When buying housing with cash or a mortgage, every officially employed person can return from the state budget a share of the funds spent in the amount of personal income tax paid on the cost of real estate. How the owner can find out the balance of the tax deduction for the apartment and receive it is discussed in the article below.

Refund of personal income tax when purchasing a home

Balance information can be obtained from past tax returns. It is possible to submit a request to the Federal Tax Service, as well as calculate the balance yourself. To do this, the amount of previously received compensation should be subtracted from the total deduction amount. The balance is carried over to each subsequent year until it is exhausted.

The deduction can be received as a lump sum or monthly if the payment is made at work. The declaration is submitted at the end of the tax period. If deductions were realized before 2014, then their subsequent registration is impossible.

If you took out a mortgage before 2014 and paid interest later (in 2015, etc.), you can receive compensation for an unlimited amount of interest.

If they are paid in the amount of 4 million rubles, then the state will have to reimburse 13% of this amount, of course, if the borrower pays personal income tax. When applying for a loan after 2014, the deduction is provided strictly from 3 million rubles.

Possible types

Taxpayers often ask why the deduction amount is divided into parts and not paid all at once. This significantly complicates the task, since each time you have to calculate the amount of the balance for the past period.

The fact is that for each type of deduction a certain limit is established, the amount of which is several times higher than the amount of personal income tax paid by a citizen for the year.

Please note! In this case, the tax deduction is provided at a time and in full, if a citizen pays personal income tax for the year, the amount of which exceeds the amount by which the tax base was reduced as a result of the deduction.

Remaining property tax deduction

It is indicated in the 3-NDFL declaration. You can calculate it yourself. When registering the second and subsequent deductions against the balance, the 3-NDFL declaration is filled out according to the standard scheme.

The applicant means:

- the amount of income received during the previous year;

- the amount of income tax paid, information can be obtained from certificate 2-NDFL;

- information about transactions for which it is necessary to pay income tax or profit tax.

You will need to indicate the value of the property for which the deduction is being issued or the amount of interest paid on the mortgage loan. You should also indicate the amounts of deductions for previous years. It can be viewed from declarations for previous years.

If the document was prepared electronically on the Federal Tax Service website, then the information will be stored on the computer or in the taxpayer’s personal account. In the “deduction for previous years” section, you must indicate the amounts that the applicant received for past tax periods.

Find out for what period you can return a tax deduction. Is it possible to get a tax refund for shared participation in construction? See here.

When buying an apartment

To get the balance, you need to subtract the amount of all tax deductions (compensations) from the total deduction amount.

For example, the previous deduction amount was paid in 2021 from 1.2 million rubles. The citizen received 156 thousand rubles. He must first pay income tax on this amount. He can get the rest only with 800 thousand rubles.

Then the citizen buys a plot of land for 1 million rubles. The remainder of the deduction is 104 thousand rubles, which are paid from 800 thousand rubles. Thus, the amount of the deduction that has been transferred to the citizen since 2021 is 800 thousand rubles. From it, the state will pay the citizen 104 thousand rubles for the purchase of land.

The mortgage loan deduction can only be used if the citizen has used the right to compensation for the purchase of housing in cash.

Those. first, the applicant must completely exhaust the limit of 260 thousand rubles and only then apply for compensation for the amounts paid for interest on the housing loan.

If a citizen uses the balance to purchase housing, then in the declaration there is no point in indicating the balance that he may have after paying off the mortgage, especially when the deduction was used by the spouse to pay off a loan on shared real estate.

Interest compensation can begin to be used immediately after receiving a deduction for the purchase of housing in cash, but only when the amount of income tax paid allows you to count on a refund.

On a mortgage, you can compensate 13% of the total interest, which is possible if income tax was paid on this amount.

If the housing was purchased at a reduced cost, for example, the contract indicates a lower cost, but in reality it is twice as much, then a deduction for interest can be issued only for the amount of the purchase of housing specified in the contract.

Transitional

The deduction goes automatically. There is no need to perform separate actions to transfer it to the next tax period. Payment calculations are carried out by a Federal Tax Service employee. The right to payment also transfers in the case where the deduction was distributed between spouses.

If the balance of the deduction has been transferred to a new period, but the applicant has stopped paying income tax, then he temporarily loses the right to payment from the state.

Tracking the progress of tax return verification in your personal account

Believe it or not, this is a wonderful gift from the state the moment you bought an apartment. There are deductions not only for the purchase of an apartment, but in this article I will only talk about them. After all, the costs of buying an apartment (building a house), renovations, etc., probably took almost all your free money. How to receive the balance of the property deduction When purchasing residential real estate, individuals can receive a property tax deduction in the amount of expenses incurred, but not more than 2 million rubles (subclause 2, clause 1, article 220 of the Tax Code of the Russian Federation). If during the first period (year) the deduction is not fully used, then its balance can be transferred to subsequent years. In this case, repeated submission of documents confirming the right to such is not required.

How to find out?

How to find out the balance of the tax deduction for an apartment - you can find out the amount in the previous declaration or send a request to the Federal Tax Service, including in electronic form. To work on the Federal Tax Service website, you will need preliminary registration, as well as key activation (EDS).

You can calculate the amount of compensation yourself. Sample documents can be viewed on the Federal Tax Service website.

How is it calculated?

The balance is calculated based on the value of the property and the amount of compensation previously received.

For example, a citizen bought an apartment with rough finishing for 1 million 340 thousand rubles. He will receive a deduction amount of 174,200 rubles. Thus: 260 thousand – 174200 = 85800 rubles. – the actual amount that the applicant will be able to receive upon the next purchase of real estate.

For example, later a citizen buys a plot of land in DNT worth 300 thousand rubles. His available deduction, taking into account the previously purchased apartment, is still 85,800 rubles. He can receive it by submitting a new declaration to the tax office.

Instead of an afterword

Property return is the largest in terms of the amount of money that you can get back into your wallet. The higher a citizen’s salary and the larger the amount of income tax he transfers to the treasury, the more money he can return at a time using the deduction. But most often the transferred personal income tax is several times less than the maximum refund amount, so the payer receives the money in parts. We have explained in detail how this happens. Good luck getting your deductions!

Annually receiving part of the property deduction is a pleasant bonus to the family budget

Transfer to next year

The balance is automatically carried over to the next year. But you can only get it if you have a taxable base and have purchased real estate.

You can submit a declaration for the purchase of real estate in any year, even if the real estate was purchased in 2021, then the deduction can be received even in 2021, but taking into account if the citizen pays income tax this year.

Exceptions are provided for pensioners who receive a deduction for the previous 3 years before retirement, provided that these years they worked under an employment contract or made a profit.

About taxes and relations with the state in simple language

Site search

Subscribe to our VKontakte group!

latest comments

- Tatyana on I have already submitted a declaration, what documents should I provide next year?

- Administrator "Simple taxes" to the entry Documents for obtaining a property deduction

- Vasily on Documents for obtaining a property deduction

Join our group on Odnoklassniki!

The last notes

- Loan agreement between an individual and a legal entity 06/28/2017

- How can you distribute the deduction for interest paid between spouses 06/06/2017

- Payment for tuition by the other spouse 05/13/2017

- Tax deduction under an equity participation agreement 03/14/2017

- Payment for treatment by the other spouse 02/11/2017

Contacts

Social media

Terms of use of the site

On the “Simple Taxes” website, the user has the opportunity to read articles written by an experienced expert, ask a question on the topic of the site and receive an answer from an expert. The expert’s answer represents his private opinion on a given issue, based on the analysis and interpretation of the norms of the current legislation of the Russian Federation and law enforcement acts, is of an informational nature, and is not binding for the user. The expert and the site administration are under no circumstances liable for any losses, including actual damages and lost profits, penalties and/or claims of third parties related to the use of answers to the questions asked.

Receipt procedure

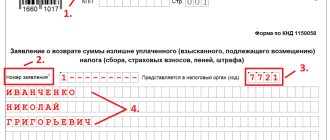

You must contact the tax office and apply for a deduction. It can be issued on paper or electronically in advance.

The applicant must indicate his income, as well as provide information confirming the fact of purchasing real estate or obtaining a mortgage loan.

A tax deduction from an employer when purchasing an apartment is one of the options for refunding funds. How to file a waiver of a tax deduction in favor of a spouse? A sample application is here.

How to calculate the standard child tax credit? Details in this article.

Required documents

To receive the remainder of the property tax deduction, you must provide:

- certificate 2-NDFL;

- declaration 3-NDFL;

- certificate of payment of interest, as well as payment documents;

- title documents for real estate;

- deed of transfer of real estate.

Here is a sample of a 2-NDFL certificate,

sample application for tax deduction,

sample declaration 3-NDFL.

A citizen can contact the Federal Tax Service in person or through a representative. If the applicant acts through an intermediary, then the tax office will need to bring a notarized power of attorney.

Our video

See how to get your taxes back when buying an apartment.

Property tax deduction is available after purchasing real estate with cash or a mortgage. It is provided only if the citizen is a personal income tax payer and receives regular income.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem, contact a consultant:

+7 (St. Petersburg)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE!

The amount of tax compensation is strictly limited and amounts to 2 million rubles. – for real estate and 3 million – for a mortgage.