Property deduction in 2021 can be applied for when purchasing real estate acquired before 2021, and not during it. At the same time, a property deduction for 2021 can be issued through the tax office at the end of the year, over the next three years: 2018-201.

- How to calculate property deduction?

- How to apply for a property deduction?

- When must real estate be purchased to receive the deduction for 2017?

- When can you apply for a property deduction for 2021?

- For which years is registration possible in 2021?

- Amount of property deduction in 2021

- Mortgage deduction in 2021

- 3-NDFL for 2017

Definition

Property deduction is the return of part of the finances that were spent on the purchase of real estate. The refund is made from income taxes paid in a certain tax period.

A citizen has the right to receive a deduction when buying or selling a residential property or plot of land. In the case of the sale of real estate, a citizen may not pay fully or partially income tax on the amount received as a result of the transaction. This happens by reducing the tax base for personal income tax.

But citizens often do not take advantage of deductions in real estate transactions, because they simply do not know about this possibility.

Codes and amounts of tax deductions for personal income tax for filling out 2-NDFL

<< Home

| Tax deduction code | Deduction amount | Categories of taxpayers covered by the deduction | Base |

| Property tax deductions | |||

| 311 | The amount of actually incurred and documented expenses for new construction or purchase of housing and land (except for interest paid on targeted loans (credits)) | Persons who purchased (built): – housing; – land plots for individual housing construction; – land plots on which the purchased housing is located | subp. 3 p. 1 art. 220 Tax Code of the Russian Federation |

| 312 | Amount of interest paid: – for targeted loans (loans) received from Russian organizations (entrepreneurs) for new construction or purchase of housing and land in Russia, – for loans received from banks for the purpose of refinancing (on-lending) loans for new construction or the purchase of housing and land in Russia | Persons who purchased (built): – housing; – land plots for individual housing construction; – land plots on which the purchased housing is located | subp. 4 paragraphs 1 art. 220 Tax Code of the Russian Federation |

| Social tax deductions | |||

| 320 | In the amount of expenses for full-time education of a brother (sister) up to 24 years old (subject to the limitation established by clause 2 of Article 219 of the Tax Code of the Russian Federation) | subp. 2 p. 1 art. 219 Tax Code of the Russian Federation | |

| 321 | In the amount of expenses for educating children (subject to the limitation established by clause 2 of Article 219 of the Tax Code of the Russian Federation) | If a parent pays for children under 24 years of age; guardian - for wards or former wards under the age of 24 who are in full-time education | subp. 2 p. 1 art. 219 Tax Code of the Russian Federation |

| 324 | In the amount of actual expenses incurred for medical services and in the cost of medications (taking into account the limitation established by clause 2 of Article 219 of the Tax Code of the Russian Federation) | A citizen who purchased medical services or medications for his own benefit or for the benefit of his spouse, parents, children (including adopted children) under the age of 18, wards under 18 | subp. 3 p. 1 art. 219 Tax Code of the Russian Federation |

| 325 | In the amount of expenses actually incurred for voluntary personal insurance (taking into account the limitation established by clause 2 of Article 219 of the Tax Code of the Russian Federation) | A citizen who has entered into an agreement in his own favor or in favor of his spouse, parents, children (including adopted children) under the age of 18, wards under 18 | subp. 3 p. 1 art. 219 Tax Code of the Russian Federation |

| 326 | In the amount of expenses for expensive treatment in medical organizations and entrepreneurs | subp. 3 p. 1 art. 219 Tax Code of the Russian Federation | |

| 327 | In the amount of expenses actually incurred (the employer can provide a deduction provided that he withheld contributions under contracts from payments in favor of the employee and transferred them to the appropriate funds) | A citizen who has paid for his own benefit and (or) for the benefit of his spouse (including in favor of a widow, widower), parents (including adoptive parents), disabled children (including adopted children under guardianship) (trusteeship)) pension (insurance) contributions under contracts: – non-state pension provision, concluded by a citizen with non-state pension funds; – voluntary pension insurance concluded by him with insurance organizations | subp. 4 paragraphs 1 art. 219 Tax Code of the Russian Federation |

| 328 | In the amount of additional insurance contributions paid for a funded pension (in the amount of actual expenses incurred, taking into account the restrictions established by clause 2 of Article 219 of the Tax Code of the Russian Federation) | A citizen who has paid additional insurance contributions for a funded pension in accordance with Law No. 56-FZ of April 30, 2008 | subp. 5 p. 1 art. 219 Tax Code of the Russian Federation |

| Professional tax deductions | |||

| 403 | In the amount of actually incurred and documented expenses | Persons who received income from performing work (rendering services) under civil contracts | clause 2 art. 221 Tax Code of the Russian Federation |

| 404 | In the amount of actually incurred and documented expenses | Persons who received: – royalties; – remuneration for the creation, publication, performance, and other use of works of science, literature and art; – rewards for discoveries, inventions and industrial designs | clause 3 art. 221 Tax Code of the Russian Federation |

| 405 | Within cost standards | Persons who received: – royalties; – remuneration for the creation, publication, performance, and other use of works of science, literature and art; – rewards for discoveries, inventions and industrial designs | clause 3 art. 221 Tax Code of the Russian Federation |

| Income exempt from taxation | |||

| 501 | Deduction from the cost of the gift in an amount not exceeding 4,000 rubles. for the reporting year | A citizen who has received a gift from an organization or entrepreneur | para. 1–2 paragraphs 28 art. 217 Tax Code of the Russian Federation |

| 502 | Deduction from the value of prizes in an amount not exceeding 4,000 rubles. for the reporting year | Persons who have received prizes in cash and in kind at competitions and competitions held according to decisions of: – the Government of the Russian Federation; – legislative (representative) bodies of state power; – representative bodies of local self-government | para. 1, 3 paragraph 28 art. 217 Tax Code of the Russian Federation |

| 503 | A deduction from the amount of financial assistance in an amount not exceeding 4,000 rubles. for the reporting year | Employees (former employees who resigned due to retirement due to disability or age) who received financial assistance from the employer | para. 1, 4 paragraph 28 art. 217 Tax Code of the Russian Federation |

| 504 | A deduction from the amount of compensation in an amount not exceeding 4,000 rubles. for the reporting year | Employees (for themselves, spouses, parents, children), former employees (age pensioners), disabled people for whom the organization reimbursed (paid) the cost of medications purchased by them (for them), prescribed by the attending physician | para. 1, 5 paragraph 28 art. 217 Tax Code of the Russian Federation |

| 505 | Deduction from the value of winnings and prizes in an amount not exceeding 4,000 rubles. for the reporting year | Persons who have received winnings and prizes at competitions, games and other events for the purpose of advertising goods (works, services) | para. 1, 6 p. 28 art. 217 Tax Code of the Russian Federation |

| 506 | A deduction from the amount of financial assistance in an amount not exceeding 4,000 rubles. for the reporting year | Disabled people who received financial assistance from public organizations of disabled people | para. 1, 7 paragraph 28 art. 217 Tax Code of the Russian Federation |

| 507 | Deduction from the cost of gifts and assistance in an amount not exceeding 10,000 rubles. for the reporting year | If assistance (in cash and in kind), as well as gifts, is provided to: – WWII veterans; – disabled people of the Second World War; – widows of military personnel who died during the war with Finland, WWII, and the war with Japan; – widows of deceased disabled veterans of the Second World War; – former prisoners of Nazi concentration camps, prisons and ghettos; – former minor prisoners of Nazi concentration camps, prisons, ghettos and other places of forced detention created by the Nazis during the Second World War | clause 33 art. 217 Tax Code of the Russian Federation |

| 508 | No more than 50,000 rubles. for each child | Employees (parents, adoptive parents, guardians) to whom the employer provided one-time financial assistance at the birth (adoption) of a child | para. 6 p. 8 art. 217 Tax Code of the Russian Federation |

| 509 | 4300 rub. for each month during the term of the employment contract | Employees who received agricultural products of their own production (work, services, property rights) from agricultural producers and peasant farms as wages. If the following conditions are simultaneously met: – the total amount of this income for the month does not exceed 4,300 rubles; – it is no more than 50 percent of the monthly remuneration amount; – revenue from the sale of goods (work, services) of an agricultural producer (peasant (farm) enterprise) does not exceed 100 million rubles. | clause 43 art. 217 Tax Code of the Russian Federation |

| 510 | Additional insurance contributions paid by the employer for the funded part of the labor pension (no more than 12,000 rubles) | A citizen in whose favor the employer paid additional insurance contributions for the funded part of the labor pension in accordance with Law No. 56-FZ of April 30, 2008 | clause 39 art. 217 Tax Code of the Russian Federation |

| Amounts that reduce the tax base for income from equity participation in an organization in the form of dividends | |||

| 601 | In an amount not exceeding the amount of tax calculated in accordance with Chapter 23 of the Tax Code of the Russian Federation | Citizens who received dividends from sources outside Russia and paid tax at the location of the source of payment abroad, if a double tax treaty has been concluded with a foreign state | clause 1 art. 214 Tax Code of the Russian Federation |

| Amounts reducing the tax base for transactions with securities and financial instruments of futures transactions | |||

| 201 | Expenses for the acquisition, sale, storage and redemption of securities traded on the organized securities market | Persons who received income from transactions with securities traded on the organized securities market | clauses 1, 3, 7, 10 art. 214.1 Tax Code of the Russian Federation |

| 202 | Expenses for the acquisition, sale, storage and redemption of securities not traded on the organized securities market | Persons who received income from transactions with securities not traded on the organized securities market | clauses 1, 3, 7, 10 art. 214.1 Tax Code of the Russian Federation |

| 203 | Expenses for the acquisition, sale, storage and redemption of securities not traded on the organized securities market, which at the time of their acquisition were classified as securities traded on the market | Persons who received income from transactions with securities not traded on the organized securities market, which at the time of their acquisition were classified as securities traded on the organized securities market | clauses 1, 3, 7, 10 art. 214.1 Tax Code of the Russian Federation |

| 205 | Amount of loss on transactions with securities traded on the organized securities market | Persons who received income from transactions with financial instruments of futures transactions that are traded on an organized market and the underlying asset of which are securities, stock indices, other financial instruments of futures transactions, the underlying asset of which are securities or stock indices | clauses 12, 13, 14, 15, 16 art. 214.1 Tax Code of the Russian Federation |

| 206 | Expenses on transactions with financial instruments of futures transactions that are traded on an organized market and the underlying asset of which is securities, stock indices, other financial instruments of futures transactions, the underlying asset of which is securities or stock indices | Persons who received income from transactions with financial instruments of futures transactions that are traded on an organized market and the underlying asset of which are securities, stock indices, other financial instruments of futures transactions, the underlying asset of which are securities or stock indices | clauses 12, 13, 14, 15, 16 art. 214.1 Tax Code of the Russian Federation |

| 207 | Expenses on transactions with financial instruments of futures transactions that are traded on an organized market and the underlying asset of which is not securities, stock indices, other financial instruments of futures transactions, the underlying asset of which is securities or stock indices | Persons who received income from transactions with financial instruments of futures transactions that are traded on an organized market and the underlying asset of which is not securities, stock indices, other financial instruments of futures transactions, the underlying asset of which is securities or stock indices | clauses 12, 13, 14, 15, 16 art. 214.1 Tax Code of the Russian Federation |

| 209 | The amount of loss on transactions with financial instruments of futures transactions that are traded on an organized market and the underlying asset of which is not securities, stock indices, other financial instruments of futures transactions, the underlying asset of which is securities or stock indices | Persons who received income from transactions with financial instruments of futures transactions traded on the organized securities market | clauses 12, 13, 14, 15, 16 art. 214.1 Tax Code of the Russian Federation |

| 210 | The amount of loss on transactions with financial instruments of futures transactions that are traded on an organized market and the underlying asset of which is securities, stock indices, other financial instruments of futures transactions, the underlying asset of which is securities or stock indices | Persons who received income from transactions with financial instruments of futures transactions traded on the organized securities market | clauses 12, 13, 14, 15, 16 art. 214.1 Tax Code of the Russian Federation |

| Amounts that reduce the tax base for repo transactions | |||

| 211 | Expenses in the form of interest on a loan incurred under a set of repo transactions | Art. 214.3, para. 1 clause 1 art. 282 Tax Code of the Russian Federation | |

| 213 | Expenses on operations associated with closing a short position and costs associated with the acquisition and sale of securities that are the subject of repo transactions | Art. 214.3, para. 1 clause 1 art. 282 Tax Code of the Russian Federation | |

| Amounts that reduce the tax base for securities lending transactions | |||

| 215 | Expenses in the form of interest paid in the reporting year on the totality of loan agreements | Art. 214.4 Tax Code of the Russian Federation | |

| 216 | The amount of excess of expenses in the form of interest paid under the aggregate of loan agreements over income received under the aggregate of loan agreements, reducing the tax base for transactions with securities traded on the organized securities market, calculated in accordance with the proportion, in accordance with paragraph 6 of clause 5 of Article 214.4 Tax Code of the Russian Federation | Art. 214.4 Tax Code of the Russian Federation | |

| 217 | The amount of excess expenses in the form of interest paid under the aggregate of loan agreements over income received under the aggregate of loan agreements, reducing the tax base for transactions with securities not traded on the organized securities market, calculated in accordance with the proportion, in accordance with paragraph 6 of clause 5 of the article 214.4 of the Tax Code of the Russian Federation | Art. 214.4 Tax Code of the Russian Federation | |

| 218 | Interest (coupon) expense recognized by the payer when opening a short position on securities traded on the securities market | clause 14 art. 214.3 Tax Code of the Russian Federation | |

| 219 | Interest (coupon) expense recognized by the payer when opening a short position on securities not traded on the securities market | clause 14 art. 214.3 Tax Code of the Russian Federation | |

| 220 | The amount of expenses for transactions with financial instruments of futures transactions not traded on the organized securities market | clause 2 art. 302 Tax Code of the Russian Federation | |

| 221 | The amount of expenses for transactions with securities accounted for in an individual investment account | Art. 214.1 Tax Code of the Russian Federation | |

| 222 | The amount of loss on REPO transactions taken to reduce income from transactions with securities traded on the securities market, in a proportion calculated as the ratio of the value of traded securities that are the object of REPO transactions to the total value of securities that are the subject of REPO | Art. 214.3 Tax Code of the Russian Federation | |

| 223 | The amount of loss on REPO transactions taken to reduce income from transactions with securities not traded on the securities market, in a proportion calculated as the ratio of the value of non-tradable securities that are the object of REPO transactions to the total value of securities that are the subject of REPO | Art. 214.3 Tax Code of the Russian Federation | |

| 224 | The amount of the negative financial result obtained in the tax period from transactions with securities traded on the securities market, by which the financial result obtained from transactions with securities not traded on the securities market is reduced, if at the time of their acquisition they were classified as traded securities | clause 12 art. 214.1 Tax Code of the Russian Federation | |

| 617 | Deduction in the amount of income received from transactions accounted for on an individual investment account | Art. 219-1 Tax Code of the Russian Federation | |

| 618 | A deduction in the amount of a positive financial result from the sale (redemption) of securities traded on the securities market and owned for more than three years. Such securities include: 1) securities admitted to trading by a Russian trade organizer on the securities market, including on the stock exchange; 2) investment units of open-end mutual investment funds managed by Russian management companies | Art. 219-1 Tax Code of the Russian Federation | |

| 620 | Other amounts that reduce the tax base in accordance with Chapter 23 of the Tax Code of the Russian Federation | ||

In what cases can a deduction be received?

Reimbursement of part of the costs of purchasing a property is a significant help. However, it is not available to everyone and not always.

Deductions are issued if a citizen buys:

- house;

- apartment;

- room;

- premises in a townhouse;

- land plot under a residential building;

- land for housing construction.

The benefit also applies to the purchase of a share in any of the objects listed above. If ownership of a commercial or other real estate property is registered, deductions cannot be obtained.

Stages of obtaining a property tax deduction

So far the process consists of four stages. But most likely, already in 2021, a bill will be adopted that will amend the Tax Code in terms of introducing a simplified procedure for obtaining tax deductions for personal income tax. The deadline for submitting amendments is February 24, 2021.

Step 1. Collect copies of all necessary documents

Copies of documents confirming the right to housing:

- when constructing or purchasing a residential building - a certificate of state registration of the right to a residential building or an extract from the Unified State Register;

- when purchasing an apartment - a purchase and sale agreement, an act of transfer of the apartment to the taxpayer, a certificate of state registration of ownership or an extract from the Unified State Register of Real Estate;

- when purchasing a land plot for construction or ready-made housing - a certificate of state registration of ownership of the land plot and a certificate of state registration of ownership of a residential building;

- when paying off interest on a mortgage - a mortgage agreement, a schedule for repaying the loan and paying interest on the use of borrowed funds.

Until 2021, to receive a deduction, it was enough to provide a certificate of state registration of the right. But in 2021, there were changes in confirming the right to a property deduction when purchasing real estate (Federal Law dated July 3, 2016 No. 360-FZ). If you purchased real estate after July 15, 2021, then the right to a property deduction will have to be confirmed with an extract from the Unified State Register.

Copies of payment documents:

- confirming expenses for the acquisition of property (receipts for receipt orders, bank statements about the transfer of funds);

- evidence of payment of interest under the mortgage agreement (certificate of interest paid for using the loan).

Stage 2. Take certificate 2-NDFL from work

Just contact the accounting department - they will prepare it.

Step 3. Fill out the 3-NDFL declaration

You will need data from your passport, 2-NDFL and other documents.

Please note that Form 3-NDFL is updated annually, but you must use the one that corresponds to the year for which the personal income tax is being returned.

On its website, the Federal Tax Service provides an example of filling out a tax return in Form 3-NDFL.

If the property was purchased as a common joint property, you must provide:

- a copy of the marriage certificate;

- a written statement on the agreement of the spouses on the distribution of the amount of property tax deduction.

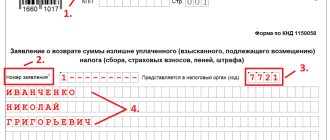

Please note: the new form 3-NDFL includes a statement for a refund of the amount of overpaid tax. It also needs to be filled out so that the tax office can transfer the amount to you.

Until 2021, the application had to be filled out separately using a special approved form (Order of the Federal Tax Service of the Russian Federation dated February 14, 2017 No. ММВ-7-8 / [email protected] ).

In your application please indicate:

- Name of the bank;

- bank account details to which the amount must be transferred (the amount in the application must match the amount indicated in the declaration).

Step 4. Submit a set of documents to the tax office

The package of documents is submitted either to the tax office at your place of residence in person, or through your personal account on the Federal Tax Service website. Specialists check documents within 3 months. If any questions arise, you will be contacted and asked for original documents. If everything is in order, the money will be credited to your account. In general, the procedure for obtaining a property tax deduction takes a maximum of 4 months.

Varieties

The purchase of a residential property is made in cash or on credit. The amount of the refund depends on how exactly the transaction was paid for. There are two main deduction options:

- basic;

- mortgage

If a citizen deposits the entire amount at once, a portion of the funds spent may be returned. If a mortgage was issued, then you can count on reimbursement of part of the interest that was paid on the loan. The deduction when applying for a mortgage loan will be extended over time.

How much can you expect?

For all officially employed people, income tax is withheld from their wages, its amount is 13%. If a taxpayer pays for the purchase of an apartment or house, then he receives the right to reduce the amount of income tax.

The two concepts should not be confused:

- tax deduction is the amount by which taxable income can be reduced;

- refundable tax - the amount that can actually be returned, it is 13% of the deduction.

The tax deduction is equal to the amount of expenses incurred by the buyer when completing the transaction, but it cannot exceed 2 million rubles. Accordingly, the maximum amount of tax refundable is 13% of 2 million, that is, 260 thousand rubles.

Thus, if an apartment was purchased for 1.5 million, then you can return 195 thousand rubles. If the costs of real estate amounted to 5 million rubles, then only 260 thousand can be returned, that is, 13% of the maximum deduction amount.

When taking out a mortgage loan, the tax deduction has been increased to 3 million, that is, you can return 390 thousand rubles. If the taxpayer applied for refinancing of a mortgage loan, then this circumstance does not interfere with the right to receive a refund of taxes. But the second loan agreement must indicate that it was issued specifically for refinancing a mortgage loan.

The buyer of an apartment can refinance more than once; this is in no way regulated by law. The only condition for receiving a deduction is that the financial organization that issued the refinancing loan must be registered in the Russian Federation.

If the taxpayer has already received a personal income tax refund on the first mortgage loan, then he will be able to receive a refund on the interest on the loan from the second bank only after the process of returning funds under the first loan agreement is completed.

When selling real estate, you can count on a tax deduction of 1 million rubles. This is the maximum amount that can be deducted from your taxable income. And one more important condition that many people forget about: you cannot return as a tax refund more than the amount of the transferred income tax.

How to calculate the amount of deduction

The maximum deduction amount is: 2,000,000 x 13% = 260,000 rubles. This amount can be applied to several purchased residential properties if their total cost is less than 2 million rubles. (clause 3 of article 220 of the Tax Code of the Russian Federation).

If real estate is purchased by spouses, then each of them has the right to a maximum deduction amount of 2 million rubles.

If a loan was taken out to purchase property, you can receive a deduction of no more than 3 million rubles for interest. The maximum deduction amount is: 3,000,000 x 13% = 390,000 rubles.

How many times can you get a tax deduction?

Until 2014, the tax deduction for the purchase of housing could be obtained once in a lifetime. Since 2014 the order has been changed. Now you can receive a deduction several times, provided that its size does not exceed 2 million rubles.

Example: if you bought an apartment for 1.2 million rubles and received a tax refund in the amount of 156 thousand, then when purchasing another apartment you can again apply for a deduction, but no more than 800 thousand rubles. That is, the total deductions should not exceed 2 million rubles.

Important: if a person exercised his right to a tax deduction before 2014, then he cannot apply for a secondary one, even if the amount was less than 2 million rubles.

The same rule applies when making deductions when selling a home, only the maximum amount should not exceed 1 million rubles.

What documents are needed to receive a deduction?

This kit includes:

- passport;

- income certificate in form 2-NDFL, which indicates income and taxes paid for the corresponding year;

- Declaration 3-NDFL, from which it is clear that property was acquired, taxes were paid and that a certain amount of property tax deduction is due.

For the apartment you will need:

- apartment purchase agreement;

- an act on the transfer of an apartment to the taxpayer or a certificate of state registration of the right to an apartment.

If the apartment was purchased through a shared participation agreement:

- an agreement on shared participation in construction or an agreement on the assignment of the right to claim;

- an acceptance certificate or other document confirming the transfer of the object from the developer to the participant;

- copies of payment documents (for example, payment orders, bank statements about the transfer of money from the buyer’s account to the seller’s account).

If the apartment was purchased on the secondary market:

- agreement on the purchase of an apartment (for example, a purchase and sale agreement);

- copies of payment documents (for example, payment orders, bank statements about the transfer of money from the buyer’s account to the seller’s account);

- documents confirming ownership of the apartment (for example, a certificate of state registration of rights).

If you bought a house and land:

- agreement for the purchase of a land plot with a residential building;

- copies of payment documents (for example, payment orders, bank statements about the transfer of money from the buyer’s account to the seller’s account);

- documents confirming ownership of a residential building (for example, a certificate of state registration of title);

- documents confirming ownership of a land plot (for example, a certificate of state registration of rights).

Until 2014, property tax deductions were issued for only one property, but now it can be received from several apartments. The limit on the amount remains the same - no more than 2 million rubles. For example, if an apartment costs 1.5 million rubles, then you can get a deduction of another 500,000 rubles. from the next apartment.

Until 2014, there were no restrictions on mortgage interest. For example, from an overpayment of 10 million rubles. it was possible to get a deduction for the entire 10 million rubles. Starting from 2014, a limit was introduced on the deduction of mortgage interest in the amount of 3 million rubles.

Tax deductions can be obtained not only for real estate, but also for mortgage interest.

For this you need the following documents:

- loan agreement with annexes and additional agreements thereto;

- documents confirming payment of interest on the mortgage (for example, a certificate from the bank).

The deduction is issued for the interest actually paid. For example, if a mortgage agreement was signed for 10 years 3 years ago, then a tax deduction is issued for the amount of interest paid for 3 years. Interest paid in the following year will be tax deductible in the following year.

Who has the right to registration

According to the law, you can apply for a tax deduction when purchasing a home if the following conditions are met:

- the applicant is a resident of the Russian Federation;

- the housing being purchased is located on the territory of the country;

- the citizen has legal income, from which income tax is withheld at the rate of 13%;

- When paying for the transaction, maternity capital funds are not used.

If residential real estate is registered in the name of a minor, then a tax deduction for it can be received by the parents or guardian of the child owner.

There are special registration conditions for pensioners. If a working pensioner buys housing, he can apply for benefits on a general basis. If a citizen is retired, then he has the right to use the transfer of personal income tax. This means that a pensioner can apply for a deduction taking into account the transferred income tax three years before purchasing an apartment.

What expenses are taken into account?

Expenses that can be included in the tax deduction:

- funds for the purchase of housing (the amount specified in the purchase and sale agreement is taken into account);

- materials and other goods for repairs;

- funds spent on repair services.

If the apartment was purchased under a mortgage lending program, then bank interest is included in the expenses.

In the event that a plot for construction has been purchased, the following expense items are taken into account:

- development of a house project;

- cost of construction and finishing materials;

- payment for construction and finishing works;

- work on connecting communications (pipelines, power lines, etc.).

All expenses incurred must be documented, otherwise they cannot be included in the deduction amount.

What is taken into account as expenses when calculating deductions

If you purchase an apartment, then the costs take into account:

- the purchase of real estate itself;

- acquisition of rights to an apartment in a building under construction;

- spending on finishing materials;

- apartment finishing work, development of design and estimate documentation.

If you buy a house or build one, then the costs include:

- development of design and estimate documentation;

- purchase of building materials, as well as finishing materials;

- the purchase of a house itself, including at the stage of unfinished construction;

- house construction and finishing work;

- carrying out electricity, water and gas supply and sewerage.

If the apartment is in marital ownership

Often apartments or plots of land are purchased by spouses and are registered in equal shares. In this case, the deduction has some conditions.

If a transaction is made by spouses who are officially married and is registered in the name of two owners (husband and wife), then both parties to the transaction acquire the right to a deduction. But this does not mean that both of them can receive it in full.

It is necessary to submit an application for distribution of the deduction amount between the spouses. How to distribute it is a personal matter for each couple. Depending on the situation, the full deduction can be issued to only one of the spouses or it can be distributed in shares between the husband and wife.

If the wife has a small salary and a low amount of paid income tax, then it is more profitable to issue a deduction only for the husband, so as not to stretch out the receipt of refunds for several years.

If a residential property is purchased by spouses, but with the personal money of one of them (premarital or inherited funds), and the second spouse is not a co-owner, then it will not be possible to distribute the deduction. It is issued in the usual manner to the spouse to whom the property is registered. An application for redistribution of deductions between spouses is not submitted.

If an apartment is acquired as shared ownership by unmarried persons, then the same procedure applies. All owners have the right to deduct in pre-agreed shares.

How to calculate the deduction amount

It’s not difficult to calculate the amount of tax deduction yourself, you just need to be careful.

Calculation procedure:

- collect documents that confirm expenses;

- calculate the amount;

- compare the amount received with existing limits; if expenses are more than 2 million rubles (or 3 million rubles for a mortgage), then the maximum limit must be taken as the base;

- calculate the amount of income tax paid to the budget for the selected tax period;

- calculate how much 13% of the declared amount of expenses will be;

- Compare the resulting figure with the amount of taxes paid.

If the amount of personal income tax for the selected period is greater than the tax to be refunded, then it is refunded in full. If less taxes were paid, then only the amount already transferred to the budget can be returned.

What else do you need to know

Taxpayers who would like to receive a tax refund when purchasing a home may find it helpful to remember:

- A tax refund on a mortgage deduction can only be received as the loan is paid off to the bank. That is, reimbursement in this case will be made in parts and will stretch over several years.

- If a citizen decides to return taxes in the current year, he can submit an application for the first year and returns for the three previous years. The deduction will be made for three years, and if a balance is found, it will be carried over to the next tax period. The second option is that a citizen has the right to submit a declaration for the current year, transferring the unused portion to subsequent years.

- If the purchase and sale transaction is concluded between close relatives, then the tax will not be refunded. Close relatives are parents and children, grandparents and grandchildren, brothers and sisters.

- Participants in shared construction must understand that they can only receive personal income tax compensation for three years. If construction lasts for a long time, then it will not be possible to receive a deduction in full.

Knowing these nuances will help you avoid mistakes when preparing documents to receive a refund.

Benefits when selling real estate

The Tax Code provides a number of benefits for real estate sellers. These rules apply to all objects, including non-residential buildings.

According to Art. 217.1 Tax Code , the minimum maximum period of ownership of an object, which upon sale will be exempt from paying personal income tax, is five years. However, there are exceptions. The period of ownership of 3 years is retained if the right to property is obtained:

- as a result of privatization;

- by right of inheritance or by agreement of gift from a close relative;

- under a life annuity agreement with a dependent.

If the ownership period is met, you will not have to pay income tax when selling. For all other cases, Art. 220 of the Tax Code (clause 1 and clause 2), according to which the seller can use a tax deduction from the sale price. Deduction amount:

- for residential properties – 1 million rubles;

- for non-residential facilities – 250 thousand rubles.

If the price specified in the purchase and sale agreement is less than the cadastral price by 70% or more (as of January 1 of the year in which the transaction is made), then the tax will be levied on an amount equal to the cadastral value. This rule was adopted to identify cases of fraud when the contract indicates a significantly reduced price that does not correspond to the actual amount received.

Important: the laws of the constituent entities of the Russian Federation may indicate other periods of ownership of objects before sale, and also change the coefficient used to calculate the fair price of an object for tax purposes.

How much will they return?

First of all, when purchasing an apartment, the amount of tax refund for 2016 depends on what official income the buyer had for the specified calendar year.

The tax authorities and the buyer himself can judge how much tax can be refunded from the purchase of an apartment based on the 2-NDFL certificate from the tax agent for whom the individual worked last year.

EXAMPLE

Shirokova purchased an apartment in 2021 for 4.5 million rubles. This means that she is entitled to the maximum amount of personal income tax compensation when purchasing an apartment, since:

4,500,000 rub. – 2,000,000 rub. ˃ 0 r.

She is claiming a property deduction for the purchase of a home for the first time. She is not entitled to standard and social deductions.

According to the income certificate in form 2-NDFL from Guru LLC, where she worked in 2021, her monthly salary is 70,000 rubles. For 2021, the budget received 109,200 rubles from it:

70,000 rub. × 12 months : 13%

As a result, how much can you get back in personal income tax for purchasing an apartment in 2017? Answer: 109,200 rubles. The remaining tax amount of 150,800 rubles (260,000 rubles - 109,200 rubles) will be transferred to 2021 and possibly 2018. Subject to receiving a Broad salary in the same amount.

Also see “How to reimburse personal income tax for purchasing an apartment.”

Many people are interested in how much personal income tax is reimbursed when purchasing an apartment under a preliminary purchase and sale agreement? Not at all! Even if there is an apartment acceptance certificate and payment documents for expenses under this agreement. The fact is that the housing is not yet owned (letter of the Federal Tax Service of Russia dated August 29, 2013 No. BS-4-11/15716).

If the price of housing in the contract is understated (beneficial to the seller, who owned it for less than 3 (5) years), how much personal income tax is returned when purchasing an apartment in this case? It depends only on the price of the apartment specified in the contract. Otherwise, be prepared to prove in court that the transaction price is too low and you actually incurred more significant costs to purchase this property.

Design rules

To apply for deductions, you must contact the authorized authorities. You can submit an application:

- to your local tax office;

- at the MFC.

If it is not possible to contact these organizations in person, you can send documents to the Federal Tax Service by registered mail. But in this case, the registration process may be significantly delayed.

An important point: you must contact the Federal Tax Service department at the place of registration, even if the person lives in another place.

There is another option - to apply for a deduction to the accounting department of the organization in which the taxpayer works. In this case, the accounting department must stop withholding personal income tax from wages in the amount of tax refundable.

Procedure

It is not difficult to apply for a deduction required by law. But for the process to go smoothly, you need to prepare in advance. Recommended procedure:

- complete and formalize a transaction for the acquisition or sale of a residential property;

- fill out for the tax period - it is impossible to receive a deduction without completing this document;

- collect documents confirming purchase or construction costs;

- write an application to the authorized bodies, attach a declaration to it and submit a package of documents in person or send by mail;

- wait for a response from the tax service.

If the answer is positive, then all that remains is to wait until the money is transferred to the account specified in the application. Tax refunds are not issued in cash.

If the Federal Tax Service refuses to receive a deduction, then you will need to find out the reasons for this decision. Since the refusal is issued in writing, the reasons for the refusal will be indicated on the form. If these are small errors, then you should try to correct them within 1 month, then you will not have to start the entire registration process all over again.

How to fill out a tax return

Filling out the declaration should not cause any particular difficulties, but it is important to avoid mistakes.

You can fill out the declaration “the old fashioned way,” that is, manually. But it is much easier and more convenient to use special programs - “Taxpayer Legal Entity” or another convenient for a citizen. If you plan to file a declaration for a property deduction for 3 years, you will need to fill out three separate documents.

Declaration forms change periodically. It is necessary to fill out the form that is used during the period when the taxpayer applies for the deduction. This is a very important point - using a form for another year may result in refusal to issue a deduction.

The declaration must indicate:

- the amount of expenses incurred that are offered for deduction;

- the amount of income subject to taxation;

- information from prepared documents.

When using a program to fill out a declaration, the filling process is greatly simplified. You will only need to fill out a few columns with the prepared data. And the program will perform all calculations automatically.

Collection of documents

To submit an application, you need to collect a package of documents. Depending on the type of deduction, a different list of papers is required, but the basic package will be the same. You need to prepare:

- passport;

- application in a certain form;

- completed tax return;

- certificate of income received;

- a contract for the purchase and sale of real estate or land or a mortgage loan agreement;

- checks, contracts and other documents to confirm expenses;

- EGRN extract.

These documents will be required when applying for any deduction. If you need to receive a mortgage deduction, you should additionally attach a schedule for making loan payments.

If a deduction is made in shares for spouses, then, in addition to the documents listed above, you need to prepare:

- Marriage certificate;

- birth (or adoption) certificate of children (if there are children in the family);

- marriage contract, if one has been concluded.

If the apartment is purchased with the personal money of one of the spouses, it is necessary to attach documents confirming this fact.

When visiting the tax authorities in person, you must prepare originals and copies of documents. If you plan to send papers by mail, then all copies must be certified by a notary; originals are not sent by mail.

After submitting the documents, you need to wait for a response - approval or refusal. It is difficult to say how long you will have to wait, but the process of reviewing applications is slow. On average, the answer comes within 2 months. The money will also not come immediately after approval; it can be received in another 1-2 months.

When can you apply for a property deduction for 2021?

You can apply for the deduction at the end of the year, during 2018-2020 (for pensioners: 2018-2021). There are no deadlines for filing during the year.

Many people believe that the 3-NDFL declaration for 2021 must be submitted by April 30, 2021, but this is not so. Until April 30, 2021, 3-NDFL is submitted only by those who need to declare income received for 2021, for example, property was sold whose tenure was less than 3 years.

Thus, you can apply for a property deduction on any day during the year. When submitting in person to the tax office, it is necessary to take into account the days and hours of operation of the tax office.

Why might there be a refusal?

The application is not always approved; sometimes the applicant receives a refusal. The denial form must list the reasons why the taxpayer cannot receive the deduction.

Common reasons for refusal to issue a deduction:

- the declaration was completed with errors;

- the attached certificates have expired;

- expense documents were found to be forgeries;

- the package does not contain enough documents to complete a refund request;

- the deadline for submitting an application for a deduction was missed;

- The applicant has no rights to receive a refund.

If the reasons for the refusal are unclear, the applicant may contact the tax authority for clarification. If the mistakes made can be corrected, then this should be done as quickly as possible so that you do not have to start the entire procedure over again.

Registration of a tax deduction is a simple procedure. But if a citizen believes that this is beyond his strength or he does not have time to collect and submit papers, then it is better to contact a lawyer for help. You will have to pay for the services of an intermediary, but the taxpayer will be spared the not-so-pleasant responsibility of independently doing “paperwork” and communicating with tax authorities.