Let's look at setting up and reflecting VAT, the most “popular” tax, in the 1C: Accounting program and start with setting up the “Accounting Policy” for correct VAT accounting.

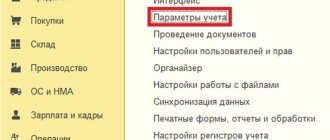

Fig. 1 Window of the 1C 8.3 Accounting 3.0 program, selecting the “Accounting Policy” section

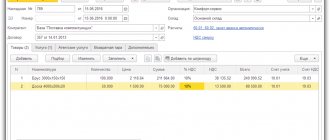

Fig.2 Window for setting up the organization's accounting policies. Go to setting up taxes and reports

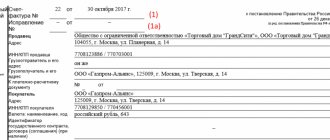

Fig.3 Window for setting up VAT accounting policies

Within the framework of this article, we will not be able to consider all the issues and features of VAT accounting in the program, so we will analyze the main points using simple examples.

Our company is a VAT payer; we purchased 5 desks at a price of 1,600 rubles. for the amount of 8000 rubles. (including VAT 1333.33 rubles). Then they sold these tables, in the amount of 5 pieces, at a price of 3,000 rubles, for a total amount of 15,000 rubles. (including VAT 2288.14 rubles).

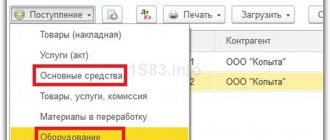

- Let's enter the documents into the program;

- We will create a purchase book and a sales book;

- Let's fill out the VAT return for the 1st quarter of 2021.

Tax registers for value added tax

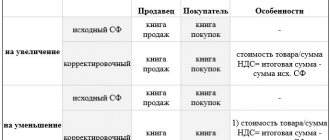

Tax registers in terms of VAT accounting include an invoice, journals of issued and received invoices, a purchase book and a sales book.

An invoice is a document that serves as the basis for accepting the presented tax amounts for deduction or reimbursement from the budget.

Errors in invoices that do not prevent tax authorities from identifying the seller, buyer of goods (work, services), property rights, the name of goods (work, services), property rights, their value, as well as the tax rate and tax amount when conducting a tax audit, presented to the buyer are not grounds for refusal to accept tax amounts for deduction.

The invoice issued for the sale of goods (work, services), transfer of property rights must indicate:

1) serial number and date of the invoice;

2) name, address and identification numbers of the taxpayer and buyer;

3) name and address of the shipper and consignee;

4) the number of the payment and settlement document in case of receiving advance or other payments for upcoming deliveries of goods (performance of work, provision of services);

5) name of the goods supplied (shipped) (description of work performed, services provided) and unit of measurement (if it is possible to indicate it);

6) quantity (volume) of goods (work, services) supplied (shipped) according to the invoice, based on the units of measurement adopted for it (if it is possible to indicate them);

6.1) name of the currency;

7) price (tariff) per unit of measurement (if it is possible to indicate it) under the agreement (contract) excluding tax, and in the case of using state regulated prices (tariffs) that include tax, taking into account the amount of tax;

the cost of goods (work, services), property rights for the entire quantity of goods supplied (shipped) according to the invoice (work performed, services rendered), transferred property rights without tax;

the cost of goods (work, services), property rights for the entire quantity of goods supplied (shipped) according to the invoice (work performed, services rendered), transferred property rights without tax;

9) the amount of excise tax on excisable goods;

10) tax rate;

11) the amount of tax imposed on the buyer of goods (works, services), property rights, determined based on the applicable tax rates;

12) the cost of the total quantity of goods supplied (shipped) according to the invoice (work performed, services rendered), transferred property rights, taking into account the amount of tax;

13) country of origin of the goods;

14) number of the customs declaration.

The procedure for maintaining a log of received and issued invoices, purchase books and sales books is established by the Government of the Russian Federation. Thus, Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax” was approved:

-form of the invoice used in calculations of value added tax, and the rules for filling it out in accordance with Appendix # 1;

- the form of the adjustment invoice used when calculating value added tax, and the rules for filling it out in accordance with Appendix No. 2;

-form of the journal for recording received and issued invoices used in calculations of value added tax, and the rules for its maintenance in accordance with Appendix No. 3;

-the form of the purchase book used in calculations of value added tax, and the rules for its maintenance in accordance with Appendix No. 4;

-the form of the sales book used in calculations of value added tax, and the rules for its maintenance in accordance with Appendix No. 5.

Final distribution of accounted VAT

The distribution of VAT on goods purchased for resale and on values written off as expenses is carried out in 1C automatically when performing the routine operation “VAT Distribution” and the VAT Assistant.

To carry out a VAT distribution operation, go to the “VAT Regular Operations” journal through the “Operations” - “Period Closing” menu, click the “Create” button and select “VAT Distribution” from the drop-down list. Fill out and complete the form according to the instructions presented in the figure below:

After carrying out the regulatory operation discussed above, go to the “VAT Accounting Assistant” document through the “Operations” - “Period Closing” menu and perform the actions shown in the figure below:

To understand the process of automatic distribution of VAT and the work of the VAT Assistant in 1C, we present to your attention three balance sheets for account 19:

- before distribution;

- after distribution, but before the formation of the purchase book;

- after distribution and formation of the purchase book.

Tax registers and VAT reporting

VAT payers must fill out the following tax registers:

— invoices;

— journal of received invoices;

— journal of issued invoices;

- Book of purchases;

- sales book.

The procedure for maintaining invoices is determined by Art. 169 Tax Code of the Russian Federation

The invoice is issued by the supplier of goods (works, services) no later than five days, counting from the day of shipment of the goods (performance of work, provision of services). This norm is enshrined in paragraph 3 of Article 168 of the Tax Code of the Russian Federation.

An invoice for the cost of goods (work, services) sold is issued by the supplier in two copies. The first (original) is transferred to the buyer. The second remains with the supplier and is filed by him in the journal of issued invoices. Invoices are filed in the invoice journal in chronological order.

The buyer maintains a record of invoices received and files them in the ledger as they are received from suppliers.

Log books for invoices received and issued should be bound and pages numbered.

As a general rule, invoices are drawn up for all transactions recognized as objects of taxation.

Therefore, invoices are prepared in the following cases.

a) when selling goods (works, services) subject to VAT.

In this case, the invoice is drawn up in two copies (one for the buyer, the second for the seller). The VAT amount is highlighted in a separate line;

b) when selling goods (work, services) not subject to VAT in accordance with Article 149 of the Tax Code of the Russian Federation.

Invoices are also issued in duplicate, but without highlighting VAT. The corresponding inscription or stamp “Without tax (VAT)” is placed on the invoice (clause 5 of Article 168 of the Tax Code of the Russian Federation);

c) in case of gratuitous transfer of goods (performance of work, provision of services).

The invoice is issued in two copies.

The buyer who receives such an invoice is not entitled to deduct VAT. Therefore, the received invoice is not registered in the purchase book (clause 11 of the Rules for maintaining purchase books and sales books).

d) when performing construction and installation work for own consumption.

Both copies of the issued invoices remain with the company.

The first copy is registered in the journal of issued invoices, entered into the sales book and serves as the basis for paying VAT on construction and installation work performed.

The second copy of the invoice is registered in the journal of received invoices and in the purchase book and serves as the basis for deducting the corresponding amount of VAT;

e) when transferring goods (performing work, providing services) for one’s own needs.

In this case, the invoice is issued in one copy, filed in the journal of issued invoices and registered in the sales book;

f) when receiving amounts related to settlements for payment for goods (works, services), for example, advance payments.

In this case, the invoice, as a rule, is issued in one copy, filed in the journal of issued invoices and registered in the sales book. Such invoices are not transferred to the buyer (clause 19 of the Rules for maintaining purchase books and sales books).

When receiving advance payments, the invoice must be issued in duplicate. The second copy is filed in the journal of received invoices and registered in the purchase book in the period when the right to deduct VAT calculated and paid upon receipt of the advance was obtained.

If an organization is a VAT payer, but enjoys an exemption from VAT in accordance with Article 145 of the Tax Code of the Russian Federation, it must prepare invoices in the generally established manner.

At the same time, VAT amounts are not highlighted in invoices, but they are marked or stamped “Without tax (VAT)” (Clause 5 of Article 168 of the Tax Code of the Russian Federation).

The Tax Code provides for cases when an invoice may not be drawn up:

— when selling securities (except for brokerage and intermediary services) (clause 4 of article 169 of the Tax Code of the Russian Federation). This rule applies to all taxpayers;

— when banks, insurance organizations and non-state pension funds carry out operations that are not subject to VAT in accordance with Article 149 of the Tax Code of the Russian Federation (clause 4 of Article 169 of the Tax Code of the Russian Federation);

— when selling goods, performing work and providing paid services directly to the population in cash using cash register equipment (CCT), subject to the issuance of a cash receipt to the buyer (clause 7 of Article 168 of the Tax Code of the Russian Federation);

— when selling goods (work, services) directly to the population for cash without using cash register systems in cases provided for by the legislation of the Russian Federation (clause 7 of Article 168 of the Tax Code of the Russian Federation).

In these cases, instead of invoices, valid strict reporting forms or valid primary accounting documents are used (when making settlements with the public through branches of credit institutions, post offices, etc.), which are registered in the sales book.

The presence of an invoice is a prerequisite for deducting VAT on purchased goods (work, services) (clause 1 of Article 169 and clause 1 of Article 172 of the Tax Code of the Russian Federation). For a legal deduction (reimbursement) of VAT, the invoice must be issued in accordance with the requirements established by paragraphs 5 and 6 of Article 169 of the Tax Code of the Russian Federation.

Otherwise, this invoice will not be considered by the tax authorities as a basis for deducting VAT (clause 2 of Article 169 of the Tax Code of the Russian Federation and clause 14 of the Rules for maintaining purchase books and sales books).

After July 1, 2002, a stamp on the invoice is not required.

The corresponding change, excluding from paragraph 6 of Article 169 of the Tax Code of the Russian Federation the requirement for a seal on the invoice, was made to Article 169 of the Tax Code of the Russian Federation by Federal Law No. 57-FZ of May 29, 2002.

Invoices should not have any erasures or erasures.

All corrections made to the invoice must be certified by the signature of the manager and the seal of the selling organization (or the signature of the individual entrepreneur-seller) indicating the date of the correction (clause 29 of the Rules for maintaining purchase books and sales books).

Buyers keep a log of original invoices received from sellers, in which they are stored, and sellers keep a log of invoices issued to buyers, in which their second copies are stored.

Buyers keep a record of invoices as they are received from sellers, and sellers keep a record of invoices issued to buyers in chronological order.

When purchasing services for the rental of residential premises during a business trip of employees and services for transporting employees to the place of business trip and back, including services for the provision of bedding for use on trains, strict reporting forms (or copies thereof) filled out in the prescribed manner with a dedicated separate The line amount of value added tax is stored by the buyer in the journal of received invoices.

Log books for invoices received and issued must be bound and their pages numbered.

Buyers maintain a purchase ledger to record invoices issued by sellers in order to determine the amount of value added tax to be deducted (refunded) in the prescribed manner.

Invoices received from sellers are subject to registration in the purchase book in chronological order as the purchased goods (work performed, services rendered) are taken into account.

When purchasing fixed assets and (or) intangible assets, the invoice is registered in the purchase book in full after the fixed assets and (or) intangible assets are registered.

When importing goods into the customs territory of the Russian Federation, a customs declaration for imported goods and payment documents confirming the actual payment of value added tax to the customs authority are registered in the purchase book.

Invoices issued and registered by sellers in the sales book upon receipt of advances or other payments on account of upcoming deliveries of goods (performance of work, provision of services) are registered by them in the purchase book upon shipment of goods (performance of work, provision of services) on account of advances received or other payments indicating the corresponding amount of value added tax.

Invoices that do not comply with the established standards for their completion cannot be recorded in the purchase book.

The purchase book must be laced, and its pages numbered and sealed.

Control over the correctness of maintaining the purchase book is carried out by the head of the organization or his authorized person.

The purchase book is kept by the buyer for a full five years from the date of the last entry.

It is possible to maintain a purchase ledger in electronic form. In this case, after the expiration of the tax period, but no later than the 20th day of the month following the expired tax period, the purchase book is printed, the pages are numbered, laced and sealed.

Sellers maintain a sales book intended for registering invoices (control tapes of cash register equipment, strict reporting forms for the sale of goods (performance of work, provision of services) to the population), compiled by the seller when performing transactions recognized as objects that are subject to value added tax , including those not subject to taxation (exempt from taxation).

Invoices issued by sellers when selling goods (performing work, providing services) to organizations and individual entrepreneurs for cash are subject to registration in the sales book. In this case, the readings of the control tapes of cash register equipment are recorded in the sales book without taking into account the amounts indicated in the corresponding invoices.

Registration of invoices in the sales book is carried out in chronological order in the tax period in which the tax liability arises.

When receiving funds in the form of advances or other payments for upcoming deliveries of goods (performance of work, provision of services), the seller draws up an invoice, which is registered in the sales book.

Sellers who perform work and provide paid services directly to the public without the use of cash register equipment, but with the issuance of strict reporting documents in cases provided for by the legislation of the Russian Federation, register in the sales book instead of invoices strict reporting documents approved in the prescribed manner and issued to customers , or summary data of strict reporting documents based on an inventory compiled based on sales results for a calendar month.

The sales book must be bound, and its pages numbered and sealed.

Control over the correctness of maintaining the sales book is carried out by the head of the organization or his authorized person.

The sales ledger is retained by the supplier for a full five years from the date of the last entry.

It is allowed to maintain a sales book in electronic form. In this case, after the expiration of the tax period, but no later than the 20th day of the month following the expired tax period, the sales book is printed, the pages are numbered, laced and sealed.

Invoices that have erasures and erasures are not subject to registration in the purchase book and sales book. Corrections made to invoices must be certified by the signature of the manager and the seal of the seller, indicating the date the correction was made.

A VAT return must be submitted by all persons recognized as payers of value added tax, regardless of the presence or absence of objects of taxation in a given tax period. The only exceptions are those taxpayers who enjoy exemption from VAT under Art. 145 of the Tax Code of the Russian Federation.

In accordance with Art. 163 and 174 of the Tax Code of the Russian Federation, as a general rule, VAT must be paid to the budget quarterly by the 20th day of the month following the expired quarter.

Exemption from the taxpayer's obligation is possible if, over the three previous consecutive calendar months, the amount of revenue from the sale of goods (work, services) of these organizations and entrepreneurs, excluding VAT, did not exceed a total of 2 million rubles. The exemption is granted for a period of 12 months.

Tax accounting registers for VAT are an important accounting tool that allows you to timely and completely generate the information necessary for the correct calculation of tax. When conducting them, one should adhere to the standards reflected in Art. 10 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

Tax register concept

Rules for creating registers

Key provisions that must be included in the accounting policies

Classification of tax accounting registers for VAT

Requirements for registering received and issued invoices

Conditions for correct compilation of a purchase book

Basic provisions for maintaining a sales book

Results

Payment of invoices with VAT under the simplified tax system

In the payment order, the buyer should not allocate VAT, that is, “Without VAT” is written. But often in practice, the VAT rate of 18% (10%) is erroneously indicated on payment slips. What to do? Do I need to generate an invoice and pay VAT to the budget?

The obligation of the “simplified” person to remit VAT arises when issuing an invoice to the buyer with allocated VAT on the basis of clause 5 of Art. 173 Tax Code of the Russian Federation. If an invoice with an allocated tax was not issued, then the obligation to transfer to the budget the VAT indicated by the buyer in the payment invoice does not arise due to the letter of the Ministry of Finance of Russia dated November 18, 2014. No. 03-07-14/58618.

In more detail, how to deal with possible errors associated with VAT under the simplified tax system, as well as legal requirements under the simplified tax system, was studied in the Master Class: SIMPLIFIED - All changes and Accounting in 1C:8. Theory and practice .

Will be considered:

- Theory “9 Circles Simplified. All changes for 2016." Lecturer: Klimova M.A. Read more >>

- Practice “STS - features and errors of accounting in 1C:8” Lecturer - O.V. Sherst Read more >>

Give your rating to this article: ( 9 ratings, average: 4.89 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Tax register concept

Information about the purpose and procedure for creating tax accounting registers contained in the code is rather scarce. Thus, a certain amount of useful information about income tax registers is in Art. 313, 314 of the Tax Code of the Russian Federation, there is even less data on VAT, all of them are placed in Art. 169 of the Tax Code of the Russian Federation. Therefore, for a better understanding of the issue of tax registers, it is better to consider these provisions in conjunction with the instructions that are in the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

In essence, a register is an accumulation of data contained in accounting documents, calculations, summary tables in paper or electronic form, for the purpose of correct taxation. At the same time, as for any component element of the accounting system, there is a fixed set of rules for it:

- No edits or empty lines.

- Prohibition on entering knowingly false and incorrect data.

Tax register is a set of documents and (or) tables for accumulating, grouping, summing up the information necessary for the correct calculation and transfer of fiscal payments for a given period of time.

The collected figures must be recorded in strict accordance with the classification given in Chapter. 21 Tax Code of the Russian Federation. At the same time, tax accounting does not require double entry; it is enough to simply sum up the monetary value of the transactions included in the tax base. At the same time, the consistency and time certainty of entering data, and the inadmissibility of gaps remain relevant.

The main thing for the payer is to create a procedure for collecting and summarizing information that makes it possible to clearly track the mechanism of formation of the tax base. The basis for creating tax accounting registers for VAT is the documentation used in accounting.

At the same time, there are differences between the accounting and tax accounting systems:

- Accounting statements are drawn up in the form of journals and contain information exclusively about the document with the help of which the fact of economic activity was recorded.

- The tax accounting nomenclature can include information both directly from documents and from existing and generated analytical reports, for example, from accounting cumulative tables, calculations, and registers.

Based on the fact that the qualitative reflection of all transactions that form the tax base is of paramount importance for correct tax accounting, in certain situations they can be replaced by already existing accounting registers. This is possible if the methodology for accumulating data for any type or area of activity is completely identical. Then the information collected in accounting journals and statements will be used to determine the tax base without any additional processing or adjustment.

Based on the above, we can conclude that after reviewing existing reports, analytical tables, and account entries, company specialists themselves must decide on the need to introduce additional tax forms. Such a need arises when it is impossible to correctly fill out tax reporting only on the basis of accounting registers.

Although there are several templates available for internal tax forms, it is expected that they will in any case be implemented in the form of tables on paper or electronic media. At the same time, the creation of registers on a computer in specialized data processing databases predetermines the possibility of printing out the necessary information to create a paper version of its display.

In addition to using the already existing list of mandatory details for standard accounting forms, it is possible to expand it in order to more fully reflect the information necessary for tax calculation. You should ensure that adding new fields does not lead to duplication of entered data. Most often, the need to expand the form or increase the columns of the analytical table arises when there are significant differences between tax accounting and accounting.

All algorithms and procedures for accumulating data for calculating taxes must be reflected in the accounting policies. The responsibility to reliably and completely enter information into the relevant registers rests with specially appointed employees. Most often, these are employees of financial services who sign the documents attached to the reporting. Amendments to tax accounting documents are permitted only to responsible persons in the event of timely detection of errors or inaccuracies. In order to prevent unauthorized employees from making adjustments, it is necessary to restrict access to the specified registers. In case of data correction, there must be a valid reason for this, as well as certification of the correctness of the new entry by the signature of the responsible person.

Accounting for “input” VAT under the simplified tax system in accounting in 1C 8.3

Input VAT is indicated as a separate line in the book of income and expenses, because it is a separate expense in the Tax Code. In accounting, the simplified version includes input VAT in the price. In accounting, this is the debit of account 41, and if you look at the posting in 1C 8.3, you will notice that the document contains VAT, but it is not in the postings. Due to the fact that in the form of the document “ Prices in the document ” there is a checkbox “Include VAT in the price”. 1C 8.3 includes input VAT automatically in the debit of account 41:

If a simplified taxation system is installed in the accounting policy settings in 1C 8.3, then by default in the document form “ Prices in document ” the checkbox “Include VAT in price” will be checked. The main thing is not to turn it off manually. And if the checkbox is turned on, then automatically the input VAT will be debited to account 41.01. In accounting, VAT is not recorded separately on account 19, but only on account 41:

Rules for creating registers

Most of the requirements for compiling tax registers are formulated in paragraph 4 of Art. 10 of the Law “On Accounting” 06.12.2011 No. 402-FZ. These include:

- indicating the title of the document;

- a clear definition of the time period for which the document records data;

- reflection of the quantitative and cost characteristics of the operation being carried out;

- indication of the names of the facts of economic activity according to the order of their implementation;

- signatures of persons responsible for maintaining the register.

As noted earlier, tax registers are necessary to register, group and accumulate data from various documented sources to form the taxable base. At the same time, the structure of the register should make it possible to understand without much difficulty the procedure for forming a taxable object for the period.

Tax authorities are not given the right to impose any standard accounting forms on companies, so companies are given complete freedom. At the same time, organizations must ensure that all required details are included in the forms used.

In those rare cases when there is an urgent need to make corrections to these tax accounting forms, it is necessary to put the date and signature of the responsible person next to them. If there is a requirement to provide original documents, you must keep copies of each copy.

Although tax legislation is quite democratic regarding the rules for creating registers, their absence is classified as a gross violation of the tax base accounting procedure and may entail a fine in the amount of 10 to 40 thousand rubles.

Tax accounting registers accumulate information about taxable amounts without using double entry, at the same time, the requirements for their registration are similar to those that apply to accounting documents. Thus, all accounting documents that allow you to achieve your goal can be classified as tax accounting registers. It is advisable to use a self-developed form or report form only if the standard accounting version lacks any data.

A company's liability for violation of legislation regarding registers arises only in the absence of those forms specified in its accounting policies. This, in particular, was stated in the resolution of the Federal Antimonopoly Service of the North-Western District dated 10.10.2005 No. A42-7611/04-15. In addition, there is court practice, according to which the payer independently determines not only the structure and list of details of tax accounting forms, but also which of them and how they need to be drawn up.

Key provisions that must be included in the accounting policies

When developing an accounting policy, the company, along with a description of the usual procedures for recording transactions, must include a detailed explanation of the methodology for summarizing and analyzing the constituent elements of the tax base. For VAT, it is advisable to reflect in it the rules for the preparation and registration of invoices, purchase and sales books, the registration journal and other registers used in the company.

In addition to the general points, for VAT it is necessary to take into account a number of nuances:

- The frequency with which invoice sequence numbers are restarted.

- Algorithms for the separate registration of transactions subject to and not subject to VAT.

- The method for calculating the threshold for refusing to maintain separate accounting is the 5% rule. It should be established how the level of expenses will be reported for different categories of transactions.

It is also necessary to develop instructions for implementing separate tax accounting for incoming assets.

The more detailed all the intricacies of VAT tax accounting are described, the easier it will be for the company to defend its point of view in the event of disputes on any issues with the inspectorate.

Acquisition of material assets (services) of general purpose

Reflection in 1C of information on received material assets and services intended for use for general production or general economic purposes is carried out in the same manner as described in the previous section. With the exception of one point: when the values (services) in question are simultaneously used in activities subject to and not subject to VAT, the “Distributed” attribute must be set.

How to install it in 1C is clearly shown in the figure below:

Classification of tax accounting registers for VAT

Mandatory documents that participate in the VAT tax accounting process are:

- Journal for recording invoices.

- Book of purchases.

- Sales book.

They accumulate data on changes in the tax base based on incoming documents and accounting calculations. Thanks to the clear structure of the information stored in them, it is subsequently much easier to draw up a declaration on their basis for the period. In particular, the documents provide for the grouping of facts of economic activity by their types: taxable, non-taxable, and subject to preferential interest.

In the book of purchases and sales, in addition to the registration data of invoices, the amount of tax allocated in them is also indicated. At the same time, they are combined according to the general procedure for collecting tax that applies to a particular transaction. The amounts calculated at the end of the period are the source for the subsequent final tax calculation. It turns out that the purchase book reflects the total amount of VAT to be deducted, and the sales book reflects the amount of tax to be accrued and paid.

The results of the received VAT from the purchase book must be reflected in the declaration in accordance with the provisions of paragraphs 2 and 7 of the rules approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. VAT refundable at all applicable rates is included in field 120 of the declaration put into effect by order of the Federal Tax Service of Russia dated 10/29/2014 No. MMB-7-3/ [email protected] The entire volume of transactions subject to taxation at a 0% rate is reflected in parts 4–6 of the declaration.

The general principles and requirements for maintaining books, both for purchases and sales, are approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. In addition, it states that these registers on paper must be bound and numbered.

Procedure for maintaining an invoice journal

The rules for maintaining a journal of issued/received invoices and the approved form of this register are also established by Resolution No. 1137. The journal itself consists of 2 parts, with the first part recording issued invoices, and the second - received ones. According to the current rules, in the invoice journal:

- it is possible to reflect information about intermediary activities in the first and second parts of the journal;

- It is possible to carry out separate registration of corrected invoices, including corrected adjustment documents.

See also the material “How to fill out an invoice journal.”

In accordance with paragraphs. 3, 3.1 and 9 art. 169 of the Tax Code of the Russian Federation, the journal of invoices can be kept not only on paper, but also in electronic format.

NOTE! Only the electronic form of the journal is submitted to the Federal Tax Service.

You should also take into account the norms of Resolution No. 1137 regarding the fact that all pages of purchase and sales books must be laced and numbered. The same resolution also contains requirements for the form of filling out and maintaining books. Let's look at them in more detail.

Conditions for correct compilation of a purchase book

By virtue of clause 3 of Art. 169 of the Tax Code of the Russian Federation, a purchase book must be compiled by all companies purchasing goods, work or services and being VAT payers by law. The basic principles of book design are enshrined in Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, which also gives permission for its design in electronic or paper form.

Among the recently emerging responsibilities of the payer related to the accounting register described, the following can be distinguished:

- Entering data on documents for payment of input tax.

- Availability of information on agency agreements in the book.

- Reflection of the assessment of transactions performed in foreign currency.

Currently, the book does not have columns that allow you to separately record the fact of acquisition and the amount of tax at various rates, as well as those exempt from taxation.

The debate about whether or not it is possible to include data in the ledger based on copies of invoices without obtaining the original version is still ongoing. Given the stable position of the Federal Tax Service, which denies any possibility of this, the judicial authorities are not so categorical. In a situation where the counterparty somehow receives the original invoice, the application of a deduction based on a copy may be considered legal. As an example, we can cite the resolution of the Federal Antimonopoly Service of the Moscow District dated 06/05/2014 No. F05-4685/2014.

Basic provisions for maintaining a sales book

Issued invoices, including corrected ones, according to Decree of the Government of the Russian Federation No. 1137, must be reflected in the sales book. The same regulatory document regulates the basic rules for its maintenance, and also contains an approved form as an appendix. The digital option for creating a sales book is established in the Federal Tax Service order dated 03/05/2012 No. MMB-7-6/ [email protected]

At the moment, there are a number of features in the preparation of this document that you should pay attention to first:

- Entering the number and date of the document for the transfer of funds.

- The need for a separate indication of intermediary operations.

- Availability of fields for entering currency valuation of transactions.

- When recording an adjustment invoice, it is not the total amount of tax that is indicated, but only the size of the discrepancy with the original version, both upward and downward.

The sales book is also subject to a provision according to which it is prepared not only by companies paying VAT, but also by companies exempt from it. In the situations described in paragraphs 1–5 of Art. 161 of the Tax Code of the Russian Federation, entrepreneurs performing intermediary operations must also maintain the described register, while they may not have the obligation to pay VAT.

A rather interesting situation has developed around the sale of property of insolvent companies. The objects of sale themselves are not subject to tax, but buyers in such transactions act as intermediaries, and therefore they must transfer VAT, albeit to the former owner of the property. This position is set out in the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated January 25, 2013 No. 11.

For the procedure for making adjustments to the book, the time to detect inaccuracies and errors is of paramount importance. So, if the need to change data arose before the end of the reporting period, the incorrect ledger line is reversed, recorded with a negative value, and the correct data is entered instead below it. If the period is closed, it is necessary to use special additional pages for correction, which are added to the part of the book related to the time period when the error was made.

The totals of columns 14–19 from the sales book serve as the basis for filling out the VAT return; until 01/01/2014, columns 4 to 9 performed the same function.

Results

Despite the lack of a uniform concept of tax registers in the code, Art. 120 mentions the possibility of applying punishment to the payer in the complete absence of their knowledge. Based on a comprehensive assessment of Art. 169, 313 and 314 of the Tax Code of the Russian Federation in conjunction with Art. 10 of the Federal Law “On Accounting”, it is possible to formulate a list of rules on the basis of which accounting processes in the accounting and tax spheres should be built.

When the existing system of analytical accounts allows you to fully obtain data for tax calculations, there is no need to enter any additional forms: tax accounting will be built on the basis of existing data. It is also possible to enter auxiliary fields into standard forms in order to correctly calculate the tax base.

It is very important to consolidate the list of used registers in the company’s accounting policies, since this can become a decisive argument in a legal dispute. This is due to the fact that inspectorates do not have the right to insist on providing those tax forms that are not enshrined in company policy.

Specifying the topic of tax registers for VAT and being guided by the text of Art. 169 of the Tax Code of the Russian Federation, which states that these are the final forms for registering and grouping primary data, the following options for their practical implementation can be distinguished:

- Journal for recording invoices.

- Book of purchases.

- Sales book.

The entire set of rules, application forms and instructions for preparing these documents are approved in Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. Using the information provided therein, the taxpayer has every opportunity to correctly fill out and make the necessary corrections to these documents. It is worth noting that the taxpayer himself is interested in the correct maintenance of registers, since they significantly simplify the process of preparing a VAT return.