800 rubles | The amount of VAT that was accepted for deduction |

| 91 s/h “Other expenses” | 76 | 10,000 rubles | Dismantling costs |

| 76 | 51 | 11,800 rubles | Transfer of funds for dismantling to the contractor's account |

| 10 | 91 | 36,000 rubles | Delivery of materials that remain after dismantling the device |

On accounting for the cost of inventories received during dismantling (disassembly) of OSes being decommissioned

Based on clause 13 of Art. 250 of the Tax Code of the Russian Federation, for profit tax purposes, non-operating income includes income in the form of the cost of received materials or other property during dismantling or disassembly during the liquidation of fixed assets being decommissioned.

The Russian Ministry of Finance believes that non-operating income takes into account the cost of received inventories, regardless of their use or non-use in production (sales or for managing an organization) (Letter dated 05/19/2008 N 03-03-06/2/58).

By virtue of paragraph 1 of Art. 274 of the Tax Code of the Russian Federation tax base for the purposes of Ch. 25 of the Tax Code of the Russian Federation recognizes the monetary expression of profit determined in accordance with Art. 247 of the Tax Code of the Russian Federation, subject to taxation. Moreover, for the purposes of determining the tax base in accordance with Art. 274 of the Tax Code of the Russian Federation, market prices are determined in a manner similar to the procedure for determining market prices established by Art. 105.3 of the Tax Code of the Russian Federation, at the time of implementation or performance of non-operating transactions (without including VAT and excise tax) (Letter of the Ministry of Finance of Russia dated July 30, 2012 N 03-01-18/5-101).

Note

. For income in the form of materials received or other property during the liquidation of depreciable property taken out of service, the date of receipt of non-operating income will be the date of drawing up the act of liquidation of depreciable property, drawn up in accordance with the accounting requirements (clause 8, clause 4, article 271 of the Tax Code of the Russian Federation) .

The cost of materials received during the dismantling of a liquidated fixed asset, taken into account as part of non-operating income, can be taken into account in expenses when releasing materials into production or subsequent sale.

Thus, when releasing materials into production, the cost of inventories, other property in the form of property received during the dismantling or disassembly of fixed assets being decommissioned, in accordance with paragraph. 2 p. 2 art. 254 of the Tax Code of the Russian Federation, is defined as the amount of income taken into account by the taxpayer in the manner provided for in paragraph 13 of Art. 250 Tax Code of the Russian Federation.

As follows from the provisions of paragraphs. 2 p. 1 art. 268 of the Tax Code of the Russian Federation, when selling other property, the taxpayer has the right to reduce income from such transactions by the price of acquisition (creation) of this property, as well as by the amount of expenses specified in paragraph. 2 p. 2 art. 254 of the Tax Code of the Russian Federation (see Letter of the Ministry of Finance of Russia dated June 20, 2018 N 03-03-06/1/42057).

On the liquidation of an OS that is under conservation

According to paragraph 3 of Art. 256 of the Tax Code of the Russian Federation, fixed assets transferred by decision of the organization’s management for conservation for a duration of more than three months are excluded from depreciable property for the purposes of Ch. 25 Tax Code of the Russian Federation.

Suppose an organization liquidates a fixed asset that is being mothballed. Does she have the right to take into account the costs of liquidating such an asset as part of non-operating expenses (provided that before the transfer to conservation, depreciation on it was accrued using the straight-line method)?

A positive answer to this question was given in the Resolution of the FAS ZSO dated July 29, 2013 in case No. A67-6366/2012.

It was noted that in accordance with the provisions of paragraphs. 8 clause 1 art. 265 of the Tax Code of the Russian Federation, the criterion for accounting for costs as part of non-operating expenses is that the liquidated object has the status of a fixed asset and the presence of certain objects under conservation does not deprive them of this status.

An analysis of this norm shows that accounting for expenses in the form of underaccrued depreciation is associated with the liquidation of an asset, regardless of whether it is in use or is being mothballed (depreciation is not accrued).

Paragraph 2 pp. 8 clause 1 art. 265 of the Tax Code of the Russian Federation specifies the method of accounting for under-accrued depreciation as part of expenses in relation to methods of calculating depreciation and does not establish a prohibition on accounting for the amount of under-accrued depreciation in relation to fixed assets that are under conservation.

The inspector’s denial of the possibility of taking into account the disputed amount as non-operating expenses actually means that the taxpayer is unable to take into account when calculating income tax the expenses incurred in creating the OS, which is unacceptable.