Personal income tax deductions for children in 2021: changes, sizes and provision

Child tax deductions are one of the types of government benefits for parents who support minor children or students under 24 years of age. The use of a deduction allows you to save part of a family’s income due to the fact that the state does not withhold taxes from it (or by refunding taxes already paid to the budget). Benefits for personal income tax (i.e. personal income tax - income tax in Russia in 2021 is 13%) are provided to citizens who support and support a child (native, adopted, adopted or ward).

Receipt through the tax office

If during the year deductions for the child were not provided by the employer or were provided in a smaller amount, then at the end of the year they can be received from the tax office in the entire amount at once in the amount of personal income tax paid for the past year.

We collect the necessary package of documents. Keep in mind that when submitting copies of documents to the tax office, you must have their originals with you. So, you will need the following:

- Declaration 3-NDFL.

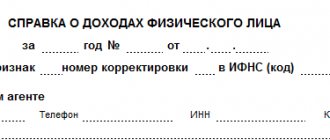

- Help 2-NDFL. Get it from your place of work in the accounting department (if you worked in several places during the year, you need to get a certificate from each employer).

- Passport of a citizen of the Russian Federation (copy of the main page and registration).

- Application for personal income tax refund with details of the bank account to which the money will be transferred.

- Copies of documents confirming the right to receive a child deduction (see above).

THEN WE PROVIDE THESE DOCUMENTS to the tax office at your place of residence.

• After receiving the documents, the tax office will check them. The verification must be completed within 3 months.

• After completing the audit, the tax office must send you a written notification within 10 working days with its results (grant or refusal to grant a deduction).

• If the decision is positive, funds must be transferred to you within 1 month.

How much to provide deductions for children under personal income tax in 2018

Officials did not provide for changes to the amount of standard deductions for children under personal income tax in 2018. Therefore, as before, the amount depends on the number of children, the relationship between parents and child, as well as on the status of the baby himself.

Deduction depending on the order of the baby. Typically, for the first child, an employee can receive a child deduction of 1,400 rubles per month. The same size is used for the second baby. For the third and subsequent ones the amount is higher – already 3,000 rubles.

Benefits for disabled people. There are also separate amounts for a disabled child:

- 12,000 rub. – for parent and adoptive parent

- 6,000 rub. – for a guardian, trustee, foster parent

These amounts, according to the latest changes, are summed up with the usual benefits depending on the order of the baby (clause 14 of the Review, approved by the Presidium of the Supreme Court of the Russian Federation on October 21, 2015, letter of the Ministry of Finance of Russia dated March 20, 2021 No. 03-04-06/15803) . For example, if there are three children in a family, and the third is disabled, then the deduction for him will be 15,000 rubles. for a parent or 9,000 rubles. for the guardian.

Increased deductions. The law allows employers to provide employees with a double deduction. This is possible in two situations:

- the employee is the only parent (adoptive parent, guardian, trustee)

- the employee receives a deduction for the second parent because he refused to receive it

We receive a deduction through the employer

We collect the necessary package of documents:

- Application addressed to the employer.

- Certificate of birth or adoption of a child (copy).

- A copy of the marriage registration document (passport or marriage registration certificate).

- Certificate of disability (if the child is disabled).

- Certificate from the educational institution (if the child is a full-time student).

ADDITIONALLY, if the employee is the only parent (guardian):

- Death certificate of the second parent (copy).

- Extract from the court decision recognizing the second parent as missing (copy).

- Certificate in form No. 25 confirming the status of a single mother (a woman with a child who officially does not have a father).

- A document confirming that the parent is not married (passport).

ADDITIONALLY, if the employee is a guardian or trustee:

- Resolution of the guardianship and trusteeship authority.

- Agreement on the implementation of guardianship or trusteeship.

- Agreement on foster family.

Next, we present the collected documents to the employer. If you work for several employers at the same time, you can receive a deduction from only one of them.

Age limits

The tax base on the basis under consideration decreases starting from the month of birth. The application of the benefit ceases at the moment of the calendar period when the heir turns 18 years old. Please note that it is provided until the end of the tax period (clause 4, clause 1, article 218 of the Tax Code of the Russian Federation). If the student continues full-time studies, then, upon confirmation of this fact, the benefit remains until he reaches the age of 24 years. In this case, the provision of tax reduction must be stopped from the month following the month of completion of training (letter of the Ministry of Finance No. 03-04-05/8-1251 dated November 6, 2012). And it doesn’t matter whether the student has a personal source of income or not. Now let's move on to the question of up to what amount of income the personal income tax deduction for a child applies in 2021.

How to get a deduction if the parents' address does not match the child's address?

Direct provision by the parents of a child is one of the grounds for receiving a standard tax deduction, but if the child is not registered at the place of residence in the same place as the parents, this fact in itself cannot be considered a reason for not providing them with a deduction.

In this regard, in the event of actual cohabitation, the presence of registration will not play a role in issuing a deduction, the right to which in this case is confirmed by the child’s birth certificate and a certificate from the housing society about the child’s cohabitation with the parent (parents).

...and not standard

The standard personal income tax deductions described above are a kind of income tax benefits that are calculated simply based on the fact that individuals receive income on a regular basis, and this is done by the employer, the source of income. Some deductions are provided on other grounds, which of course does not eliminate the need to have income subject to personal income tax to receive them.

Thus, Article 219 of the Tax Code describes the so-called social tax deductions for personal income tax. They are provided, in particular, for the costs of training at various universities, technical schools and colleges, etc., if the latter have the appropriate license or other document that confirms the right of the educational institution to provide the relevant educational services. We are talking about money spent on one’s own education, as well as on the education of children: relatives under the age of 24 and those under the taxpayer’s care – up to 18 years.

Another social deduction can be obtained in connection with the expenses incurred for treatment - for yourself and your immediate relatives (spouse, parents and minor children). also, as in the case of educational institutions, treatment must take place in medical centers or individual entrepreneurs that have the appropriate license and carry out medical activities in accordance with the list of medical services approved by the Government of the Russian Federation.

Individuals who pay pension contributions under non-state pension agreements or insurance contributions under voluntary pension insurance agreements can also count on personal income tax benefits.

The total amount of all social deductions by which the personal income tax tax base can be reduced also has its own limit - 120,000 rubles per year (unless we are talking about a number of cases during treatment). If during one calendar year a person paid, for example, for both education and treatment, and the total amount of expenses exceeded the limit, then he himself has the right to choose which specific expenses and in what amount to take into account within the given amount.

The same citizens who purchased an apartment or built a house during the reporting period have the right to a property deduction (Article 220 of the Tax Code of the Russian Federation). Property deductions also apply when selling real estate, as well as other property. Their application depends on the transaction amount, as well as on the time during which the object being sold was owned by the seller.

Individual entrepreneurs on the general taxation system, as well as persons working under civil contracts, can take advantage of the so-called professional deduction for personal income tax (Article 221 of the Tax Code of the Russian Federation).

Limit value of the insurance premium base

If an employee comes to you in the middle of the year, along with an application and other documents, you will need a 2-NDFL certificate from the previous place of work. The certificate will confirm that the employee’s income did not exceed 350,000 rubles, and he has the right to receive a personal income tax deduction.

To receive a child tax deduction, first of all, an individual will need to fill out documents such as a declaration (filled out in accordance with the 3-NDFL form), a certificate with information about income (issued by the employer and filled out according to the 2-NDFL sample), an application containing a request for personal income tax return and bank card details, as well as make a copy of the birth certificate.

- For security costs. Each individual who is the natural father, mother, trustee or guardian of a child, who is involved in his upbringing and support, is entitled to financial compensation.

- To pay for education. If the taxpayer’s child is receiving full-time education and has not reached twenty-four years of age at the time of filing the deduction, then part of the money spent on education can be returned (if the payment took place less than three years ago).

- For medical expenses. Sometimes it happens that an individual spends money on paying for medical services, as well as purchasing medicines necessary for the treatment of his child. In this case, the taxpayer has the right to return the personal income tax he previously paid or, in other words, to slightly reduce the price for treatment.

Such a measure is unlikely to please Russian citizens, because today they already have to tighten their belts in order to finance the costs of housing and communal services, pay for the purchase of food, provide themselves with daily travel and buy clothes, which are becoming more expensive every day.

If the second parent is declared missing or incompetent by the court, then the remaining parent is also entitled to a double deduction. Receiving a double standard deduction is also possible if both parents are employed and one of them decides to refuse to receive benefits in favor of the other parent.

Personal income tax limit

For clarity, let's look at an example. Manager Ivanteev S.L. turned to the management to receive standard deductions for children according to personal income tax (up to what amount we have already said the limit is 350,000 rubles). Ivanteev has three children:

- Ivanteeva Anna Sergeevna, date of birth - 06/11/1995, not studying, education completed.

- Ivanteeva Maria Sergeevna, date of birth - 03.11.2010.

- Ivanteev Ivan Sergeevich, date of birth - 07/15/2015.

The employee's salary is 40,000 rubles per month.

The eldest daughter is over 18 years old and is not a full-time student, therefore, the benefit does not apply to her. The other two are under 18 years old, so in 2021 Ivanteev S.L. a monthly reduction in the tax base for the second son or daughter was provided in the amount of 1,400 rubles. and for the third - 3000 rubles.

In September, income exceeded 350,000, the income limit for the personal income tax deduction for children was reached, so reducing the personal income tax base no longer applies. Thus, the tax base for the tax period was reduced by 35,200 rubles, and the amount of personal income tax paid to the budget was reduced by 4,576 rubles. In the 2-NDFL certificate, the standard deductions provided must be reflected in section 4. The codes are established by Order of the Ministry of Finance No. ММВ-7-11/ dated 09/10/2015.

Deadlines for granting relief

Deductions are made monthly for one calendar year until the parent’s total income exceeds 350,000 rubles. Starting from the month when this amount was exceeded, the provision of benefits ceases. Deductions can only be used starting from the new calendar year.

For example, if the salary of an employee of an organization is 30,000 rubles, then tax benefits will be provided for only 11 months. In the 12th month, the amount of annual income will reach the maximum value.

How is a deduction provided for a child if parental rights are deprived?

Deprivation of the rights of one of the parents is not a reason for providing a double deduction for the child to the second parent as the only one. Persons deprived of such rights, at the same time, are not exempt from child support responsibilities; they pay alimony to persons in whose education (care) the child is, and are entitled to a standard tax deduction for children.

The mother of a child has the right to claim a double standard tax deduction if the father, deprived of parental rights (obligatory if he provides for the child and income is taxed with personal income tax at a rate of 13%), refuses to receive a standard tax deduction in favor of the mother.

Social tax benefits

The Tax Code establishes a strict list of social deductions that a citizen can use. However, in fact, you can only receive it after the tax has been paid and the necessary expenses have been made.

Such expenses include:

- Contributions in the form of donations and for charitable purposes;

- Tuition payment;

- Receiving medical services or purchasing medications;

- Transfer of voluntary contributions to non-state pension funds;

- Additional payments for the insurance component of the pension;

- Payment for an independent assessment of your qualifications.

For each deduction, the conditions for its receipt are established (list of documents, maximum return amount, etc.).