We prepare the implementation: how invoices and delivery notes are issued

Each fact of economic activity is accompanied by the preparation of primary documents.

Based on them, the accountant records the completed transaction in accounting. Operations for the sale of products, work, services, etc. are no exception. During this operation, the seller must issue a primary document (for example, a bill of lading), on the basis of which the product, work, service is transferred (or ownership is transferred) to the buyer. If the seller pays VAT, then in general cases he issues an invoice to the buyer. But he can do this not at the time of transfer of the asset or ownership of it, but within five days after shipment. Thus, the delivery note and invoice are a single set of documents for the sale of goods, but they are intended to take into account various objects. To understand the difference between a delivery note and an invoice, let's look at each document separately.

What to do?

To submit

The documents must correctly indicate the name of the seller or buyer, their details and data about goods, products or services, as well as write their cost. The issued documents are signed by officials and sealed. Then they are transferred to the counterparty at the time of sale of goods and materials or provision of services, or until the actual implementation or completion of work.

Registration

It is necessary to register primary documents in registration journals and primary documentation books. This responsibility is imposed on the accounting department, because according to the Accounting Rules, all documents must be registered on the day they are issued.

https://www.youtube.com/watch?v=kVlA0A3itWc

Responsibility for the correct entry of data into certain primary documents rests either with the chief accountants or with the responsible persons who, according to the job description, are required to fill out these documents.

- How to record the acceptance of inventory items for safekeeping

What is a bill of lading used for?

A consignment note in the form TORG-12 is one of the types of primary documents on the basis of which the transfer, for example, of goods purchased for resale or products of own production to the buyer takes place. That is, the invoice is needed to record inventory items.

The form and instructions for filling out the consignment note were approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132. However, according to the Law “On Accounting” dated December 6, 2011 No. 402-FZ, economic entities have the right:

- develop your own forms of primary documentation while maintaining the necessary details;

- supplement unified forms with essential details.

Is it necessary to indicate bank details in TORG-12? What if it doesn't have a seal? You will find answers to these and other controversial questions about filling out the document in ConsultantPlus. Trial access to the legal system is free.

Simultaneously with the issuance of the consignment note, accounting entries are generated for the sale of:

- Dt 62.1 Kt 90.1 - reflects the fact of sale of products or goods to the buyer;

- Dt 90.2 Kt 41, 43 - cost of goods or products sold.

Based on the delivery note, the buyer will reflect in his accounting the receipt of material assets by posting Dt 10, 15, 41... Kt 60.1.

Receiving goods without a power of attorney (carrying a stamp)

- Only its sole executive body, for example, the general director, can receive goods on behalf of an organization without a power of attorney. However, in this case, the seller, before drawing up the delivery note, is obliged to make sure that the person receiving the goods is the real sole executive body. It is necessary to request a document on the appointment of the general director, which contains passport data, and also require the presentation of the passport itself to verify this data.

- The goods can also be received by a materially responsible person appointed by order of the General Director, or on the basis of a general power of attorney. The order and the general power of attorney must clearly indicate the authority to receive the goods and the right to sign the TORG-12 consignment note, as well as the passport details of the materially responsible person. The seller is also obliged to verify passport data when shipping the goods.

In both cases, the signature is placed in only one column. The cargo was received by the consignee :

- The cargo was received by the consignee - filled in when the consignee receives the goods. The position, full name and signature are indicated (for example, General Director Petrov V.A.).

What is the difference between a bill of lading and other transfer documents?

We have already found out when a delivery note is issued, but in addition to it, other transfer documents can be issued during the sales process:

- invoice for the release of materials to the third party - form No. M-15;

- act of completion of work / provision of services;

- act of acceptance and transfer of fixed assets - form No. OS-1, etc.

From the names it is clear that the execution of the listed documents occurs depending on what property is being transferred: materials, work, services, fixed assets, intangible assets, etc.

All these documents are characterized by the fact that they must contain the details of the transferring and receiving parties, the name and, if necessary, characteristics of the transferred asset, quantity, price and value, the date when the asset was transferred, etc. The documents must be certified by the signatures of authorized persons with each party to the transaction and sealed (if any).

Look at what details should be present in the primary documents.

Date of discharge

Is it possible to issue one invoice for several invoices or certificates of work performed? Inventories can be shipped to one buyer on different days, from different warehouses of the same seller, and each shipment is accompanied by an invoice.

The Tax Code does not provide for the requirement to issue an invoice for each invoice, and if the supplier issues one invoice for several invoices, such an action is not an offense, provided the established deadlines are met. In other words, from the date of preparation of the first and last invoice, the date of issue of the invoice should not exceed 5 calendar days.

What is the purpose of an invoice and how is it different from a delivery note?

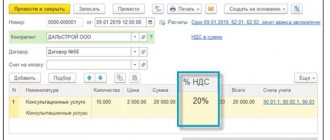

An invoice is a primary document used to record value added tax. The seller-taxpayer is obliged, when performing transactions subject to the specified tax, to issue an invoice, thus showing the accrual of VAT: Dt 90.3 Kt 68/VAT.

An invoice can be issued not only upon shipment, but also under other circumstances (for example, when funds are received from the buyer as an advance), when an invoice is not required, but VAT must be charged.

The buyer - a VAT payer has the right, on the basis of the received invoice, to accept the amount of VAT for deduction, reducing the amount of tax payable to the budget. The buyer's incoming VAT is reflected on the basis of posting Dt 19 Kt 60.1, and the tax deduction statement is Dt 68/VAT Kt 19. However, for this, the document must comply with all the requirements of tax legislation.

The form of the invoice and the rules for filling it out are given in Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 (as amended on August 19, 2017 No. 981). The invoice, as well as the delivery note, must indicate the name of the product, its quantity, unit price and total cost, VAT rate and amount, amount including VAT. In addition, the details of the seller and buyer (shipper, consignee) are provided here. The document is certified by the signatures of authorized persons (usually the manager and chief accountant of the organization or individual entrepreneur). Unlike the consignment note, there is no space for printing in it.

What details of the consignment note in the TORG-12 form are required to be filled out in order to accept expenses for tax accounting and apply VAT deductions? You will find the answer to this question from 2nd class adviser to the State Civil Service of the Russian Federation E. S. Grigorenko in K+, having received trial access to the system for free.

What are the types of TN?

The enterprise can organize a standard paper document flow, or an automated electronic document flow mechanism can be introduced.

Accordingly, invoices can be generated on paper or electronically . If an electronic document is signed with a qualified signature, then it is considered equivalent to a document on paper with a handwritten signature (Clause 1, Article 6 of the Law of 04/06/2011 No. 63-FZ).

- Paper invoices are drawn up in 2 copies: one document remains at the enterprise, and the other is provided to the buyer.

Such a document must be certified by the manager and the head of the accounting department. When transporting cargo, the consignment note is given to the driver. If errors were made in the document, they can be corrected by confirming the changes with signatures from the seller and buyer. - In electronic form, the document is compiled in one copy, but consists of two files.

The first file is filled out by the seller, and the second by the buyer. Such a document is signed with an electronic signature on both sides. The invoice is sent to the buyer only in electronic form; the driver, when transporting the cargo, receives only the consignment note.

Important! If an error was made in the electronic invoice, it will no longer be possible to correct it. In such cases, a report on the identified differences is drawn up and agreed upon with the counterparties.

What is more convenient - paper or electronic?

The introduction of electronic document management in an organization has its pros and cons. So, the advantages include:

- The process of creating, receiving and executing documents is accelerated.

- The efficiency of process control increases.

- The quality and efficiency of work processes increases, since less time is required to search the database for the necessary documents, generate registers and reports.

- Unnecessary information is not disseminated, since each employee has access only to certain documents.

But this modern approach to creating and storing documents also has its disadvantages:

- Risk of information loss when equipment fails.

- The problem is with staff training; this kind of innovation requires acquiring new skills from employees.

- The introduction of electronic document management requires large financial costs.

- Limited list of partners - not all companies work with electronic documents.

It is definitely difficult to say that any type of invoice is more convenient.

For example, you can make any changes to a paper invoice simply by adding signatures; doing this with an electronic document is much more difficult, which can create additional difficulties. But, taking into account all the advantages, we can say that electronic invoices make the process more automated and clear.

Is it possible to issue a delivery note and an invoice in one document?

So, a delivery note is intended to account for inventory items, an invoice is intended to account for VAT. Is it possible to compose them in the form of one document?

Maybe. Such a document has been in effect since 2013 - from the moment the Federal Tax Service issued a letter dated October 21, 2013 No. ММВ-20-3 / [email protected] in order to facilitate the document flow of business entities. The letter contains a new form with the details of both documents. It was called UTD (universal transfer document).

Our legislation periodically adjusts the invoice form, and therefore the UTD form also changes.

UPD replaces:

- set of invoice and transfer document;

- transfer document.

The law does not oblige the use of UPD; this is voluntary. If a business entity decides that the UTD will be issued during shipment, then it is better to register such a decision in the accounting policy.

Is it possible to indicate services in TORG-12

1 tbsp. 146 of the Tax Code of the Russian Federation). As for the input VAT charged to you by the transport company, you have the right to deduct it (Articles 171, 172 of the Tax Code of the Russian Federation). And don’t forget to issue an invoice to your buyer (Clause 3 of Article 168 of the Tax Code of the Russian Federation).

But what if the cost of delivery is included in the price of goods, the sale of which is taxed at a rate of 10%? Apply the rule of paragraph 1 of Art. 153 of the Tax Code of the Russian Federation and there is no need to separately calculate VAT on such delivery at a rate of 18%. After all, delivery of goods to the buyer in such a situation is not an independent activity of the seller. But, adhering to this position, know that the tax authorities are unlikely to like it. And, most likely, you will have to prove the legality of applying the 10% VAT rate in court. And the courts will support you.

Results

So what is the difference between an invoice and a delivery note?

They are intended to reflect two different accounting objects in the accounting and tax registers. The delivery note takes into account inventory items, and the invoice takes into account VAT. Both documents are issued upon shipment or upon transfer of title, but the invoice is issued immediately at the time of shipment, and the invoice is issued within 5 days after that. The information reflected in these two documents overlaps to some extent. That is why, in order to simplify document flow, tax authorities have developed a single form that combines the details of the invoice and the primary transfer document. A sample UPD is shown above. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Transportation of goods by own transport and payment of UTII

And I would like to mention one more problem. If the cost of delivery is highlighted separately in the contract, the tax authorities may try to charge you additional UTII. Of course, provided that imputation has been introduced for transport services in your region. But the Russian Ministry of Finance explained that such delivery is not an independent type of business activity, but only a way of fulfilling the seller’s obligation to transfer the goods. And UTII needs to be paid only if a separate contract for the carriage of goods is concluded upon delivery. Therefore, in case of claims from tax authorities, you can argue with them, relying on the explanations of the financial department. By the way, the courts also agree that it is not necessary to pay UTII in such cases.

* * *

As you can see, the easiest way is when the shipping cost is included in the price of the product. And there is no risk that you will be recognized as a UTII payer.

What should the form look like?

Filling out such a form will not be difficult for both an individual entrepreneur and an official of an organization. However, when filling out, it is necessary to take into account certain rules that allow you to navigate in the correct provision of information. These rules include seven mandatory items. If one of the following items is not specified, the completed document has no legal force.

The following mandatory items should be approached with increased attention:

- title and serial number of the document;

- Date of preparation;

- the name of the economic entity that is responsible for creating the form;

- evidence of business practice;

- determining the value of the result of economic activity;

- indication of the position of the person involved in drawing up the transaction;

- surname and initials, as well as seals of the companies carrying out the transaction.

All of the above points must be present in a fully completed form. If one of the listed items is missing, the delivery note loses its legal force. Please also note that providing false information may result in criminal liability.