Depreciation in accounting can be calculated using the reducing balance method.

This accrual method allows you to write off the cost of fixed assets in an accelerated manner compared to a uniform linear order. The method is based on the use of residual value and an accelerating factor and is used for fixed assets whose operational properties are rapidly declining.

From what amount can OS be

Changes made to the Tax Code since the beginning of last year interpret restrictions on the cost of operating systems as follows:

- All properties of fixed assets, including depreciation, are possessed by objects valued at more than 100,000 rubles. Taking into account the presence of other signs of OS in them.

- If the evaluation criteria are in the range from 40,000 to 100,000 rubles, then this object can be classified as fixed assets with subsequent write-off of its value in the form of depreciation only in accounting. In tax accounting, depreciation is not provided for it, and the cost is written off on the day of commissioning.

- Objects that have signs of fixed assets, but with an initial valuation of less than 40,000 rubles, are classified as inventories of a material and technical nature in accounting.

- Fixed assets involved in operation, but having a cost of less than 3,000 rubles, are accounted for in account No. 21. Their internal movements are reflected in off-balance sheet accounts.

The application of Article 340 “Increase in the cost of inventories” is described in this video:

Formulas for the accelerated method

The rules for calculating depreciation using the non-linear reducing balance method are prescribed in clause 19 of PBU 6/01.

Calculation using the reducing balance method of deductions is based on the residual value, which allows you to have the largest deductions in the first months and years of use. Then, over time, the amount of depreciation decreases.

If the company additionally introduces an accelerating factor, then the process of writing off using the reducing balance method is accelerated.

Formulas:

Annual rate = 1* 100% * Ku / SPI

Annual depreciation = Residual value * Annual norm

Monthly depreciation = Am. / 12 months

Residual value = Original – Accumulated depreciation

These formulas contain the following indicators:

- Ku is an accelerating factor that an enterprise has the right to adopt to speed up the process of transferring the cost of fixed assets to costs; you can choose a value within 3.

- SPI is the useful life that the company sets independently for accounting purposes.

- The initial cost is the one at which the fixed asset was accepted for accounting (if a revaluation was carried out, then the replacement cost is taken).

- Accumulated depreciation is the amount of deductions for an object over its entire service life at the time of calculation.

- Residual value is the difference between the initial cost and deductions made, calculated annually.

- The annual rate is a percentage indicator that reflects the share of the cost of the operating system attributable to expenses annually.

Calculation example

Initial data:

The company purchased a machine for the production of plastic bottle caps in December 2021.

The sum of all costs for its acquisition, delivery and configuration amounted to 1,500,000 rubles. excluding VAT.

At this cost the machine was accepted for accounting.

The selected period of use for the machine is 4 years.

The accounting policy states that the company uses the nonlinear accelerated declining balance method for production equipment.

Since the organization plans to load the machine 100% immediately after commissioning and use it intensively with maximum efficiency, it was decided to additionally introduce an acceleration factor = 2.

Depreciation begins in January 2021.

Calculation:

Norm = 1 * 100% * 2 / 4 = 50%

That is, it is planned to write off 50% of the remaining cost of the machine every year.

The process of depreciation using the reducing balance method is presented in the form of a table:

| Year | Annual norm | Residual value | Annual depreciation | Depreciation monthly |

| First | 50% | 1 500 000 | 750 000 (1500000 * 50%) | 62 500 (750000 / 12) |

| Second | 750 000 (1500000 – 750000) | 375 000 (750000 * 50%) | 31 250 (375000 / 12) | |

| Third | 375 000 (1500000 – 750000 – 375000) | 187 500 (375 000 * 50%) | 15 625 (187 500 / 12) | |

| Fourth | 187 500 (1500000 – 750000 – 375000 – 187500) | 93 750 (187 500 * 50%) | 7 812,50 (93 750 / 12) |

Total deductions for 4 years = 750,000 + 375,000 + 187,500 + 93,750 = 1,406,250.

Remaining value at the end of useful life = 1,500,000 – 1,406,250 = 93,750.

How to write off this balance?

There are several ways:

- Add this amount to the last month and write off in December 2021 7,812.50 + 93,750 = 101,562.50;

- Divide this amount evenly over the last year of operation.

In this case, it is convenient to choose the second option, distributing the residual value of 187,500 over 12 months of the last year of operation.

Then depreciation charges in the last year = 187,500 / 12 = 15,625.

Other non-linear accrual methods:

- by the sum of the numbers of years of SPI;

- proportional to production.

When is it used?

The reducing balance method is only available for accounting purposes. In practice, it is convenient to use in cases where you need to quickly return the money spent on fixed assets in order to re-equip, update, improve, or replace existing fixed assets.

This need usually arises for fixed assets that:

- quickly age morally (computer equipment);

- intensively used - production equipment;

- wear out quickly.

The method based on the reducing balance is not used, as a rule, in relation to long-term operated property.

It does not lose its qualities (buildings, structures, furniture), and therefore does not require the use of an accelerated method.

Advantages and disadvantages

The reducing balance method has its advantages and disadvantages.

| Advantages | Flaws |

| There is a possibility of a quick return of funds invested in the OS | Has limited scope |

| Has increased efficiency of investments in depreciable assets | Not used for vehicles, except for taxis and company vehicles |

| You can independently regulate the rate of property write-off using the acceleration coefficient | Not used for OSs that have a service life of less than three years |

| Application causes discrepancies with depreciation calculated in tax accounting |

Increase in the value of fixed assets

If an existing facility, accounted for as fixed assets, has been refurbished, then the company has the right to revaluate it upward. This is allowed, but not more than once a year. The value of property can be increased if:

- Modernization (partial or complete).

- Retrofitting (equipping with new units or parts).

- Reconstruction.

- Technical update (transition to new technologies).

- Completion.

- Or revaluation for other reasons.

All expenses in this case are entered into account 08, and they must be documented by documents such as:

- Estimated project.

- Work acceptance certificate.

- The act of handing over the object.

- Updated inventory card for the facility.

- Order from the manager regarding the work completed and the facility being put into operation.

The video below will tell you how to keep records of non-current and low-value assets in 1C:

Reduction and markdown

Since the depreciation period for fixed assets can be long, their market value may also change during this period. In such cases, they are re-evaluated. Revaluation of an object with a decrease in its value is called markdown. Markdown purposes:

- Determination of the real value of the object, valid on the market at the moment.

- Analysis of the effectiveness of using the OS.

- Tax reduction.

OS valuation can be carried out in one of two ways:

- Direct recalculation in accordance with their real value.

- Indexed according to the degree of wear.

Accounting records reflect both a decrease in the value of the object and a decrease in its depreciation.

Postings in accounting

| Period | Contents of operation | Debit | Credit | Amount, in rub. |

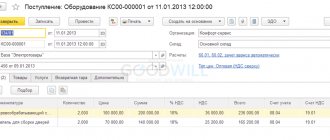

| March 2016 | The costs of purchasing the OS are reflected | 08 | 60 | 48000 |

| The property was put into operation as OS | 01 | 08 | 48000 | |

| Deferred tax liability accrued (RUB 48,000 × 20%) | 68 | 77 | 9600 | |

| April 2016* | Accrued depreciation of fixed assets | 20 | 02 | 1000 |

| The deferred tax liability was partially repaid (RUB 1,000 × 20%) | 77 | 68 | 200 |

*During the entire depreciation period of the equipment, you will need to repeat the same transactions as in April.

Automated accounting, tax and warehouse accounting at large enterprises and in the public sector

To learn more

Impairment of fixed assets

During operation, the costs of maintaining an OS object may exceed the income they generate. That's when the depreciation of fixed assets occurs. Its signs:

- A drop in the market valuation of the property.

- The change in the situation is not for the better for the company.

- Excess of book value over market value.

- Obsolescence or wear and tear of the OS.

- Prolonged non-use of equipment.

- The impending closure of the company.

- The fixed asset is expected to be disposed of.

- Deterioration in the economic results of using this OS.

If an object has one of the signs of depreciation, then it is checked for this item. Its procedure is enshrined in standard IAS 36 “Impairment of Assets” and consists of comparing the carrying amount with the recoverable amount. In this case, the book value should not be higher. The recoverable amount is calculated as the difference between:

- Fair (market value).

- Costs of sale or dismantling with the cost of materials or parts suitable for use.

Another criterion for the effectiveness of a company’s use of fixed assets is turnover and liquidity.

The impairment of fixed assets is described in this video:

Other innovations

- A new criterion has emerged for recognizing a fixed asset. Such a criterion is the material form of the object.

- PBU 6/01 states: fixed assets do not include objects that are expected to be resold in the future. There is no such restriction in FSBU 6/2020.

- A requirement has been introduced to check fixed assets for impairment.

- A separate group of fixed assets has been identified - investment real estate. These are objects intended for rental and (or) for generating income from an increase in their value. Such property is accounted for separately according to special rules.

Liquidity

This is an opportunity to quickly convert the fixed assets on the company’s balance sheet into money. This ability is assessed by liquidity indicators, which include:

- The general coefficient is calculated as follows: the size of current assets / short-term liabilities × 100%. Optimal value: 100 – 200%.

- Absolute coefficient equal to the ratio: cash value of fixed assets/current liabilities×100%. It is recommended to keep it in the region of 10 – 30%.

- Urgent liquidity (20 – 40%): (cash + securities)/short-term liabilities×100%.

- Adjusted ratio : (cash + securities + accounts receivable) / short-term liabilities × 100% within 80 – 100%.