An appeal to a higher tax authority or in court against an inspection decision that does not suit the taxpayer is provided for in Art. 138 Tax Code of the Russian Federation. At the same time, the applicant cannot immediately appeal the decision in court, that is, go there directly - his application will simply not be accepted. Decisions of the tax office or its officials can be appealed to a higher tax authority or to the same authority that issued the tax act.

You can appeal to a higher tax authority any documents that are signed by the head or deputy head of the tax authority.

You can appeal to the same tax authority that issued the tax act documents signed by other employees of the tax authority, for example, an inspector or the head of a department.

The procedure for appealing a tax decision can include from one to three stages.

You are having an on-site tax audit. When to involve a lawyer/attorney?

Of course, it is better to engage a qualified lawyer from the moment you receive notice of the inspection.

What can a lawyer do during the review process?

Help to correctly respond to requests and demands from tax officials, record procedural violations committed by them, and accompany taxpayer employees during interrogations.

If the inspection report has already been handed to you, then the lawyer will help you provide written objections to the report and collect evidence of the absence of a tax violation.

If you have not engaged a lawyer before, be sure to seek qualified legal assistance at the stage of challenging the decisions of the tax inspectorate. With the help of a lawyer, you can draw up a complaint to a higher tax authority and to the court, refute the arguments of the tax authorities, and select suitable judicial practice. Appealing a decision of the tax inspectorate is the very case when it is better to trust a lawyer (a specialist in arbitration disputes and tax law).

Lawyer in tax disputes

Tax disputes are very complex and require certain qualifications from a lawyer. The lawyer will point out to the court all violations committed by the tax authority during individual activities during the audit (for example, during seizure, examination). This will help to recognize part of the tax authorities’ evidence as inadmissible.

Consultation with an experienced lawyer on tax disputes

Get

Procedure for consideration

The time frame for consideration of the case is limited to 6 months. This period includes preparation for the trial and the actual decision-making. If necessary, the period may be extended. The reason for the extension is the particular complexity of the issue and the case, in which there are many participants and interested parties.

If the court accepts the application for consideration, the applicant is informed of the time and place where the hearing will take place. The plaintiff has the right to attend the meeting, but his failure to appear is not grounds for postponing the meeting.

During the consideration of the case, the court:

- checks the contested act or its individual parts for compliance with current legislative norms;

- establishes the legality of the powers of the persons who drew up and signed the disputed document;

- checks whether the subject of the dispute violates the legal rights and interests of the applicant.

In judicial practice, judges fully check the legality of decisions and actions of employees of regulatory authorities, and not just study the arguments given in the application. If it is determined that the actions or inactions of employees do not comply with the law, then a court decision will cancel all legal consequences that occurred as a result.

Copies of the court decision are sent to all participants in the process. The deadline for sending copies of the arbitration court decision is 5 working days. When applying to a court of general jurisdiction, this period is reduced to 3 days.

You have received an inspection report. What to do?

No later than five days from the date of drawing up the on-site tax audit report, it is handed over to the taxpayer.

You have one month to submit your written objections.

Should I do this? On the one hand, after receiving your objections, tax authorities can carry out additional tax control measures and draw up an additional act.

But if you are confident that you are right and are ready to defend it in court, then you need to provide objections. Your arguments may be taken into account when making a decision.

Objections to the tax authority’s act

Objections should include the most significant arguments. How to write objections to an inspection report

In your objection, be sure to include:

- name of the Federal Tax Service, address,

- name, contacts, TIN of the person being inspected,

- date and number of the act,

- state your disagreement with the position of the tax authorities,

- be sure to refer to laws and other legal acts, clarifications of the Ministry of Finance and the Federal Tax Service, judicial practice,

- list all documents attached to the objections.

How to send objections to the Federal Tax Service

Objections are signed by the manager or representative by proxy. Do not forget to attach this power of attorney, otherwise objections will not be considered.

Objections can be submitted in person or sent by mail.

Attention! If the decision is made before the deadline for filing objections, it will be canceled, since this is a gross procedural violation.

You may be interested in: Letter from the tax office: what to do?

Appeal (appeal of the decision of the Federal Tax Service)

The decision will come into force one month from the date of delivery. To postpone this date, file an appeal.

Appealing a tax decision through an appeal means that you will have:

- one month to submit a complaint,

- one month for its consideration by tax authorities,

- perhaps another month, for which its consideration will be extended if necessary.

Attention! The Tax Code does not contain the ability to restore the deadline if it is missed. If you file a complaint outside the deadline, it will be considered as a regular complaint, meaning it will not delay the entry into force of the decision. You can submit a petition to suspend the execution of the decision, but it must be accompanied by a bank guarantee.

Photo: RIA Novosti

Where to file an appeal?

Decisions of the Federal Tax Service and the interregional inspectorate for major taxpayers are appealed to the Federal Tax Service.

Decisions of district and interdistrict Federal Tax Service Inspectors are disputed in the Federal Tax Service Directorate for the relevant constituent entity of the Russian Federation.

What to write in an appeal against tax decisions?

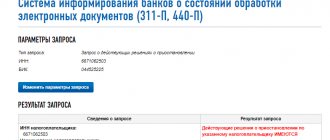

A complaint can be submitted in writing or electronically (via TKS or through your personal account).

Please include the following information:

- name of the higher authority, its location,

- name, tax identification number, contact details of the individual entrepreneur or company,

- the decision being appealed,

- data from the Federal Tax Service, which made the controversial decision,

- their arguments refuting the arguments of the tax authorities,

- your requirements,

- method of obtaining a decision on a complaint

The complaint is sent through the tax authority that made the controversial decision.

Let's draw up an appeal

Leave a request:

We'll call you back!

Attention! The court will not accept arguments about procedural violations of the inspection if you did not raise them during the pre-trial appeal (Resolution of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57)

You may be interested: Tax Code 2021: The Ministry of Finance has prepared large-scale changes

Appealing non-normative acts of the tax authority, actions (inaction) of its officials

A complaint can be filed against a decision that has entered into force within a year from the date of its adoption; against other non-normative acts of tax authorities, against actions or inactions of officials - within a year when you learned of a violation of your legitimate interests.

You can appeal various actions (inaction) of tax authorities that you consider illegal:

- requirements for the provision of documents,

- extension or refusal to extend deadlines for submitting documents,

- taking interim measures,

- untimely cancellation of interim measures,

- an order to the bank to write off funds from the accounts of an organization or individual entrepreneur, refusal to return or offset overpaid taxes,

- appointment of examination,

- notch,

- untimely return of illegally collected taxes and others.

The complaint is submitted in paper or electronic form through the Federal Tax Service, which made the controversial decision.

We will file a complaint against the actions/inactions of tax officials

Briefly describe your problem in the form via the link

Ask for help

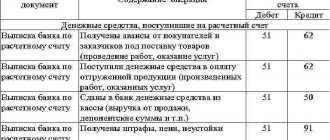

Request for payment of tax

A sample request for tax payment was approved by order of the Federal Tax Service of Russia dated February 13, 2021 No. ММВ-7-8/ [email protected] Appendix No. 2 to this document contains a form that all inspectorates are required to use when issuing demands for repayment of arrears of taxes and fees , fines and penalties. The document must contain information about the amount of debt and the amount of penalties as of the date the claim was made. The deadline for fulfilling the requirement to pay tax or other amounts is also specified separately. Article 69 of the Tax Code obliges controllers to also indicate in the request the grounds for levying tax and references to the relevant articles of the Tax Code, which establish the obligation to transfer a particular amount to the budget.

The deadline for fulfilling the tax payment request is 8 days from the date of its receipt. However, the document itself may establish a different period, which, if specified, has priority.

The deadlines within which controllers can issue demands to the taxpayer are also established by law. In this case, they will depend on the situations in which the arrears arose (Article 70 of the Tax Code of the Russian Federation).

All of the above aspects of filing a tax payment request must be strictly observed by inspectors when drawing up the document. Any flaw in this process may itself be grounds for appealing the claim.

Judicial appeal against actions/inactions of tax authority officials

Only after receiving (failure to receive on time) a decision on the complaint has the right to send an application to the arbitration court.

The application must be submitted no later than three months after receiving the tax authority’s decision on the complaint.

The court may restore the term if it finds the reasons valid.

Attention! For individual entrepreneurs, illness or long business trips are considered valid reasons. As for organizations, the presence of a manager, lawyer, or other official on a business trip, vacation or sick leave is not a valid reason (Resolution of the Armed Forces of the Russian Federation dated June 30, 2020 No. 12).

If you do not appeal the decision, but only demand the return of the overcharged tax and penalties, then go straight to court.

You may be interested in: Complaint about inaction: how to write and send

conclusions

Disagreements with representatives of tax authorities are a common occurrence for people conducting economic and business activities. This is due to the specifics of the work and the inevitable participation of any commercial organization in tax relations.

If the claims of the tax authorities are unfounded, you should not put up with them. Taxpayers have every right to defend their interests. You need to act consistently and confidently, backing up your words with documents. Often, a dispute can be resolved already at the first stage, that is, by submitting objections to the body that made the decision, which, in the taxpayer’s opinion, was illegal.

If the local tax authority does not admit that it was wrong, you can appeal to a higher authority. The last resort for resolving tax disputes is arbitration.

To increase the chances of successfully resolving the problem, entrepreneurs and company managers turn to lawyers whose specialization is tax disputes. The lawyer collects a full package of documents, draws up objections or complaints and represents the interests of the employer in court. Contacting a lawyer will help you avoid mistakes and increase the chances of resolving the dispute in favor of the taxpayer.

You may find it useful:

How to apply to court

What to write in the application:

- name and address of the court,

- name, contact details of the tax office,

- name, contact details of the applicant,

- number and date of the decision,

- data on pre-trial appeal,

- grounds for unlawful actions of officials,

- an indication of how the interests of the applicant have been violated,

- requirements,

- application.

Attach to your application a copy of the appealed decision, the tax audit report, and documents confirming your position.

Don’t forget to pay the state fee (3,000 rubles for companies, 300 rubles for individual entrepreneurs) and send a copy to the tax authority. Please include proof of her referral with your application.

If you ask to recover money from the tax office, then the state duty is calculated as for a property claim .

If you ask to take interim measures (to suspend the execution of a non-normative act), you must pay an additional state fee of 3,000 rubles.

To support your arguments, be sure to provide examples from judicial practice in your region or the Armed Forces of the Russian Federation.

The application is signed by the manager or representative (with a power of attorney attached).

What forms of violations can be appealed?

You can make such a complaint in different situations, for example:

- incorrect assessment of taxes, errors in the amount or illegality of actions in this matter in general;

- imposing various fines without the right to do so;

- delay in tax deduction for more than four months (or more than one, legal disputes are still ongoing in this regard);

- incorrect final results of the tax inspectorate or their absence at all.

You can submit a document at any time. This applies both to the time after the inspection and before it formally begins. You can also submit it altogether in the absence of inspections on your own initiative. For example, when funds due for payment by law are delayed.

How to behave in court

A representative with a legal background may participate in the court hearing. But the Constitutional Court in Resolution No. 37-p dated July 17, 2020 explained that in tax and similar disputes, along with a representative with a legal background, a company official who does not have a legal background but has the necessary information (for example, an accountant, executive director) may be present and so on).

And although, according to the law, it is the tax authority that must prove that the decisions it makes are legal and do not violate the rights of the taxpayer, the outcome of the case largely depends on the active position of the taxpayer.

Submit evidence, requests to obtain evidence, objections to inspection reviews, requests to call witnesses, use the possibility of notarized evidence (for example, electronic correspondence).

Choosing a protection method

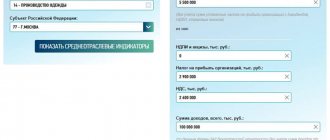

There are several ways. You can choose only one, you can combine several, but which ones exactly? It may seem like an incident, but you can ask the tax authorities about this directly. After all, as you know, tax authorities must inform taxpayers free of charge, including about the rights of taxpayers (subclause 4, clause 1, article 32 of the Tax Code of the Russian Federation). It can be done:

- by phone (8-800-222-22-22);

- via the Internet (https://www.nalog.ru);

- in person or in writing (127381, Moscow, Neglinnaya St., 23 or at the address of your tax office).

It must be remembered that when applying in writing, 30 days are allotted for a response (which can be successfully used to delay time, so that, for example, the statute of limitations expires).